Between 2025 to 2035, these market segments are projected to grow at the fastest pace, owing to the rise in emissions regulations, developments in fuel vapor management technologies, and a growing number of hybrid and plug-in hybrid vehicle sales. Without active purge pumps (APPs), efficient fuel vapor purging is not possible, putting pressure on evaporative emission control (EVAP) systems to meet strict air-pollution regulations, such as Euro 7 or USA EPA Tier 3, which already mandate a reduction in hydrocarbon emissions.

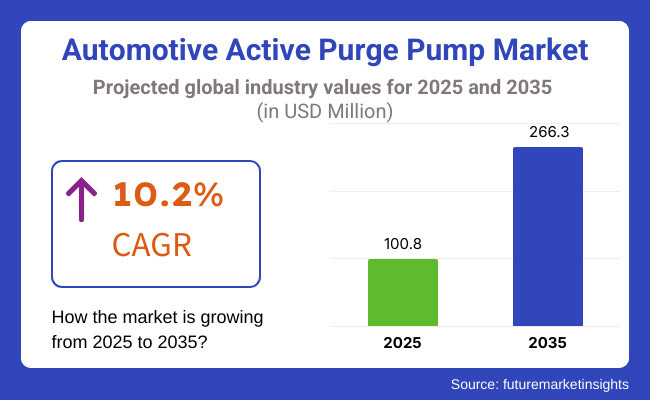

The market is anticipated to attain USD 100.8 Million in 2025 and is estimated to surpass USD 266.3 Million by 2035, holding a compound annual growth rate of 10.2% throughout the forecast period. The future trends in the form of the shift towards electric-powered purge pumps, artificial intelligence-powered emission control systems and sustainable fuel technologies are already redefining the sector. Moreover, the growing government mandates for the reduction of volatile organic compounds (VOCs) in gasoline-powered & hybrid vehicles is further spurring market growth.

Explore FMI!

Book a free demo

North America is expected to have a significant share of the Automotive Active Purge Pump Market, owing to strict regulations regarding emissions and high vehicle production rates along with increasing demand for fuel-efficient powertrains. The EPA and California Air Resources Board (CARB) regulations designed for advanced fuel vapor management system put the United States and Canada in the top of the regions.

Major automotive manufacturers, including General Motors, Ford, and Stellantis, are introducing active purge pumps in both gasoline and hybrid (including plug-in hybrid electric vehicles, or PHEVs) applications to improve fuel economy and reduce evaporative emissions. Increasing consumer awareness regarding environmental sustainability and fuel economy benefits also drives the market growth.

Europe accounts for a significant portion of the Automotive Active Purge Pump Market, as nations like Germany, the UK, France, and Italy spearhead automotive R&D, emissions control technologies, and hybrid vehicle production. Strict Euro 7 regulations in the European Union, which will be applied in the next few years, are forcing automakers to use updated EVAP systems, with electrically driven purge pumps.

Growing demand for highly fuel-efficient and low-emission vehicle & engine components, in turn, is fuelling the shift towards hybrid powertrains in direct response to EU emission reduction objectives. Developing APPs like VW, BMW, and Mercedes-Benz are taking the lead in hybrids and plug-in hybrids as a means of improving fuel economy while meeting requirements.

Based on region, the automotive active purge pump market is anticipated to lead by Asia-Pacific region, showing the highest CAGR, owing to increasing vehicle production, higher adoption of hybrid and fuel-efficient vehicles along with rising environmental awareness. Countries such as China, Japan, South Korea and India emerge as major players under these parameters due to their growing automotive industries along with government policies to encourage emission reducing technologies.

The aggressive emission reduction regulations introduced by China, the world's largest market for automobiles, are also driving the use of EVAP control systems such as APPs in gasoline- and hybrid-powered vehicles. Automakers in Japan and South Korea, which includes the likes of Toyota, Honda, Hyundai and Kia, are working on fuel vapor recovery systems, lightweight purge pump components, and AI-augmented emission control systems.

Market growth is also being fuelled by India's increasing urbanization and its growing emphasis on emission control regulations leading automakers to adopt advanced purge pump technologies into new vehicle models as they seek compliance with Bharat Stage VI (BSVI) emission regulations.

Challenges

High Costs and Shift to Fully Electric Vehicles

The high cost of advanced EVAP control systems increases the vehicle manufacturing expenses for end-use manufacturers, which is likely to restrain the growth of the Automotive Active Purge Pump Market in the near future. In fact, electronic purge pumps with predictive capabilities are more expensive to produce due to sophisticated engineering and a need for precision manufacturing.

Moreover, the urgent shift towards purely electric vehicles (EVs) that wouldn't need fuel vapor management systems, presents a long-term concern for the sustainability of the market. With governments globally banning ICE vehicles and pushing EV adoption, the demand for APPs in regular gasoline and hybrid vehicles are likely to drop-off over the longer term.

Opportunities

AI-Driven Emission Control and Electrified Purge Pump Technologies

There are challenges for this market but also major growth opportunities. The use of AI-powered emission control strategies to adjust purge cycles in real time based on the fuel tank pressure, ambient temperature, and other vehicle operation data is enhancing fuel economy and emissions.

The introduction of electrically powered purge pumps (eAPPs) that have no dependence on engine vacuum systems is restructuring EVAP control on hybrid and plug-in hybrid vehicles. The development of new lightweight composite materials, smart purge pump sensors, and AI-based predictive maintenance are also improving APP efficiency, durability, and vehicle configuration.

The production growth of hybrid vehicles, rising investment in sustainable fuel technologies, along with regulatory mandates for zero-emission vehicle components - these trends are adding to the overall market demand and pushing the market towards even more sustainable automotive solutions. The use of automated fuel vapor management technologies is poised to increase as automakers further enhance fuel economy and emissions compliance.

The automotive active purge pump (APP) market witnessed significant growth from 2020 to 2024, fueled by stricter emission regulations, a rise in vehicle electrification, and improvements in evaporative emission control systems. After that, active purge pumps are used for actively purging fuel vapor from the evaporative emission control system (EVAP) into the combustion engine for burning hydrocarbon emissions. The government policies such as USA Environmental Protection Agency (EPA) Tier 3 standards, Euro 6 emission norms, and China 6 regulations and others, which mandated lower limits for the emission of volatile organic compounds (VOC) and higher consumption for high-efficiency purge pumps, should drive the segment during the forecast period.

The automotive active purge pump market is projected to make paradigm shifts between 2025 and 2035, due to advancements such as AI-driven purge optimization, cutting-edge nanomaterial-based filters, and intelligent evaporative emission control systems. Adaptation of purge pump technologies for hybrid powertrains and alternate fuel systems will shift as zero-emission vehicles (ZEVs) and fuel-cell electric vehicles (FCEVs) become a larger part of the automotive market. Predictive vapor management, real-time diagnostics, and adaptive emission reduction based on driving conditions, fuel type, and climate variables will be driven by AI-enhanced active purge control systems in the future.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with EPA Tier 3, Euro 6, and China 6 emission norms. |

| Technological Advancements | Development of electrically driven purge pumps, advanced solenoid valves, and smart diagnostic integration. |

| Industry Applications | Used in internal combustion engine (ICE) vehicles, hybrid cars, and plug-in hybrid electric vehicles (PHEVs). |

| Adoption of Smart Equipment | Integration of OBD-compliant purge pump diagnostics and vacuum-assisted purge cycles. |

| Sustainability & Cost Efficiency | Shift toward low-energy purge solutions, reduced hydrocarbon emissions, and energy-efficient EVAP control. |

| Data Analytics & Predictive Modeling | Use of OBD-II data for fault detection and basic performance analytics. |

| Production & Supply Chain Dynamics | Challenges in component sourcing, cost-sensitive manufacturing, and emission compliance requirements. |

| Market Growth Drivers | Growth driven by global emission reduction policies, hybrid vehicle adoption, and demand for fuel efficiency. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter hybrid vehicle emission mandates, AI-driven emission tracking, and blockchain-based component certification. |

| Technological Advancements | AI-powered adaptive purge control, nanomaterial-based VOC filtration, and real-time emission optimization. |

| Industry Applications | Expansion into synthetic fuel-powered vehicles, fuel-cell EVs (FCEVs), and next-gen hybrid powertrains. |

| Adoption of Smart Equipment | IoT-enabled predictive purge scheduling, AI-driven vapor management, and self-calibrating purge modules. |

| Sustainability & Cost Efficiency | 3D-printed lightweight purge pump components, bio-based purge system materials, and energy-efficient purge cycle optimization. |

| Data Analytics & Predictive Modeling | AI-driven purge optimization, predictive failure analytics, and blockchain-enabled real-time emission monitoring. |

| Production & Supply Chain Dynamics | AI-enhanced supply chain automation, decentralized manufacturing hubs, and blockchain-tracked component authentication. |

| Market Growth Drivers | Future expansion fueled by AI-powered emission management, sustainable fuel vapor recovery, and next-gen hybrid-electric powertrain adoption. |

The USA automotive active purge pump market is evolving thanks to strict emission rules, high uptake of evaporative emission control systems, and advancements in fuel economy technology. Under stringent emission guidelines handed down by the Environmental Protection Agency (EPA) and California Air Resources Board (CARB) automakers need to add active purge pump tech to meet hydrocarbon emissions limits.

Though the adoption of hybrid and plug-in hybrid vehicles (PHEVs) is on the rise, and the need for efficient fuel vapor management systems grows, evaporative emissions must be adequately handled. Ford, General Motors, and Tesla are investing in next-gen purge pumps to comply with changing emission regulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.5% |

Increasing focus on emission control, government-led clean air initiatives, and rising investments in hybrid vehicle technology have driven the Automotive Active Purge Pump Market in the United Kingdom. The UK government’s 2050 Net Zero policy and introduction of Ultra Low Emission Zones (ULEZ) have meant that OEMs are being forced to address their EVAP systems which is in turn driving up the demand for active purge pumps.

While the UK automotive industry moves towards the electrification of vehicles, there is still a strong demand for its hybrid and highly fuel-efficient combustion engine vehicles that keep the needs for advanced fuel vapor management systems strong.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 9.8% |

The EU automotive active purge pump market is growing steadily owing to strict Euro 7 emission standards, rising production of hybrid vehicles, along with a strong focus on fuel efficiency improvements. The European Commission’s Green Deal is forcing OEMs to retrofit low-emission technology, like advanced purge pump systems, into IC and hybrid applications.

The leading markets are in Germany, France and Italy, where OEMs like Volkswagen, BMW and Renault have invested in advanced purge pump technologies to meet the new evaporative emission requirements. Growth in demand for high-performance purge pumps is also being driven by the increasing emphasis on plug-in hybrid vehicles (PHEVs).

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.2% |

The early adoption and leadership in technology reflected by Japan, along with stringent regulatory arrangements in place for emission control and evolving fuel vapor management systems are all aiding the growth of the automotive active purge pump market in Japan. Minister of Land, Infrastructure, Transport and Tourism (MLIT) of Japan is enforcing stricter evaporative emission standards, which is pushing the automakers to use advanced purge pumps in hybrid and fuel efficient cars.

Japanese automotive manufacturers like Toyota, Honda, and Nissan have been leveraging their purification capabilities to implement next-gen technology for purge pumps to smooth vehicle dynamics and enhance the metering of fuel systems, thereby improving emissions and efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.4% |

In South Korea, the Automotive Active Purge Pump Market is accelerating due to government-backed emission reduction initiatives, booming automotive industry improvements, and increasing hybrid vehicle use. And to comply with stricter fuel vapor emission regulations from the South Korean Ministry of Environment, automakers are leaning towards sophisticated purge pump technologies.

Hyundai and KiaReduce gasoline vapors or evaporative emissions from vehicles through smart EVAP systems, AI-based fuel management, or green vehicle components that improve purge pump system efficiency. Additional increasing demand for next-generation purge pumps is being driven by the roll-out of plug-in hybrid (PHEV) production.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.6% |

Rising demand for fuel-efficient vehicles, rising process efficiency and production output as a result of automation, and rising automation levels are some other factors driving the growth of the automotive active purge pump market. With the market divided by different material types, metal and non-metal components lead, providing benefits in durability, weight reduction, and thermal resistance.

Metal-based active purge pumps represent the largest market share since they exhibit great mechanical strength, resistance towards extreme temperature ranges, and can sustain harsh operating conditions. Matched in aluminum and stainless steel, these pumps ensure years of long-lasting performance, corrosion resistance, and faulty vapor containment in internal combustion engine (ICE) and hybrid vehicles.

Metal active purge pumps are typically favored in heavy-duty and high-performance vehicles, as these manufacturers are concerned with structural integrity and reliability over a range of high pressure and temperature conditions. This is opening the door for manufacturers to design even more efficient and weight-minimal purge pump systems, helping to improve fuel economy and emissions.

Metal-based active purge pumps have higher manufacturing costs and are heavier. But advancements in precision metal forming, alloy optimization, and even hybrid metalpolymer pump designs alleviate these concerns while promising to deliver enhanced efficiency and cost-effectiveness.

The demand for non-metal active purge pumps in this area is accelerating rapidly, featuring high-performance plastics and composites that offer extremely lightweight construction, reduced manufacturing costs, and enhanced chemical resistance capabilities. This allows for much more freedom to incorporate complex geometries and optimize aerodynamics while maintaining good vapor management.

The growing adoption of non-metal purge pumps such as non-metallic cargo pumps in electric and hybrid vehicles, drives the demand for weight reduction, which help in increasing the battery efficiency as well as the electric vehicle range. By using polymers, the pumps are also better able to resist fuel vapors, absorb less heat, and fit better with new emission controls.

But, mechanical strength, thermal expansion, and degradation with time, are some of the issues faced by the non-metal pumps. Manufacturers are responding with reinforced composites, heat resistant polymeres, and hybrid construction techniques that marry metallic endurance with polymer efficiency.

The choice of manufacturing process plays a crucial role in determining the cost, quality, and scalability of active purge pump production. Among various techniques, injection molding and vacuum forming dominate the market due to their efficiency, precision, and material optimization capabilities.

Non-metal active purge pumps are primarily manufactured using injection molding, making it an efficient process with reduced scrap losses and the ability to replicate precise components. With this, manufacturers can achieve the need for complex geometries, multi-functional components, and surface finishing with cost-effective mass production.

In fact, this new approach to using plastic and composite purge pumps has only increased demand for more modern injection molding processes like multi-shot molding, gas-assisted molding, and overmolding. This promotes robust, economical, and heat resistant pump components which improve the long-term performance and durability of the pump.

Injection molding has its advantages, but its structural integrity can be a limiting factor due to the high pressures introduced. But even with cost-efficiency, durability concerns are never an easy issue to tackle given how advanced reinforced polymer composites and high-temperature molding techniques today are, as well as how automated the process has become to ensure less for them is wasted.

Vacuum forming is becoming an important process for much of the active purge pump component development, prototyping, and small-volume production runs. This process enables manufacturers to develop components that are thin-walled, lightweight, and aerodynamically molded, thus minimizing total weight while increasing efficiency in the system.

As custom designs and power-efficient designs are crucial in electric and hybrid vehicles, the demand is increasing for vacuum-formed components in these types of vehicles, as they improve battery efficiencies or evacuate emissions. Lower tooling costs and shorter production cycles make vacuum forming an attractive option for limited-production and high-performance vehicle applications as well.

But vacuum forming is not as good as injection molding or metal fabrication for making high-strength, pressure-retaining components. Manufacturers are developing multi-layer composite materials, heat-treated vacuum-formed parts, and hybrid manufacturing approaches to improve strength and durability while remaining cost-effective in response to these challenges.

The Automotive Active Purge Pump (APP) Market continues to grow due to factors like growing emission restrictions, the change towards evaporative emissions control and improvement in vehicle fuel systems efficient. Specialized active purge pumps are also crucial in reducing hydrocarbon emissions since they are responsible for managing fuel vapors and are targeted in design to hybrid & ICE (internal combustion engine) vehicles. Firms target electric-driven purge pumps, intelligent monitoring systems, and lightweight materials to improve fuel efficiency, decrease emissions, and increase system longevity. This market comprises top automotive component suppliers, manufacturers of emission control systems, and powertrain technology companies, all of whom contribute to the next generation of evaporative emissions solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Continental AG | 18-22% |

| Robert Bosch GmbH | 15-19% |

| Denso Corporation | 10-14% |

| Rheinmetall Automotive AG | 8-12% |

| Agilent Technologies Inc. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Continental AG | Develops high-efficiency active purge pumps with integrated diagnostics and smart control features for emissions reduction. |

| Robert Bosch GmbH | Specializes in electric purge pump systems that enhance hydrocarbon vapor management and fuel system performance. |

| Denso Corporation | Manufactures compact and energy-efficient active purge pumps for hybrid and ICE vehicles. |

| Rheinmetall Automotive AG | Focuses on low-emission evaporative purge systems with advanced sensor integration. |

| Agilent Technologies Inc. | Provides automotive-grade purge pump solutions with precise vacuum control and hydrocarbon management. |

Continental AG (18-22%)

Continental leads the active purge pump market, offering smart, electronically controlled purge pumps designed for low-emission and hybrid vehicle applications.

Robert Bosch GmbH (15-19%)

Bosch specializes in AI-enhanced purge pump technologies, integrating real-time emissions monitoring and adaptive purge control.

Denso Corporation (10-14%)

Denso focuses on lightweight, high-efficiency purge pumps, optimizing fuel vapor recovery and emissions compliance in next-gen hybrid powertrains.

Rheinmetall Automotive AG (8-12%)

Rheinmetall develops low-emission active purge systems with integrated sensors for real-time fuel vapor detection and control.

Agilent Technologies Inc. (6-10%)

Agilent provides high-precision purge pumps, catering to automotive fuel system testing, emissions reduction, and hydrocarbon control solutions.

Other Key Players (30-40% Combined)

Several automotive emissions control system manufacturers and component suppliers contribute to advancements in purge pump efficiency, durability, and compliance with global emission standards. These include:

The overall market size for the Automotive Active Purge Pump Market was USD 100.8 Million in 2025.

The Automotive Active Purge Pump Market is expected to reach USD 266.3 Million in 2035.

Stringent emission regulations, increasing vehicle electrification, and growing demand for fuel-efficient and eco-friendly automotive components will drive market growth.

The USA, Germany, China, Japan, and South Korea are key contributors.

Electrically driven purge pumps are expected to dominate due to their efficiency in reducing hydrocarbon emissions and compliance with emission standards.

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Automotive Door Guards Market - Market Outlook 2025 to 2035

Automotive Connecting Rod Bearing Market -Trends & Forecast 2025 to 2035

Aircraft Strut Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.