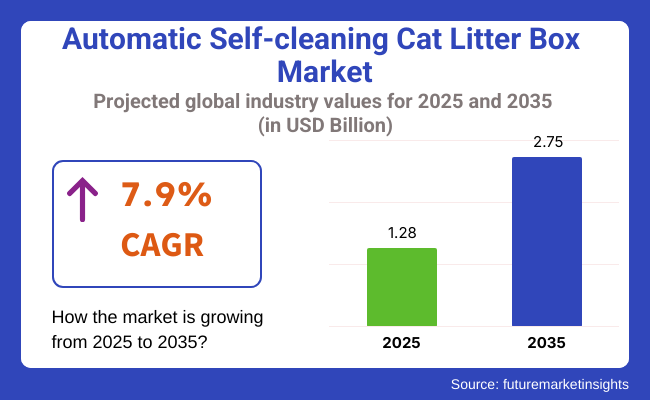

The automatic self-cleaning cat litter box market size was USD 1.28 billion in 2025 and is expected to grow at a CAGR of 7.9% from 2025 to 2035. The valuation is estimated to be USD 2.75 billion by 2035.

One of the major drivers for this growth is the increasing trend toward smart home solutions among pet owners seeking low-maintenance, hygienic, and automatic options for pet care. The industry is being transformed because of growing urbanization and the growth of dual-income households, where time and convenience factors take precedence.

Consumers are becoming open to technology-intensive pet care products with minimal manual handling, improved odor control, and pet health monitoring features. Apart from this, the rapid growth of pet populations across the globe, particularly among millennials, is driving perpetual demand for clever, low-fuss litter solutions.

Key players are integrating IoT technologies and sensor-based automation into litter boxes to notify owners of cleaning schedules, track unusual waste patterns, and maximize waste disposal efficiency. Such features appeal to digitally savvy consumers looking for end-to-end digital ecosystems for pet health.

Attention to sustainable designs such as biodegradable waste disposal systems and energy-efficient operations is intersecting with broader sustainability trends.North America and the Asia-Pacific are still viable markets due to rising disposable incomes and growing uptake of pet care innovation. In addition, growing e-commerce platforms and subscription models are providing easy access to products, together with customer education that increases product visibility and credibility.

As the competition becomes more sophisticated, companies are making themselves stand out with AI-enabled diagnostics, control panels through mobile apps, and stylish designs that fit into interior decor. This co-mingling of convenience, innovation, and style is converting automatic self-cleaning litter boxes from exclusive privileges to becoming an essential commodity among pet owners everywhere.

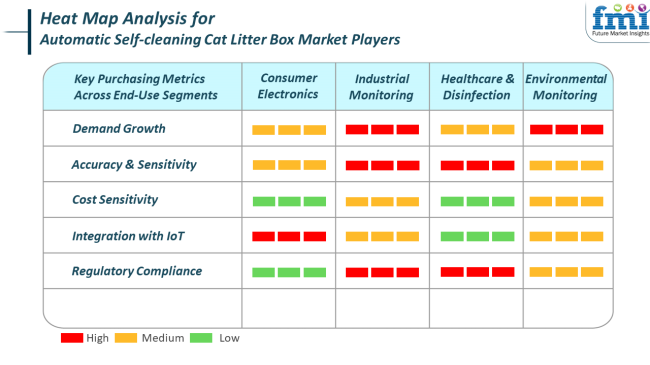

The automatic self-cleaning cat litter box industry is closely tied to consumer electronics trends, particularly as IoT integration becomes a major differentiator. Consumer demands for effortless app control, real-time monitoring, and integration into smart home systems are fueling demand across tech-enabled homes.

This category prioritizes hygiene, automation, and ease of use as key buying criteria. Medical and disinfectant requirements drive the use of high-sensitivity sensors that track pet waste for deviations, as consistent with the early detection of potential feline medical conditions. This area identifies increasing value in systems using antimicrobial components and enclosed waste chambers, emphasizing compliance with health-aware standards even within home settings.

From the environmental monitoring side, interest is directed toward sustainability, waste management, and minimized litter consumption. Self-cleaning litter boxes that conserve resource waste and enable eco-friendly disposal resonate with environmentally aware pet owners. As manufacturers react by implementing greener alternatives and optimized efficiency, these factors continue to influence long-term adoption and customer retention.

The industry faces some inherent risks that are likely to dampen its growth pattern. A key risk involves the expensive initial purchase price of such machines, which can scare off price-conscious buyers, especially in emerging markets. Even if convenience over a long period is a big selling advantage, penetration can be delayed due to affordability concerns.

Dependence on technology also presents a risk to performance and longevity. Sensor faults or disruptions in connectivity with the related mobile applications can cause consumer dissatisfaction and higher product returns. Due to the personal and emotional aspects of pet care, negative consumer experiences can have a strong influence on brand reputation and trust. Moreover, the absence of uniform health and safety certifications for such goods could pose issues, particularly in markets with changing regulatory environments.

Without a common compliance standard, producers face industry access limitations. With the maturation of the industry, compliance with rigorous quality standards and proactive customer care will be necessary to counteract these risks and maintain long-term success.

From 2020 to 2024, the industry experienced steady growth due to increasing pet ownership and a shift towards more convenient pet care solutions. Consumers sought products that offered better hygiene, odor management, and convenience of maintenance.

Technological innovation, such as integration with apps and self-cleaning programs, was also on the rise, ensuring that the products were more convenient. In addition, there was a shift towards premium products offering features like self-cleaning capabilities and compatibility for houses with multiple cats.

During 2025 to 2035, the valuation will further grow as pet owners keep seeking more intelligent, efficient, and environmentally friendly ways for their pets. The integration of advanced technologies, including artificial intelligence and sensor-based systems, will most probably make these products more convenient and functional. The demand for automated self-cleaning litter boxes will also see growth in emerging markets, driven by rising urbanization and disposable incomes.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increasing pet ownership and demand for convenient pet care solutions. | Rising disposable incomes, urbanization, and the need for smart pet care products. |

| Introduction of app connectivity and self-cleaning cycles. | Utilization of artificial intelligence and next-generation sensor technologies. |

| Focus on hygiene, odor control, and low maintenance. | Focus on energy efficiency, smartness, and multi-cat compatibility. |

| Growth in North America and Europe. | Dramatic growth is expected in Asia-Pacific and emerging markets. |

| Need for premium products with high-end features. | Growing demand for environmentally friendly and sustainable pet care products. |

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.1% |

| UK | 6.9% |

| France | 6.4% |

| Germany | 6.6% |

| Italy | 5.8% |

| South Korea | 7.2% |

| Japan | 6.1% |

| China | 8.8% |

| Australia-NZ | 7.5% |

The USA is anticipated to achieve an 8.1% CAGR during the forecast period. Growing pet ownership among suburban and urban families, combined with an increased focus on hygiene as well as pet health, is driving demand for automated self-cleaning litter boxes.

Convenience related to these products is attractive to busy consumers, especially millennials and Gen Z pet owners. In addition, the enormous buying power of USA consumers justifies premium prices for smart pet technology. Suppliers are investing heavily in innovation in smart litter boxes in terms of IoT-based sensors, smell-controlling mechanisms, and cellular connectivity to address technologically conscious consumer segments.

USA e-commerce penetration is another stimulus, ensuring the ease of availability of niche pet care products. DTC merchants and players are driving product awareness to all-time highs via digital media, stimulating adoption.

The USA is also the location of several startups and industry leaders that have pledged to be sustainable, implementing recyclable material content and power-efficient processes into their products. Robust pet insurance coverage and a supportive regulatory environment are creating favorable conditions for sustained revenue expansion.

The UK is forecasted to report a 6.9% CAGR throughout the study. Increased demand for intelligent and networked pet care solutions among British pet owners is driving the growth. The UK's urbanization and dense living conditions create hygiene and odor control, which are top concerns in pet ownership, and automatic litter boxes can effectively handle them. Multibuy householders want to pay more for time-saving, self-cleaning litter products, and that's where product interest starts to develop.

The UK pet care industry is heading for premiumization, and consumers seek intelligent products to enhance pet health and owner convenience. Increasing interest in feline urinary health is also propelling demand since sophisticated litter systems are able to monitor usage and warn of impending issues.

Companies are introducing app-connected litter boxes, which also leads to real-time monitoring capability. Access to well-established pet store chains and an established e-commerce infrastructure enables easier access to feature-packed smart litter box solutions. Government interest in the well-being of animals and rising disposable incomes further provide scope for growth within urban centers like London, Manchester, and Birmingham.

France will grow at a CAGR of 6.4% over the forecast period. The French are increasingly embedding smart technology into daily life, including pet grooming and care routines. The growing number of indoor cats, especially in urban areas such as Paris and Lyon, is driving demand for high-end litter management systems.

Automatic self-cleaning litter boxes are a hygienic and convenient alternative for French cat owners for manual scooping that complies with national standards of cleanliness and simplicity. Low-maintenance and eco-friendly pet products are pushing companies to introduce self-cleaning, low-litter, eco-friendly pet litter boxes that reduce litter usage and smell.

Public awareness campaigns and the availability of a strong network of veterinarians also spurred demand. The industry is supplemented by spillover from R&D backed by European pet tech startups and increased product visibility in online and specialist retail outlets. With animal companionship increasingly on trend, France is set to experience ongoing development.

Germany is projected to dominate with a growth rate of 6.6% CAGR during the forecast period. Precision engineering focus of Germany and technology adoption are propelling the automatic self-cleaning cat litter box industry. Europe's high rates of pet ownership, particularly among young professionals and seniors, have created a demand for low-maintenance, automated pet care.

The country's industrialized manufacturing foundation is fueling the development of intelligent litter systems with motion sensors, AI-driven health tracking, and auto-clean cycles. German consumers' increasing eco-concern is fueling demand for energy-saving and recyclable litter boxes.

Urban towns like Munich and Berlin are experiencing increasing adoption because of the compact and convenient nature offered by the automated types. Germany's high internet penetration rate and e-commerce industry also ease the sale of smart pet products.

Adherence to regulatory standards and strict product regulations see to it that manufacturers take note of safety and efficiency issues and, therefore, make Germany a steady force behind European development.

Italy has grown at a 5.8% CAGR throughout the research period. Self-cleaning automatic litter boxes are gaining momentum gradually in Italy as a result of the pet humanization trend and changing lifestyles among consumers.

With more Italians residing in apartments and urban areas, there is great demand for efficient pet waste management systems. Italian owners are gravitating toward smart home technology that simplifies daily life, such as caring for pets.

Although the industry in Italy is less mature than in Northern Europe, retail growth and awareness marketing are making automated litter boxes more visible. Italian owners are becoming increasingly concerned about cleanliness, especially in multi-cat households, making contained and odor-controlling litter products more popular.

Home e-commerce and social media-based product discovery are fueling brand penetration. As consumers seek new, space-saving, and convenient products, Italy is expected to be a moderate but consistent growth.

South Korea is expected to register a growth of 7.2% CAGR during the study period. South Korea's advanced technological infrastructure and growing pet population are turning it into a fertile ground for the adoption of smart litter boxes. High-density urban areas like Seoul need odorless and space-saving pet care solutions, making automatic self-cleaning systems highly desirable.

The cultural value placed on cleanliness and internet connectivity is also propelling the adoption of these devices. South Korean customers are very sensitive to tech-based applications, like pet health monitoring and automatic alerts. Owners are aggressively promoting sensor-driven and AI-enabled litter boxes to complement early supporter support.

Domestic firms and startups are actively engaged in generating innovation for a technologically literate community, whereas international brands are establishing themselves in the industry via online channels. Government encouragement of pet welfare and expansion in pet cafes and boutique pet services indicate growing pet roles in South Korean society.

Japan is estimated to grow at 6.1% CAGR during the study period. Japan's shrinking household size and aging population are generating single-person households with pet companions, and nine times out of ten, the pet is a cat.

This emerging population is driving demand for automated pet care systems that minimize physical effort and maximize convenience. Self-cleaning litter boxes that work automatically are gaining popularity because of their cleanliness benefit and the ability to simplify daily tasks, particularly for older pet owners.

Japanese urban living spaces in Tokyo and Osaka, which are characterized by compact spaces, are fueling demand for low-profile, short-design litter boxes. Demand for robotics and home automation in Japan is also paving the way for the rapid adoption of products. Manufacturers based in Japan are investing funds into intelligently designed litter boxes that are capable of quickly interacting with other pieces of equipment around the house.

Additionally, product quality and consumer care requirements present in Japan are encouraging further external brands to shape the products specifically for selling the items within Japan. These changes suggest a progression expansion of the category throughout the decade.

China is expected to grow at an 8.8% CAGR during the forecast period. As one of the fastest-growing pet care markets globally, China is witnessing strong growth in the number of cat owners, especially among millennial and Gen Z buyers.

Urbanization, rising disposable incomes, and a growing interest in Western pet care culture are fueling demand for connected, self-cleaning litter solutions. Chinese customers now desire technology-rich, AI-enabled litter boxes that provide real-time monitoring, remote tracking, and improved odor control.

A strong e-commerce ecosystem and social media activity in China are the major drivers for penetration. Home-grown rivals are rapidly picking up innovation and bringing in value segments of inexpensive as well as high-end products.

Spending on intelligent home appliances and heightened sensitivity to cleanliness and well-being of pets also drive expansion. Growing used to convenience and automation in evolving lifestyles, China will be a global leader in adopting self-cleaning cat litter boxes during the forecast period.

The Australia-New Zealand region will record a 7.5% CAGR in the forecast period. Continued pet adoption growth, particularly for pets like cats, is fueling the demand for cutting-edge pet care technology in Australia and New Zealand. A growing expenditure on high-end, health-focused products such as cat self-cleaning litter boxes is being observed. These products are being demanded by stressed working professionals and urban consumers seeking convenient, hygiene-focused solutions.

Off and online shopping growth has increased access to local and international brands offering smart litter systems. Ecology and sustainability are also among the issues, proposing the application of reusable litter, power-saving features, and environmentally friendly products.

There is a small but growing niche of smart homes in New Zealand, which plays a role in creating favorable conditions for growth. Moreover, increasing awareness regarding cat health and odor control fuels the growth. Together, the two nations are favorable to the long-term adoption of automatic self-cleaning litter technologies in the ten years up to.

Single cat litter boxes and multi-cat litter boxes are the two major product segments for the automatic self-cleaning cat litter box industry. In 2025, single-cat litter boxes will account for 70% of the share, while multi-cat litter boxes will occupy the remaining 30%.

Single cat litter boxes are usually found in homes where one cat resides due to their low prices, simplicity, and suitability for individual households. These products are generally smaller, easy to maintain, and include user-friendly features such as automatic scooping mechanisms and waste compartment disposal systems.

For instance, Pet Safe and Litter-Robot are two of the main companies tapping into this particular need by designing product lines of efficient self-cleaning litter boxes for single-cat households. Scoop Free automatic litter boxes from Pet Safe exemplify a design for consumers with only one cat. For instance, with its crystal litter tray for drying waste to reduce odors and its automatic rake-cleaning system, this product is very popular because it is easy to use and maintain.

Multi-cat litter boxes have a smaller share in the industry, as they are specially designed for households that have multiple cats. Their feature is primarily the larger compartments with enhanced cleaning features to accommodate the larger amount of waste generated by various cats. They are expensive and larger, but they all do the same work done by Single Cat models, such as time-saving cleaning processes and improved hygiene.

Multi-cat special Litter-Robot models include the Litter-Robot 3 Connect. This new version has more advanced sensors and consists of an enhanced disposal system to manage larger volumes of waste effectively. Multi-cat litter boxes will have their share in a growing industry as more families are moving towards owning multiple pets.

By distribution channel, the automatic self-cleaning cat litter box market is segmented into offline and online. The offline channels will dominate the market with 60% of the share, and online channels will hold 40%.The dominance of offline sales is driven by the traditional retail setup, whereby customers can actually check and feel the products before purchasing them.

Key players in this segment include pet stores, home-goods stores, and larger chain stores such as Petco and PetSmart. These stores allow customers to see, feel, and touch various models, thus giving an idea of product features, sizes, and suitability for their pets.

Countless offline customers prefer instant product access and in-store assistance in their purchase decision processes. Furthermore, these offline sales will include regions having inadequate e-commerce infrastructure or customers who choose not to buy larger, expensive items online without first seeing them.

Online sales are a faster-growing segment, thanks to the convenience of ordering from e-commerce platforms, including Amazon, Chewy, and Walmart. The adoption of online shopping was already gaining traction among consumers before and during the days of the COVID-19 pandemic, with a considerable shift towards digital channels.

Online platforms indeed offer consumer reviews, detailed descriptions of products, and pricing competition. One company, Litter-Robot, took advantage of the surge in online sales through its website by providing its self-cleaning litter box to significant e-commerce sites. The speed of delivery and return convenience were appealing to the tech-savvy cat owners seeking easy, time-saving solutions.

The automatic self-cleaning cat litter box market is currently on an accelerated pace of development motivated by innovative pet tech companies and the increasing demand from consumers for pet hygiene solutions based more on the convenience principle.

Whisker is a leading pet housing brand that is naturally popularized by the flag bearer, the Litter-Robot premium version, which retains its place in the premium range through constant hardware innovations and integration into smart homes. In early 2025, Whisker introduced its Litter-Robot 4, featuring WhisperQuiet technology and enhanced health-tracking capabilities.

Radio Systems Corporation (PetSafe) has made impressive entrance strides in marketing the self-cleaning litter boxes integrated with odor-control accessories and Wi-Fi monitoring features with its overall pet care product line.

Another key player, Spectrum Brands Holdings Inc. (through Tetra and Nature's Miracle)-its pet division-has recently emphasized cost-effective automation and touch surfaces that boast antimicrobial properties in its latest offerings in the hope of appealing more to mass consumers.

New entrants like Smarty Pear and iKuddle have now been bringing innovation through AI with the app connection. In 2024, Smarty Pear's Leo's Loo Too started to gain popularity due to UV sterilization and smart alerts, whereas iKuddle brought voice command compatibility into the fold.

Companies in China, such as PETKIT and AIRROBO, are venturing into the e-commerce channel to scale up with competitively priced products embedded with IoT coupled with stylish designs that are strongly appealing to urban pet owners who are tech-savvy.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Whisker | 22-26% |

| Radio Systems Corporation | 14-18% |

| Spectrum Brands Holdings Inc. | 10-14% |

| Smarty Pear | 9-12% |

| PETKIT | 7-10% |

| Other Players | 20-26% |

| Company Name | Offerings & Activities |

|---|---|

| Whisker | Released Litter-Robot 4 with quieter operations, odor control, and app-based insights. |

| Radio Systems Corporation | Offers Pet Safe Scoop Free line with automatic raking and disposable trays. |

| Spectrum Brands Holdings Inc. | Focuses on antimicrobial, self-cleaning units under Nature’s Miracle brand. |

| Smarty Pear | Introduced AI-powered Leo’s Loo Too with UV sterilization and Wi-Fi monitoring. |

| PETKIT | Expanded global presence with sleek app-integrated litter boxes for smart homes. |

Key Company Insights

Whisker (22-26%)

Maintains its leadership with high-end, tech-integrated models, dominating North America and gaining global visibility through direct-to-consumer strategies.

Radio Systems Corporation (14-18%)

Leverages its established brand Pet Safe to offer reliable mid-range self-cleaning solutions with a focus on convenience and consumables bundling.

Spectrum Brands Holdings Inc. (10-14%)

Provides budget-friendly automation under trusted brands, targeting mass-market retailers and emphasizing antimicrobial hygiene features.

Smarty Pear (9-12%)

An innovation-forward entrant rapidly gaining its revenue share with smart features, UV sanitation, and child-safe locking systems.

PETKIT (7-10%)

Excels in Asian and online marketplaces with sleek, app-synced litter boxes, well-received by urban and tech-focused consumers.

Other Key Players

The segmentation is into Single Cat and Multi Cat.

The segmentation is into Offline and Online.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry valuation is estimated to be USD 1.28 billion in 2025.

The industrial valuation is projected to grow to USD 2.75 billion by 2035, driven by the increasing adoption of smart pet products and the convenience offered by self-cleaning litter boxes.

China is expected to grow at a rate of 8.8%, fueled by rapid urbanization, increased pet ownership, and demand for convenience.

Single-cat litter boxes are the leading product segment, owing to their suitability for urban households with one pet.

Key players in the industry include Whisker (Litter-Robot), Radio Systems Corporation (PetSafe), Spectrum Brands Holdings Inc., Smarty Pear, iKuddle, Petree Litter Box, Cosmic Pet, Petnovations, Inc., PETKIT, and AIRROBO.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 7: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 13: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 19: Western Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 23: Western Europe Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 37: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 41: East Asia Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 16: Global Market Attractiveness by Product, 2023 to 2033

Figure 17: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ million) by Product, 2023 to 2033

Figure 20: North America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 21: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 30: North America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 34: North America Market Attractiveness by Product, 2023 to 2033

Figure 35: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ million) by Product, 2023 to 2033

Figure 38: Latin America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 39: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 48: Latin America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ million) by Product, 2023 to 2033

Figure 56: Western Europe Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 57: Western Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 66: Western Europe Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ million) by Product, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ million) by Product, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ million) by Product, 2023 to 2033

Figure 110: East Asia Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 111: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 120: East Asia Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ million) by Product, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Automatic Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Automatic Goat Waterer Market Size and Share Forecast Outlook 2025 to 2035

Automatic Wine Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Automatic Content Recognition Market Size and Share Forecast Outlook 2025 to 2035

Automatic Coffee Machine Market Analysis – Size, Share & Forecast 2025 to 2035

Automatic Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA