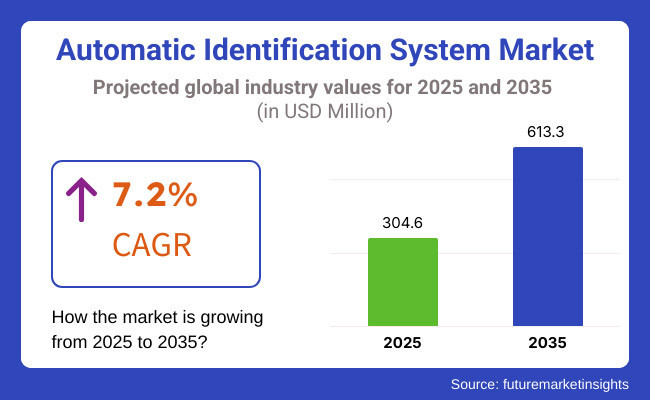

The global automatic identification system market is slated to register USD 304.6 million in 2025. The industry is expected to witness 7.2% CAGR from 2025 to 2035 and witness USD 613.3 million by 2035.

An automatic identification system (AIS) is used in ship-to-ship and ship-to shore maritime communications to identify and track ships in real-time. The technology itself is extremely simple: transponders transmit data such as vessel position, speed, course and identification information to other nearby ships, coastal stations and even satellite systems. AIS enables improved safety at sea, avoidance of collisions with other vessels, and traffic management by providing real-time, accurate, and continuous information about the position and movements of a particular vessel.

Growth is primarily driven by increasing demand for real-time ship monitoring, collision avoidance systems, and compliance with regulations. These technologies, along with artificial intelligence (AI) powered data analytics and machine learning, are driving the communication and surveillance functionality in the marine industry to enhance navigation and improved operational performance.

Organizations are leveraging cloud-based AIS solutions, predictive analytics, and automated alert to ensure effective fleet management, maintaining safety at sea. These trends are coupled with a growing focus on environmental monitoring, cybersecurity, and integrated data integration, contributing to the market's expansion.

Explore FMI!

Book a free demo

The global automatic identification system (AIS) industry is growing due to the increasing maritime security concerns, increasing ship traffic, and stricter regulatory requirements from organizations like IMO (International Maritime Organization). AIS technology is crucial in avoidance of collisions, tracking of ships, and efficient maritime operations.

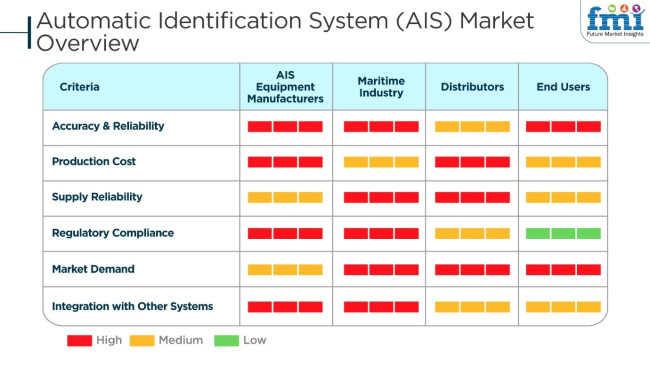

AIS device producers emphasize high precision, compliance, and compatibility with navigation systems. Marine applications such as commercial shipping, naval defense, and fisheries emphasize compliance and consistency for safe and efficient operations. Distributors guarantee consistent supply chains, while end users like ship operators, coast guards, and port authorities require cost-effective and reliable AIS solutions.

Trends are shifting to the deployment of satellite-based AIS (S-AIS) for worldwide tracking of vessels, maritime analytics fueled by AI, and IoT and big data integrations. A major challenge posed is high investment costs and vulnerability to cyber risks, but automations and big data analytics growth are fueling industry-wide increases in adoption.

Contracts and Deals Analysis

| Company | Kpler and Spire Maritime |

|---|---|

| Contract/Development Details | Kpler acquired Spire Maritime, a ship tracking firm providing satellite-based AIS data for maritime analytics, oil traders, and shipping companies. This acquisition strengthens Kpler’s capabilities in vessel tracking and maritime intelligence. |

| Date | November 13, 2024 |

| Contract Value (USD Million) | Approximately USD 240 - USD 250 |

| Estimated Renewal Period | 5 - 7 years |

| Company | Orbcomm and USA Coast Guard |

|---|---|

| Contract/Development Details | Orbcomm secured a contract with the USA Coast Guard to upgrade its AIS-based vessel tracking system, enhancing maritime security and navigation efficiency. |

| Date | October 5, 2024 |

| Contract Value (USD Million) | Approximately USD 50 - USD 70 |

| Estimated Renewal Period | 4 - 6 years |

| Company | exactEarth and European Maritime Safety Agency (EMSA) |

|---|---|

| Contract/Development Details | exactEarth renewed its AIS data services contract with EMSA to support vessel tracking, collision prevention, and maritime safety regulations in European waters. |

| Date | August 28, 2024 |

| Contract Value (USD Million) | Approximately USD 30 - USD 40 |

| Estimated Renewal Period | 3 - 5 years |

In 2024 and early 2025, the automatic identification system market experienced significant growth, driven by strategic acquisitions and high-value government contracts. Kpler's acquisition of Spire Maritime for approximately USD 240 - USD 250 million enhances its maritime analytics capabilities, reinforcing its dominance in vessel tracking intelligence. Similarly, Orbcomm's partnership with the USA Coast Guard focuses on improving AIS-based navigation and maritime security.

Challenges

The automatic identification system market faces challenges such as cybersecurity threats, high initial deployment costs, and integration complexities with legacy systems. Organizations must continuously update AIS protocols to prevent data breaches and unauthorized access. Additionally, compliance with region-specific maritime regulations and the need for satellite connectivity in water pose challenges for AIS providers. Resistance to AIS adoption among smaller vessel operators further hinders industry growth.

Opportunities

Despite these challenges, significant opportunities exist in the industry. AI-driven predictive analytics, blockchain-based maritime security, and real-time fleet monitoring are transforming AIS applications. The expansion of 5G connectivity and satellite-based AIS solutions is improving vessel tracking accuracy and maritime situational awareness.

Government policies promoting digitalization in maritime operations, along with increasing demand for automated vessel management, are driving industry growth. Additionally, the development of hybrid AIS solutions combining terrestrial and satellite communication is broadening industry potential.

Between 2020 and 2024, the automatic identification system market expanded rapidly due to growing maritime security concerns, regulatory mandates, and advancements in vessel tracking technology. Governments and shipping companies adopted AIS to enhance navigation safety, optimize fleet management, and comply with International Maritime Organization (IMO) regulations. Satellite-based AIS (S-AIS) provided extended coverage beyond coasts, with AI-powered analytics improving fuel optimization, maintenance forecasting, and routing optimization.

Development of AIS between 2025 and 2035 will be equipped with autonomous navigation with AI-governed ships, quantum cryptography communication, and decentralized seagoing information networks. Intelligent ports and green shipping lanes will integrate AIS with emissions tracking, automatic berthing, and blockchain-based ship registries.

Edge computing will deliver improved vessel-to-vessel communication and improved situational awareness. Enhanced cybersecurity norms and AI-facilitated anomaly detection will ensure data integrity, and sustainability-focused AIS applications will lead the maritime sector toward net-zero emissions.

Industry Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| IMO and regional mandates enforced AIS adoption for commercial vessels to improve maritime safety. | Quantum-secure AIS communication regulations, decentralized maritime data-sharing frameworks, and AI-driven compliance enforcement will shape future governance. |

| Satellite-AIS (S-AIS) expanded coverage, and AI-driven maritime analytics enhanced vessel tracking. | AI-powered autonomous navigation, quantum-secure AIS data encryption, and blockchain-based vessel registries will redefine maritime operations. |

| AIS facilitated vessel traffic management, collision avoidance, and maritime security. | AI-driven predictive vessel routing, emissions monitoring, and automated smart port integration will expand AIS applications. |

| Maritime operators used cloud-based AIS platforms, enhanced GPS tracking, and data analytics for fleet optimization. | Autonomous ships, AI-powered maritime situational awareness, and edge computing-driven AIS communication will lead to next-generation vessel navigation. |

| Fuel-efficient route planning and real-time vessel monitoring reduced operational costs. | AI-optimized maritime logistics, net-zero emissions tracking, and decentralized green shipping corridors will enhance sustainability and cost savings. |

| AI-driven maritime traffic analytics, anomaly detection, and fleet optimization improved efficiency. | Quantum-computing-assisted AIS data processing, AI-powered collision prediction, and real-time emissions tracking will enhance maritime intelligence. |

| AIS industry faced cybersecurity threats, data congestion, and interoperability challenges across global fleets. | Blockchain-secured AIS data networks, AI-driven vessel identity verification, and decentralized AIS data-sharing models will improve security and accessibility. |

One of the principal threats in the automatic identification system (AIS) business is the regulatory compliance and cybersecurity threats. As a highly essential tool for making maritime traffic and oceans safer, AIS has attracted the attention of international legislative authorities like those of the International Maritime Organization (IMO) and the USA Coast Guard.

Another major risk is disruption in the supply chain and component shortages. The AIS systems are particularly dependent on specific electronic elements, GPS receivers, and communication modules. The supply of components is positively correlated with the performance of global markets; however, geopolitical strife, logistical delays, and an ongoing semiconductor shortfall can all play a role in the equation leading to pricing issues and production delays.

Apart from that, the growing rivalry among AIS vendors and innovations in technology bring about challenges. The industry for AIS is a battleground of technologies like satellite-based vessel monitoring systems (VMS) and advanced radar solutions, which are the most important alternatives to AIS. The companies, which do not integrate their AIS products with, for example, the internet on the iot, are in danger of losing their positions in the industry.

Class A AIS transponders are, by the way, meant for larger commercial vessels, passenger ships, and cargo carriers, and they are used to follow the guidelines from IMO (International Maritime Organization). These transponders are meant to provide very powerful transmission, position updates in real time, and improved navigational safety for ocean-going vessels.

They are prevalent in global shipping, naval works, and offshore energy sectors as well. Key players operating in the global industry for automatic identification systems (AIS) include SAAB AB, ComNav Marine, and Japan Radio Co. (JRC), which are regarded for providing advanced Class A automatic identification systems with integrated GNSS receivers and encrypted communication to offer better monitoring of vessel movements to boost maritime security.

Shipping companies, coast guards, and port authorities can track vessel movements, maximize fuel efficiency, and safely regulate shore infrastructure using fleet management solutions based on AIS technology.

Fleet management systems integrated with AIS data offer real-time information about vessel position, speed, and operational status, enabling businesses to lower operational expenditures and enhance safety. AI-based predictive analysis and geofencing are implemented in advanced fleet management solutions to improve route optimization and fleet coordination.

| Countries/Regions | CAGR (2025 to 2035) |

|---|---|

| USA | 8.7% |

| UK | 8.4% |

| European Union | 8.6% |

| Japan | 8.5% |

| South Korea | 8.9% |

FMI states that the USA automatic identification system market will grow at a compound annual growth rate (CAGR) of 8.7% during 2025 to 2035 due to the surging need for AI-driven AIS solutions to offer real-time navigation, collision avoidance, and regulatory compliance.

The USA defense, shipping, and logistics industry employs AIS to improve marine operations, extend ship monitoring, and ensure seaport safety. Policymaking also drives investment in satellite-based AIS solutions and IoT-based tracking and monitoring solutions for environmental monitoring and naval defense.

Growth Drivers in the USA

| Primary Drivers | Details |

|---|---|

| Assured Monitoring and Protection of Trade | AI-enabled AIS technology enhances maritime security and efficiency. |

| Improved Satellite-Based AIS | Growing need for enhanced ship monitoring and naval surveillance. |

| Regulatory Policies and Security Boosts | Government policies facilitate investment in AIS to increase port security and environmental monitoring. |

The UK automatic identification system market is slated to witness CAGR of 8.4% between 2025 and 2035, cites FMI. The drivers for growth are the rising use of digital navigation systems, compliance with regulations, and smart ports initiatives. Government laws maintain maritime safety and protect the environment, and AI-based AIS solutions find their principal application in ship traffic monitoring and fleet performance monitoring.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| Adoption of AI-Based AIS Solutions | Enhances fleet performance and stops maritime accidents. |

| Increased Application of Digital Aids to Navigation | Smart harbors stimulate demand for real-time AIS monitoring. |

| Maritime Regulatory Safety Requirements | Regulatory and safety requirements necessitate AIS adoption. |

The EU AIS industry will grow at a CAGR of 8.6% from 2025 to 2035, according to a research report by FMI. Stringent EU maritime safety regulations compels to invest in satellite-based AIS, intelligent logistics, and naval safety solutions. Cloud monitoring and AI analytics drive further growth.

Growth Drivers in the EU

| Key Drivers | Details |

|---|---|

| Stringent Maritime Safety Legislation | Compliance costs compel firms to invest in real-time AIS monitoring. |

| Satellite-Based AIS Solution Integration | Smarter security and logistics solutions result in adoption. |

| AI & Cloud-Based Analytics Technologies | Ship track efficiency optimization maximizes maritime operations. |

The Japanese industry for AIS is poised to grow at a CAGR of 8.5% between 2025 and 2035, cites FMI, with investment in high-precision AIS technology for maritime traffic management and safe navigation. Japan focuses on sea innovation and smart shipping, driving AIS adoption in naval defense, fisheries, and logistics industries. Firms utilize real-time analysis of AIS data and automated tracking of ships.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| High-Precision AIS Solutions | Seamless management of marine traffic and navigation for security. |

| Smart Shipping & Maritime Innovation | Rapid deployment of AI-based ship tracking solutions. |

| Increased Fisheries & Defense Spend | Growing use of automated monitoring and real-time processing of AIS data. |

As per FMI, the South Korean AIS industry is poised to grow at 8.9% CAGR during the forecast period of 2025 to 2035 due to government investment in digital shipping infrastructure and AI-based navigation solutions. AIS satellite augmentation, AI-driven forecasting analytics, and IoT-enhanced ship monitoring improve operational efficiency and regulatory compliance. Cybersecurity advancements and blockchain-backed AIS solutions drive continued development.

Growth Drivers in South Korea

| Key Drivers | Details |

|---|---|

| AIS Navigation System Expansion Powered by AI | Real-time vessel tracking combined with weather forecast monitoring enhances shipping logistics. |

| Smart Port Technology Investment by Government | Infrastructure expansion improves maritime efficiency and security. |

| Cybersecurity & Blockchain-Based AIS Implementation | Secure vessel tracking and data transmission drive industry demand. |

The automatic identification system market is fast becoming competitive owing to the regulations laid in place to ensure safe sailing within the water and the need for real-time vessel tracking, enhanced satellite-based navigation mechanisms, and their proliferation. The growth has been mainly noted in the adoption of AIS for collision avoidance, fleet management, and compliance with environmental standards in commercial shipping, defense, and offshore industries.

Major players include Saab AB, ORBCOMM, exactEarth, Garmin, and Furuno, which top the competition with their sophisticated AIS transponders, satellite-based AIS services, and AI-based maritime analytics. These emerging enterprises and niche providers would target their specialized solutions toward emerging autonomous shipping, integrated port management, and predictive maintenance.

The forces driving the competition pertain to investing in AI-based data analytics and cloud-enabled tracking platforms combined with next-generation AIS technologies that will interface with IoT and cybersecurity frameworks. Hence, companies enhancing in-orbit satellite AIS capabilities and improving data accuracy to build more global coverage will have a strong position in the industry.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Saab AB | 20-25% |

| Orbcomm | 15-20% |

| exactEarth | 12-17% |

| Furuno Electric Co., Ltd. | 8-12% |

| Garmin Ltd. | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Saab AB | Provides advanced AIS solutions, real-time vessel tracking, and maritime security applications. |

| Orbcomm | Develops satellite-based AIS, fleet management solutions, and data-driven maritime analytics. |

| exactEarth | Specializes in space-based AIS, predictive vessel tracking, and maritime intelligence solutions. |

| Furuno Electric Co., Ltd. | Focuses on AIS transponders, navigation systems, and collision avoidance technology. |

| Garmin Ltd. | Offers integrated AIS solutions, marine GPS systems, and real-time ship monitoring tools. |

Key Company Insights

Saab AB (20-25%)

Saab AB dominates the AIS industry with real-time ship tracking, cutting-edge maritime security solutions, and integrated navigation technologies.

Orbcomm (15-20%)

Orbcomm improves maritime safety through satellite-based AIS, fleet management software, and predictive maritime analytics.

exactEarth (12-17%)

The exactEarth is a space-based AIS solutions expert that provides global ship tracking, collision avoidance, and maritime data intelligence.

Furuno Electric Co., Ltd. (8-12%)

Furuno Electric Co., Ltd. specializes in AIS transponders, electronic navigation aids, and maritime collision avoidance systems.

Garmin Ltd. (5-9%)

Garmin Ltd. manufactures combined AIS tracking systems, shipborne GPS units, and cloud-based ship tracking services.

Other Key Players (20-30% Combined)

The industry is slated to reach USD 304.6 million in 2025.

The industry is predicted to reach USD 613.3 million by 2035.

Key players include Saab AB, Orbcomm, exactEarth, Furuno Electric Co., Ltd., Garmin Ltd., L3Harris Technologies, Spire Global, Kongsberg Gruppen, Japan Radio Company Ltd. (JRC), and Weatherdock AG.

South Korea, slated to grow at 8.9% CAGR during the forecast period, is poised for the fastest growth.

Class A AIS is being widely used.

By category, the industry covers vessel-based and shore based.

The application includes fleet management, vessel tracking, maritime security, and others.

In terms of region, the industry spans North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

Catenary Infrastructure Inspection Market Insights - Demand & Forecast 2025 to 2035

Category Management Software Market Analysis - Trends & Forecast 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.