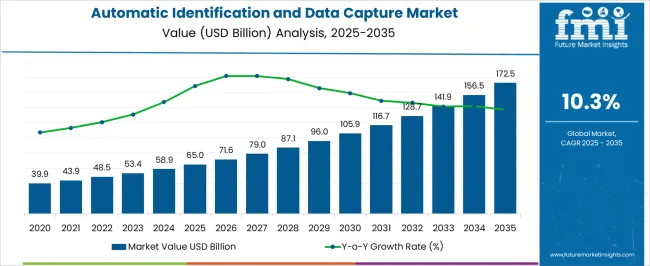

The Automatic Identification and Data Capture Market is estimated to be valued at USD 65.0 billion in 2025 and is projected to reach USD 172.5 billion by 2035, registering a compound annual growth rate (CAGR) of 10.3% over the forecast period.

| Metric | Value |

|---|---|

| Automatic Identification and Data Capture Market Estimated Value in (2025 E) | USD 65.0 billion |

| Automatic Identification and Data Capture Market Forecast Value in (2035 F) | USD 172.5 billion |

| Forecast CAGR (2025 to 2035) | 10.3% |

The Automatic Identification and Data Capture market is witnessing significant growth, driven by the increasing need for efficient data collection, tracking, and management across diverse industries. The adoption of barcode scanning, RFID, and other identification technologies is being supported by growing demand for operational efficiency, inventory accuracy, and real-time visibility. Advanced technologies enable rapid and precise data capture, reducing manual errors and improving decision-making processes in logistics, supply chain management, and asset tracking.

Integration with enterprise resource planning and warehouse management systems enhances automation, scalability, and workflow optimization. Regulatory compliance, particularly in retail, healthcare, and manufacturing sectors, is further accelerating adoption, as organizations seek traceability and audit readiness.

Rising demand for contactless and automated solutions is being fueled by the need for faster transactions, improved customer experiences, and enhanced security As enterprises prioritize data-driven operations and digital transformation initiatives, the market is expected to sustain long-term growth, supported by continuous technological innovation, increased adoption across end-use industries, and enhanced connectivity in business operations.

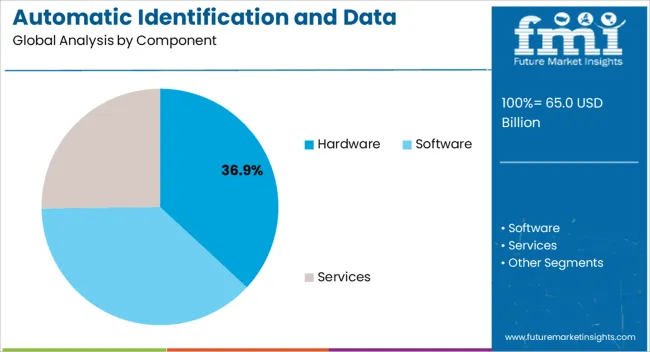

The hardware component segment is projected to hold 36.9% of the market revenue in 2025, establishing it as the leading component type. Its growth is being driven by the essential role that physical devices such as scanners, readers, and sensors play in enabling accurate and efficient data capture. These hardware devices provide the foundation for reliable performance in barcode scanning, RFID, and other automatic identification technologies.

Integration with software platforms ensures seamless data processing, storage, and real-time analytics. The rising demand for durable, high-performance hardware capable of supporting high-volume operations has strengthened adoption across retail, logistics, and manufacturing sectors. Advances in sensor technology, miniaturization, and wireless connectivity have enhanced device efficiency and flexibility.

Enterprises are leveraging hardware solutions to reduce manual intervention, minimize errors, and achieve faster operational throughput As demand for automated identification and data capture continues to grow, hardware is expected to maintain its leading position, driven by the need for scalable, reliable, and high-performance devices that support digital transformation initiatives and process optimization across industries.

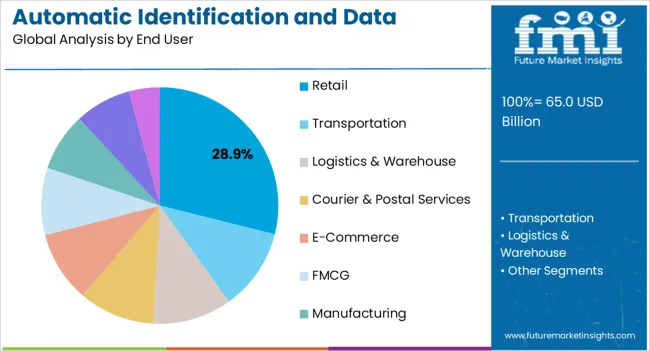

The retail end-user segment is anticipated to account for 28.9% of the market revenue in 2025, making it the leading end-use industry. Growth is driven by the need for accurate inventory management, faster checkout processes, and enhanced customer experiences. Automatic identification and data capture technologies enable real-time tracking of products, reduce stockouts, and improve operational efficiency.

Retailers are increasingly adopting barcode scanning, RFID, and IoT-enabled devices to enhance supply chain visibility and streamline store operations. Integration with point-of-sale and inventory management systems supports data-driven decision-making and improved planning. The adoption of contactless and automated solutions is being accelerated by changing consumer expectations for seamless shopping experiences and faster transactions.

Compliance with regulatory standards for product traceability further reinforces the importance of these technologies in retail operations As the retail sector continues to embrace digitalization and operational efficiency initiatives, the segment is expected to remain a primary driver of market growth, supported by technological advancements and increased adoption of automated identification solutions.

The growing e-commerce industry globally, increasing use of smartphones for QR code scanning and image recognition, and rising adoption of automatic identification and data capture solutions due to their ability to minimize queuing and transaction time and provide greater convenience to users in making small-value payments are the key factors that are anticipated to boost the market growth over the analysis period.

Additionally, the surging adoption of automatic identification and data capture solutions by banking and financial institutions to ensure customer safety and security, along with data privacy are some other factors that are expected to accelerate the growth of the automatic identification and data capture industry during the forecast period.

The automatic identification and data capture sector is witnessing a surge, owing to the rise in the use of the e-commerce industry paired with an increase in demand for smartphones, which is expected to propel the growth of the market in the forthcoming years.

The rising adoption of automatic identification and data capture solutions owing to their ability to minimize human error is expected to fuel the growth of the market during the forecast period.

The high cost associated with the installation of automatic identification and data capture systems is one of the key factors that is expected to impede the growth of the automatic identification and data capture sector during the forecast period. In addition, the rise in concerns about malware attacks and security breaches is projected to challenge the automatic identification and data capture business over the analysis period.

A huge chunk of a retail outlet’s total sale is contributed by low-value products and it is therefore economically unviable to use technologies such as RFIDs and 2D barcodes which are at the base of developments in the Automatic Identification & Data Capture market.

This is true for many other industries too, where the cost of large-scale implementation is hampering the growth of the automatic identification and data capture industry.

| Attributes | Value |

|---|---|

| Automatic Identification and Data Capture Market Size (2025) | USD 52,910.7 million |

| Automatic Identification and Data Capture Market Projected Size (2035) | USD 147,992.7 million |

| Automatic Identification and Data Capture Market CAGR (2025 to 2035) | 10.8% |

The global demand for automatic identification and data capture is projected to increase at a CAGR of 10.8% during the forecast period, reaching a total of USD 147,992.7 million in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2025, sales witnessed significant growth, registering a CAGR of 10.8%.

Data capturing has become essential to track and trace products of nearly all end-user industries. Not only does this help in analyzing the information about the product but also stores and saves information regarding the purchase of the product along with recording minute details of the same.

Although the COVID-19 pandemic affected the demand for automatic identification and data capture, the increasing sales of consumer products and emerging end-user industries are positively influencing the demand for automatic identification and data capture.

| Countries | Market Share (2025) |

|---|---|

| United States | 16.4% |

| Germany | 9.4% |

| Japan | 4.3% |

| Australia | 5.4% |

The growth of automatic identification and data capture is largely driven by the increasing awareness and high adoption of AIDC devices, increasing government legislation & investments, particularly in retail, healthcare, and manufacturing industries; it contributes to the technological development of numerous industries in the region.

The region is expected to witness the leading growth during the forecast period, owing to the wide acceptance of advanced technologies in the region. In terms of regional platforms, North America holds the leading market share in the market. The region accumulated a market share of 27.2% in 2025.

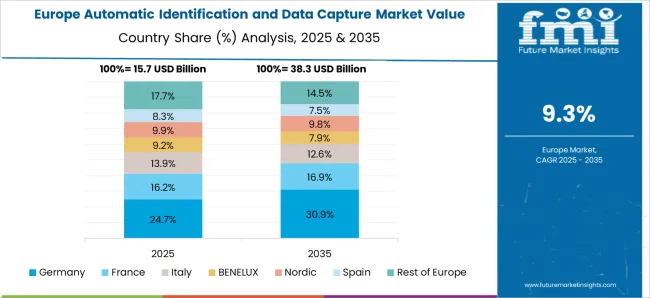

Europe expanded with 22.1% share in the market. The region is presently experiencing prominent growth in the barcode, RFID, and biometric technologies in various industries such as retail, manufacturing, transportation & logistics, healthcare, and BFSI. Furthermore, technological advancement and innovation are changing the landscape for automatic identification and data capture in the market in the region.

According to Future Market Insights, Europe is expected to provide immense growth opportunities for automatic identification and data capture and is expected to yield 24.7% revenue in 2025.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 8.2% |

| India | 14.3% |

Retail and logistics companies are expanding their presence in the Asia Pacific region to capitalize on the increased purchasing power of middle-class people. This, in turn, has led to the growth of automatic identification and data capture in the market in the region.

The significant presence of several market players, such as Panasonic, SATO, Toshiba, Godex, and Optoelectronics in the region is likely to propel the growth of the automatic identification and data capture sector in Asia Pacific. Thus, Asia Pacific is expected to procure a 32% market share for the automatic identification and data capture of the market in 2025.

Hardware segment dominated the market with 44.3% in 2025. The high requirement for hardware components in several automatic identification and data capture products such as barcoding solutions, magnetic stripe cards, smart cards, optical character recognition (OCR) systems, RFID tags, printers and readers, tablets, wearables, VR devices, heads-up display devices, Google Glass, and biometric systems, has contributed to the leading size of the hardware segment.

The increasing sales of these products are contributing to the growth of the hardware component segment.

Key players in the global automatic identification and data capture sector are Onna, Consilio, Amplitude, ContentSquare, LiveRamp, mParticle and TreasureData

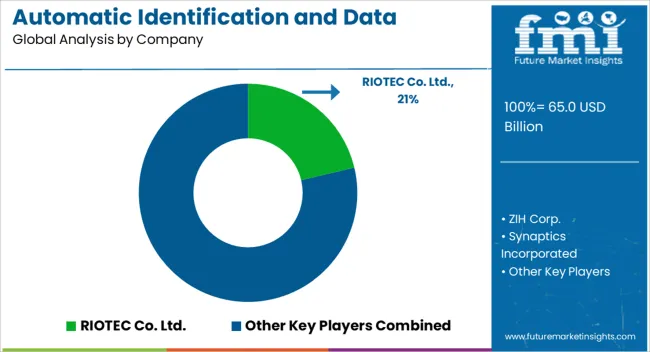

Key participants present in the global market are RIOTEC Co. Ltd., Datalogic, ZIH Corp., Synaptics Incorporated, CVISION Technologies Inc., SATO Holdings Corporation, and Toshiba TEC Corporation, among others.

Key Players :

The global automatic identification and data capture market is estimated to be valued at USD 65.0 billion in 2025.

The market size for the automatic identification and data capture market is projected to reach USD 172.5 billion by 2035.

The automatic identification and data capture market is expected to grow at a 10.3% CAGR between 2025 and 2035.

The key product types in automatic identification and data capture market are hardware, _rfid reader, _barcode scanner, _smart cards, _magnetic ink character recognition devices, _optical character recognition devices, _biometric devices, software, services, _integration & installation services and _support & maintenance services.

In terms of end user, retail segment to command 28.9% share in the automatic identification and data capture market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Automatic Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Automatic Goat Waterer Market Size and Share Forecast Outlook 2025 to 2035

Automatic Wine Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Automatic Content Recognition Market Size and Share Forecast Outlook 2025 to 2035

Automatic Coffee Machine Market Analysis – Size, Share & Forecast 2025 to 2035

Automatic Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA