Development of electric vehicles is anticipated to boost the growth of the Automatic Gearbox Valves market during 2025 to 2035. Automatic gearbox valves are responsible for controlling hydraulic pressure to enable smooth gear changes and optimal transmission performance. The growth of the market is also aided by the increasing adoption of advanced transmission systems in both passenger and commercial vehicles and the rise of fuel efficiency standards and the increasing number of electronic control unit (ECU) incorporated in the modern gearbox.

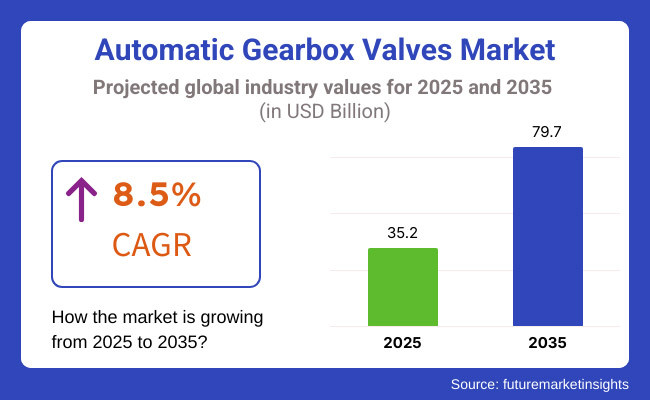

This segment of the global market will reach USD 35.2 Billion by 2025, and is anticipated to be valued at USD 79.7 Billion in 2035, showcasing a CAGR of 8.5% throughout the projections period. The automotive industry is being increasingly influenced by the thrust towards electric vehicles (EVs), hybrid transmission systems and smart mechatronic valve control technologies. Also improvements in the material science for manufacturing lightweight and corrosion-resistant valve components and the increasing adoption of AI-based predictive maintenance systems are further expected to provide the higher situation for the expansion of the valves market.

Explore FMI!

Book a free demo

Automatic Gearbox Valves Market in North America is expected to account for a notable share, owing to an increase in sales of SUVs as well as luxury vehicles, demand for fuel-efficient transmissions, technology incorporation in electric and hybrid powertrains. The USA and Canada dominate a region that has a high allure of automatic transmission vehicles and very strict fuel economy regulations set by agencies like EPA and NHTSA.

The growing market scenario for leading transmission system manufacturers such as BorgWarner, Eaton, and Allison Transmission also assists in the growth of the market. AI-based valve actuation technologies coupled with electronic transmission control unit (TCU) integration are being utilized to boost the efficiency of automatic gearboxes, which is creating a subsequent demand of high-performance hydraulic & solenoid valves.

Europe has a significant chunk of the Automatic Gearbox Valves Market, with Germany, the UK, and France being the pioneers for automotive transmission innovation along with regulatory compliance. The stricter CO₂ emissions regulations in the European Union are pushing car manufacturers towards the use of hybrid and fuel-efficient transmission systems, which is driving the demand for gearbox valves in precision-engineered applications.

However, various advanced hydraulic and electronic valve actuation systems in the gearbox used by the likes of Volkswagen, BMW, Mercedes-Benz, etc., for DCT and AMT technologies, are high on the list of features, which you would love to have in your vehicle, if you at the helm of affairs in an organization of the likes of Europe or similar. Moreover, the rising electrification of commercial as well as passenger vehicles is positively influencing the electronically controlled valve actuators market for next-generation transmission.

The Automatic Gearbox Valves Market is expected to be dominated by the Asia-Pacific region over the forecast period owing to the increasing vehicle production, demand for automatic transmission systems, and sales of electric vehicles (EVs). Overseas, countries like China, Japan, South Korea, and India are major contributors, taking advantage of growing automotive production, government incentives for more fuel-efficient vehicles, and increasing consumer desire for more comfortable driving experiences.

As China is the largest automobile market worldwide, the increased sales of automatic and hybrid vehicles will lead to the rise in demand for advanced gearbox components such as electro-hydraulic valve components in the region. Japan and South Korea has some of the most well-known car brands like Toyota, HONDA and, HYUNDAI the driving force to push boundaries in automotive industry with new products like CVT (Continuously Variable Transmission) and Intelligent Gear Shift Control. The demand for cheaper gearbox valve solutions for budget-friendly cars is also driven by India's general urbanization process and the rise in the use of automatic vehicles.

Additionally, deploying AI-enabled transmission control systems is likely to significantly contribute to market growth in the region along with the provision of advanced manufacturing of domestic auto part manufacturers and enhancements of valve material durability.

Challenges

High Costs and Complex Integration

It is anticipated that the high cost of precision-engineered transmission components, which ultimately raises the total expenses associated with the manufacturing of vehicles, will act as one of the major challenges for Automatic Gearbox Valves Market. Advanced manufacturing processes and large research and development investments makes it hard for small to medium-sized automotive suppliers to enter the market for hydraulic and electronic valve control unit integration.

The increasing competition from EVs, which utilize simpler transmission systems than traditional ICE vehicles, also has long term repercussions for the automatic gearbox valve market. Production and market dynamics are also influenced by supply chain disruptions, semiconductor shortages, and the rising and falling prices of raw materials.

Opportunities

AI-Enhanced Gearbox Control and Sustainable Valve Materials

The report also highlights potential opportunities and challenges in the Automatic Gearbox Valves market. AI-based predictive maintenance and self-learning transmission control algorithms are beginning to be used in automatic transmissions that improve efficiency by enabling adaptive shift strategies according to real-time assessments of driving conditions.

The development of sustainable and low mass materials, including carbon-fiber-reinforced composites and corrosion-resistant alloys, is enhancing the durability and thermal properties of gearbox valves. Moreover, it is generally expected that more devices would come with Electromechanical Valve Actuation technologies in place of Hydraulic solenoid valves that allows for faster reaction time and better energy efficiency.

The growing adoption of automatic transmissions in affordable cars and increasing requirement for high-performance gearbox valves in luxury and sports vehicle are further contributing to market growth. This strong growth in autonomous and connected vehicles is also driving a need for intelligent transmission control systems with AI-integrated valve actuators.

From 2020 to 2024 the automatic gearbox valves market grew moderately, with rising adoption of automatic and semi-automatic attuned in passenger and commercial vehicles. The growing need for an improvement in driving comfort by consumers paved the way for increased adoption of electro-hydraulic valve control systems, precision solenoid valves and proportional flow control valves for various applications. Growing preference towards dual-clutch and continuously variable transmissions (CVTs) and the shift towards 8-speed and 10-speed automatic transmissions, have further fuelled the demand for high power density gearbox valves.

Over this decade, from 2025 to 2035, the automatic gearbox valve landscape will witness transformation as electrified transmissions make way for vehicle propulsion, AI-assisted predictive valve control, and next-gen hydraulic actuation technologies. His target for the introduction of these multi-speed transmissions on the market is the increasing penetration of hybrid and electric vehicles (EVs) with that type of technology, which will produce new demands for electronically controlled gearbox valves optimized for torqueing seamlessly and recovering energy.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with CO₂ emission standards, CAFE regulations, and efficiency mandates for automatic transmissions. |

| Technological Advancements | Growth in electro-hydraulic valve control, solenoid-based actuation, and multi-speed transmission optimization. |

| Industry Applications | Used in passenger cars, commercial vehicles, and high-performance automatic transmissions. |

| Adoption of Smart Equipment | Integration of TCUs for shift timing control and electronic pressure regulation. |

| Sustainability & Cost Efficiency | Shift toward low-friction hydraulic valves and energy-efficient transmission components. |

| Data Analytics & Predictive Modeling | Use of basic transmission diagnostics and shift response analysis. |

| Production & Supply Chain Dynamics | Challenges in costly high-precision manufacturing, complex valve assemblies, and raw material sourcing. |

| Market Growth Drivers | Growth fueled by increasing demand for automatic transmissions, hybrid vehicle adoption, and transmission efficiency improvements. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered transmission efficiency optimization, blockchain-based gearbox valve traceability, and EV-specific transmission regulations. |

| Technological Advancements | AI-driven adaptive valve control, smart solenoid valves with real-time diagnostics, and fluid-free electromagnetic transmission valves. |

| Industry Applications | Expanded into hybrid and electric vehicle transmissions, AI-assisted smart shifting systems, and self-learning gearboxes. |

| Adoption of Smart Equipment | AI-powered transmission learning models, predictive gearbox maintenance, and IoT-connected valve diagnostics. |

| Sustainability & Cost Efficiency | 3D-printed lightweight gearbox valves, energy-efficient AI-controlled valve actuation, and recyclable composite valve materials. |

| Data Analytics & Predictive Modeling | Real-time AI-driven transmission health monitoring, predictive valve wear analytics, and adaptive hydraulic optimization. |

| Production & Supply Chain Dynamics | AI-driven supply chain optimization, blockchain-secured gearbox component authentication, and decentralized production hubs. |

| Market Growth Drivers | Future expansion driven by smart transmission technology, AI-powered gearbox optimization, and next-gen shift-by-wire valve actuation. |

Demand for automatic transmission and growing automobile industry specifically in the emerging economies are also expected to contribute significantly to the growth of automatic gearbox valves market in the projected time frame automatic gearbox valves in United States. Strict fuel economy and emission rules set forth by the National Highway Traffic Safety Administration (NHTSA) and the Environmental Protection Agency (EPA) are incentivizing automakers to build automatic gearboxes with greater efficiency via more effective valve designs.

The increasing penetration of hybrid and electric vehicles (EVs) is also acting as a growth multiplier for the global automobile electronically controlled gearbox valves market as OEMs integrate next-generation electronically controlled gearbox valves into their vehicle designs to amplify performance. Major automobile manufacturers, including Ford, General Motors, and Tesla, are pouring funds into smart transmission systems with smart valve actuation technologies powered by AI.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.8% |

The UK Automatic Gearbox Valves Market is driven by the rising consumer preference for automatic and semi-automatic transmission vehicles, increasing demand for fuel-efficient drivetrains increases the demand for Automatic Gearbox Valves, and government initiatives promoting hybrid and electric vehicle adoption.

The UK government, for instance, has banned new petrol and diesel cars by 2035, which is accelerating the move toward hybrid and EV powertrains, driving a demand for high-precision gearbox valves that maximise transmission performance. The evolution of adaptive gearbox valve control systems for DCTs and CVTs is also being presented in 31 papers, showcasing recent improvements in performance and efficiency in both concepts.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.3% |

The Automatic Gearbox Valves Market in the European Union is considerably driven up by strict regulations on emissions and growing use of cutting-edge automatic transmittal systems as well as swift electrification of the transportation business. The European Automobile Manufacturers Association (ACEA) is promoting low-emission and high-efficiency vehicle parts such as electronically controlled gearbox valves.

It accounts for major markets such as Germany, France and Italy, as automotive manufacturers including Volkswagen, BMW and Renault are focusing highly on such high-performance automatic transmission systems which incorporates intelligent hydraulic and solenoids vales in order to achieve better gear shifting and fuel efficiency. The rapid growth in the adoption of autonomous vehicles coupled with AI-based predictive maintenance systems is significantly contributing to the demand for self-adjusting gearbox valves.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.5% |

Japan’s position as a leader in the development of transmission technology, the increasing demand for hybrid vehicles, and the surging investment in next-gen automotive components are driving the Automatic Gearbox Valves Market in the country. For example, Japanese car manufacturers (Toyota, Honda, and Nissan) lead the development of CVT and hybrid transmissions, focusing on the integration of high-efficiency gearbox valves to improve performance and fuel economy.

The Japanese government through the Ministry of Economy, Trade and Industry (METI) promotes smart mobility solutions and targets low weight and efficient gearbox valves to further boost energy efficiency of automatic transmissions. Moreover, the fortified robotics and AI-based automation technological platforms of the country is pushing the efficient as well as accurate operation of valve control mechanisms in modern transmission architecture.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.7% |

The South Korean Automatic Gearbox Valves Market is growing rapidly owing to the modifiers of technology alley in automotive systems, fast growing production of electric and hybrid vehicles, smart investment in smart transmission systems and factors driving the growth of this market during the forecast period. Advancements in next-generation gearbox technology with government support from South Korea's MOTIE (Ministry of Trade, Industry, and Energy) would spur demand for high-performance solenoid and hydraulic valves.

Major South Korean automakers like Hyundai, Kia are integrating AI-based transmission management systems, which use adaptive gearbox valves to improve fuel efficiency, torque management, and driving comfort. The growing deployment of autonomous vehicle technologies along with connected vehicle ecosystems is additionally propelling the growth of electronically controlled automatic gearbox valves.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.9% |

The increase of demand for an uninterrupted transmission performance, fuel efficiency, vehicle automation, etc. are likely to boost the Automatic Gearbox Valves Market. The market for gearbox valves is led by pressure control valves and shift control valves owing to their importance in maintaining hydraulic pressure and ensuring efficient shifting operations, contributing significantly to the efficiency of a gearbox system as a whole.

In automatic transmissions, pressure control valves are crucial for regulating hydraulic pressure, which allows for smooth gear changes, prevents overheating, and ensures optimal torque application. These valves competently control the level of oil pressure in the circuit, reducing the load on clutch parts and transmission gears, which is good for the long run of the vehicle and gasoline saving. These are some of the automotive segment processes that can require the utilization of high-precision pressure control valves with the increasing adoption of new technology automatic transmissions, for instance, CVT (Continuously Variable Transmissions) and DCT (Dual-Clutch Transmissions). With the move toward hybrid and electric powertrains, manufacturers also are working on electronically controlled pressure valves for next-gen transmission systems.

But issues like complicated manufacturing processes, valve wear over time, and maintenance in general are troubling. This segment is anticipated to witness promising growth, due to innovations such as smart pressure control systems, self-adjusting hydraulic valves, and self-adaptive gripping systems with enhanced valve coatings for durability, responsiveness, and long-term operational performance.

The correct selection and optimal function of shift control valves are critical to automatic and semi-automatic transmissions. These valves regulate hydraulic pressure for the engagement and disengagement of clutches and gears, allowing for smooth acceleration and deceleration.

Increasing demand for driving comfort, enhanced vehicle responsiveness, and reduced shift lag among consumers have shifted producer focus to electronic shift control valves that enable faster and improved adaptation to the driving conditions, with reduced transmission shock and precise on-off valve characteristics for fast gear engagement. Furthermore, there has been an uptrend of such "adaptive shift control" technologies, which learn and adapt to the driver's style of driving and conditions of the road, in premium as well as performance-oriented vehicles.

Although they provide some benefits, shift control valves do have drawbacks when it comes to calibration complexity, wear and tear in high-performance applications, and dirt in the oil. However, various innovations related to AI-based shift logic, automatic cycling of hydraulic cleaning systems, and lightweight valve body materials are addressing these limitations and making shift control valves more efficient, durable, and responsive.

The adoption of automatic gearbox valves is primarily driven by passenger and commercial vehicle applications, as both segments focus on enhancing transmission reliability, efficiency, and overall driving experience.

Automakers are continuously adopting advanced automatic and semi-automatic transmission systems in passenger vehicles to improve driving experience, fuel economy, and performance, which is the primary reason behind the larger share of the passenger vehicle segment in the automatic gearbox valves market. The demand for automatic transmissions in compact, mid-size, and luxury vehicles will boost the requirement for high-performance pressure and shift control valves that offer a no-torque loss acceleration response and low transmission lag.

The increasing adoption of electric and hybrid vehicles is further contributing to the demand for intelligent gearbox valve systems, which can optimize torque distribution and adapt to different power requirements. Advances in electromechanical and solenoid-based type valves are also accentuating gearbox efficiency, greatly minimizing transmission losses while maximizing overall vehicle dynamics.

Although the market continues to grow, increased production costs and complex transmission designs are barrier to the mass adoption of advanced gearbox valve system solutions for economy vehicles. Nonetheless, advancements in affordable valve manufacturing technology, transmission control driven by AI as well as adoption of lightweight materials will be instrumental in supporting the overall market growth.

Automatic transmission systems are being gradually adopted in the commercial vehicle sector, especially for heavy-duty trucks, buses, and logistics fleets, where durability, as well as load-handling efficiency of transmission, is essential. Long-distance travel, high torque, and driver fatigue demand pressure control and shift control valves in passenger cars.

Focusing on producing the fuel-efficient vehicles with minimal maintenance costs, many automakers are benchmarking automated manual transmissions (AMT) and intelligent shift control systems for better vehicle uptime. Moreover, fleet operators are increasingly implementing AI-based transmission control systems that utilize predictive analytics and adaptive gear shifting to optimize performance across different terrain and loading conditions.

Although this accessibility element of the "commercial" segment has its benefits, it comes at cost in respect to gearbox overheating, valve clogging from overuse and the cost of repair. Nevertheless, innovations in self-lubricating valve systems, high-pressure hydraulic actuators, and predictability-seeking sensors are likely to serve to reduce the prevalence of gearbox valves in commercial vehicles, both in terms of operation and maintenance.

Rising adoption of automatic transmissions in passenger and commercial vehicles, technological advancements in transmission control technologies, increasing demand for fuel-efficient and smooth driving experiences, and the increasing vehicular proliferation within rapidly growing economies are primarily driving the growth of the Automatic Gearbox Valves Market. Market Dynamics, Electronic shift-by-wire systems, digital transmission control through AI, and increased adoption of electric and hybrid vehicles are some of the major market drivers. Leading companies are focused on developing high precision solenoid valves, electronically controlled transmission valves, and adaptive hydraulic valve technology to improve gear shifting, fuel economy, and vehicle performance. Major players in the marketplace consist of automotive component manufacturers, transmission system experts, and electronic control unit (ECU) suppliers, all of which are playing a role in innovations for next-gen transmission valve bodies and shift actuators.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BorgWarner Inc. | 15-20% |

| ZF Friedrichshafen AG | 12-16% |

| Aisin Corporation | 10-14% |

| Bosch Mobility Solutions | 8-12% |

| Schaeffler AG | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| BorgWarner Inc. | Develops electro-hydraulic and solenoid-based automatic transmission valves for high-performance vehicles. |

| ZF Friedrichshafen AG | Specializes in electronically controlled transmission valves and shift-by-wire actuation systems for automatic gearboxes. |

| Aisin Corporation | Manufactures precision hydraulic valves for automatic transmissions, including CVTs and hybrid drivetrains. |

| Bosch Mobility Solutions | Provides intelligent transmission control valves with AI-powered shift pattern optimization. |

| Schaeffler AG | Focuses on adaptive valve body systems that improve fuel efficiency and driving comfort. |

BorgWarner Inc. (15-20%)

BorgWarner leads in automatic gearbox valve technologies, offering electro-hydraulic control valves for modern automatic and dual-clutch transmissions.

ZF Friedrichshafen AG (12-16%)

ZF specializes in electronically controlled transmission valve systems, integrating shift-by-wire and mechatronic actuators for high-performance vehicles.

Aisin Corporation (10-14%)

Aisin provides hydraulic and electronic transmission valves, catering to automatic, CVT, and hybrid vehicle transmission systems.

Bosch Mobility Solutions (8-12%)

Bosch integrates AI and predictive analytics in transmission valve control, improving gear shifting, fuel efficiency, and vehicle responsiveness.

Schaeffler AG (6-10%)

Schaeffler develops lightweight and adaptive gearbox valves, focusing on reducing transmission lag and optimizing power efficiency.

Other Key Players (35-45% Combined)

Several automotive component manufacturers and transmission system suppliers contribute to advancements in solenoid valves, electronic shift actuators, and adaptive gearbox control technologies. These include:

The overall market size for the Automatic Gearbox Valves Market was USD 35.2 Billion in 2025.

The Automatic Gearbox Valves Market is expected to reach USD 79.7 Billion in 2035.

Increasing adoption of automatic transmission vehicles, advancements in gearbox technology, and rising demand for fuel-efficient and smooth-driving systems will drive market growth.

The USA, China, Germany, Japan, and South Korea are key contributors.

Pressure control valves are expected to dominate due to their essential role in precise transmission fluid control and performance optimization.

Germany Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

United Kingdom Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

United States Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

Fire Truck Market Growth - Trends & Forecast 2025 to 2035

Run Flat Tire Inserts Market Growth - Trends & Forecast 2025 to 2035

Decorative Car Accessories Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.