The burgeoning automated portal management industry globally is anticipated to see meaningful progression from 2025 through 2035, motivated by multiplying desires for enhanced security choices, developing endorsement of wise building innovations, and a reinforcing concentration on vitality effectiveness in both private and business spaces.

Automated passage controls, permitting seamless, hands-free access and exit, are quickly turning into a standard include in cutting edge foundation activities, improving accommodation, wellbeing, and openness for clients.

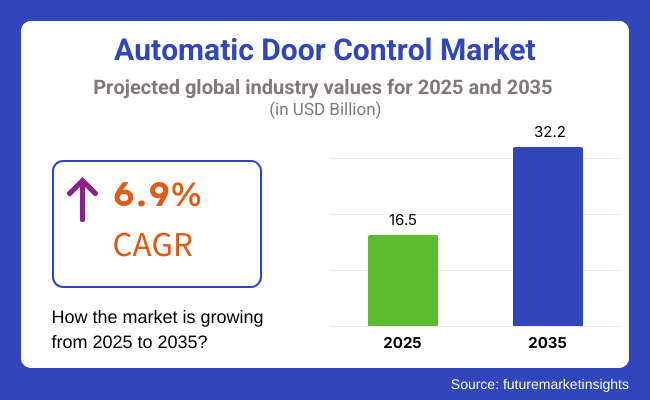

By 2025, the automated entrance control market was assessed at very nearly USD 16.5 billion, and projections anticipate it will achieve USD 32.2 billion by 2035. This addresses a compound yearly development rate of 6.9% over the projection time frame. Advancing sensor innovation, expanded joining of IoT and AI-driven answers, and the continuing migration toward savvy and maintainable plan approaches are supporting the market development.

The developing accentuation on the client experience and wellbeing is encouraging the selection of automated entrance controls in medicinal services offices, airplane terminals, shopping centres, and other open regions.

Furthermore, expanded mindfulness of cleanliness, particularly taking after worldwide wellbeing issues, is boosting interest for contactless and automated section frameworks. Makers are putting resources into development to create exceedingly responsive, vitality proficient passage control instruments that enhance both operational execution and visual allure.

The 6.9% CAGR reflects the market’s steady expansion across various end-use sectors. As building codes and regulations become more stringent regarding accessibility and energy conservation, automatic door controls are expected to become an integral part of next-generation architectural and infrastructural designs.

Explore FMI!

Book a free demo

North America continues to serve as a dominant force for automatic door controls owing to widespread implementation of clever construction answers and stringent administrative benchmarks. The United States and Canada are at the forefront, propelled by investments in commercial real estate, medical facilities, and airports that emphasize vitality efficiency and user comfort. State-of-the-art sensor technologies, coupled with the region’s intensifying focus on contactless remedies, have fuelled considerable market adoption.

The integration of IoT and wise home platforms is also adding to the market’s progress, as customers and companies search for automated remedies that improve security and streamline access control. North America’s established base of pioneering technology providers and robust retrofitting demand for older building stock further facilitate market expansion.

Additionally, the region's culture of adaption has supported established construction outfits and start-ups alike in implementing novel access mechanisms that benefit inhabitants and staff while saving on operational costs long term.

Europe remains a substantial stakeholder for programmed entryway direction frameworks, upheld by strict building codes, vitality productivity orders, and the expanding acknowledgment of supportable development practices. Nations like Germany, the UK, and France lead the market, with solid endorsement in business structures, restorative offices, and open framework. The mechanical advancement and expanded quantity of new frameworks keeps on empowering development.

The European Union’s push for keen urban communities and vitality proficient structures has quickened the selection of programmed entryway controls joined with propelled sensors, AI calculations, and vitality sparing innovations.

The development of the retail part and the prerequisite for secure, dependable access arrangements in high-activity territories additionally energize the market’s advancement crosswise over the locale. The ongoing improvement of keen frameworks has further improved the unpredictability and assorted variety of entryways across urban communities, shops, and workplaces.

Asia-Pacific nations have witnessed dramatic economic growth in recent decades, accelerating the automation of basic functions. Countries experiencing expanded infrastructure and rising incomes now demand efficient door systems. As cities swell and buildings multiply in height and scope, automatic doors ensure the smooth flow of large volumes of people.

Where cities were once small and movement was limited, now mammoth urban areas stretch for miles and millions commute daily. Electric doors slide silently open, preventing bottlenecks and minimizing wasted time. In the bustling commercial districts and sprawling apartment towers that continue rising to accommodate burgeoning populations, automated doorways have become essential to avoid chaos. Transformative infrastructure programs and an emphasis on sustainability bring greater reliance on technologies that require less physical effort.

Public transit networks strain to move ever larger crowds while construction continues at a torrid pace. Automatic doors on trains and subways, in stations and terminals help shuffle travellers where they need to go without delay.

As living standards climb higher across the region, safety and convenience gain greater priority. Sensor-activated doors spare individuals exertion while protecting the flow of commuters, shoppers, workers and residents. Developing nations embrace solutions that ease accessibility challenges as modernization progresses apace.

Challenge

High Initial Costs and Integration Complexity in Automated Door Systems

The growth of the automatic door control market. Automatic door systems are a critical part of businesses and public infrastructure that enables enhanced security, access and energy efficiency, but integrating these technologies means increased installation costs and an associated poor integration with already implemented building management systems. Moreover, in particular, safety standards that change from year to year and regional compliance needs when it comes to deployment, further add layers of complexity.

To overcome these issues, manufacturers should prioritize modular and affordable door control systems that offer user-friendly interfaces, compatibility with smart building solutions, and high energy efficiency. Predictive maintenance functionality and IoT-enabled diagnostics will also help to reduce operational costs and downtime.

Opportunity

Expansion of Smart Building Infrastructure and Contactless Technologies

Rapid global uptake of smart and energy-efficient solutions, along with a growing inclination towards contactless technologies, is providing an impetus to the automatic door control Market.

Businesses and healthcare facilities are also important users of automatic door systems, as they need to operate on the right foot, and to cure the spread of germs, companies and service providers are integrating such automatic door systems in their spaces. Artificial intelligence-powered door control, biometric authentication, and voice-activated entry solutions are changing how buildings implement access control.

Furthermore, Sustainability initiatives are improving, and manufacturers are producing energy-efficient and solar automatic doors to minimize the environmental impact. Fortunes will then favour those companies that will invest in advanced sensor technology, advanced cloud-based monitoring, AI-powered security integration.

The automatic door control market recorded significant growth from 2020 to 2024, driven by a growing demand for hands-free access solutions across various sectors such as healthcare, retail, and commercial spaces. The shift to hygiene-centric, contactless entry-based systems accelerated adoption, particularly in public spaces.

But high costs, supply chain disruptions, and installation complexities limited widespread adoption among smaller businesses and residential applications. In response, companies are investing in increased automation, implementing AI-driven motion sensors, and improving product durability for reliability and efficiency. Moreover, advancements in wireless connectivity and real-time access monitoring have propelled the cloud-integrated door control solutions market.

2025 to 2035: The market will experience significant advancements with AI-powered automation, predictive maintenance, and improved security features. Advanced automatic door control systems: Solutions based on the integration of facial recognition, voice-activated commands, and smart connectivity IoT-enabled access control and real-time data analytics to enhance the effectiveness of energy efficiency optimization and security monitoring will also continue to grow in the coming years.

Furthermore, the rising number of net-zero energy buildings will push the need for self-powered, low energy consumption automatic doors. The next decade of automatic door control innovation will be dominated by AI-driven automation, touchless access solutions, and sustainable smart building integration companies.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with accessibility and hygiene-focused entry standards |

| Technological Advancements | Growth in motion-sensing and RFID-based automatic doors |

| Industry Adoption | Increased use in healthcare, retail, and commercial spaces |

| Supply Chain and Sourcing | Dependence on electronic components and global suppliers |

| Market Competition | Presence of established access control manufacturers |

| Market Growth Drivers | Demand for touchless access and hygiene-enhancing solutions |

| Sustainability and Energy Efficiency | Initial implementation of low-energy automatic doors |

| Integration of Smart Monitoring | Limited real-time tracking and access analytics |

| Advancements in Contactless Access | Use of motion sensors and RFID keyless entry |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of AI-driven security compliance and sustainable energy regulations. |

| Technological Advancements | Widespread adoption of AI-powered, voice-controlled, and biometric entry systems. |

| Industry Adoption | Expansion into smart cities, advanced transportation hubs, and residential automation. |

| Supply Chain and Sourcing | Shift toward localized manufacturing and sustainable material sourcing. |

| Market Competition | Rise of AI-driven security start-ups and next-gen access automation firms. |

| Market Growth Drivers | Increased investment in biometric authentication, AI-driven access control, and energy-efficient door systems. |

| Sustainability and Energy Efficiency | Full-scale adoption of solar-powered, energy-efficient, and recyclable automatic door materials. |

| Integration of Smart Monitoring | AI-based predictive analytics, cloud-integrated access control, and real-time security automation. |

| Advancements in Contactless Access | Growth in facial recognition, gesture-based access, and touch-free authentication systems. |

The United States automatic door control market has steadily grown due to increasing demands for intelligent building solutions, the construction of more commercial areas, and stricter accessibility rules. Both the Americans with Disabilities Act and construction safety codes are driving widespread use of self-operating sliding and swinging doors in public structures, hospitals, and shopping complexes.

The hospitality and transportation industries have become major customers of contactless and sensor-based entrance control systems, needing touchless access in airports, hotels, and shopping malls. Moreover, the rising preference for smart homes and internet-connected security setups is fuelling requirements for automated access to residential properties.

Advances in AI-guided permission management and heightened investments in high-security automated entrance arrangements mean the USA automatic door control market is anticipated to considerably expand its scope and impact.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

The United Kingdom automatic door control market has steadily expanded in recent years due to rising investments channelled towards commercial real estate ventures and an increasing societal adoption of intelligent security solutions along with stricter governmental regulations aimed at enhancing building accessibility.

Under the UK's Disability Discrimination Act and Construction Design and Management directives, the implementation of automatic entranceways has been strongly encouraged in hospitals, government offices, and other commercial complexes to foster a more inclusive architecture.

Meanwhile, key sectors such as retail and hospitality, which includes everything from multinational hotel chains to bustling shopping centres and corner restaurants, have wholeheartedly embraced the entrance-facilitating practicalities and energy-preserving perks of automated doors integrated with sensor-based triggering systems. Furthermore, a growing conscientiousness surrounding the development of sustainable and energy-efficient building technologies has driven increased utilization of low-energy automated entryways.

With smart building investments continuing to rise across the nation and automated doorways further expanding into applications within high-security compounds, the UK automatic door control market is positioned for steady maturation in the coming years according to various analyses.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.7% |

The rapidly advancing European Union mechanized entryway governance sector has undergone robust expansion in recent years, propelled by rigorous structural protection benchmarks, intensifying urbanization, and expanding investments in brilliant infrastructure initiatives. Nations like Germany, France, Italy, and others have emerged as pioneering implementers of mechanized entryway platforms in both commercial and industrial verticals.

The EU's fixation on energy-proficient edifices, in accordance with the European Green Deal and Energy Performance of Buildings Directive, has exponentially accelerated the adoption of automated doorway mechanisms that better insulate and reduce consumed energy.

In addition, the proliferating necessity for contactless access remedies in healthcare and public structures is further fuelling market growth. The debut of more intelligent automated security entrance systems has enabled edifices to ensure safety while minimizing human contact amid the ongoing pandemic.

With continuous investments in brilliant metropolitan projects and high-security architectural digitization, experts anticipate that the EU automated doorway management market will steadily continue evolving in the coming years. Presently, the EU is working to develop standardized guidelines for automated doors to harmonize prerequisites and ensure reliable functionality, accessibility, and security across borders as freedom of movement increases post-pandemic.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.8% |

The evolving Japanese automatic door control market is being reshaped by increasing adoption of cutting-edge intelligent building technologies, burgeoning demand from commercial and transportation verticals, and strong governmental emphasis on accessible infrastructure. Japan's aging demographic phenomenon is intensifying the necessity for barrier-free facilities, including self-operating sliding and sensor-based entrances in hospitals, public transit stations, and residential complexes.

The transportation sphere, notably train terminals and airports, represents a major customer of sophisticated, AI-driven automatic doors to optimize passenger flow and security. Additionally, Japan's pioneering robotics and deep integration of AI in smart structures are spurring innovative non-contact and biometric-enabled entrance management systems.

With continuous technological refinement and rising investments in energy-efficient building solutions, the dynamic Japanese automatic door control sector is poised for steady evolution to accommodate diverse accessibility needs through integrated smart technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.9% |

The South Korean automatic door control industry has witnessed dependable development, fuelled by expanding keen city ventures, developing reception in cutting edge office structures, and developing interest for propelled wellbeing arrangements. The South Korean administration's venture in keen foundation and computerized change is quickening the selection of AI-controlled and IoT-coordinated programmed entryway control frameworks.

The business genuine estate and lodging divisions, including extravagance inns, corporate structures, and shopping centres, are significant shoppers of sensor-based and facial acknowledgment passage frameworks. What's more, the developing reception of vitality proficient and natural agreeable building innovations is driving interest for programmed entryways with keen vitality the board highlights. These frameworks have started to see more prominent penetration as developing urban communities search for keen arrangements.

With ascendant urbanization and solid interest for savvy wellbeing arrangements, the South Korean programmed entryway control part is relied upon to create dependably. Be that as it may, the commercial centre faces difficulties in expanding reception crosswise over provincial regions and smaller scale ventures due to enormous underlying capital necessities and specialized impediments currently being tended to by driving merchants.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.8% |

In the automatic door control type market, the automatic sliding door segment and automatic revolving door segment each hold a considerable share across the automatic door control's market and this can be attributed to the growing adoption of advanced entrance solutions across commercial, healthcare, and public infrastructure sectors with the demand for enhancing accessibility and energy efficiency coupled with improved pedestrian flow.

High-performance automatic doors serve an essential function in providing barrier-free entry, enhancing security, and smartly utilizing space and are thus necessary in airports, hospitals as well as hotels, office buildings, and retail outlets.

Automatic sliding doors are one of the most common automatic entrance solutions that provide efficient, hands-free operation, space-saving, efficient access control, and energy. Unlike traditional model swing door, sliding door open and close with seamless movement and doesn't need extra clearance, which certainly makes it much better for functionality in high traffic areas.

Growing emphasis on touchless entry to reduce contamination and avoid infection in hospitals and healthcare facilities, aligning with the increasing importance of good hygiene standards for patient care, has been paving the way for adoption of sensor-activated sliding door systems. Studies show the wide accessibility in medical environments with automatic slider doors increases accessibility up to 40%, leading to better mobility for the patients and health-care personnel.

Thereby, the prominent rise of automatic sliding doors in airports and transportation hubs, which are run on high-speed and power-efficient door mechanisms that facilitate seamless passenger transitions, has perfectly complemented the market demand, thereby ensuring wider proliferation of these solutions in international and domestic travel terminals.

The incorporation of AI-based motion detectors and smart access control systems equipped with automated traffic monitoring and security monitoring have added to the uptake, providing enhanced security and operational efficiencies in commercial and institutional applications.

Energy-efficient automatic sliding doors with thermal-insulated glass panels and low-power motorized systems have improved the market size ensuring greater sustainability in green buildings and smart city developments.

Multi-functional automatic sliding doors, integrating fire-rated abilities with high-security access control, have advanced the segment and market expansion as a whole by providing better adaptability at critical infrastructure and government institutions.

Although automatic sliding doors provide benefits such as saving space, enhanced accessibility, and hygiene control, there are numerous issues, including high initial investment costs, sensor calibration and maintenance in a high pedestrian flow environment. Nevertheless, recent developments like AI-powered entry analytics, self-cleaning sensor tech, and modular sliding door designs are improving efficiency, durability, and scalability for automatic sliding door systems, keeping this market growing.

Due to increased dependence on energy-efficient, noise-free, and visually appealing entryway solutions, automatic revolving doors has had steady acceptance across the globe; particularly across segments such as luxury hotels, corporate office buildings, and high-security government institutions. Compared to sliding doors, revolving doors allow controlled air exchange process reducing change in temperature inside the building and improving the energy efficiency of building.

As commercial buildings increasingly prioritize guest experience and operational efficacy, the demand for automatic revolving doors at high-end hotels and office buildings with unique, sensor-controlled entryways that allow for body-scaled customization and architectural appeal continued to underpin adoption of luxury or premium revolving door systems. Automatic revolving doors save up to 30% of lost building energy and can help enhance sustainability in HVAC-based surroundings, according to studies.

Growth of automatic revolving doors in both government offices and funded institutions, paired with bulletproof glass and biometric security integrations in the door section has developed market demand, ensuring penetration in high-security environments.

In fact, the use of AI that enhances pedestrian flow by providing adaptive speed and direction control as well as congestion detection has increased adoption, paving the way for better safety and accessibility in crowded public spaces.

The introduction of modular automatic revolving door systems, with adjustable entrance widths, and automated emergency exit products have facilitated market growth by allowing increased adaptability for use in a variety of building designs.

Silent motorized revolving doors with low-noisel drive systems ( < 22dBA ) integrated with seamless changes from Glass to Frame, have also enabled better penetration into the market and proved to be better compliant to noise sensitive environments such as hospitals and libraries.

But automatic revolving doors have drawbacks as well, including high installation costs, space limitations in dense buildings, and potential barriers for disabled folk. But recent innovations in adaptive entry speed control, AI-assisted user recognition, and hybrid sliding-revolving door designs are enhancing usability, sustainability, and market penetration, promising ongoing market penetration for automatic revolving door solutions.

Two of the main market segments are hospital and airport sectors since industries are increasingly focusing on automatic door control to regulate accessibility, enhance energy efficiency, fulfil changing safety standards, etc.

Hospitals, clinics, and medical research centres increasingly adopt smart entryway systems to maximize sanitation, improve the speed of patients being treated, and ensure adherence to infection-prevention protocols; hence, the healthcare sector has become one of the largest consumers of automatic door control solutions. Instead, automatic doors help limit surface contact compared to conventional swinging doors, which is a key point in limiting cross-contamination in health care settings.

Surging demand for automatic door systems for use in operating rooms and intensive care unit (ICU) rooms with hermetically sealed sliding doors for airflow containment and sterilized conditions is increasing adoption of high-performance medical-grade door automation as hospitals pivot to focus on patient safety and mitigation of in-hospital infections. Research shows that automatic doors in medical facilities decrease microbe spread by more than 60%, leading to greater hygiene and patient assistance.

It has also led to an increased demand for the automatic doors in terms of use in emergency rooms and trauma centres, as these facilities require fast-opening sliding and swing doors for seamless patient transfer, fuelling the overall automatic doors market expansion during the forecast period.

Touchless access control solutions, which include voice-activated and motion sensor door systems, have increased adoption even further, maximizing accessibility for people who are mobility impaired.

Introduction of self-sanitizing automatic doors through UV-light sterilization and antimicrobial coating technologies has been a significant contributor to market growth that supports enhanced sustainability in the disease transmission sensitive accessible environments such as, healthcare settings.

Automatic doors help enhance patient safety, accessibility, and hygiene control, but the access control systems are expensive to integrate, require regular maintenance, and are challenged when a power failure is encountered.

But, the automatic door control automatic entry is being substituted with new technologies, such as automated emergency door systems with battery backup systems, AI powered child language analysis and hybrid air sealed medical doors, coupled with their electric and robotic, are being unrolled, specifically to give flexibility and long lasting practical cost alternatives to ensure automatic opening door control continues to develop for medical buildings usage.

In fact, strong market adoption has been achieved in the airport sector, especially with international terminals, security checkpoints, and passenger boarding areas, as aviation hubs continue to deploy smart door control solutions to benefit safety and traffic management as well as to elevate traveller experience. Automatic procedures provide better access separation of airport zones than manual doors and rekeys-and facilitate the movement of people across those transitional spaces where access to secure areas is controlled.

The growing need for automatic sliding and revolving doors at terminal entry and exit points, with integrated biometric authentication and facial recognition capabilities, has promoted the adoption of high-security automatic door solutions, as airports focus on traveller safety and adherence to regulatory requirements. Data shows that automated security checkpoint doors lower passenger wait times by up to 25%, maintaining a more seamless boarding and immigration process.

The increasing installations of automatic door systems in baggage handling regions & cargo terminals and deployment of high-speed with impact threshold automatic shutter doors, has propelled the demand in the market followed by increased acceptance in air freight logistics and baggage processing.

AI-powered people flow analytics, leveraging gate placement control and congestion analysis to optimize passenger movement, has also increased the adoption and has ensured improved efficiency in congested terminals.

The growth of temperature-sensitive automatic door systems equipped with intelligent climate-control options that offer a high degree of energy efficiency has provided a significant boost in the market, ensuring better sustainability in high-traffic airport environments.

Although automatic doors at airports are associated with benefits related to security, energy efficiency, and passenger convenience, they also present with challenges such as high maintenance costs, heightened cybersecurity threats in biometric authentication, and possible unreliability in extreme weather conditions.

But from AI-enabled crowd management to climate-smart portal designs of doors to future-ready contactless access control have seen solutions phase in that heighten operational efficiency, security and the traveller experience-and leave the future open to automatic door control in forward-looking airport infrastructure.

The automatic door control market is witnessing growth owing to a rising demand for contactless entry solutions, energy-efficient building automation, and smart security systems in commercial, residential, healthcare, and transportation sectors.

To address the growing demand, companies are also focused in the development of AI based motion sensor, IoT based access control, and energy efficient automatic door solutions for improved convenience, security and sustainability. Market analysis introduces worldwide building automation, the global automatic sidewalk door, sliding automatic doors, swing automatic doors, revolving automatic door, folding automatic doors, and others.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ASSA ABLOY AB | 15-20% |

| DormaKaba Holding AG | 12-16% |

| Stanley Black & Decker, Inc. | 10-14% |

| GEZE GmbH | 8-12% |

| Horton Automatics (Overhead Door Corporation) | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| ASSA ABLOY AB | Develops high-performance automatic sliding, swing, and revolving doors with AI-powered motion sensors and smart access control. |

| DormaKaba Holding AG | Specializes in integrated automatic door solutions with biometric authentication and IoT-based access management. |

| Stanley Black & Decker, Inc. | Manufactures commercial-grade automatic doors with energy-efficient operation and remote control capabilities. |

| GEZE GmbH | Provides intelligent automatic door closers, touchless entry systems, and automated safety doors for smart buildings. |

| Horton Automatics (Overhead Door Corporation) | Offers custom automatic door systems for healthcare, commercial, and public infrastructure applications. |

Key Company Insights

ASSA ABLOY AB (15-20%)

The automatic door control market with its innovative AI-integrated smart entry solutions, high-efficiency access control, and biometric authentication technologies.

DormaKaba Holding AG (12-16%)

DormaKaba is an access automation company that provides touchless entry methods, smart building automation solutions, and IoT-enabled door access controls.

Stanley Black & Decker, Inc. (10-14%)

Stanley makes rugged automatic door systems for commercial applications, including real time monitoring and security integrations.

GEZE GmbH (8-12%)

AI-driven door automation solutions for energy-efficient designs that align with safety regulations and sustainability strategies.

Horton Automatics (Overhead Door Corporation) (5-9%)

Horton is a supplier of high-performance automatic doors, which feature high-end motion detection and remote access control.

Other Key Players (40-50% Combined)

There are a range of contributors towards next generation automatic door implementations, AI sector authentication systems and other sustainable door control systems in the form of building automation and access control industrialists. These include:

The overall market size for Automatic Door Control Market was USD 16.5 Billion In 2025.

The Automatic Door Control Market expected to reach USD 32.2 Billion In 2035.

The demand for automatic door control systems will be driven by factors such as rising demand for convenience, enhanced security, and energy efficiency in residential, commercial, and industrial spaces. Additionally, increased adoption in healthcare, retail, and transportation sectors, along with technological advancements, will further fuel market growth.

The top 5 countries which drives the development of Automatic Door Control Market are USA, UK, Europe Union, Japan and South Korea.

Automatic Sliding and Automatic Revolving Doors Drive Market Growth to command significant share over the assessment period.

High Voltage Glass Insulator Market Growth - Trends & Forecast 2025 to 2035

Hedge Trimmers Market Growth - Trends & Forecast 2025 to 2035

High Speed Steel (HSS) Tools Market Growth - Trends & Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.