The market for Automatic Dishwashing Products remains stable as urbanization rates continue to rise combined with rising demand for convenience-centric cleaning solutions along with increasing adoption for dishwashers paired with the Automatic Dishwashing Products market. Market growth is also being driven by a shift towards energy-efficient and water-saving dishwashing appliances, in addition to innovations in eco-friendly and biodegradable detergent formulations. Furthermore, increasing health consciousness is paving the way for the growth of high-performance automatic dishwashing detergents, rinse aids, and machine cleaners.

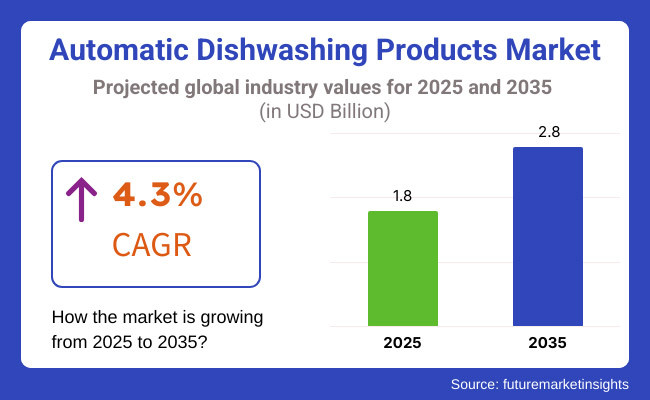

The market is anticipated to grow USD 1.8 Billion by 2025, at a CAGR of 4.3% during 2025 to 2035. Smart dishwashers, plant-based cleaning agents, and AI shall continue to disrupt the market. Furthermore, growing investments in sustainable packaging, phosphate-free formulations, and enzyme-based dishwashing solutions is also propelling the market growth.

Explore FMI!

Book a free demo

The Automatic Dishwashing Products Market of North America is expected to dominate the market due to the high adoption rate of dishwashers in homes, and an increasing demand for premium cleaning solutions opportunity offered by dishwasher detergent High focus on eco-friendly detergents is expected to further drive the North America Automatic Dishwashing Products Market growth. The USA and Canada top the region with growing household dishwasher penetration, increasing e-commerce distribution networks and growing consumer preference for time-saving cleaning products.

There is a growing realization among consumers that biodegradable, phosphate-free and plant-based detergents are the way of the future, and this shift is taking place at light speed across North America. The innovation of the product is further propelled by technological development in automatic dishwashing liquids, enzyme-based detergents, and multi-functional pods. This is contributing to the growth of the market as the region has a strong retail presence-from major supermarket chains and online marketplaces to subscription-based detergent services.

Automatic Dishwashing Products Market of Europe holds a significant share in the Automatic Dishwashing Products Market; leading countries for sustainable cleaning solutions and high-efficiency dishwashing products include Germany, the UK, France, and Italy. Strict European Union (EU) environmental regulations in the region forced manufacturers to remove phosphates, microplastics and harsh chemicals from automatic dishwashing detergents.

Such a scenario is driving demand for low-foam, fast-dissolving, and water-efficient detergents across households, especially in urban apartments using compact and energy-efficient dishwashers. Moreover, the July 2022 introduction of private-label green dishwashing lines across European supermarkets is providing cheaper alternatives to expensive brands, increasing availability of sustainable products for consumers.

The Asia-Pacific region remains the top revenue contributor in the global Automatic Dishwashing Products Market with the highest CAGR, motivated by increase in disposable income, fast urbanization, and growing awareness toward hygiene and automation. Growing demand: China, Japan, South Korea and India are seeing the growth in demand for dishwashers and compatible detergents, primarily among urban centres where convenience and efficiency are in higher demand.

Automatic dishwashing gels, pods, and rinse aids are benefiting from China’s expanding middle-class population and rapid rate of adoption of smart home appliances. Japan and South Korea, both recognized as pioneers in the manufacturing of small household machines like dishwashers, are playing a role in the creation of super concentrated, water-saving, and fragrance-free dishwashing products. The growth of dual-income households and a growing awareness of hygiene standards in such emerging markets, like India’s emerging dishwasher market, is also driving the market growth in the region.

Demand for personalized and subscription-based dishwashing products is additionally growing in Asia-Pacific because of the increase in online retail and direct-to-consumer sales fashions as well as AI-enabled good dishwashing methods.

From 2020 and 2024, the automatic dishwashing products market grew massively as more consumers wanted the convenience, hygiene and sustainability. Rising double income households, urbanization along with impetus towards smart kitchen devices pushed the segment for dishwashing detergents tablets, gels, powders, and rinse aids. Changing perceptions regarding water and energy efficiency had also an impact on product innovation, contributing to the creation of low-phosphate biodegradable and eco-friendly detergents.

The automatic dishwashing products market is projected to experience transformational advancements during 2025 to 2035, with AI-based smart dosing technology, waterless dishwashing solutions, and biodegradable nanocoatings reinventing the industry process. Moreover, AI-powered smart dishwashers will determine the precise amount of detergent needed per load according to its type and whether it is dirty or not, thus saving time and water. The rise of solid-state and encapsulated enzyme detergents will provide sustainable and extended performance.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter phosphate and microplastic bans, eco-label compliance, and low-VOC detergent regulations. |

| Technological Advancements | Growth in enzyme-based detergents, biodegradable surfactants, and concentrated gel formulas. |

| Industry Applications | Used in households, commercial kitchens, and industrial foodservice operations. |

| Adoption of Smart Equipment | Limited integration with smart dishwashers and automatic dosing systems. |

| Sustainability & Cost Efficiency | Adoption of eco-friendly detergents, compostable packaging, and reduced water consumption. |

| Data Analytics & Predictive Modeling | Basic usage tracking through smart dishwashers and detergent efficiency analysis. |

| Production & Supply Chain Dynamics | Supply chain affected by raw material fluctuations, rising costs of green ingredients, and logistical disruptions. |

| Market Growth Drivers | Growth driven by urbanization, time-saving consumer trends, and eco-conscious product demand. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-enabled ingredient verification, AI-driven regulatory compliance tracking, and global green certification standards. |

| Technological Advancements | AI-powered smart dishwashing systems, probiotic-infused cleaning solutions, and self-cleaning nano-coatings. |

| Industry Applications | Expansion into waterless dishwashing appliances, zero-residue cleaning solutions, and AI-assisted dish care automation. |

| Adoption of Smart Equipment | AI-optimized detergent dispensing, IoT-connected dish care assistants, and load-specific auto-cleaning formulations. |

| Sustainability & Cost Efficiency | Ultra-low water dishwashing solutions, AI-driven detergent refilling systems, and carbon-neutral detergent production. |

| Data Analytics & Predictive Modeling | Real-time AI-powered dishwashing performance optimization, predictive detergent replenishment, and blockchain-based sustainability tracking. |

| Production & Supply Chain Dynamics | AI-enhanced supply chain automation, decentralized detergent production hubs, and on-demand detergent refill stations. |

| Market Growth Drivers | Future expansion fueled by smart kitchen automation, AI-assisted dish care, and zero-residue cleaning innovations. |

The USA automatic dishwashing products market is expected to grow because of the growing use of dishwashers, the growing need for eco-friendly detergents, and the use of new cleaning solutions in automatic dishwashing product formulations. Under its Safer Choice program, the USA Environmental Protection Agency is promoting phosphate-free and biodegradable dishwashing products. Good call for dishwasher tablets, pods, and gel-based solution sourced cleaning products see consumers moving to more convenience-driven cleaning solutions. Top brands like Finish, Cascade, and Seventh Generation are creating new formulas with a combination of enzymatic and plant-based cleaning agents to offer both power and sustainability.

Besides, the surging smart home trend and growing penetration of automatic dishwashers in the USA households are also paving the way for market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

The UK Automatic Dishwashing Products Market is influenced by factors such as increasing adoption of dishwashers in households, growing awareness about sustainable cleaning products, regulations by the government regarding sustainable packaging. Due to the UK’s Plastic Packaging Tax and sustainability initiatives, makers are creating recyclable, plastic-free packaging solutions for dishwashing products. Moreover, preference for low-chemical, allergen-free detergents is providing potential avenues of growth for organic and non-toxic formulations.

Increasing penetration of e-commerce platforms and direct-to-consumer sales channels is further enabling the reach of premium automatic dishwashing powders, gels, and tablets in the UK market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.1% |

In the European Union, a fast-growing market for Automatic Dishwashing Products is driven by environmental regulations, high penetration of dishwashers and demand for sustainable and high-efficacy detergents. There are regulations by the European Chemicals Agency on phosphates and micro plastics in detergents, sparking innovation in sustainable, biodegradable dishwashing products.

It’s most important markets are Germany, France, and Italy, followed by rising trends for premium and organic dishwashing brands. Demand for low-temperature-activated detergents that boost cleaning while consuming less water and energy is also being driven by the move towards environmentally friendly and energy-efficient dishwasher solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.3% |

Rising urbanization, increasing adoption of compact dishwashers, rising demand for high-efficiency detergents are some factors boosting the growth of Automatic Dishwashing Products Market in Japan. According to the Japanese Ministry of the Environment, the use of concentrated and biodegradable detergents is also an ecological cleaning practice.

With a taste in Japan for fragrance-free and skin-sensitive dishwashing formulations, there is demand for hypoallergenic, plant-based dishes. Dishwasher makers like Panasonic and Toshiba, on the other hand, are busy developing high-efficiency dishwashers that use low-foam, enzyme-based detergents which can leave behind food stains if you ignore the manufacturer's recommendations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

The market for automatic dishwashing products in South Korea has seen strong growth driven by a confluence of growing disposable incomes, increasing urbanization, and rising demand for high-performance cleaning solutions. Guided by these facts, the Korean Ministry of Environment recommends using green and non-phosphate dish-washing goods, to cut back on the pollution of the water.

The rising popularity of smart kitchen appliances is driving up demand for niche cleaning products for high-tech dishwashers. South Korea’s booming e-commerce market is also increasingly making access to convenient, subscription-based dishwashing products available to consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The automatic dishwasher products market is experiencing robust growth as a result of the growing adoption of dishwashers in the household, commercial establishments, enhance the focus on convenience and developments in detergent formulations. Depending on product type, the market is categorized into detergent tablets and detergent gel, with the former accounting for a major share in the market owing to higher convenience associated with them, better cleaning performance, and increasing demand for environment-friendly formulations.

Automatic dishwasher detergent tablets are the most popular product as they contain a premeasured detergent concentration, which provides Herculean cleaning properties and reduces waste. These three-in-one tablets feature detergent, rinse aid, and grease-cutting agents, delivering better stain removal, grease-cutting and water softening all without needing extra products.

Globally, the rising preference for convenience and multi-purpose cleaning with detergents has been a strong driver for detergent tablets especially in households and commercial kitchens where quick, mess-free, and effective cleaning cycles are prioritized. Another rising category are eco-friendly, biodegradable, and phosphate-free detergent tablets, and sustainability concerns are increasingly affecting consumers' choice of what to buy.

Though, costs higher than traditional detergent powders and impacting packaging waste remains a challenge. These collectively render the product more sustainable and reduce costs to the customers, and hence manufacturers are working on water soluble film coatings, plastic-free packaging and concentrated tablet formulations.

Detergent gel is another top product category, praised for its ability to dissolve rapidly, dose to personal preference and provide streak-free cleaning performance. Unlike the common tablets and powders, detergent gel can also be adapted as per the load size, soil level, and dishwasher settings making it a versatile choice for different washing requirements.

Growing use of compact and energy efficient dishwashers in urban households has driven the demand for low-residue, fast-acting detergent gels for dishwashing, especially among environmentally-aware consumers seeking together phosphate-free and plant-based formulations. Moreover, gel-based detergents with enzyme, fragrance boosters, and anti-hard-water agents are on the rise for their gentle yet strong cleaning abilities.

While detergent gel offers several benefits, it has its downsides as well, like higher packaging costs and a risk of overuse due to the absence of portion control. Innovations in biodegradable gel formulations, concentrated gel capsules and smart-dosing dispensers are likely to facilitate the wide adoption of this segment.

Automatic dishwashing products are in high demand across commercial and residential applications, as consumers and businesses seek time-saving, water-saving, and hygienic dishwashing solutions.

Automatic dishwashing products are mainly for commercial use, and the commercial end user segment accounts for a considerable share, owing to the necessity of high-volume dishwashing in restaurants, hotels, catering services, and institutional kitchens. In restaurants and commercial kitchens their use of industrial dishwashers has led to the development of high-performance detergent tabs and gels capable of achieving rapid, streak-free dish cleanliness without damaging glassware and utensils.

Stricter food safety guidelines and hygiene standards in the foodservice sector have also resulted in an increasing adoption of antibacterial, eco-friendly, and fragrance-free dishwashing detergents, which help make clean-ups safe and free of harmful chemicals. Moreover, the need for bulk pickings and low-cost detergent refills are also expected to increase with the commercial industries pursuing economical and waste-free cleaning solutions.

Although dishwasher tablets are highly sought after, they are not without their challenges, including water hardness issues, their compatibility with different models, and residue build up on glassware. From evolving industrial-strength detergent formulations through supplementation with water softening agents, to AI-directed dishwasher cycle optimization, the commercial dishwashing space is primed for further enhancement.

Residential Segment, Strong Growth with Increasing Adoption of Dishwashers in New Households, Specifically in Urban and Higher Income Regions. With combinations of these features, consumers are increasingly opting for dishwasher-friendly detergent tablets and gels, as they require minimal effort to use, save on water and grease-removing is generally superior to handwashing.

The increasing preference for convenient, single-dose detergent solutions has also fuelled the growth of all-in-one detergent tablets, which eliminate the requirement for separate rinse aids and water softeners. Moreover, the shift towards environments friendly and skin-safe detergent formulations is affecting the evolution of biodegradable, fragrance-free and plant-based dish washing products.

On a broader basis, price sensitivity, based on limited dishwasher penetration, has hindered the growth of the residential segment in developing markets. To appeal to a wider variety of consumers, manufacturers are responding to these concerns with affordably priced detergent packs, multipurpose cleaning formulas, and compact dishwasher-compatible solutions.

Rising environmental concerns worldwide are likely to increase the demand for commercial automatic dishwashing products while an increase in disposable income has also given rise to demand for household automatic dishwashing products, thus driving the growth of the automatic dishwashing products market. The market is powered by technical developments in enzyme-based organizations, water-efficient products, and smart dish-washing appliances. Companies are introducing sustainable packages, phosphate-free detergent, and multi-functional cleaning agents for both residential and commercial users. Global household cleaning product manufacturers, specialty chemical firms, and eco-friendly product innovators are all involved in this push, developing new dishwashing tablets, gels, and powders, and rinse aids as well.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Procter & Gamble Co. (Cascade, Fairy) | 18-22% |

| Reckitt Benckiser Group plc (Finish) | 15-19% |

| Unilever plc (Sun, Seventh Generation) | 10-14% |

| Henkel AG & Co. KGaA (Somat) | 8-12% |

| Church & Dwight Co., Inc. (OxiClean) | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Procter & Gamble Co. (Cascade, Fairy) | Produces enzyme-based automatic dishwashing pods, tablets, and liquid detergents with grease-fighting capabilities. |

| Reckitt Benckiser Group plc (Finish) | Specializes in multi-functional dishwasher tablets, rinse aids, and eco-friendly automatic dishwashing solutions. |

| Unilever plc (Sun, Seventh Generation) | Offers phosphate-free, plant-based dishwashing detergents focused on sustainability and biodegradable ingredients. |

| Henkel AG & Co. KGaA (Somat) | Develops high-performance dishwashing powders, gels, and water-saving detergent formulations. |

| Church & Dwight Co., Inc. (OxiClean) | Provides oxygen-powered dishwashing boosters and eco-friendly dishwashing formulas. |

Procter & Gamble Co. (18-22%)

As a leader in automatic dishwashing products, P&G makes Cascade and Fairy dishwashing detergents that use enzymatic grease-cutting power and water-efficient cleaning performance.

Reckitt Benckiser Group plc (15-19%)

Reckitt Benckiser is a global leader in manufacture of Finish-branded dishwashing products, emphasizing multi-action tablets as well as rinse aids and low temp cleaning solutions for hard water regions.

Unilever plc (10-14%)

Under brands such as Sun and Seventh Generation, Unilever offers eco-friendly dishwashing detergents and products that are plant-based, biodegradable, phosphate-free.

Henkel AG & Co. KGaA (8-12%)

Henkel provides premium dishwasher detergents under the Somat brand, integrating anti-stain and water-efficient cleaning technologies.

Church & Dwight Co., Inc. (6-10%)

Church & Dwight offers OxiClean dishwashing boosters and oxygen-powered detergents, catering to eco-conscious consumers and high-efficiency dishwashers.

Other Key Players (30-40% Combined)

Several household cleaning product manufacturers and eco-friendly brands contribute to innovations in sustainable packaging, enzyme-based detergents, and advanced dishwasher cleaning solutions. These include:

The overall market size for the Automatic Dishwashing Products Market was USD 1.8 Billion in 2025.

The Automatic Dishwashing Products Market is expected to reach USD 2.8 Billion in 2035.

Rising household and commercial dishwasher adoption, increasing demand for eco-friendly and biodegradable detergents, and advancements in cleaning formulations will drive market growth.

The USA, Germany, China, Japan, and France are key contributors.

Detergent tablets are expected to lead in the Automatic Dishwashing Products Market.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.