During the period from 2025 to 2035, across all bundles, the Automatic Banding Machine Market is set for development as they are a low-cost labelling a technique and are a manufacture automatic process. The demand for enhanced packaging efficiency, reduced material wastage, and improved product aesthetics have led industries such as food & beverage, pharmaceuticals, logistics, and e-commerce to adopt automatic banding machines. They are also good because they are beneficial they work fast and save on manpower charges they can be used with many types of banding item to include paper and plastic.

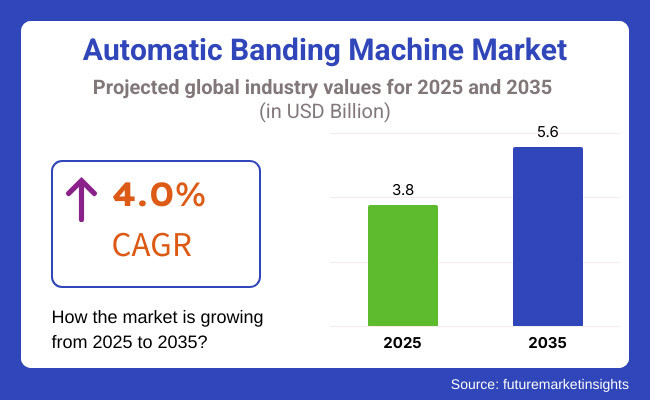

This is projected to progress at 4.0% CAGR over the coming years from USD 3.8 billion in 2025 to USD 5.6 billion by 2035. Additionally, the rising emphasis on sustainable packaging solutions and smart automation technologies is also driving market growth. While companies are focused on minimizing packaging waste without jeopardizing their products' security, many businesses are investing in an automatic banding machine that presents them with a green solution to their strapping challenges that will also save them money.

Explore FMI!

Book a free demo

In North America, the Automatic Banding Machine Market including USA, Canada, and Mexico are primarily driven by the growing adoption of automation in packaging industries to reduce carbon footprints and adhere to strict sustainability regulations. Banding machines are becoming increasingly popular in food processing, pharmaceuticals and e-commerce sectors in the USA and Canada as an efficient method to bundle products together with minimal packaging waste. A focused approach towards Industry 4.0 and smart manufacturing has resulted in the implementation of IoT and AI driven banding systems, thus enhancing operational efficiency and minimizing downtime in production lines.

Europe is expected to hold a major market share, with Germany, France, and the UK taking the lead for automatic banding machines in logistics, retail, and consumer goods industries. Deadlines on packaging waste by the European Union and efforts by companies to work on sustainable alternatives are driving demand for paper-based and biodegradable banding materials. In order to meet sustainability goals while maintaining high-speed packaging operations, companies in the region are investing in advanced banding solutions that offer superior automation, energy efficiency, and precision.

The Automatic Banding Machine Market is projected to grow at their fastest rate during the forecast period in Asia-Pacific owing to growing manufacturing industries, e-commerce, and the adoption of automated packaging solutions. China, Japan, South Korea, and India are also promoting automation technologies to increase productivity and satisfy growing demand from consumers in those countries. China dominance in industrial automation and Japan focus on precision packaging solution are accelerating the expansion of market. Moreover, the growth of India’s logistics and retail sectors is leading to higher demand for high-speed banding solutions to enhance supply chain efficiency.

Challenge

High Initial Costs and Maintenance Requirements

Automatic banding machines necessitate significant capital investment, which can be a barrier for small and mid-sized firms. When it comes to such advanced machines with high-speed capabilities, in addition to IoT-enabled features, high upfront costs can make it difficult for businesses on a budget to make the investment. The total cost of ownership is also higher due to the need for ongoing maintenance and technical expertise to operate automated systems. In response to these challenges, producers are concentrating on producing affordable, modular banding solutions with decreased operational costs easily integrated into existing production lines.

Opportunity

Integration of Smart Automation and Sustainable Banding Solutions

Market growth opportunities are present due to the growing demand for smart packaging automation in addition to increasing need sustainable banding materials. Furthermore, the incorporation of AI-driven tracking, near real-time data analysis, and predictive maintenance within banding machines is enhancing productivity while minimizing downtime. Moreover, the move towards biodegradable banding materials like paper bands and biodegradable adhesives is in line with global sustainability objectives. Manufacturers that adopt intelligent, energy-efficient banding technologies with integrated smart automation are likely to find themselves at a competitive advantage in this changing landscape.

2020 to 2024: Rising Demand for Automation in Packaging and Logistics

The automatic banding machine market was significantly growing between 2020 and 2024 because of the rising request for good, high-speed packaging solutions in end-user industries such as food & beverage, logistics, pharmaceuticals, and printing.

To provide efficient packaging with reduced material waste, manufacturers looked for cost-effective yet eco-friendly bundling solutions. This type of bundling has gained popularity with automatic banding machines that tightly bind the products together with little packaging material (compared to plastic shrink wraps and superficial adhesives).

The e-commerce boom drove a need for fast, accurate bundling solutions in warehouses and fulfilment centres. Logistics companies approached automatic banding systems to enhance their parcel sorting process, minimize the handling time, and also increase the safety of shipment.

Banding machines were adopted on account of the demand for tamper-proof, hygienic, and recyclable packaging solutions in the food & beverage industry. The companies turned to paper and biodegradable bands as sustainable alternatives to plastic wraps, consistent with global sustainability initiatives and regulatory requirements.

But issues like high advisory costs for adoption, complex upkeep of the machines and limitations in compatibility with various packaging materials created barriers to broad deployment. Inspire of these challenges, the evolution of servo-driven and sensor-based banding technologies allowed for more streamlined operations and reduced downtime.

2025 to 2035: AI-Powered Banding, Sustainability Innovations, and Industry 4.0 Integration

The automatic banding machine market is undergoing a technological transformation, propelled by AI-powered automation, eco-friendly materials, digital connectivity, and 2025 to 2035.

Artificial Intelligence smart banding machines will take over packaging processes by automatically adjusting the needed tension level, identifying variations in additional to the material used and dynamically adjusting the speed of banding depending on customer needs. Machine learning algorithms, used together with Big Data, will certainly facilitate predictive maintenance, which means reducing downtime and increasing the lifespan of your machines.

Manufacturers will lead the way sacrificing their manufacturing profits for biodegradable, recyclable, and compostable banding materials. Businesses will be in line with global environment standards and carbon reduction goals whereby other technologies such as water-soluble adhesive, reusable paper bands, and compostable films will gain wider traction.

In the logistics & e-commerce sectors, automated parcel banding systems will be interconnected with robotic sorting lines and AI-driven warehouse management systems to increase the overall speed of order fulfilment. RFID-enabled banding machines will allow real-time monitoring of packages, streamlining supply chain visibility and minimizing instances of mislaid packages.

Precision banding solutions are being used in the pharmaceutical and medical sectors for secure bundling of lab samples, sterile medical devices, and pharmaceutical packages. Highly sophisticated tamper-proof banding with built-in authentication features will ensure security and compliance with regulation.

Furthermore, Industry 4.0 and IoT-based monitoring will be implemented as a given; enterprises will have the ability to monitor banding machine performance from a remote location, change machine settings from cloud platforms, and receive predictive maintenance notifications.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Technological Advancements | Adoption of servo-driven, sensor-based banding machines. |

| Sustainability Initiatives | Shift toward paper and biodegradable bands for eco-friendly packaging. |

| Industry 4.0 & IoT | Limited integration of IoT-based machine monitoring. |

| Logistics & E-commerce | Increased use in parcel sorting, warehouse automation, and order fulfilment. |

| Food & Beverage Industry | Demand for hygienic and tamper-evident banding solutions. |

| Pharmaceutical & Medical Applications | Compliance-driven adoption for securing pharmaceutical packs. |

| Operational Efficiency | High-speed banding systems for mass production. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technological Advancements | Rise of AI-powered, self-adjusting, and predictive maintenance-enabled banding machines. |

| Sustainability Initiatives | Expansion of fully compostable, recyclable, and reusable banding solutions. |

| Industry 4.0 & IoT | Widespread adoption of IoT-enabled remote monitoring, cloud-based analytics, and real-time machine optimization. |

| Logistics & E-commerce | Growth of RFID-enabled, AI-driven banding systems for real-time tracking and security. |

| Food & Beverage Industry | Adoption of antimicrobial and smart-label banding for enhanced safety and compliance. |

| Pharmaceutical & Medical Applications | Expansion of tamper-proof, authentication-enabled banding for regulated healthcare packaging. |

| Operational Efficiency | AI-powered, automated systems with minimal material waste and enhanced precision. |

Automatic banding machines and the United States is the primary market, growing with the level of automation in the packaging and logistics industry. Increasing demand for efficient, secure, and sustainable bundling solutions in various industries including food & beverage, pharmaceuticals, and e-commerce is driving the growth of bundling materials market. The requirement for precise banding with little waste also appeals with the country’s sustainability programs, and boosting adoption. To improve operational efficiency for meeting stringent packaging regulations, manufacturers are emphasizing smart sensors, IoT and AI embedded advanced banding machine in their production processes.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

The market in the United Kingdom is expected to grow at a significant rate owing to the growth of retail, logistics and pharmaceuticals. As the pressure increases to address plastic packaging waste, companies are seeking paper-based and biodegradable banding solutions. Technological advancements such as the growth in e-commerce as well as the increasing inclination of end users towards automated warehouse operations are also expected to boost the demand for high-speed banding machines. In addition, the increasing implementation of Industry 4.0 technologies such as smart automation and remote supervision is also hastening the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.7% |

Increased demand is aiding the expansion of the automatic banding machines market in Europe, as well, with Germany, France, and Italy being the top three countries that are adopting automatic banding machines. Robust regulatory framework in the region that promotes sustainable packaging practices is fuelling investments by the industries for eco-friendly banding solutions. Growing pharmaceutical and food processing industries and continuous automation in manufacturing are fuelling the demand for high precision banding systems. Moreover, increasing usage of automated banding solutions for enhanced product safety and optimized supply chain processes by logistics and warehousing facilities is expected to drive the demand for the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.9% |

Japan is the fastest-growing banding machine market in Asia because of the country’s high standards of packaging quality and attention to industrial automation. Trends Observed in the Industry Robotics, AI-driven quality control, smart packaging solutions are among the major trends shaping the industry. The food packaging industry, specifically, is leveraging sophisticated banding machines that adhere to regulations and meet market demands for less and eco-friendly packaging. Also, Japan has an extremely sophisticated logistics industry that uses automatic banding machines to improve efficiency of supply chain management.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

Increase in demand for packaging services in sectors like electronics, cosmetics, and food, among others, has theorem to the increasing use of machinery automatic banding machine in South Korea. There are some strong advanced technologies by the country in category of smart packaging systems and automated production lines fuelling the growth of the market. Moreover, the growing requirement for secure bundling solutions across export-oriented sectors is propelling the investments in high-efficiency banding machines. Additionally, the rapid development of e-commerce and last-mile logistics services is driving the proliferation of automated banding systems in packaging and distribution centres.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.9% |

The automatic banding machine plays a role in helping businesses improve their production processes while reducing costs, and increasing sustainability and market demand, which drives growth in the automatic banding machine market. With these, manufacturers can feed products in bulk and, whether using paper or plastic, securely wrap products whilst minimising waste, utilising minimal material for greater product consistency.

Automatic banding machines are advancing as an increasing number of industries are embracing automation, and are focused on reducing their labour costs while enhancing precision, especially in logistics, food & beverages, pharmaceutical, and e-commerce sectors. Manufacturers are spending on semi-automatic and fully automatic banding machines to enhance efficiency and meet high-volume packaging requirements.

Semi-Automatic Banding Machines Balance Cost and Flexibility

Semi-automatic machines is ideal for small to medium-sized businesses that need a solution that is economical but effective. Products are held by an operator and fed into the machine, which then encloses the band & seals it by heat or ultrasonic welding.

These systems are suitable for low to medium-volume production lines, being customizable and low-cost without sacrificing accuracy. Semi-automatic models are widely used in industries like printing, pharmaceuticals and food packaging for on demand bundling of brochures, medicine packages and small cartons.

Fully Automatic Banding Machines Maximize Efficiency in High-Volume Operations

Fully automatic banding machines are hands-off, running continuously, very fast and perfect for high-volume production and logistics operations. They are incorporated directly into automated production lines, applying bands to products evenly and within a certain tension.

Fuels automation in food manufacturing and shipping with the need for fully automatic banding machines to maximize outputs, reduce labour time and increase packaging quality. These machines have additional options, such as intelligent sensors, programmable settings, and integration with conveyors, making them ideal for fast-paced settings that require efficiency and accuracy.

Less than 20 Bundles/Min Machines Serve Small-Scale Packaging Needs

Automatic banding machines (less than 20 bundles per minute capacity) are designed for low-volume businesses and specialty packaging applications. They’re used in boutique packaging, pharmaceutical labelling and food portioning, where precision and a gentle touch come first.

These systems make it possible for businesses that need custom or delicate packaging solutions from luxury goods to fresh produce and medical devices to ensure their products are bundled safely as well as looking nice.

20 -30 Bundles/Min Machines Balance Speed and Accuracy

Businesses with moderate-speed banding needs that still maintain quality and accuracy rely on machines ranging from 20 30 bundles per minute. These models find applications in commercial printing, medium-scale logistics, and food processing for bundling newspapers, magazines, beverage packs, and boxed products.

Through automated tension control, customizable banding strength, and effortless production line integration, organizations benefit from high-speed packaging while keeping product integrity.

As industries look for sustainable, economical, and high-speed packaging solutions, the automatic banding machine market flourishes. Tension control integrated with AI, smart automation, energy-efficient banding technologies are innovative solutions introduced by companies to improve accuracy and operational efficiency. Banding solutions: Paper, plastic and biodegradable banding solutions that optimize logistics, retail, food packaging, and pharmaceutical applications.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Bandall Inc. | 18-22% |

| Sunpack Xutian | 12-16% |

| Felins | 10-14% |

| HXCP Precision Machinery Co., Ltd. | 8-12% |

| TPC Packaging Solutions | 7-11% |

| ISG PACK | 6-10% |

| CARBONCHI CTI Ltd | 5-9% |

| Bandpak | 4-8% |

| EAM-MOSCA CORPORATION | 3-7% |

| StraPack, Corp. | 3-6% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bandall Inc. | Manufactures precision banding machines with biodegradable banding options and fully automated integration. |

| Sunpack Xutian | Develops high-speed, heat-sealed banding systems, offering customized solutions for industrial and retail applications. |

| Felins | Specializes in sustainable, paper-based banding machines with automated tension adjustment for diverse industries. |

| HXCP Precision Machinery Co., Ltd. | Produces high-efficiency automatic banding machines, integrating sensor-based tension control. |

| TPC Packaging Solutions | Provides automated banding machines with AI-driven material optimization for high-volume packaging applications. |

| ISG PACK | Designs compact, semi-automated banding machines, catering to pharmaceutical and food-grade packaging. |

| CARBONCHI CTI Ltd. | Innovates energy-efficient and IoT-enabled banding machines for automated production lines. |

| Bandpak | Offers modular and portable banding solutions, supporting e-commerce, logistics, and industrial sectors. |

| EAM-MOSCA CORPORATION | Develops high-speed plastic and paper banding systems, integrating automated material feed systems. |

| StraPack, Corp. | Manufactures high-durability automatic banding machines, enhancing efficiency for bulk and heavy-duty packaging. |

Bandall Inc. (18-22%)

Bandall Inc. leads the market with eco-friendly, precision banding solutions, integrating biodegradable banding materials and smart automation.

Sunpack Xutian (12-16%)

Sunpack Xutian develops customizable high-speed banding systems, optimizing banding efficiency for industrial packaging.

Felins (10-14%)

Felins specializes in sustainable, heat-sealed banding machines, offering smart automation for retail and food packaging.

HXCP Precision Machinery Co., Ltd. (8-12%)

HXCP enhances sensor-based banding technology, ensuring secure tension control and automated band feed.

TPC Packaging Solutions (7-11%)

TPC integrates AI-driven banding automation, improving packaging efficiency for large-scale industries.

ISG PACK (6-10%)

ISG PACK produces compact banding machines, ideal for pharmaceutical and food processing applications.

CARBONCHI CTI Ltd. (5-9%)

CARBONCHI innovates IoT-powered banding machines, enhancing automated tension monitoring and precision control.

Bandpak (4-8%)

Bandpak provides portable and modular banding solutions, catering to e-commerce, logistics, and bulk packaging sectors.

EAM-MOSCA CORPORATION (3-7%)

EAM-MOSCA delivers automated plastic and paper banding systems, integrating smart material tracking.

StraPack, Corp. (3-6%)

StraPack enhances heavy-duty automatic banding machines, optimizing high-speed industrial packaging.

Other Key Players (30-40% Combined)

Emerging companies introduce AI-integrated banding, biodegradable material innovations, and energy-efficient automation. Notable players include:

The overall market size for the Automatic Banding Machine Market was USD 3.8 Billion in 2025.

The Automatic Banding Machine Market is expected to reach USD 5.6 Billion in 2035.

The demand is driven by increasing automation in packaging, rising e-commerce activities, growing demand for efficient product bundling, and stringent regulations on sustainable packaging solutions.

The top 5 countries driving market growth are USA, UK, Europe, Japan, and South Korea.

Automatic Banding Machines is expected to command a significant share over the assessment period.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Medical Transport Box Market Trend Analysis Based on Material, Capacity, End-User and Regions 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.