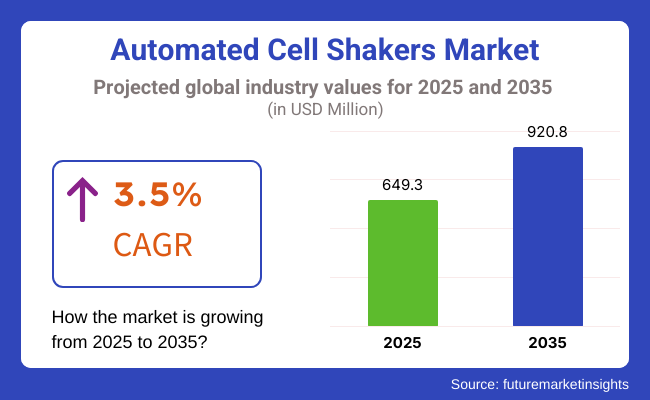

The global automated cell shakers market is anticipated to witness steady growth between 2025 and 2035 owing to the rising need for high-throughput cell culture coupled with bioprocessing advancements and laboratory workflow automation. It is expected to grow from USD 649.3 million in 2025, and the increasing demand for automated laboratory incubator shakers, smart shaking platforms, and bioreactor shaking systems are the key features of the market.

Despite some challenges, the market is likely to reach USD 920.8 million by 2035, at a CAGR of 3.5%, with strong investments in automated bioprocessing solutions, AI-powered laboratory equipment, and next-gen cell culture automation technologies.

The growing applications in pharmaceutical research, regenerative medicine, and biotechnology are driving the market growth. Technological advancements play a vitally important role in market development, including IoT-enabled shakers, cloud-integrated real-time monitoring systems, and AI-driven laboratory automation.

Mixing solutions by shaking them is a common step in biopharmaceutical and academic research labs, and new smart orbital shakers, incubator shakers that provide precise temperature control during shaking, and automated microplate shaking systems are making for more reproducible results.

The increasing demand for benchtop cell culture shakers and larger bioprocessing shaking platforms are due to the trend toward personalized medicine, protein expression research, and stem cell expansion. Moreover, the emergence of robotic liquid-handling systems with built-in shaking ability will drive efficiencies in high-throughput screening (HTS) and drug discovery.

However, there are headwinds to the expansion of the market, such as costly equipment, difficult integration into existing laboratory automation ecosystems, and heavy regulation (USA regulatory issues are best and worst handled by others) compliance.

With biological products such as vaccines, biologics, etc., requiring GMP-compliant, CE-certified and FDA-approved shaking incubators, the compliance rate limits entry barriers for new entrants in the market. In addition, the energy efficiency constraints of orbital and reciprocating shakers in the high-speed regime are limitations.

Analysts at FMI see a steady future outlook for automated cell shakers industry as real-time pH, redox potential, dissolved oxygen, and metabolites are monitored through the automation of fermentation. This is combined with advances in hybrid shaker-incubators, inducing scalability across laboratories.

There is significant growth in the development of high-throughput screening in drug discovery as well as sophisticated smart and IoT-enabled laboratory devices. Moreover, this enhances automated cell shakers with real-time monitoring, control, and AI optimization features.

These advances are leading to improved reproducibility and efficiency in laboratory workflows. Increasing interest in regenerative medicine, stem cell research, and biologics manufacturing increases the scope of use of automated shakers in cell culture applications. This has created an innovative approach to laboratory automation through partnerships between the academia and biopharma companies, which is expected to result in next-generation shaking systems with enhanced control features and connectivity.

Explore FMI!

Book a free demo

The automated cell shakers market experienced rapid escalation during the period commencing 2020 up to 2024. The increasing requirement of automated cell shakers comes mainly from the areas of biotechnology, life science & pharmaceutical research, and academic laboratories. Breakthroughs in bioprocessing, thought-cell culture optimization, and high-throughput screening applications paved the way for adopting automated shakers that induced uniform and replicable conditions for cell growth.

New horizons of the foreseeable market will remain dominant during the years 2025 to 2035, as AI-enabled automation, Fischer smart bioreactors, and rapid developments toward energy-efficient laboratory instruments kept big waves in innovations in sustainability.

There will be strict quality control measures on the manufacturing processes of biopharmaceuticals and standardization in cell culture from regulatory sources. The new initiatives would focus on energy reduction in practically every aspect of laboratory work, including the use of recyclable components for shakers and more automated lab efficiencies.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| FDA and EMA compliance focused on GMP (Good Manufacturing Practice) standards for cell culture applications. | Stricter regulations on AI-driven bioprocess automation and real-time cell growth monitoring. Standardization of automated cell culture conditions for global research labs. |

| Growth in orbital and incubated shakers with integrated temperature and CO₂ control. Introduction of remote monitoring for culture conditions. | AI-driven shakers optimize mixing conditions dynamically. Smart bioreactor integration for real-time cellular response analysis. |

| High demand from pharmaceutical, biotech, and academic research labs for reproducible cell culture results. | Expansion of automated shakers in personalized medicine, regenerative therapy, and bioprinting applications. Increased adoption in emerging markets. |

| Rising investments in cell-based therapies, biologics manufacturing, and vaccine development. Growth in high-throughput screening research. | AI-powered bioprocessing reduces human intervention in cell culture. Expansion of decentralized, automated lab infrastructure for precision medicine. |

| Some manufacturers introduced energy-efficient motors and recyclable shaker components. | Widespread adoption of energy-efficient, low-noise shakers. AI-optimized lab operations reduce resource wastage and improve efficiency. |

| Dependence on specialized laboratory equipment manufacturers in North America, Europe, and Asia. Supply chain disruptions impacted production and delivery timelines. | AI-driven predictive maintenance minimizes downtime. Decentralized manufacturing hubs improve supply chain resilience. |

Non-compliance with safety standards has seen recalls made for shaking incubators and orbital shakers in recent years, where risks of equipment overheating or unreliable speed control have become apparent. Hence, it is imperative for suppliers to establish thorough validation regimes to ensure their products remain reliable and compliant with regulatory standards as laboratory automation becomes more advanced.

| Regulatory Compliance | Key Details |

|---|---|

| FDA Compliance (USA) | Automated shakers for drug development must follow 21 CFR Part 11 (data integrity) and 21 CFR Part 210/211 (GMP for pharmaceuticals). |

| CE Marking (Europe) | Required for market entry in the EU. Compliance with Directive 2014/30/EU (EMC) and Directive 2014/35/EU (Low Voltage) is mandatory. |

| GMP Requirements | Shakers in pharmaceutical and biologics production must meet GMP standards for sterility, validation, and calibration. |

| ISO 13485 (Europe & Global) | Required for medical-grade laboratory automation. Ensures quality management systems for lab equipment manufacturers. |

| Regional Variations (China) | China’s NMPA (National Medical Products Administration) requires CCC certification for clinical-use laboratory shakers. |

| Regional Variations (Japan) | Japan’s PMDA mandates compliance with JIS (Japanese Industrial Standards) for imported lab automation devices. |

| Middle East & India Compliance | Saudi Arabia’s SFDA and UAE’s Ministry of Health regulate biotech equipment. India requires BIS (Bureau of Indian Standards) approval. |

| IEC 61010-1 (Global Safety Standard) | Ensures electrical safety for laboratory instruments, including automated shakers. Required for CE and global certification. |

| RoHS Directive (EU) | Limits toxic substances like lead and cadmium in lab equipment. Mandatory for all electronic devices sold in the EU. |

| WEEE Directive (EU) | Requires proper recycling and disposal of lab automation devices. Manufacturers must provide waste management solutions. |

| Energy Efficiency Regulations (USA & EU) | The USA ENERGY STAR program and EU EcoDesign Directive set energy-efficiency standards for lab equipment. |

| Biosafety & Containment (Global) | Automated shakers for live cell cultures must comply with ISO 14644 (cleanroom standards) and CDC/WHO biosafety levels. |

The automated cell shaker market is growing deeper into non-traditional areas like food technology, synthetic biology, and environmental sciences, and it is continuing to penetrate existing biotech and pharmaceutical uses. We see them in food who use these shakers for fermentation processes to foster the development of alternative proteins and cultured meat products.

For example, INFORS HT offers customized bioreactors and incubation shakers for various cell culture (including food) applications. Automated cell shakers in environmental science enhance research efficiency and scalability by facilitating the cultivation of microbial communities used in bioremediation and biofuel production.

Huge amounts of money are poured into emerging ventures and existing businesses creating next-generation automation products. Specifically, 12 weeks ago, robotics and automation companies based in the USA attracted a record USD 748.9 million in startup investment, demonstrating that their ventures still maintain strong investor interest.

Automation in the research laboratory is heavily supported by government and private grants. For example, the USA Commerce Department awarded USD 50 million to HP to expand semiconductor technology that is important to life sciences instrumentation (think automated cell shakers). Such investments highlight their dedication to the development of laboratory automation technologies.

Partnerships with original equipment manufacturers (OEMs) and joint ventures are plentiful as OEMs seek to incorporate complementary technology. Biotech firms partner with automation equipment manufacturers to provide complete solutions that streamline laboratory processes for efficiency and scalability. Through these partnerships, meaningful innovation is developed to serve the changing needs of the many scientific industries.

End User Purchasing Trends in the Automated Cell Shaker Market

| Key Factors | Details |

|---|---|

| Key Buyers | Biotech companies, pharmaceutical laboratories, academic research institutes, contract research organizations (CRO), Diagnostic laboratories, Foos, and environmental research laboratories. |

| Top Features End Users Look At | Precise temperature and speed control, programmable settings, ability to monitor remotely via IoT & scalability for high-throughput applications, compatibility with lab automation systems, and energy efficiency. |

| Top Concerns of End Users | High initial investments (problem number one!), limited compatibility with existing laboratory automation workflow, user interface complexity, trouble with maintenance and calibration, regulatory compliance issues, and space limitations in smaller labs. |

| Pricing Influence among End Users | End users should weigh cost vs performance. Premium brands dominate pharmaceutical R&D, while budget-conscious academic and startup labs prefer cost-effective options. Multi-unit discounts and service contracts impact purchase decisions. |

| Buying vs Renting Trends | Traditional large biotech and pharmaceutical companies prefer purchasing instruments for long-term use. Academic labs and startups favor rental-type usage models to reduce capital expenditure. Automation systems are increasingly available on a leasing and subscription basis. |

| Countries | CAGR through 2025 to 2035 |

|---|---|

| USA | 2.7% |

| Germany | 3.1% |

| Japan | 5.4% |

The USA automated cell shaker market is projected to grow steadily due to the rising adoption of cell culture techniques in the biopharmaceutical & biotechnology industries. The primary factors attributed to the market growth are the increased demand for highly efficient cell culture processes, laboratory automation, and their incorporation into biopharmaceutical production. Hence, integrating AI and IoT in laboratory equipment results in operational efficiency that augments the market growth.

Market Growth Factors in the USA

| Key Factors | Implications |

|---|---|

| Recent Developments in Biotechnology Research | Continuous innovations in the field of biotechnology call for accurate and efficient cell culture, thereby driving the demand for automated cell shakers. |

| Trends in Laboratory Automation | Automation has already shifted to accelerate adoption, improving laboratory efficiency and reproducibility. |

| Biopharmaceutical Production Expansion | The biopharmaceutical industry relies on scalable and reliable cell culture systems, requiring greater automation. |

With its strong healthcare system and research and development focus, Germany is primed for growth. This optimistic outlook is primarily due to the rising acceptance of laboratory automation, increased adoption of bioprocessing technologies, and local governments promoting biotech research. In addition, the presence of leading pharmaceutical companies and research institutions has positively impacted the market.

Market Growth Factors in Germany

| Key Factors | Implications |

|---|---|

| R&D Driven Growth | The focus on research and development in Germany supports the usage of various advanced laboratory instruments, including automated cell shakers. |

| Government Aid | Government-backed initiatives in biotechnology and life sciences research help spur laboratories toward adopting automation. |

| Presence of Key Industry Players | Germany's leading pharmaceutical and biotech companies invest in advanced laboratory equipment to gain a competitive edge. |

The increasing expansion of the biotechnology sector, higher investments in pharmaceutical research, and a rising focus on laboratory automation are propelling the growth of India's insulated cell shakers market. Increasing demand for biopharmaceuticals is fueling the development of the biotechnology sector, along with government support to encourage biotech startups and utilization of advanced laboratory technologies.

These collaborative activities between academic institutions and industry actors favor the expansion of research activities which in turn, promotes market growth.

Market Growth Factors in India

| Key Factors | Implications |

|---|---|

| Collaboration Between Academia and Industry | Collaboration between universities and companies improves research outcomes, supporting automated cell shakers' growth. |

| Pharmaceutical R&D Investments | Higher R&D investments toward drug discovery and development implementation ensure the use of sophisticated laboratory instruments. |

| High-throughput Screening | The need for an effective drug screening process calls for automated solutions in laboratories. |

Japan's automated cell shakers market is expanding due to strong investments in biotechnology, a well-established pharmaceutical industry, and increasing research in regenerative medicine and cell therapy. The country's focus on laboratory automation and high-throughput screening techniques drives demand for automated equipment.

Additionally, government initiatives promoting biomedical research and collaborations between academic institutions and industry players contribute to market expansion. The presence of major biotech companies and research institutions further strengthens the demand.

Market Growth Factors in Japan

| Key Factors | Implications |

|---|---|

| Technological Innovation | Japan is a world leader in precision engineering, improving laboratory equipment performance. |

| Adoption of Laboratory Automation | The transition towards fully automated labs has increased the demand for cell culture equipment. |

| Academic-Industry Collaborations | Industry-academic partnerships drive innovation and adoption. |

Brazil’s automated cell shakers market is experiencing steady growth, driven by expanding pharmaceutical and biotechnology sectors, rising government investments in research infrastructure, and increasing demand for biologics and vaccines. The country’s growing life sciences industry and partnerships between international and local biotech firms fuel the adoption of advanced laboratory equipment. Additionally, the expansion of biopharmaceutical production, particularly in vaccine development, supports market growth.

Market Growth Factors in Brazil

| Key Factors | Implications |

|---|---|

| Growing Biotech Startups | The rising number of biotech firms increases the demand for advanced lab instrumentation. |

| Growth of Pharmaceutical Manufacturing | Local production of drugs drives demand in Brazil |

| Government Investments in Research | Investments in life sciences research made by the government foster infrastructure building and lab automation. |

Orbital shakers account for a significant market share in 2025. Some of their advantages are their versatility and precision and a wider range of biological and pharmacological research applications. Applying shakers for cell culture, bacterial growth, and mixing offers smooth motion to assist oxygen transfer and nutrient distribution in the cell suspension.

The demand for the biopharmaceutical industry, regenerative medicine, and personalized medicine research combine to fuel the growth of this market. Features like programmable speed control, temperature settings, and CO₂ compatibility are leading to improved efficiency.

North America and Europe mainly dominate this segment due to good investment in biotech R&D and well-established academic research institutions. In contrast, the Asia-Pacific region is rapidly advancing with pharmaceutical manufacturing and bioprocessing. AI-enabled orbital shakers with real-time monitoring capabilities, cloud-connected lab automation, and energy-efficient designs for sustainable labs outline the near future.

On the other hand, benchtop incubator shakers have picked up popularity owing to their compact profile, temperature control functions, and capability to optimize cell growth conditions. The incubator shakers are most useful for microbial fermentation, protein expression studies, and mammalian cell cultures for drug discovery and vaccine production.

The demand for space-saving multifunctional laboratory equipment is rising, especially in small to mid-sized biotech labs, academic institutions, and contract research organizations (CROs). North America and Europe hold the largest portion of the market, backed by robust research funding and cell-based therapy advancement. In contrast, Asia-Pacific is emerging as a key region with increased investment in biotechnology and clinical research.

Future advancements include developing smart incubator shakers with automated parameter adjustments, more precise CO₂ and humidity control for cell viability, and AI-controlled optimization of shaking speeds for different cell lines.

Somatic cells, like immortal cell lines, have gained huge market revenues owing to their use for almost every single application in cancer studies, vaccine production, gene therapy, and drug screening. For instance, HEK293, HeLa, and CHO cells are used for biopharmaceutical production because they yield results that are highly consistent and reproducible over the series of runs performed.

North America occupies the leading share of this segment because of the strong presence of the biotech industry and government funding directed toward cell-based research. At the same time, Asia-Pacific is the fastest-growing area, with countries like China and India gearing their investments toward large-scale biomanufacturing facilities.

Besides this, demand for finite cell lines will likely create relatively lower opportunities for market players. Demand for toxicological testing, regenerative medicine, and nascent drug discovery will remain high because of their predictable growth behavior and physiological relevance.

North America and Europe are the two regions that have adopted these measures due to strict regulations and strong funding for academic research. On the other hand, Asia-Pacific is experiencing this growth as governments invest in advanced cell culture facilities. Emerging innovations include 3D bioprinting-compatible shaking platforms, AI-assisted culture monitoring for viability assessment, and adaptive shaking systems leveraged for sensitive primary cells.

The market witnesses intense competition for large global enterprises and emerging laboratory equipment manufacturers. Rising demand for precision instruments in laboratories, advancement in cell culture techniques, and rising automation in biopharmaceutical and academic research have boosted the market on a huge scale.

Companies invest in energy-efficient, high-capacity, and even programmable cell shakers to safeguard their competitive position. The market landscape is formed by several well-established companies in the life sciences equipment segment, and each of them influences the evolving automated future of the laboratory.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Thermo Fisher Scientific | 22-26% |

| Eppendorf AG | 18-22% |

| Benchmark Scientific | 10-14% |

| Ohaus Corporation | 8-12% |

| Grant Instruments | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Thermo Fisher Scientific | Provides high-capacity, programmable orbital shakers designed for precision and reproducibility in cell culture research. |

| Eppendorf AG | The company offers a range of advanced cell shakers with digital control systems, ensuring optimal mixing and temperature regulation. |

| Benchmark Scientific | It specializes in compact, high-performance laboratory shakers, integrating user-friendly controls and customizable settings. |

| Ohaus Corporation | The company develops durable and energy-efficient shaking platforms for life sciences applications, including microbiology and drug development. |

| Grant Instruments | The company manufactures benchtop and incubated shakers with vibration-free operation, supporting academic and pharmaceutical research. |

Key Company Insights

Thermo Fisher Scientific (22-26%)

Thermo Fisher Scientific is a world leader in scientific instruments, offering precision-engineered, high-capacity automated cell shakers.

Eppendorf AG (18-22%)

Eppendorf AG is a market leader for high-quality laboratory equipment, offering advanced shaking platforms for reproducible and scalable cell culture applications.

Benchmark Scientific (10-14%)

Benchmark Scientific, a leader in laboratory automation, makes compact, powerful cell shakers for research laboratories and biotech companies.

Ohaus Corporation (8-12%)

Ohaus Corporation specializes in laboratory precision instruments and provides durable and efficient orbital shakers suited for a wide range of applications.

Grant Instruments (5-9%)

Grant Instruments, a trusted name in laboratory equipment, delivers high-performance cell shakers designed for reliable and consistent experimental outcomes.

Other Key Players (25-35% Combined)

The market is expected to reach USD 649.3 million in 2025.

The Automated Cell Shakers market is expected to garner a revenue of USD 920.8 million in 2035.

The market is expected to grow at a CAGR of 3.5% from 2025 to 2035.

Demand for efficient automated laboratory equipment to enhance productivity and accuracy in cell culture applications will drive the market.

Key players in the market are Thermo Fisher Scientific, Eppendorf AG, Benchmark Scientific, Ohaus Corporation, and Grant Instruments.

The market is segmented based on product type into automated cell shakers, orbital shakers, ambient shakers, orbital double decker shakers, orbital triple decker shakers, benchtop incubator shakers, cell shaker with rotatory arms, and accessories.

The market is segmented into finite cell line cultures and infinite cell line cultures.

The application segmentation includes cell therapy, drug development, stem cell research, and regenerative medicine.

The end-user segmentation includes mega pharmaceutical companies, biopharmaceutical companies, CDMOs/CMOs, research organizations, academic institutes, and hospitals (providing cell therapy/regenerative medicine).

Geographically, the market is segmented into North America, Latin America, East Asia, South Asia, Europe, Oceania, and the Middle East and Africa.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.