In 2024, the market for automated brewing system grew at a moderate rate. This was because more and more microbreweries were using automation technologies to keep things consistent and efficient. Breweries in North America and Europe experimented with AI-driven brewing solutions that could optimize recipes and improve workflow efficiencies. Smart automation features also gained traction for home brewing kits, being popular with hobbyists and small-scale producers.

Sustainable brewing technologies gained traction with the introduction of automated brewing systems utilizing energy-efficient and water-saving technology. However, raw material shortages in early 2024 due to supply chain disruptions again slowed manufacturing output.

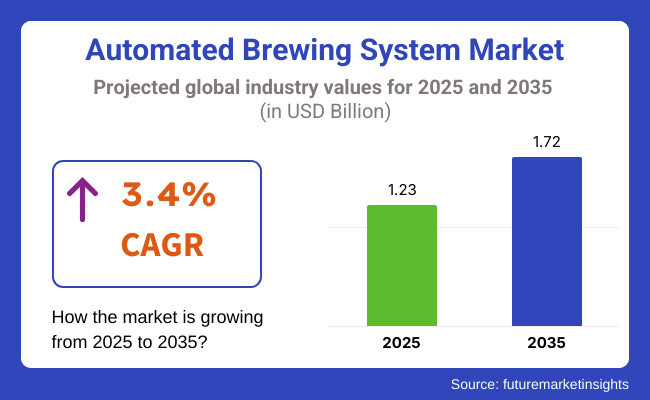

In 2025 brewing enterprises will boost their embrace of cloud-based brewing management platforms for event monitoring and process automation.

In 2035, smart IoT (Internet of Things) and AI-powered brewing solutions will help improve process efficiency, and sustainability-directed activities will promote using renewable energy sources at breweries. Growth will also come from emerging markets in Asia-Pacific and Latin America as more breweries in these areas invest in automation.

Future Market Insights (FMI) conducted a survey and expert interviews with brewery owners, automation technology providers, raw material suppliers, and industry experts to analyze trends, challenges, and the future of automation and sustainability in brewing. They sought to make sense of the evolving trends, challenges, and future scenarios of the industry in view of greater automation and sustainability.

One of the most notable survey findings was the increasing prevalence of AI-driven brewing solutions. In June 2022, Hoppy Brewing Systems, a brewing technology company, released a survey analyzing the trends and preferences of breweries regarding display and analytics solutions. 2845 owners responded, and 68% noted that real-time monitoring and predictive analytics are becoming the norm for maximising brewing efficiency and minimising operational costs.

IoT-integrated brewing systems are increasingly in demand, which enable seamless process automation and remote control, according to experts of leading brewing equipment manufacturers. In addition, mid-size breweries expressed an increasing willingness to adopt platforms for managing cloud brewing to improve quality control and scalability.

Sustainability was another recurring theme in the survey responses. Around 72% of breweries mentioned that water and energy consumption reduction is a high priority, prompting manufacturers to introduce energy-saving brewing equipment.

In its international sustainability goals, experts said, there was a greater investment in systems for recovering waste heat and CO₂ recapture technology. Some stakeholders also pointed out the challenges of high upfront capital expenditure and the need for technical training for brewers who move to automation.

Industry analysts expect a high demand for customised brewing automation solutions in the future, particularly among craft breweries and microbreweries. Changing consumer demands also indicated a possible shift towards automated low-alcohol and non-alcoholic beer production, the survey suggested. Overall, stakeholders are confident that ongoing innovations in automation, AI, and sustainability will drive the market in the coming years.

| Countries | Key Regulations & Policies |

|---|---|

| United States | FDA & TTB laws regulating brewing automation, stringent alcohol content labeling, and sustainability incentives for energy-efficient brewing equipment. |

| United Kingdom | There are HMRC alcohol duty regulations, food safety standards-compliant automation, and carbon emissions reduction policies for breweries. |

| France | Stricter environmental regulation of brewery emissions, waste management legislation, and subsidies for energy-efficient brewing technology. |

| Germany | The Reinheitsgebot (Beer Purity Law) is having an impact on ingredient automation, stringent hygiene legislation, and energy efficiency norms for breweries. |

| Italy | There are EU-compliant regulations of food and drink safety, incentives for automated craft breweries, and taxation on automated brewing equipment. |

| South Korea | The new liquor tax system favors automated microbreweries and government-sponsored digitization programs for food processing companies. |

| Japan | National Liquor Tax Act revisions favor craft beer automation, brewery integration with robotics, and strong alcohol advertising regulations. |

| China | The government is making efforts to automate breweries, enhance safety compliance checks, and implement policies against binge drinking. |

| Australia-NZ | Food Standards Code governing automated brewing operations, carbon-free brewing incentives, and automation tax rebates for breweries. |

| India | States are regulating alcohol, which has an impact on automated systems. Additionally, excise duty regulations and government support for MSMEs in automation are also being implemented. |

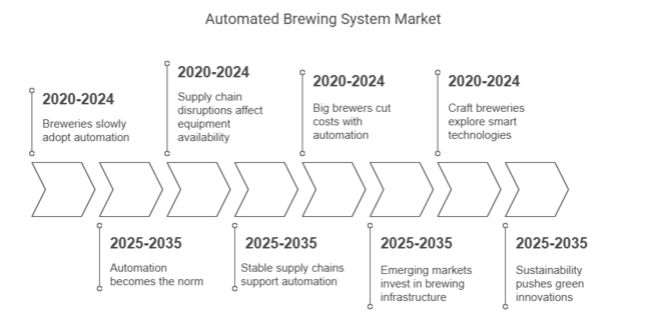

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Breweries are slowly adopting automation. | Automation becomes the norm no matter the size of the brewery. |

| Using IoT and AI-driven brewing solutions picked up the pace. | AI-driven brewing, predictive maintenance, and cloud-based management become the industry standard. |

| Equipment availability remained affected by supply chain disruptions. | Stable supply chains support widespread automation adoption . |

| Big brewers used large-scale automation to cut costs. | Emerging markets invest in new brewing infrastructure. |

| Independent craft breweries explored smart brewing technologies to enhance efficiency, consistency, and automation in their brewing processes. | There are a million craft breweries, and they do everything in-house, without automation. |

| The emphasis is on sustainability with energy-efficient systems. | Tightly controlled sustainability pushes green innovations. |

| Post-pandemic investment recovery accelerated the adoption of smart brewing. | Ongoing investment in automation for non-alcoholic and specialty beers. |

Full-size brewers, used in commercial breweries, dominate the industry. They have focused on achieving high volumes delivered with consistent quality, which is why the sector is the leading segment. Breweries favor full-size systems with IoT-enabled automation and AI-driven brewing controls for enhanced efficiency.

On the contrary, mini brewers (i.e., small-scale high breweries) are the fastest-growing segment of the market, growing in tandem with the burgeoning trend of home brewing and small-scale craft beer production. Compact, easy-to-use brewing systems with intelligent brewing options have become increasingly popular with hobbyists and microbreweries. Mini brewers with augmented models will see strong adoption as the marketplace for custom and experimental brews continues to grow.

Brewing systems with a capacity of 10 liters or more cover the largest market share, as they are used not only by professional craft breweries but also for the mass production of beer. Following this development, the systems consist of completely automated brewing modules that deliver precision, effectiveness, and low human engagement.

Meanwhile, the 5 to 10-liter segment is expanding rapidly with the increasing number of small brewpubs, microbreweries, and home breweries. These mid-capacity models offer the ideal balance of scalability and affordability, drawing in new participants.

More recently, sub-5-liter systems have been successful in niche markets, especially with hobby brewers and novice users wanting to do automated brewing.

Completely automatic brewing systems are at the forefront, favored by large and medium-sized breweries that demand high consistency, efficiency, and process automation. These systems have no human intervention, using AI-based monitoring, real-time data tracking, and remote brewing control.

Semi-automatic systems are the most rapidly expanding segment, especially among brewpubs and craft brewers who want automation with some level of manual control over the brewing process. They offer a mix of customizations and efficiency, which is appealing for experimental brewing.

Manual brewing systems are slowly on the decline in commercial environments but continue to have their place among traditionalists and artisanal brewers who like hands-on control.

The USA holds the largest automation brewing systems, 40% industry share, owing to a strong craft beer market and rapid uptake of brewing automation. To enable improved efficiency, even larger and midsize breweries are paying for AI-led brewing solutions, IoT-led monitoring, and cloud-assisted brewing software. Increasing demand for low-alcohol and non-alcoholic beers is likely to drive the adoption of automation to safeguard production consistency.

On top of that, homebrewing continues to be a robust growth trend, underpinning sales of smaller volume and mid-range capacity automated brewing systems. The USA government encourages energy-efficient brewing systems by providing tax incentives that speed up the automation process in the brewing business.

The craft beer movement is shaping the automated brewing system market in the UK alongside sustainability regulations. As labor and energy prices rise, breweries are turning to semi-automatic and fully automatic systems to improve economies. Breweries have invested in energy-efficient brewing solutions as the government pushes for carbon neutrality and reduced consumption of water.

The increase in brewpubs and microbreweries led to the creation of high demands for 5-10-liter automated brewing systems (an optimized hybrid of customized and automated production). AI and data analytics are also benefiting the UK's beer industry by using innovative brewing techniques.

In France, the automated brewing market is on the rise, alongside the country's burgeoning craft beer scene and sustainability efforts. Beer consumption has increased considerably, which has helped boost investments in brewing automation. With the French government trying to reduce CO₂ emissions and energy consumption, the breweries there have started to use eco-friendly brewing technologies.

Small to medium-sized breweries typically use semi-automatic brewing systems as they seek to maintain some control over their recipes while simultaneously reaping the benefits of automation. Furthermore, automated home brewing systems have grown as French consumers seek personalized craft beer experiences.

Since Germany has one of the oldest and most traditional beer industries in the world, it is undergoing a transformation towards automation alongside adherence to the Reinheitsgebot (Beer Purity Law). The brewing landscape is now dominated by large breweries, which are plowing massive investments into fully automated brewing systems that maximize the efficiency of large-scale production.

Nonetheless, craft beer and specialty beer segments are driving demand for semi-automatic systems, enabling brewers to experiment while maintaining accuracy. Moreover, Germany's energy efficiency regulations have been so strict that local breweries were obliged to adopt low-energy brewing technologies and even integrate AI solutions into their big brewing plants.

The craft beer boom in Italy over the last ten years has pushed demand for brewing, massaging, and semi-automatic systems. Although the country has a well-established wine-drinking culture, the younger generation is more interested in artisanal and craft beers, with microbreweries on the rise.

This leads Italian breweries to invest in semi-automated systems ranging from 5 to 10 liters, which can guarantee flexibility and consistency. Sustainability regulations similar to the EU's energy efficiency directives are also driving breweries to new, more sustainable brewing systems. Automation also assists breweries in complying with Italy's strict hygiene and food safety laws.

The demand for automated brewing systems is booming thanks to South Korea’s burgeoning craft beer industry. A new tax structure finalized by the government for liquor has provided a level playing field for many of the small brewing businesses in India, resulting in a boom for brewpubs and small-scale brewing facilities. The past decade has seen a rise in the popularity of mini and mid-sized brewing systems, which offer both automation and the ability to replicate recipes.

Moreover, South Korean consumers optimize technology-based solutions, creating demand for IoT-integrated and AI-enabled brewing systems. In addition, the government is promoting the adaptation of sustainable brewing processes, which, along with all other factors, is fuelling the automation trend in the market.

Big breweries largely lead Japan's beer industry, but there is a growing interest in craft and specialty beers. Hence, the demand for semi-automatic and fully automated brewing systems is also on the rise. Due to strict liquor tax regulations and quality control s in the country, automation exists as an attractive solution for consistency and compliance.

Automation in sake adjustments has paved the way for the use of advanced brewing technologies in beer brewing, including AI-powered fermentation tracking. Japan's focus on precision and efficiency means that fully automated systems will be more widely adopted in larger breweries, while semi-automatic systems will have a following among craft brewers.

Among the fastest-growing beer markets in China, automation is becoming one of the most important keys to modernizing brews. The government has pushed for industrial automation and smart manufacturing, investing heavily in AI- and IoT-driven brewing systems. The big breweries are already fully automated brewing and craft breweries are trying to implement semi-automatic solutions to ensure flexible production.

Moreover, since consumers in China are becoming more health-conscious, the focus on low-alcohol and health-minded drinks is leading to innovation in brewing automation. The strict safety and quality regulations imposed by the government also spur breweries to invest in advanced brewing technologies. China is expected to surge at a robust CAGR of 5.8% during the forecast period 2025 to 2035.

Australia and New Zealand each have their own distinct craft beer culture but are embracing automation in breweries to sustain quality and streamline processes. Small- and medium-sized breweries prefer semi-automatic or fully automatic brewing systems to help cut labor costs and allow for better scalability.

Government programs to support energy-efficient brewing technologies are driving the market for sustainable brewing solutions. Furthermore, home brewing's increased popularity has driven demand for mini-automated brewing systems, enabling consumers to create their craft beers. As the market continues to expand, breweries are also beginning to adopt AI-assisted process optimization tools.

In urban centers, such as Mumbai, the emerging craft beer industry is spearheading demand for automated brewing systems. The country is subject to state-specific alcohol regulations, so automation represents a useful method for preserving compliance and precision. Automation in the brewing industry- Midsize and larger breweries are investing in fully automated systems to streamline production, while semi-automatic systems are gaining traction among brewpubs and microbreweries.

Breweries are embracing the Internet of Things (IoT) and AI-powered brewing systems for accurate recipe control due to the increasing need for premium and flavored craft beers. Furthermore, the expansion of market growth is anticipated to occur due to government support for MSMEs investing in automation.

Old incumbents and disruptive startups dominate the market for automated brewing. 2024 market share leaders are:

PicoBrew (USA): 25% market share

PicoBrew remains a champion of the automated brewing market, offering state-of-the-art, user-friendly brewing solutions optimized for home or commercial use. Their focus on making connected devices for brewing and subscription boxes for ingredients has secured their place.

BrewArt (Australia) -20% market share

In 2024, with this rapid expansion in the Asia-Pacific region, BrewArt is gaining significant traction. They found favor among consumers with their modular brewing devices and their emphasis on craft beer personalization.

Keurig Dr Pepper (United States)-18% market share

QuasiEndgames Keurig Dr Pepper entered the auto brewing scenario in early 2024 with their "Keurig BrewMaster" products, neatly designed for both coffee and beer Keurig fans. Their well-oiled distribution machinery, coupled with the name recall, has earned them a large portion of the market in no time.

LG Electronics (South Korea): 15% market share

The "LG HomeBrew" is an automation system connecting to the smart home and AI in 2024, an unexpected move for the company. They cater to status-minded consumers with cutting-edge, high-end products.

Brewie (Hungary)-10% market share

Brewie remains innovative with its fully integrated brewing systems, which boast professional-grade features such as customizable recipes and mobile app controls. In Europe, they are still very well represented.

Others (startups and niche players): 12% market share

The category includes new baby startup companies like BrewBot (UK) and Grainfather (New Zealand), which are becoming more and more popular due to their unique concepts and cheap price ranges.

In March 2024, PicoBrew Acquires BrewBot

With the acquisition of BrewBot, a UK-based startup that had developed community-driven brewing platforms, PicoBrew solidified its market position. With this acquisition, PicoBrew will expand its reach in Europe and integrate BrewBot's software offerings.

Keurig Dr Pepper is Set to Join Forces with AB InBev (May 2024)

To kick things off, Keurig Dr. Pepper announced a trade deal with AB InBev to help produce co-branded beer pods designed for the BrewMaster system. We hope that the combination of AB InBev's beer portfolio and Keurig's distribution network will facilitate its reach.

LG Electronics introduces the AI Smart Brew System (Jan. 2024)

LG unveiled an AI-backed automated brewing system back in October 2023 called the "LG HomeBrew," which used machine learning to adjust the brewing parameters based on the preferences of individual users. This launched into the automated brewing fray.

North America (June 2024): BrewArt Expands

In October 2023, BrewArt expanded into the North American market via a partnership with Walmart and Amazon. In doing so, they have greatly expanded their global reach and market share!

Grainfather

Grainfather, a New Zealand-based company, secured USD 20 million in Series B funding to accelerate product development and expand into new markets, including South America and Africa.

Microsoft and Brewie Join Forces for IoT Integration (Feb 2024)

They turned to Microsoft for help in integrating their IoT systems with Azure to enable remote brewing and data analytics. Such collaboration has made Brewie more attractive to tech-orientated consumers.

The automated brewing system market is a part of the food & beverage processing equipment industry, the industrial automation and smart manufacturing industries, as well as consumer-driven alcoholic beverage trends. As an important sector of the worldwide brewing market, this industry is influenced by macroeconomic variables such as disposable profit, changing customer preferences, new technology, and policy standards.

The improving global economic condition, along with growing trends of urbanization and increasing disposable income, has contributed to a rise in demand for premium and craft beer, which is driving investments in automation for scalability and increasing efficiency.

As the world recovers from the pandemic, the hospitality and brewery industries are adapting to new demand patterns. The need to efficiently manage operations and scale production in real-time has become a key driver for automation in brewing systems (2023 to 2024).

Machine learning, IoT, and cloud-based brewing solutions have all advanced to simplify automation for breweries, large and small enterprise systems, and small craft brewers alike, spawning a larger developer market. However, volatility in raw material prices, high initial investment costs, and supply chain disruption may impede the industry's growth.

Governments worldwide are advocating for sustainable brewing solutions, particularly efficient automated brewing solution, which is gaining significant momentum in the market due to its lower energy consumption. Inflation trends will affect the market, as will taxes on alcoholic beverages and trade regulations.

Rising Demand for Craft and Specialty Beers- Increasing demand for craft beers, flavored beers, and non-alcoholic beers is driving demand for more flexible and customizable brewing systems. Breweries using AI and IoT-enabled automation will gain a competitive advantage.

Emerging Market Growth-Countries like India, China, and South Korea are catching on to the brewing business with a growing number of microbreweries and brewpubs. New players can also use automated brewing systems to optimize costs and ensure consistency.

Sustainability-Driven Innovation-With governments implementing energy efficiency and carbon neutrality policies, breweries that invest in low-energy, water-saving breeding technologies will gain incentives and have a stronger brand image.

The integration of AI and IoT-Smart brewing systems with predictive maintenance, real-time monitoring, and AI-powered recipe formulations-will attract breweries looking to optimize production and reduce waste.

Direct-to-Consumer Home Brewing Market - The growing interest in home brewing and personalized beer experiences drives the demand for mini-breweries, which are compact, user-friendly, and come with automated sensors and controls.

Niche Market-Newcomers have to target brewpubs, microbreweries, and home brewers instead of getting to the big leagues. Low-cost, semi-automatic, or customizable systems may also attract early adopters.

Use Technology to Differentiate-AI-powered recipe formulation, IoT-driven real-time monitoring, and mobile app integration can give new entrants an edge in the market.

Form Strategic Alliances: Aligning with retail outlets and other key partners throughout the value chain will ensure rapid brand awareness and product adoption.

Promote Sustainability-Advertising brewing systems as energy-efficient, waste-reducing, and water-saving can help best position itself with global sustainability trends that appeal to eco-minded breweries.

Flexible Pricing Models-Introducing subscription-based pricing, leasing, and rental models can reduce barriers to entry for small brewers and increase adoption rates.

The industry is divided into full-sized and minibrewers.

It is segmented into Less than 5 liters, 5 to 10 Liters, 10 Liters, and others

It is fragmented into manual, semi-automatic, and fully automatic

It is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East, and Africa (MEA)

They provide reliability, save time, and accelerate the manufacturing process of beers.

Homebrewers and microbreweries suit semi-automatic and compact brewing systems.

AI assists with tracking fermentation, fine-tuning recipes, and predicting when maintenance will be required.

Capacity, automation, customizable features, and smart technology compatibility.

Many systems today take advantage of energy-efficient processes, water recycling, and sustainable materials.

Table 1: Global Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Volume (MT) Forecast by Region, 2017 to 2033

Table 3: Global Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 4: Global Volume (MT) Forecast by Product Type, 2017 to 2033

Table 5: Global Value (US$ Million) Forecast by Capacity, 2017 to 2033

Table 6: Global Volume (MT) Forecast by Capacity, 2017 to 2033

Table 7: Global Value (US$ Million) Forecast by Mechanism, 2017 to 2033

Table 8: Global Volume (MT) Forecast by Mechanism, 2017 to 2033

Table 9: North America Value (US$ Million) Forecast by Country, 2017 to 2033

Table 10: North America Volume (MT) Forecast by Country, 2017 to 2033

Table 11: North America Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 12: North America Volume (MT) Forecast by Product Type, 2017 to 2033

Table 13: North America Value (US$ Million) Forecast by Capacity, 2017 to 2033

Table 14: North America Volume (MT) Forecast by Capacity, 2017 to 2033

Table 15: North America Value (US$ Million) Forecast by Mechanism, 2017 to 2033

Table 16: North America Volume (MT) Forecast by Mechanism, 2017 to 2033

Table 17: Latin America Value (US$ Million) Forecast by Country, 2017 to 2033

Table 18: Latin America Volume (MT) Forecast by Country, 2017 to 2033

Table 19: Latin America Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 20: Latin America Volume (MT) Forecast by Product Type, 2017 to 2033

Table 21: Latin America Value (US$ Million) Forecast by Capacity, 2017 to 2033

Table 22: Latin America Volume (MT) Forecast by Capacity, 2017 to 2033

Table 23: Latin America Value (US$ Million) Forecast by Mechanism, 2017 to 2033

Table 24: Latin America Volume (MT) Forecast by Mechanism, 2017 to 2033

Table 25: Europe Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: Europe Volume (MT) Forecast by Country, 2017 to 2033

Table 27: Europe Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 28: Europe Volume (MT) Forecast by Product Type, 2017 to 2033

Table 29: Europe Value (US$ Million) Forecast by Capacity, 2017 to 2033

Table 30: Europe Volume (MT) Forecast by Capacity, 2017 to 2033

Table 31: Europe Value (US$ Million) Forecast by Mechanism, 2017 to 2033

Table 32: Europe Volume (MT) Forecast by Mechanism, 2017 to 2033

Table 33: East Asia Value (US$ Million) Forecast by Country, 2017 to 2033

Table 34: East Asia Volume (MT) Forecast by Country, 2017 to 2033

Table 35: East Asia Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 36: East Asia Volume (MT) Forecast by Product Type, 2017 to 2033

Table 37: East Asia Value (US$ Million) Forecast by Capacity, 2017 to 2033

Table 38: East Asia Volume (MT) Forecast by Capacity, 2017 to 2033

Table 39: East Asia Value (US$ Million) Forecast by Mechanism, 2017 to 2033

Table 40: East Asia Volume (MT) Forecast by Mechanism, 2017 to 2033

Table 41: South Asia Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: South Asia Volume (MT) Forecast by Country, 2017 to 2033

Table 43: South Asia Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 44: South Asia Volume (MT) Forecast by Product Type, 2017 to 2033

Table 45: South Asia Value (US$ Million) Forecast by Capacity, 2017 to 2033

Table 46: South Asia Volume (MT) Forecast by Capacity, 2017 to 2033

Table 47: South Asia Value (US$ Million) Forecast by Mechanism, 2017 to 2033

Table 48: South Asia Volume (MT) Forecast by Mechanism, 2017 to 2033

Table 49: Oceania Value (US$ Million) Forecast by Country, 2017 to 2033

Table 50: Oceania Volume (MT) Forecast by Country, 2017 to 2033

Table 51: Oceania Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 52: Oceania Volume (MT) Forecast by Product Type, 2017 to 2033

Table 53: Oceania Value (US$ Million) Forecast by Capacity, 2017 to 2033

Table 54: Oceania Volume (MT) Forecast by Capacity, 2017 to 2033

Table 55: Oceania Value (US$ Million) Forecast by Mechanism, 2017 to 2033

Table 56: Oceania Volume (MT) Forecast by Mechanism, 2017 to 2033

Table 57: Middle East and Africa Value (US$ Million) Forecast by Country, 2017 to 2033

Table 58: Middle East and Africa Volume (MT) Forecast by Country, 2017 to 2033

Table 59: Middle East and Africa Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 60: Middle East and Africa Volume (MT) Forecast by Product Type, 2017 to 2033

Table 61: Middle East and Africa Value (US$ Million) Forecast by Capacity, 2017 to 2033

Table 62: Middle East and Africa Volume (MT) Forecast by Capacity, 2017 to 2033

Table 63: Middle East and Africa Value (US$ Million) Forecast by Mechanism, 2017 to 2033

Table 64: Middle East and Africa Volume (MT) Forecast by Mechanism, 2017 to 2033

Figure 1: Global Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Value (US$ Million) by Capacity, 2023 to 2033

Figure 3: Global Value (US$ Million) by Mechanism, 2023 to 2033

Figure 4: Global Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 6: Global Volume (MT) Analysis by Region, 2017 to 2033

Figure 7: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 10: Global Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 11: Global Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Value (US$ Million) Analysis by Capacity, 2017 to 2033

Figure 14: Global Volume (MT) Analysis by Capacity, 2017 to 2033

Figure 15: Global Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 16: Global Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 17: Global Value (US$ Million) Analysis by Mechanism, 2017 to 2033

Figure 18: Global Volume (MT) Analysis by Mechanism, 2017 to 2033

Figure 19: Global Value Share (%) and BPS Analysis by Mechanism, 2023 to 2033

Figure 20: Global Y-o-Y Growth (%) Projections by Mechanism, 2023 to 2033

Figure 21: Global Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Attractiveness by Capacity, 2023 to 2033

Figure 23: Global Attractiveness by Mechanism, 2023 to 2033

Figure 24: Global Attractiveness by Region, 2023 to 2033

Figure 25: North America Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Value (US$ Million) by Capacity, 2023 to 2033

Figure 27: North America Value (US$ Million) by Mechanism, 2023 to 2033

Figure 28: North America Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 30: North America Volume (MT) Analysis by Country, 2017 to 2033

Figure 31: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 34: North America Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 35: North America Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Value (US$ Million) Analysis by Capacity, 2017 to 2033

Figure 38: North America Volume (MT) Analysis by Capacity, 2017 to 2033

Figure 39: North America Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 40: North America Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 41: North America Value (US$ Million) Analysis by Mechanism, 2017 to 2033

Figure 42: North America Volume (MT) Analysis by Mechanism, 2017 to 2033

Figure 43: North America Value Share (%) and BPS Analysis by Mechanism, 2023 to 2033

Figure 44: North America Y-o-Y Growth (%) Projections by Mechanism, 2023 to 2033

Figure 45: North America Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Attractiveness by Capacity, 2023 to 2033

Figure 47: North America Attractiveness by Mechanism, 2023 to 2033

Figure 48: North America Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Value (US$ Million) by Capacity, 2023 to 2033

Figure 51: Latin America Value (US$ Million) by Mechanism, 2023 to 2033

Figure 52: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 54: Latin America Volume (MT) Analysis by Country, 2017 to 2033

Figure 55: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 58: Latin America Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 59: Latin America Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Value (US$ Million) Analysis by Capacity, 2017 to 2033

Figure 62: Latin America Volume (MT) Analysis by Capacity, 2017 to 2033

Figure 63: Latin America Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 64: Latin America Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 65: Latin America Value (US$ Million) Analysis by Mechanism, 2017 to 2033

Figure 66: Latin America Volume (MT) Analysis by Mechanism, 2017 to 2033

Figure 67: Latin America Value Share (%) and BPS Analysis by Mechanism, 2023 to 2033

Figure 68: Latin America Y-o-Y Growth (%) Projections by Mechanism, 2023 to 2033

Figure 69: Latin America Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Attractiveness by Capacity, 2023 to 2033

Figure 71: Latin America Attractiveness by Mechanism, 2023 to 2033

Figure 72: Latin America Attractiveness by Country, 2023 to 2033

Figure 73: Europe Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Value (US$ Million) by Capacity, 2023 to 2033

Figure 75: Europe Value (US$ Million) by Mechanism, 2023 to 2033

Figure 76: Europe Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 78: Europe Volume (MT) Analysis by Country, 2017 to 2033

Figure 79: Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 82: Europe Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 83: Europe Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Value (US$ Million) Analysis by Capacity, 2017 to 2033

Figure 86: Europe Volume (MT) Analysis by Capacity, 2017 to 2033

Figure 87: Europe Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 88: Europe Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 89: Europe Value (US$ Million) Analysis by Mechanism, 2017 to 2033

Figure 90: Europe Volume (MT) Analysis by Mechanism, 2017 to 2033

Figure 91: Europe Value Share (%) and BPS Analysis by Mechanism, 2023 to 2033

Figure 92: Europe Y-o-Y Growth (%) Projections by Mechanism, 2023 to 2033

Figure 93: Europe Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Attractiveness by Capacity, 2023 to 2033

Figure 95: Europe Attractiveness by Mechanism, 2023 to 2033

Figure 96: Europe Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: East Asia Value (US$ Million) by Capacity, 2023 to 2033

Figure 99: East Asia Value (US$ Million) by Mechanism, 2023 to 2033

Figure 100: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 102: East Asia Volume (MT) Analysis by Country, 2017 to 2033

Figure 103: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 106: East Asia Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 107: East Asia Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: East Asia Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: East Asia Value (US$ Million) Analysis by Capacity, 2017 to 2033

Figure 110: East Asia Volume (MT) Analysis by Capacity, 2017 to 2033

Figure 111: East Asia Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 112: East Asia Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 113: East Asia Value (US$ Million) Analysis by Mechanism, 2017 to 2033

Figure 114: East Asia Volume (MT) Analysis by Mechanism, 2017 to 2033

Figure 115: East Asia Value Share (%) and BPS Analysis by Mechanism, 2023 to 2033

Figure 116: East Asia Y-o-Y Growth (%) Projections by Mechanism, 2023 to 2033

Figure 117: East Asia Attractiveness by Product Type, 2023 to 2033

Figure 118: East Asia Attractiveness by Capacity, 2023 to 2033

Figure 119: East Asia Attractiveness by Mechanism, 2023 to 2033

Figure 120: East Asia Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia Value (US$ Million) by Capacity, 2023 to 2033

Figure 123: South Asia Value (US$ Million) by Mechanism, 2023 to 2033

Figure 124: South Asia Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 126: South Asia Volume (MT) Analysis by Country, 2017 to 2033

Figure 127: South Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 130: South Asia Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 131: South Asia Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia Value (US$ Million) Analysis by Capacity, 2017 to 2033

Figure 134: South Asia Volume (MT) Analysis by Capacity, 2017 to 2033

Figure 135: South Asia Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 136: South Asia Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 137: South Asia Value (US$ Million) Analysis by Mechanism, 2017 to 2033

Figure 138: South Asia Volume (MT) Analysis by Mechanism, 2017 to 2033

Figure 139: South Asia Value Share (%) and BPS Analysis by Mechanism, 2023 to 2033

Figure 140: South Asia Y-o-Y Growth (%) Projections by Mechanism, 2023 to 2033

Figure 141: South Asia Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia Attractiveness by Capacity, 2023 to 2033

Figure 143: South Asia Attractiveness by Mechanism, 2023 to 2033

Figure 144: South Asia Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Oceania Value (US$ Million) by Capacity, 2023 to 2033

Figure 147: Oceania Value (US$ Million) by Mechanism, 2023 to 2033

Figure 148: Oceania Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 150: Oceania Volume (MT) Analysis by Country, 2017 to 2033

Figure 151: Oceania Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 154: Oceania Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 155: Oceania Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: Oceania Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: Oceania Value (US$ Million) Analysis by Capacity, 2017 to 2033

Figure 158: Oceania Volume (MT) Analysis by Capacity, 2017 to 2033

Figure 159: Oceania Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 160: Oceania Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 161: Oceania Value (US$ Million) Analysis by Mechanism, 2017 to 2033

Figure 162: Oceania Volume (MT) Analysis by Mechanism, 2017 to 2033

Figure 163: Oceania Value Share (%) and BPS Analysis by Mechanism, 2023 to 2033

Figure 164: Oceania Y-o-Y Growth (%) Projections by Mechanism, 2023 to 2033

Figure 165: Oceania Attractiveness by Product Type, 2023 to 2033

Figure 166: Oceania Attractiveness by Capacity, 2023 to 2033

Figure 167: Oceania Attractiveness by Mechanism, 2023 to 2033

Figure 168: Oceania Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Value (US$ Million) by Capacity, 2023 to 2033

Figure 171: Middle East and Africa Value (US$ Million) by Mechanism, 2023 to 2033

Figure 172: Middle East and Africa Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 174: Middle East and Africa Volume (MT) Analysis by Country, 2017 to 2033

Figure 175: Middle East and Africa Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 178: Middle East and Africa Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 179: Middle East and Africa Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Value (US$ Million) Analysis by Capacity, 2017 to 2033

Figure 182: Middle East and Africa Volume (MT) Analysis by Capacity, 2017 to 2033

Figure 183: Middle East and Africa Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 184: Middle East and Africa Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 185: Middle East and Africa Value (US$ Million) Analysis by Mechanism, 2017 to 2033

Figure 186: Middle East and Africa Volume (MT) Analysis by Mechanism, 2017 to 2033

Figure 187: Middle East and Africa Value Share (%) and BPS Analysis by Mechanism, 2023 to 2033

Figure 188: Middle East and Africa Y-o-Y Growth (%) Projections by Mechanism, 2023 to 2033

Figure 189: Middle East and Africa Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Attractiveness by Capacity, 2023 to 2033

Figure 191: Middle East and Africa Attractiveness by Mechanism, 2023 to 2033

Figure 192: Middle East and Africa Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automated Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Compound Storage and Retrieval (ACSR) Market Size and Share Forecast Outlook 2025 to 2035

Automated People Mover Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Mineralogy Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Material Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Labeling Machines Market Size and Share Forecast Outlook 2025 to 2035

Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management (AIM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automated Window Blinds Market Size and Share Forecast Outlook 2025 to 2035

Automated Cannabis Testing Market Size and Share Forecast Outlook 2025 to 2035

Automated Algo Trading Market Size and Share Forecast Outlook 2025 to 2035

Automated Number Plate Recognition (ANPR) and Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automated Tray Fill and Seal Machines Market Size and Share Forecast Outlook 2025 to 2035

Automated Poly Bagging Machines Market Size and Share Forecast Outlook 2025 to 2035

Automated External Defibrillator Market Analysis – Size, Share, and Forecast 2025 to 2035

Automated Suturing Devices Market Analysis - Growth & Forecast 2025 to 2035

Automated Blood Processing Equipment Market Growth – Trends & Forecast 2025 to 2035

Automated Container Terminal Market Analysis by Automation, Product, Project, and Region: Forecast for 2025 to 2035

Automated Parcel Delivery Terminals Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA