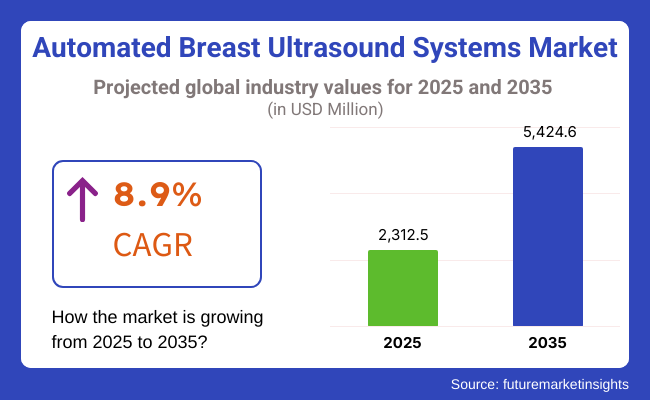

In 2025, the market was valued at approximately USD 2,312.5 million and is projected to reach USD 5,424.6 million by 2035, reflecting a compound annual growth rate (CAGR) of 8.9% during the forecast period. The global automated breast ultrasound systems (ABUS) market is poised for significant growth between 2025 and 2035, driven by increasing awareness of breast cancer screening, technological advancements in imaging, and the rising prevalence of breast cancer.

ABUS treats imaging under a different light, especially for women with dense breast tissues, for whom it may sometimes be a burden to use standard mammography procedures. Latest developments in artificial intelligence and 3D imaging are enhancing the tuning of diagnostic efficiency and accuracy. Additionally, government initiatives in favor of early detection and screening programs would support market expansion.

High equipment costs, the need for specialized training, and regulatory constraints could nonetheless impede market growth. Regardless of these limitations, the improvement of breast cancer detection rate and consequent impact on patient outcome is deemed to drive sustained growth of the ABUS market over the next decade.

The market for automated breast ultrasound systems has progressed from being a support in diagnosis to an integral part of breast cancer screening, particularly for women with dense breasts during the historic period. While mammography is efficacious for a majority of patients, it does have limitations in viewing tumors in dense breasts due to overlapping tissue structures. Hence, the need was felt for automated, standardized, and operator-independent ultrasound imaging, resulting in the emergence of ABUS as its preferred solution.

Besides being used as a supportive adjunct to mammography, handheld ultrasound systems added more than any imaging quality, and more than one operator was dependent upon it for centering and titling. The ABUS was the means through which these specific challenges were addressed, offering three-dimensional imaging, thus ensuring reproducibility, accuracy, and efficiency in breast cancer detection. As the incidence of breast cancer increased, together with increasing awareness campaigns concerning early detection, ABUS became popular among healthcare providers and diagnostic centers.

Over time, advancements have been made in the design of the transducer, image speed, and workflow optimization, all of which have improved the usability of ABUS, making it suitable for routine screening, preoperative planning, and post-treatment assessment. The rapid growth of regulatory approvals and reimbursement policies has also driven market expansion. Currently, ABUS is one of the mainstays of breast imaging, which has brought improvements in rates of cancer detection, patient outcomes, and overall efficiency of diagnosis in modern-day health care services.

Explore FMI!

Book a free demo

An abundance of healthcare infrastructure, widespread adoption of advanced imaging technologies, and a substantial investment in research and development are expected to contribute to North America's dominance in the ABUS market during the study period.

Concomitantly, the rapid market growth in the USA is propelled by a high breast cancer incidence rate, an early detection focus, and new and innovative diagnostic solutions. The adoption of the patient-centered care model by ABUS and the presence of major market players further augment growth. However, stringent government regulations and above-average developmental costs could hinder the regional market's progress.

Europe contributes significantly to the ABUS market due to factors such as increased awareness of advanced breast imaging options and the consequent rise in demand for improved procedures with better patient outcomes.

The most important countries in terms of becoming frontiers in healthcare innovation, with the highest investment in medical devices, particularly focusing on novel imaging technologies, are Germany, France, and the UK. Such an adoption of ABUS will further fuel market growth. Nonetheless, economic uncertainties and regulatory differences will shape the market trends in this region.

The Asia-Pacific region is expected to be the fastest-growing region in terms of ABUS, driven by improved healthcare infrastructure, increased healthcare spending, and growing awareness of advanced imaging options.

Examples of countries likely experiencing an increase in breast cancer cases resulting from lifestyle change and a fast-ageing population include China, India, and Japan. Another factor promoting the industry's growth is the region's burgeoning medical device sector. However, limited awareness in rural areas and regulatory issues may lessen accessibility within certain regions.

Limited Awareness and Training Requirements of Healthcare Workers is Limiting the Product Adoption

One major impediment restraining the Automated Breast Ultrasound Systems (ABUS market is ignorance and the absence of specialization in the training of medical professionals. While ABUS provides standardized and automated imaging, interpreting high-resolution 3D ultrasound images requires skill sets distinct from those used in conventional 2D ultrasound or mammography.

Most radiologists and sonologists are not sufficiently trained to differentiate between benign and malignant lesions on ABUS scans, resulting in some possible misinterpretations with very low diagnostic confidence. This knowledge gap holds back acceptance, as medical professionals most likely would be reluctant to incorporate ABUS into regular breast cancer screening programs.

Besides the limited awareness, the lack of knowledge on the part of physicians and patients is said to be another aspect restricting market growth. Large numbers of general practitioners and gynecologists remain unaware of the benefits of ABUS for dense breast tissue screening, and so continue to rely solely on mammography.

Patients, too, lack knowledge about other options for breast imaging and hence do not demand ABUS-based screening. Factors like these lead to poor consolidation of ABUS technology, especially in developing regions, where there is little training and awareness initiated with respect to ABUS technology. Unless these constraints are addressed through training, awareness campaigns, and collaboration in academics, the full potential of ABUS for breast cancer detection and diagnosis will remain unlocked.

A significant market opportunity for the Automated Breast Ultrasound Systems (ABUS) market lies in its ability to advance early breast cancer detection.

Over time, people have realized that mammography is not compatible with the kind of tissue they might have in their breasts. People, especially women, have become increasingly demanding about what complementary screening technologies should be able to offer. More so, such technology should give a better diagnosis for women who have dense breast tissue and thus may have a higher risk for undetected tumors.

ABUS, among other things, identifies smaller, earlier-stage lesions that could otherwise have been missed, providing earlier intervention and better patient outcomes.

But even increasing ABUS uptake, which surely offers an opportunity for more accurate detection in initial diagnosis, is not all that is possible; it stands to improve diagnosis itself. Adding ABUS into routine screenings would therefore reduce false positives and unnecessary biopsies along the diagnostic pathway.

As more healthcare systems prioritize preventive care and early intervention, ABUS provides an invaluable tool for upgrading screening programs, particularly for high-risk and underserved populations.

The ABUS industry has been experiencing significant growth due to technological advancements and the increasing value placed on patient-centered imaging solutions. An example of this is automated 3D imaging systems, which provide spatially comprehensive views of breast tissue to improve diagnostic accuracy.

Portability and easy-to-use devices in ABUS will also provide wider access to advanced diagnostics in many healthcare settings, be it in underserved or remote areas.

Another emerging trend in this field is the integration of artificial intelligence algorithms to assist in image analysis, thereby reducing the time required to interpret images and increasing confidence in diagnoses. Again, combined with some other imaging modalities such as mammography, overall screening efficiencies have improved, which is a testimony to the broadening application and benefit of such innovations.

One of the major trends accelerating the growth of the Automated Breast Ultrasound Systems (ABUS) market is the increasing expansion of regulatory approvals and reimbursement assurance.

Regulatory bodies like the FDA and European CE authorities have been increasingly recognizing the role of ABUS as an adjunctive screening tool that adds to screening for the density of breast tissue, making it acceptable for widespread use. These approvals have encouraged healthcare facilities to adopt ABUS in their regular protocols of screening for breast cancer.

Concurrently, the widening scope of reimbursement policies has rendered ABUS fairly accessible to a wider patient pool. Insurers, in general, have been extending cover for ABUS scans, making it a viable option for patients, especially for the high-risk category of individuals.

This not only encourages healthcare practices to adopt ABUS but also enables the majority of patients to seek early detection for malignant states, leading to improved clinical outcomes. The result of regulatory support, along with reimbursement availability, is allowing the market to grow at a rapid pace.

From 2020 to 2024, steady growth was observed in the ABUS (automated breast ultrasound systems) market, driven by rising breast cancer incidence rates, concerns about early detection, and advancements in ultrasound imaging technology. ABUS is being opted for as an adjunct screening tool, especially in circumstances where mammography is less effective, such as among women with dense breast tissue.

The facilities are further enhanced by improved imaging resolution, AI for automated lesion detection, and government interventions for breast cancer screening. Limiting widespread adoption were the challenges posed by high costs of equipment, limited reimbursements, and the required training of radiologists.

The market drivers for 2025 to 2035 include AI-integrated image analysis, portable and handheld ABUS devices, and enhanced automation for real-time diagnostics. The pathway will be refined by regulatory bodies to further enhance the acceptance of AI-assisted breast screening technologies. The demand for personalized breast cancer screening and the increasing use of telemedicine will fuel market growth.

Sustainability will focus on energy-saving ultrasound devices and environmentally friendly probe materials. Resilience in the supply chain will also be enhanced with the localized manufacturing and diversification of ultrasound component suppliers.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Strict FDA and CE approvals for ABUS devices; guidelines promoting adjunct screening for dense breast tissue. |

| Technological Advancements | AI-powered image analysis, improved 3D imaging, and automation for standardized breast screening. |

| Consumer Demand | Increased adoption in hospitals and diagnostic centers for adjunct breast cancer screening. |

| Market Growth Drivers | Rising breast cancer incidence, increasing awareness of early detection, and advancements in imaging technology. |

| Sustainability | Limited focus on sustainability; emphasis on device durability and long-term imaging performance. |

| Supply Chain Dynamics | Dependence on specialized imaging component manufacturers, occasional shortages of high-frequency ultrasound transducers. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Regulatory adaptation for AI-assisted ABUS interpretation and expansion of reimbursement policies. |

| Technological Advancements | Real-time AI-driven diagnostics, portable and handheld ABUS, and cloud-based image storage for telemedicine. |

| Consumer Demand | Growth in at-home and remote screening solutions, with rising demand for AI-assisted breast health monitoring. |

| Market Growth Drivers | Expansion of personalized screening programs, AI-driven efficiency improvements, and improved accessibility in emerging markets. |

| Sustainability | Shift toward energy-efficient ABUS systems, eco-friendly ultrasound probes, and sustainable device manufacturing. |

| Supply Chain Dynamics | Regionalization of manufacturing, diversification of suppliers, and increased automation in ultrasound system production. |

Market Outlook

The market in the USA for Automated Breast Ultrasound Systems (ABUS) is growing rapidly with the increasing incidence of breast cancer and the problems faced by mammogram-based methods in detecting tumors in dense breast tissue.

It is when ABUS is introduced that the images can be as clear of a quality conducive to providing adequate detection rates. The high price and the need for special training are obstacles to mass acceptance.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.8% |

Market Outlook

The expansion of the ABUS market in Germany is greatly supported by a sound healthcare infrastructure and the promotion of the early detection of cancer. The limitations of conventional mammography in the case of women with dense breast tissue have opened a wider space for using the ABUS system, while strong regulatory requirements and exorbitant costs may shadow its growth.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.0% |

Market Outlook

The ABUS market for China is experiencing rapid growth because of increasing incidence rates of breast cancer and the growing awareness of early detection methods. Developments and improvements in economic conditions and the healthcare infrastructure shall contribute to the convenience of access to advanced diagnostic technologies.

However, the disparity in healthcare access for urban and rural residents can hinder market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.1% |

Market Outlook.

India's ABUS market is on the threshold of growth due to increasing awareness of breast cancer and a growing focus on its early detection. The development of healthcare facilities and rising healthcare expenditure, meanwhile, aid the market's growth. Nevertheless, challenges such as limited resources in rural areas and variations in the quality of healthcare may act as deterrents to growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.9% |

Market Outlook

Brazil's ABUS market is experiencing growth, supported by improvements in healthcare infrastructure and increased focus on women's health. The prevalence of breast cancer necessitates the availability of advanced diagnostic technologies. Economic disparities and regional differences in healthcare access may pose challenges to market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.6% |

The ABUS system, with its ever-growing use in breast cancer screening, specifically in the detection of abnormalities in breast tissue that is dense, has dominated the markets.

The provision of high-resolution 3D imaging increases the diagnostic accuracy, thereby enhancing radiologists' and physicians' choice of use. The introduction of AI-assisted imaging solutions has also improved efficiency and workflow automation. Rising awareness about breast cancer, regulatory approvals, and the increasing thrust towards early detection have all contributed to the uptake of ABUS.

Hospitals and diagnostic centers continue to invest in this technology to maintain its dominance in the market segment.

Automated Breast Volume Scanner (ABVS): The ABVS segment is experiencing a market surge as it provides comprehensive volumetric imaging for breast cancer diagnosis.

Unlike conventional ultrasound, ABVS captures high-resolution 3D images of lesions, providing a more precise view of breast tissue and enabling a more accurate assessment of breast tissue lesions. The automated breast volume scanner is a worthwhile preoperative tool for planning and post-treatment monitoring, enhancing clinical decision-making capabilities.

Although installation figures are lower compared to ABUS, rising investments in advanced diagnostic imaging solutions are driving the demand in hospitals, research centers, and specialized diagnostic facilities, mainly towards personalized breast cancer treatment.

Hospitals: The Largest Market for Automated Breast Ultrasound Systems - Enriching the Imaging Infrastructure

Automated Breast Ultrasound Systems (ABUS) markets primarily target hospitals as their end-user segment. They offer well-established imaging facilities and provide access to professional radiologists who cater to the rising acceptance of modern breast cancer therapies.

This accelerates the market drivers for integrating ABUS with mammography to bolster early detection in the vast female population stroke by the fact that breast cancer is rising and is usually less visible in women with dense breast tissue with conventional mammography.

The growing demand for hospitals to adopt AI-assisted ultrasound systems, 3D automated imaging, and enhanced workflow efficiency has also spurred some hospitals toward this cause. Competition from government initiatives promoting breast cancer awareness, screening programs offered through hospitals, and increasing investments in hospital radiology departments has led to a significant increase in demand for these systems within the hospital setting.

Diagnostic Imaging Laboratories: Increasing Access to Early Detection of Breast Cancer

diagnostic imaging centers are becoming a prominent segment of the ABUS market, offering specialized breast imaging services outside the hospital environment. These centers target patients who desire cost-effective, quicker, and specialized diagnostic care, and hence are a must-have component of breast cancer screening programs.

Independent imaging centers' growth, expansion of tele-radiology services, and technology advancements in portable ABUS solutions are driving the market in this segment. Furthermore, the application of cloud-based imaging storage and AI-driven diagnostic devices is also facilitating more efficient and precise interpretation of breast ultrasound imaging in diagnostic laboratories.

As requests for non-surgical, radiation-free breast imaging are on the rise, diagnostic imaging laboratories shall become a go-to point in ensuring wider reach for early diagnosis of breast cancer as well as for personalized screening programs.

Increased incidence of breast cancer, ongoing technology growth across ultrasound imaging, and rising demand for supplementary screening tests propelled the market growth of ABUS. Market players invest more on AI-based imaging, optimizing workflow, and widening regulatory clearance to cement their hold in the market.

The competition in the market comes more seriously as established medical imaging companies strive to penetrate the next-generation ABUS.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| GE Healthcare | 33.5% |

| Siemens Healthineers | 21.9% |

| Hologic, Inc. | 13.8% |

| Canon Medical Systems | 10.0% |

| Other Companies (combined) | 20.9% |

| Company Name | Key Developments/Activities |

|---|---|

| GE Healthcare | 2024: Develops AI-driven ABUS technology with advanced imaging algorithms. |

| Siemens Healthineers | 2024: Specializes in automated breast screening systems for dense breast tissue detection. |

| Hologic, Inc. | 2025: Provides integrated ultrasound solutions for breast cancer diagnostics. |

| Canon Medical Systems | 2025: Focuses on high-resolution ultrasound imaging and improved detection capabilities. |

Key Company Insights

GE Healthcare(33.5%)

The prominent player in ABUS market is GE Healthcare, is focused on giving life to AI-driven imaging systems that considerably improve cancer detection in denser breast tissue. The company is involved intensively in R&D and collaborations that improve imaging accuracy.

Siemens Healthineers (21.9%)

Siemens Healthineers provides automated breast screening solutions to facilitate early detection and improve workflow efficiencies. The company is also expanding its ultrasound technologies.

Hologic, Inc. (13.8%)

Hologic is dedicated to complete breast health solutions, integrating automated ultrasound with advanced diagnostics for better patient outcomes.

Canon Medical Systems (10.0%)

Canon aims to provide high-resolution ultrasound imaging with increased sensitivity, assisting clinicians in improving the detection of breast abnormalities at an early stage.

Several other companies contribute significantly to the automated breast ultrasound systems market by developing innovative and cost-effective imaging solutions. Notable players include:

Hitachi Ltd.

The global Automated Breast Ultrasound Systems industry is projected to witness CAGR of 8.9% between 2025 and 2035.

The global Automated Breast Ultrasound Systems industry stood at USD 2,123.6 million in 2024.

The global rare neurological disease treatment industry is anticipated to reach USD 5,424.6 million by 2035 end.

China is expected to show a CAGR of 6.1% in the assessment period.

The key players operating in the global automated breast ultrasound systems industry are GE Healthcare, Siemens Healthineers, Hologic, Inc., Canon Medical Systems, Hitachi Ltd., Delphinus Medical Technologies, Inc. and others.

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Prostate-Specific Antigen Testing Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.