The report provides insights on the key drivers, restraints, and opportunities affecting the growth of this market during the Forecast period from 2025 to 2035. Regenerative medicine and accelerated approaches in automated bioprocessing include the manufacture and upscaling of CAR-T cell therapy, stem cell therapy, gene-modified therapies. As the industry shifts toward advanced manufacturing methodologies that streamline, standardize, and enable scalable production processes, it has become increasingly necessary for automated closed systems to meet product quality, regulatory compliance, and cost-effectiveness demands.

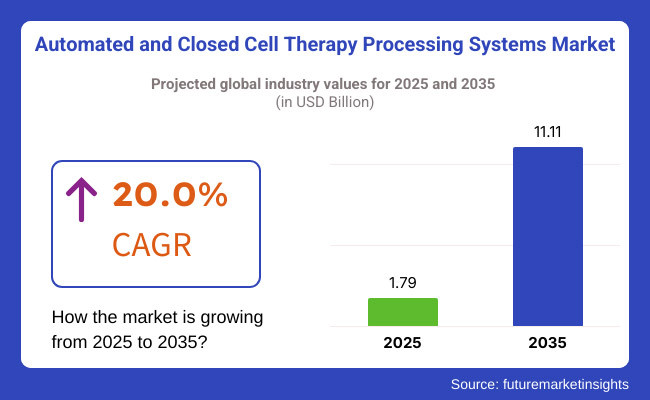

Market is anticipated to move into single-digit growth stage taking from USD 1.79 billion in 2025 to USD 11.11 billion by 2035, over the forecast period outperforming at arobust CAGR of 20.0 %. Rapid growth of the biopharma manufacturing market can be attributed to the increase in number of FDA and EMA approvals (USA FDA) for cell-based rate therapies, coupled with growing investments in biopharmaceutical manufacturing. Using automation, along with real-time monitoring and single-use bioprocess technology, is controversially increasing efficiency and reducing the risk of human error in cell therapy manufacturing.

Explore FMI!

Book a free demo

North America has a dominant share of 38% in the market which is high compared to Europe and APAC region; the Innovation Acceleration Challenges Category projects its core IVPA Approach with the UNEIR Effect on biopharmaceutical manufacturing & regenerative medicine, which will further allow the production of an automated and closed cell therapy processing system. Key strengths driving the region include robust government funding, the growing number of clinical trials, and the presence of key industry players such as Thermo Fisher Scientific, Lonza, and Miltenyi Biotec. The FDA’s concentration on making regulatory routes easier for cell-based therapies is also driving the market adoption more quickly. Furthermore, the demand for CAR-T cell therapies is rising, and the increasing implementation of automated GMP (Good Manufacturing Practice) facilities is streamlining production and scalability.

An intense five years drive institutions toward cell therapy manufacturing has resulted in a foothold, mainly in Europe, of which Germany, the UK and France are emerging as key centers for advanced manufacturing capabilities. The European Medicines Agency (EMA) continues to promote cell therapy research and commercialization, driving greater investments in automated bioprocessing and closed-system manufacturing. The shift toward AI-driven automation and modular bioprocessing in Germany one of the world’s leading biopharmaceutical producers is gaining traction as a way to improve consistency and efficiency while driving down the cost of therapy. The high prevalence of chronic diseases and the rising demand for autologous & allogeneic cell therapies further strengthen the market in European region.

The automated and closed cell therapy processing system market in the Asia-Pacific region is projected to grow at the highest CAGR, primarily due to increasing investments in healthcare, growing biomanufacturing capabilities, and supportive regulations for cell-based therapies. This landscape is led essentially by China, Japan, South Korea, and India with the former being supported by strong government initiatives to promote regenerative medicine and biopharmaceutical innovation. China's thriving biotech market and burgeoning stem cell research are driving automated closed-system processing. At the same time, Japan's laws for regenerative medicine, and fast-tracking development of cell therapies are promoting investment in next-generation bioprocessing technologies. Contract development and manufacturing organization (CDMO) expansion in the region is further providing a growth boost to the market.

Challenge

High Capital Investment and Technological Complexity

Automated and closed cell therapy processing systems implementation involves considerable capital investment, which poses a hindrance to small and emerging biotech companies. Moving from manual to automated workflows requires top-of-the-line robotics, AI-assisted monitoring, and real-time control of processes, for which the upfront costs and technical complexity can be high. The challenge of ensuring adherence to evolving regulatory standards for Advanced Therapy Medicinal Products (ATMPs) also makes things more complicated. To address these challenges, companies are building modular and scalable automation solutions, enabling a gradual implementation without interfering with productive workflows already in place in factories.

Opportunity

Increasing Adoption of AI and Robotics in Cell Therapy Manufacturing

Cell therapy processing is being transformed by AI, robotics and real-time analytics, allowing for greater precision, less variability and more scalability. With the ability of AI to streamline processes, predictive analytics, automated quality controls, and real-time monitoring of critical variables, it is able to greatly enhance manufacturing efficiency. Robotic-driven closed systems increase sterility assurance, reduce contamination risk, and enable consistency across large batches. With the increased demand for automated and high-throughput cell therapy manufacturing, businesses that invest in, AI-driven automation, cloud-based bioprocessing platforms, and intelligent monitoring systems will be well-positioned for a competitive advantage in the changing market.

The automated & closed bubble cell therapeutic handling transfer agent market grew quickly from 2020 to 2024, driven by an increase in investment in regenerative medicine, an increase in the need for cell-based therapies and advances in bioprocessing automation.

The biopharma industry turned to automation for cell therapy manufacturing to reduce the production cost, mitigate contamination risk, and facilitate regulatory compliance. The shift towards personalized medicine and autologous cell therapies led to demand for closed-system processing, which resulted in reduced manual interventions and improved reproducibility.

CAR-T cell therapies and stem cell research became key growth drivers which encouraged pharmaceutical companies to invest in scalable automated platforms capable of high-throughput cell processing under sterile conditions. A strong boost in production efficiency was achieved by implementing automated systems for monitoring in real-time, well-controlled cell culture and harvesting.

The USA and Europe also have stringent regulatory requirements that require manufacturers to develop GMP compliant closed-system bioprocessing solutions. Meanwhile, the adoption was relatively slow due to high equipment costs, complex system integration, and high costs of accessing in emerging markets.

Such obstacles notwithstanding, single-use bioprocessing, AI-integrated analytics, and microfluidics-based cell handling all promise to improve efficiency and confidence around cell therapy manufacture, laying the groundwork for how future generations.

The automated & closed cell therapy processing system Market will face a dramatic change between 2025 to 2035, through AI-powered automation, continuous bioprocessing and decentralized cell therapy production models.

This includes the use of AI-integrated bioprocessing platforms for cell therapy manufacturing which will allow real-time quality control, automated error detection, and predictive analytics for process optimization. Smart automation will improve the accuracy of processes such as cell expansion, differentiation and cryopreservation, resulting in a more consistent therapeutic product.

The growing decentralization of cell therapy manufacturing will drive the adoption of modular, closed-system bioreactors that enable on-site production of cell therapies at hospitals and clinics to reduce logistical complications and treatment lead time. Point of care manufacturing platforms will enable autologous therapies, ensuring prompt delivery of patient specific therapies.

Single-use, closed-loop bioprocessing systems will improve the scalability, cost-efficiency, and good manufacturing practice (GMP) compliance of the production of cell therapies, as well as reduce risks for contamination and improve the reproducibility of the process. These will include integrating automated microfluidic cell sorting and AI-powered imaging technologies which will facilitate improved cell purity and viability resulting in better success rates in regenerative treatments.

3D bioprinting, and tissue engineering will also advance in the market, combining fully automated cell therapy processing to biofabrication for the generation of personalized tissue grafts and organoid models. These advancements will considerably widen the utilization of cell therapies beyond oncology into neurology, orthopedics, and cardiovascular medicine.

As sustainability takes center stage, green, low-energy bioprocessing solutions will arise, paving the way towards a greener cell therapy manufacture, with low biowaste and efficient resource usage.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Technology Evolution | Adoption of closed-system, single-use bioprocessing |

| Cell Therapy Applications | CAR-T and stem cell therapies required manual interventions |

| Regulatory & Compliance | Focus on GMP, FDA, and EMA compliance |

| Decentralized Manufacturing | Centralized production in specialized labs |

| AI & Machine Learning | Limited automation in cell viability monitoring |

| Scalability & Cost Efficiency | High costs and complex system integration |

| Sustainability Focus | Initial focus on single-use, sterile consumables |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology Evolution | Integration of AI-powered, smart automation, and decentralized manufacturing |

| Cell Therapy Applications | Fully automated, AI-enhanced cell therapy processing for diverse applications |

| Regulatory & Compliance | Adoption of real-time compliance monitoring and blockchain-secured bioprocessing |

| Decentralized Manufacturing | Expansion of point-of-care cell therapy manufacturing in hospitals and clinics |

| AI & Machine Learning | AI-driven predictive analytics, automated error correction, and smart process optimization |

| Scalability & Cost Efficiency | Growth of modular, low-cost, and cloud-connected bioprocessing solutions |

| Sustainability Focus | Shift to eco-friendly, energy-efficient, and waste-reducing cell therapy systems |

The United States dominates the automated and closed cell therapy processing systems market owing to the strong biotechnology and pharmaceutical industries in the region. Growing interest in regenerative medicine and personalized therapies increases the need for cell processing automation to aid biotechnology companies in their endeavor. Moreover, the presence of several players in the industry, in addition to the high investments in cell therapy research, would further aid in the growth of the market. Similarly, favorable regulations from organizations like the FDA facilitate the transition toward closed systems in clinical and commercial applications to boost compliance and efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 21.5% |

The United Kingdom market is experiencing growth owing to the increasing government funds for cell therapy research and innovations in bioprocessing technology. An increasing number of biotech companies and research institutes are contributing to innovations in the field of automated cell processing solutions. Closed systems can be monitored in real time to ensure they meet strict regulatory requirements, ultimately leading to increased reliability and scalability of processes. Demand for platforms to manufacture cell therapy is rapidly increasing across the nation as personal medicine and immunotherapy become increasingly prevalent.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 21.2% |

Market in European Union growing at a considerable pace, owing to rising adoption of automated and closed systems used in cell therapy manufacturing Germany, France, and Belgium are notable contributors, thanks to strong biotech ecosystems and government-backed initiatives. Growing prevalence of chronic diseases and subsequent demand for advanced regenerative medicine solutions drive demand for automated processing platforms. The European Medicines Agency (EMA) is stringent with quality control measures and this, in turn, is predicted to drive the use of closed cell therapy processing systems in the region.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 22.0% |

The established pharmaceutical industry in Japan and the country’s strong emphasis on regenerative medicine are expected to contribute to the growing adoption of automated and closed cell therapy processing systems. The aforementioned regulatory regime promotes innovation of biopharmaceuticals in the country with a focus on automating cell therapy manufacturing for improving precision and efficiency. Intensifying collaborations between academic research institutions and biotech firms propelling technology innovations make Japan an important market for automated cell therapy processing solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 22.3% |

Rapid development of biotechnology and stem cell research propelled South Korea as one of the largest markets for automated and closed cell therapy processing system. Cell and gene therapy investment is actively promoted by the government, leading to the development of new automation solutions. The country’s advanced manufacturing infrastructure and rising adoption of personalized medicine further drive up market demand. With biopharmaceutical companies ramping up production, the demand for efficient closed processing systems is on the upswing.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 22.1% |

This market is expected to grow fast due to increasing need for precision, sterility, & scalability in cell therapy manufacturing, thereby focusing on automated & closed cell therapy processing systems. The automation is the approach to decrease potential contamination risks, ensure that the regulations at the forefront of technology are adhered to, improve efficiency of the processes as stem cell and non-stem cell therapies are increasingly being accepted to combat chronic diseases.

Traditional manufacturing of cell therapies uses labor-intensive, open processes that have an especially high risk for human error and contamination. Automated and closed systems mitigate this risk type significantly by providing end-to-end workflow solutions that guarantee uniform quality across the laboratory with reproducible results. Separation, expansion, and cryopreservation, these are very advances techniques, and companies are investing in these techniques to produce more viable cells in a more efficient manner.

Stem Cell Therapy Leads the Market with Expanding Regenerative Medicine Applications

The most prevalent type of cell therapy is stem cell therapy, and it is leading the automated & closed cell therapy processing system market due to its increasing areas of application in regenerative medicine, oncology, and immune system disorders. With increasing numbers of patients receiving hematopoietic stem cell transplants (HSCT) for leukemia, lymphoma and genetic diseases, the need for automated processing systems that enhance purity, viability and therapeutic effectiveness of cells is rising.

The quality and viability of cells are critical for subsequent transplantation, making automation key to stem cell expansion, differentiation and preservation. The possibilities for scale up of both induced pluripotent stem cells (iPSCs) and mesenchymal stem cells (MSCs) further strengthens the case for the employment of automated workflows able to produce products at scale.

The non-stem cell-based therapy is quickly increasing adoption rate around the world, particularly for CAR-T therapy and NK immunotherapy. The personalized cancer therapies necessitate manufacturing procedures that are highly controlled, reproducible and efficient, and this is where automated systems come in.

The CAR-T therapy modifies a patient’s T-cells to identify and eliminate the cancer cells so the quality control is critical in the separation, gene-modification, expansion, and infusion of cells. They significantly lower both the risk of contamination and the value of the variation of the batch, guaranteeing the patients an exact delivery of treatments.

As cell-based immunotherapies expand from oncology into autoimmunity and infectious diseases, the need for fully automated and standardized processing solutions will clearly grow.

Separation Techniques Ensure High-Purity Cell Isolation

Separation may include isolation of highly pure and viable cell populations from tissues for therapeutic applications. In automated closed systems, unlike manual separation which requires centrifugation or filtration based methods, cell sorting, enrichment and depletion methods are conducted with precision.

As the development of autologous and allogeneic cell therapies becomes ever more complex, the need for separation technologies including magnetic-activated cell sorting (MACS) to distinguish cells from each other, and fluorescence-activated cell sorting (FACS) to select cells based on specific surface markers to remove unwanted cell populations and improve therapeutic performance also increases. With the need for increasing reproducibility and regulatory compliance, automated separation systems have become essential tools in cell therapy processing, affecting ultimately the process efficiency.

Expansion remains a crucial step in cell therapy manufacturing, allowing for large-scale production of therapeutic cells while maintaining potency and viability. Automated Our innovative expansion systems offer controlled growth environments, with real-time monitoring of cell density, nutrient supply and waste removal.

Bioreactor-based methods of cell expansion have greatly reduced the amount of manual, flask-based techniques that are laborious and poorly scaling and variable in nature. The now common use of single-use bioreactors and perfusion based expansion systems for CAR-T, NK cell and MSC manufacture allows for reproducible cell yield and concentration.

Moreover, with the need for allogeneic cell therapies being off-the-shelf, there is a growing need for high-volume, low-cost production processes for therapies to be accessible to a larger patient population, which is leads to a more trend towards automated expansion systems.

Cell therapy processing automated and closed cell therapy processing system is a herding step of cell therapy generation. To improve cell viability, sterility, and therapy standardization, companies are investing in automated bioprocessing, closed-system scalability, and real-time quality control solutions. Market competitiveness is fueled by novel GMP-compliant automation, AI-driven bioprocess monitoring, and single-use bioreactor innovations.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Lonza | 18-22% |

| BioSpherix | 12-16% |

| Cellares | 10-14% |

| Sartorius | 8-12% |

| Cytiva | 7-11% |

| ThermoGenesis Holdings Inc. | 6-10% |

| Thermo Fisher Scientific Inc. | 5-9% |

| Miltenyi Biotec | 4-8% |

| Fresenius Kabi | 3-7% |

| Pfizer | 3-6% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Lonza | Develops GMP-compliant closed-system cell therapy platforms, integrating automated bioprocessing and real-time monitoring for cell expansion. |

| BioSpherix | Specializes in modular closed-system incubators, enhancing contamination-free cell processing under controlled oxygen conditions. |

| Cellares | Offers fully automated, end-to-end cell therapy manufacturing platforms, focusing on scalability and reproducibility. |

| Sartorius | Provides single-use bioreactors and automated cell culture systems, optimizing upstream bioprocessing workflows. |

| Cytiva | Innovates in microfluidic-based closed-system solutions, improving cell separation and purification efficiency. |

| ThermoGenesis Holdings Inc. | Delivers automated CAR-T cell processing systems, reducing manual intervention in cell therapy workflows. |

| Thermo Fisher Scientific Inc. | Supplies high-throughput cell processing and storage technologies, ensuring compliance with regulatory standards. |

| Miltenyi Biotec | Develops magnetic-activated cell sorting (MACS) technology, automating cell isolation and enrichment for clinical applications. |

| Fresenius Kabi | Focuses on closed-system apheresis and cryopreservation technologies, enhancing cell therapy logistics and stability. |

| Pfizer | Integrates advanced bioprocess automation into cell therapy production, ensuring efficient large-scale manufacturing. |

Lonza (18-22%)

Lonza leads the market by providing highly automated, GMP-certified closed systems, ensuring standardized cell therapy production with minimal contamination risks.

BioSpherix (12-16%)

BioSpherix specializes in oxygen-controlled closed incubator systems, enabling precise microenvironment regulation for stem cell and immunotherapy applications.

Cellares (10-14%)

Cellares revolutionizes scalable cell therapy manufacturing, offering integrated automation for streamlined and cost-effective bioprocessing.

Sartorius (8-12%)

Sartorius enhances single-use bioreactor efficiency, supporting high-yield cell expansion and controlled differentiation.

Cytiva (7-11%)

Cytiva pioneers microfluidics-driven closed-system processing, improving cell separation, purification, and quality assurance in therapy manufacturing.

ThermoGenesis Holdings Inc. (6-10%)

ThermoGenesis advances automated CAR-T therapy workflows, eliminating manual processing steps to improve efficiency and cell viability.

Thermo Fisher Scientific Inc. (5-9%)

Thermo Fisher Scientific strengthens large-scale automated cell processing, ensuring standardized bioprocessing for commercial-scale applications.

Miltenyi Biotec (4-8%)

Miltenyi Biotec drives MACS-based cell enrichment and sorting, automating high-purity cell selection for precision therapy development.

Fresenius Kabi (3-7%)

Fresenius Kabi focuses on closed-system apheresis and cryopreservation, securing safe and stable cell storage solutions.

Pfizer (3-6%)

Pfizer integrates automated bioprocessing into its cell therapy pipeline, optimizing efficiency and regulatory compliance.

Other Key Players (30-40% Combined)

Emerging companies drive next-gen automation, AI-powered bioprocessing, and adaptive manufacturing platforms. Key players include:

The overall market size for the Automated & Closed Cell Therapy Processing System Market was USD 1.79 Billion in 2025.

The Automated & Closed Cell Therapy Processing System Market is expected to reach USD 11.11 Billion in 2035.

The demand is driven by increasing adoption of cell and gene therapies, the need for contamination-free processing, rising regulatory compliance requirements, and advancements in automation to enhance efficiency and scalability.

The top 5 countries driving market growth are the USA, UK, Europe, Japan, and South Korea.

Stem Cell Therapy segment is expected to lead in the Automated & Closed Cell Therapy Processing System Market

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.