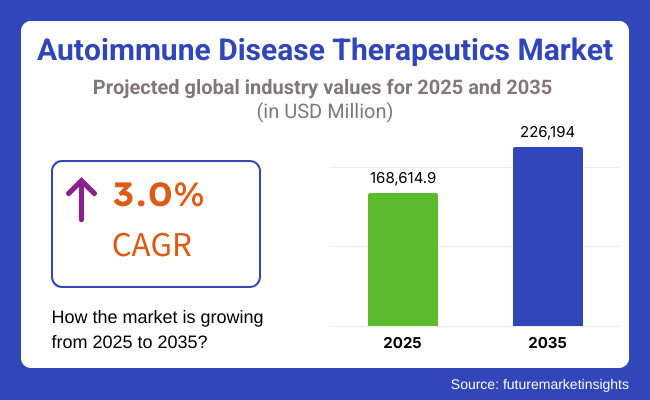

The market is expected to reach approximately USD 168,614.9 million in 2025 and expand to around USD 226,194.0 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.0% over the forecast period.

The autoimmune disease therapeutics market is projected to witness substantial growth between 2025 and 2035, driven by increasing prevalence of autoimmune disorders, advancements in biologic therapies, and rising awareness of early diagnosis and treatment.

Market growth is turning on a few key drivers, which are a growing pipeline of targeted immunomodulatory agents and augmentation in uptake of biosimilars. Precision medicine is still determining how autoimmune diseases are treated, while improvements in diagnostics and biomarker research are also propelling treatment efficacy.

Nevertheless, the high cost of care, involvement in arduous regulatory approval processes, and side effects of immunosuppressive agents remain major hindrances to market growth. On the other hand, the latest developments in biologic drugs, higher patient access programs, and increased investments in AI-based drug discovery present opportunities for sector players.

Explore FMI!

Book a free demo

Due to the increasing number of sick persons, better healthcare systems, and major presence of market player pharmaceutical organizations, North America stands as the most prominent in the therapeutics market for autoimmune disease.

At the forefront is that country, the United States, where with increasing use of biologicals, substantial investments in autoimmunity research, and insurance policy decisions favoring affordability in therapy, it is really the country in which one has to be.

With increasing rheumatologic diseases such as rheumatoid arthritis, multiple sclerosis, and inflammatory bowel disease therapy, the need for targeted therapy rises. Yet, there are barriers in the way: high costs of the medicines, stiff regulations of the FDA, and concerns about long-term side effects from immunosuppressants. However, with continuous research and investment in research, better options can be expected.

With a powerfully government-funded healthcare system alongside research facilities of advanced immunology sciences, Europe becomes a better market for therapies targeting autoimmune diseases while having proliferating patient admittance to newer therapeutic options.

Some of the key countries that include Germany, France, and the UK, serve as major markets and are boosted by broader biologic drug pipelines given by the arrival of awareness among the public on autoimmune diseases.

However, drug manufacturers often wrestle against the constraining EMA regulation and the pressure from government reimbursement policies. Upcoming needs for personalized medicines and biomarker-based diagnostics will be important to shape the market even as biosimilar uptake promotion initiatives reduce costs and bring wider access avenues.

Symposia between biotech companies and universities have fanned flames into the innovation toward the next generation of autoimmune therapeutics.

The Asia-Pacific autoimmune disease therapeutics market is experiencing a tremendous growth due to the rising occurrences of autoimmune diseases with enhanced healthcare infrastructure and growing investments in pharma R&D.

China, Japan, and India are a few of the key markets with heightened patient awareness and availability of sophisticated treatment techniques. But these have not been discovered to be affordable; there is also no availability of widespread diagnostics facilities and inconsistency in the regulatory provisions.

Though, various initiatives such as increased adoption of biosimilars, government-sponsored disease management programs, and increased collaborations in the pharmaceutical sector are driving market growth. New opportunities for the treatment of autoimmune diseases are also being explored in this region through advances in regenerative medicine and cell-based therapies.

Challenges

This again is a major factor that puts constraints on the future market options for Global Autoimmune Disease Therapeutics Market due to patent expiry on certain biologics.

Biologics mainly defined the market for therapy, primarily using monoclonal antibodies and, for example, fusion proteins, translating into tremendous sales for the respective pharmaceutical companies. Expiration of such patents opens competitive avenues for biosimilars-these cheaper products found quite similar to originators in terms of effectiveness with more safety.

With such a perception, biosimilars will enter into competitive forces eroding the rates within the market as health systems may ignore a lot of patients from opting for these alternatives simply for cost-cutting purposes.

Such factors will have an adverse effect on the income stream of the respectivecompany if most of these income streams derive from patented biologics. In addition, biosimilars in the marketplace compel Originators to spend on commercial efforts, lifecycle management strategies as well as research & development for next-generation therapies.

Opportunities

Strong Clinical Pipeline with New Treatments Can Be A Prospect for the Market

Strong momentum in the development pipeline for newly developed drugs suggests that the global autoimmune therapeutics market would be fueled highly in the future. Continuous effort into basic and applied research and development always gives rise to newer biologics, small molecules, and gene therapies with better efficacy, safety, and mechanisms of action as compared to their predecessors.

One major change in the field of managing autoimmune diseases is brought by biologics, such as monoclonal antibodies or fusion proteins, of "creating new advances" for ever-increasing therapeutic use. Oral bioavailability and target pathways unavailable for biologics intracellularly have started directing the use of small molecule drugs.

Gene therapy and RNA-based treatments have made some advancements in developing novel approaches to altering the disease process at a genetic level, with positive long-term remission, if not radical cure, in some cases.

Advancements in Biologic and Targeted Therapies

Improvements in biologics and targeted therapies are shifting the management of autoimmune disorders. Monoclonal antibodies (mAbs), like TNF inhibitors, have revolutionized the treatment of rheumatoid arthritis and psoriasis by specifically targeting components of the immune system.

Newer treatments, including IL-17 and IL-23 inhibitors, are promising great advancement in the management of psoriasis and ankylosing spondylitis with a more individualized approach and less toxicity.

Such breakthroughs have empowered clinicians to provide more efficacious, personalized treatment options that improve health outcomes and quality of life. Never have the management of autoimmune diseases been as targeted and patient-specific as it is now.

Advancements in Cell Therapy and Gene Editing for Autoimmune Disorders

For many of the autoimmune disorders, cell therapy and gene editing are making the most promising new approaches for their treatment. Researchers are turning the CAR-T (Chimeric Antigen Receptor T-cell) therapy that is initially designed for cancer treatment into a new form of treatment for autoimmune disease patients.

By modifying the patient's immune cells, the treatment could control the immune response finely so that the prospect of long-term remission arises rather than just relieving the symptoms.

Other promising developments in gene editing are CRISPR gene editing: the gene editor that allows scientists to engineer the DNA by making specific changes with the idea of correcting faulty immune responses right at their origin.

These technologies herald a shift away from treating autoimmune disorders toward curing them altogether. With these new therapies in the pipeline, it won't be long until patients can expect to rely on long-term solutions that were previously thought to be a dream.

| Market Shift | 2020 to 2024 |

|---|---|

| Technological Advancements | Embracing advanced biologics and small molecule inhibitors with selectivity for certain immune pathways to improve treatment specificity and minimize adverse effects. |

| Consumer Demand | Greater awareness and subsequent increased demand for useful and affordable treatments, with patients demanding therapies that can deliver enhanced quality of life and disease control. |

| Market Growth Drivers | Growing incidence of autoimmune disorders, heavy investments in research and development, and encouraging government policies that encourage innovation in therapeutics. |

| Sustainability | Early attempts at green manufacturing processes and minimizing the environmental effects of pharmaceutical production, with some of the companies embracing green chemistry principles. |

| Supply Chain Dynamics | Dependence on traditional distribution networks, prioritizing the availability of therapies within urban and peri-urban healthcare centers, at times resulting in difficulties in terms of reaching remote communities. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technological Advancements | Artificial intelligence and machine learning applications in drug development and discovery to discover new therapeutic targets and rationalize treatment regimens. |

| Consumer Demand | Increased choice for personalized treatment approaches, with healthcare providers and patients working together to customize therapies according to individual genetic profiles and disease characteristics. |

| Market Growth Drivers | Growth in emerging markets with developing healthcare systems, greater emphasis on early detection and intervention, and collaborative arrangements between pharmaceutical firms and research institutions to encourage innovation. |

| Sustainability | Universal practice of sustainable measures, such as the application of biodegradable materials, energy-efficient production processes, and programs for diminishing the carbon footprint of drug development and distribution. |

| Supply Chain Dynamics | Supply chain optimization by means of digital technologies and e-commerce platforms, promoting transparency, efficiency, and access, with timely delivery of therapies to a worldwide patient base, including those in remote and underserved areas. |

Market Outlook

United States continues to the front line in managing autoimmune diseases owing to its better healthcare system and excellent investment in research and development. More and more autoimmune diseases such as rheumatoid arthritis and psoriasis have made their requirements related to effective therapies-highly with an emphasis on biologics such as monoclonal antibodies and JAK inhibitors.

Advances in targeted therapy and personalized medicine coming up with new strategies are reshuffling the hands of the patients against choices they have never experienced before. Supportive laws, new drug approvals, and good insurance coverage put an icing on the cake by making the USA "the" center for the treatment of autoimmune diseases.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 1.8% |

Market Outlook

The rapidly growing autoimmune disease market in China is driven mainly by the huge population and the increased number of cases. Healthcare is trying to become more accessible with the great contribution of biotechnology into the economy to propel the market expansion through heavy government funding. In fact, the increasing need for biologics such as mono-clonal antibodies has necessitated local manufacturers to increase production.

China is adopting modern techniques such as targeted therapy and gene editing in future therapies, which will, therefore, characterize the future of autoimmune management. Patients are accessing better sophisticated therapeutics due to increasing awareness and continuous health reforms, thereby improving their lives.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.5% |

Market Outlook

The Indian autoimmune disease therapeutics market is progressing with its benefits drawn from the growing healthcare sector and increasing awareness in healthcare. Increasing cases of autoimmune diseases such as rheumatoid arthritis and lupus have further led to rising demand for biologics and immunosuppressive therapies.

The market is also witnessing a growing shift towards personalized medicine and its demand for targeted therapies. Although costs of these drugs still remain a barrier, there is currently an increasing effort to improve access and affordability for health services as well as ever-increasing regulatory support for novel therapies to fuel the Indian market's growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

Market Outlook

Germany boasts a flourishing market for autoimmune therapeutics, ranking one of the biggest in Europe, with an efficient healthcare system and high expenditure on health funding. R&D capabilities play an important role in bringing forth innovative products in the fields of biologic therapy including TNF inhibitors, monoclonal antibodies, and JAK inhibitors.

However, this prevalence of autoimmune disorders along with a growing need for personalized treatment creates a pathway leading to the growth of this market. Besides, there is space in Germany's regulatory environment for approval of innovative therapies and reimbursement policies for making treatments available for advanced autoimmune diseases.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 1.4% |

Market Outlook

The market for autoimmune therapeutics in Brazil is witnessing rapid growth owing to improvement in healthcare infrastructure and rising incidence of autoimmune diseases. Government policies are working toward higher access to biologics, such as monoclonal antibodies and immunosuppressants. Parallely, awareness and reforms in healthcare are assuring more access for patients to get the treatment that they need, although affordability still remains a concern.

The future seems to be optimistic for some revolutionary advancements in targeted and gene therapies expected to provide long-term benefits for patients. Favorable government legislation for biotechnology will further drive the growth of these innovative treatments and their accessibility.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.1% |

Anti-Inflammatory Drugs

Anti-inflammatory drugs are some of the most commonly used therapy classes in the autoimmune disease market utilized in managing excessive immune response hyperactivity and application of other chronic autoimmune diseases marked by inordinate inflammation.

Expansion in this market comes as a result of the skyrocketing prevalence of autoimmune diseases among the population and increased entry of biologic treatment approaches together with the exponentially growing pipeline of targeted anti-inflammatory therapies.

North America and Europe have been at the forefront of utilizing anti-inflammatory drugs because of the robust regulatory backing of the biologic therapy, but Asia-Pacific is rapidly catching up as the region is increasing healthcare access globally and enhancing diagnosis rates of autoimmune diseases.

Interferons

The growing utilization of interferon-based treatments, the growing demand for disease-altering therapies for MS, and the thrilling evolution of pegylated versions of interferons are key drivers for this market. North America and Europe are the primary markets for interferon-based therapeutics with high patient uptake in the treatment of MS, but in the Asia-Pacific region, growing market penetration is witnessed due to the ever-increasing healthcare infrastructure and rising prevalence of MS.

Prospective trends are next-generation interferons with enhanced tolerability; AI-assisted precision medicine for treatment of MS and gene therapy modalities targeting interferon modulation to treat autoimmune disease.

Rheumatic Disease

The rheumatic conditions of rheumatoid arthritis (RA), psoriatic arthritis (PsA), and lupus take the largest share of the autoimmune disease therapeutics market. These are chronic conditions treated with a long-term regimen of biologics, NSAIDs, and targeted immunosuppressants. The treatments of choice for RA and related disorders to diminish inflammation and protect against joint destruction are TNF inhibitors, JAK inhibitors, and IL-6 inhibitors.

Due to the increasing rates of diagnosis of rheumatic diseases, the demand for biologics and personalized treatment keeps increasing. North America and Europe currently lead in advanced therapies, although Asia is fast catching up. Greater awareness about healthcare and access to biologic therapies are beginning to tell on improvement of outcomes in patients in the region.

Some exciting innovations lie ahead. Scientists are exploring AI-driven drug repurposing to search for new therapies, while oral biologics may ease treatment administration from the standpoint of patients in the near future. Also on the horizon, stem cell regenerative therapy holds a promise for joint repair and long-lasting control of the disease.

Multiple Sclerosis (MS)

Multiple sclerosis is an autoimmune disorder in most circumstances that requires lengthy treatment with interferons long-term or monoclonal antibodies. The goal of treating the condition is to delay disease progression, lessen belligerent relapses, and mitigate other neurologic signs.

Increasing incidence rates throughout the world, introduction of newer treatments, and increasing interest in developing neuroprotective drugs all propel the MS market. North America and Europe constitute the major markets for MS treatment, given that most extensive clinical research transpired and there will be great support for disease-modifying treatment (DMTs) compared with Asia-Pacific, where increasingly high growth rates are observed with rising incidences of MS diagnoses.

Future trends would encompass using AI techniques in the monitoring of MS disease course, biomarker-guided approaches for immunotherapy personalization, and combined fuel therapies merging neuroprotection with immune modulation.

Highly competitive market for the therapeutics of autoimmune diseases is accompanied by an increase in the prevalence of these disorders, advancements in treatment pathways associated with biologics, and targeted therapies, and rising investments in the development of new immunomodulatory therapeutics.

Several companies are investing in monoclonal antibodies and JAK inhibitors and in some new biologic therapies to stay ahead of the competition. The market is being shaped by established pharmaceutical companies, biotechnology innovators, and new drug-developing companies, which are all parts of the dynamic landscape of autoimmune disease therapies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| AbbVie Inc. | 16.6% |

| Johnson & Johnson | 11.4% |

| Sanofi S.A. | 8.8% |

| F. Hoffmann-La Roche Ltd | 7.4% |

| Novartis AG | 6.9% |

| Others | 49.0% |

| Company Name | Key Offerings/Activities |

|---|---|

| AbbVie Inc. | Leading the market by providing immuno-biologics like Humira, Rinvoq, and Skyrizi, which are used for various autoimmune diseases. |

| Johnson & Johnson | Special Posts: Targeted therapies like Stelara and Tremfya for inflammatory and autoimmune conditions. |

| Amgen Inc. | Specializes in biologics for autoimmune diseases, particularly Enbrel, a TNF inhibitor used widely. |

| Novartis AG | Covers the spectrum of immunomodulatory treatments; Cosentyx is for psoriasis and other autoimmune disorders. |

| Eli Lilly and Company | Immunobiologics for autoimmune disease-overall; Taltz and Olumiant in inflammatory pathways are among them. |

Key Company Insights

AbbVie Inc. (16.6%)

Enters as a forthcoming company with Humira, a highly commercialized biologic, while its pipeline has begun to fill with next-generation immunotherapies in the autoimmune therapeutics market.

Johnson & Johnson (11.4%)

Targeted biologics are among those that J&J focuses on, as it is leading in innovative treatment for autoimmune diseases like psoriasis and Crohn's disease.

Sanofi S.A. (8.8%)

Alongside that, Amgen has a very strong foothold in the treatment of autoimmune diseases, providing TNF inhibitors and a pipeline of new biologic therapies for inflammatory conditions.

F. Hoffmann-La Roche Ltd (7.4%)

Known for its IL-17 inhibitors, Novartis aims to diversify its portfolio with innovation by adding hoary immunotherapeutics.

Novartis AG (6.9%)

An important biotech company, Eli Lilly has focused on critical developments in disease-relevant biologics that engage the immune pathways in chronic inflammatory diseases.

From these leading companies, there is a wide network of different manufacturers that add their value to the overall market making a case for product diversity and technological advancement. These include:

The global autoimmune disease therapeutics industry is projected to witness CAGR of 3.0% between 2025 and 2035.

The global autoimmune disease therapeutics industry stood at USD 2,123.6 million in 2024.

The global autoimmune disease therapeutics industry is anticipated to reach USD 226,194.0 million by 2035 end.

China is expected to show a CAGR of 5.5% in the assessment period.

The key players operating in the global autoimmune disease therapeutics industry are AbbVie Inc., Johnson & Johnson, Sanofi S.A., F. Hoffmann-La Roche Ltd, Novartis AG, Amgen Inc., Pfizer Inc., Biogen Inc., Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd., UCB S.A. and Others.

Cold Relief Roll-On Market Analysis by Application, Distribution Channel, and Region through 2035

At-Home Micronutrient Testing Industry Share, Size, and Forecast 2025 to 2035

Burn Matrix Devices Market Insights - Size, Share & Industry Growth 2025 to 2035

Chlorhexidine Gluconate Dressing Market Outlook - Size, Share & Innovations 2025 to 2035

Chloridometer Market Report Trends- Growth, Demand & Forecast 2025 to 2035

Coagulation Markers Market Trends - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.