The AutocollimatorsMarket is expected to witness a positive trend from 2025 to 2035, owing to the rise in require high-precision optical measurement, technology advances in metrology, and increased automation in manufacturing and aerospace industries. Due to their use in optics testing, machine tool calibration and spaceresearch applications, autocollimators have become essential instruments when industries require faster alignment, calibration and surface measurement. Increasing use of laser-based and digital autocollimators also boost the market growth, as they offer higher precision and real-time measurement capabilities.

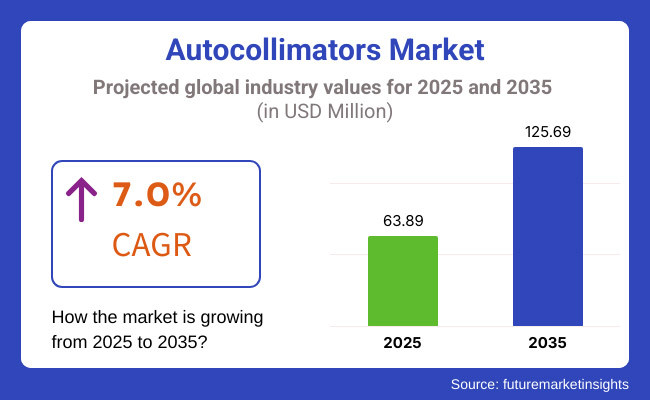

There is a forecasted growth of USD 63.89 Million in 2025, andit is predicted to reach USD 125.69 Million by 2035, with a CAGR of 7.0%over the forecast period. Themarket is significantly driven by rising investments in aerospace and defence, increased demand for semiconductor manufacturing, and advancements in nanotechnology. This is further aided with integration of AI-powered imaging, automated calibration, and IoT-enabled remote monitoring that bringsthe new phase in the autocollimators industry to optimize efficiency and measurement accuracy.

Explore FMI!

Book a free demo

The geography segment is segmented in the following way: NorthAmerica is the one that holds the biggest share of the Autocollimators Market and is likely to continue doing so due to high demand for high-end manufacturers in customers concerning the aerospace, defence, and precision manufacturing industries. In the region, the United Statesis in the lead, investing tens of billions into space exploration, semiconductor production and high-precision optics testing. Stricter calibration and alignment standardsare being encouraged by the National Institute of Standards and Technology (NIST) and other regulatory organizations leading to increased use of more advanced autocollimators. Moreover, the region is experiencing a surge in R&D investments for AI-powered metrology solutions, which are expanding the capabilities of autocollimators for industrial automation andquality control.

Europeleads the market with Germany, the UK, and France pioneering work in automated optical metrology, aerospace engineering, and high-precision manufacturing. The increasing trending ofIndustry 4.0, smart factories, automation in quality inspection in the region are contributing to the growth of digital and laser based autocollimators. On the other side, the European Union is promoting precision optics for defence and medical equipment, as well assemiconductor production, which will provide a significant boost to the growth of the market.

The Autocollimators Market in the Asia-Pacific region is projected toremain the most lucrative and expand at the fastest CAGR as a result of industrial developments, a rise in semiconductor manufacturing investments, and growing aerospace engagement. In world between Automated Metrology and Industries: At the cutting edge: the nations that refuse to be left behind China and Japan and South Korea all are steadily marching toward automated metrology,with government initiatives aimed at supporting high-precision manufacturing and nanotech breakthroughs.” A major driver for autocollimatorsfor use in lens testing, alignment, and quality control is the booming electronics and optics manufacturing sector in China. The increasing demand for automated inspection systems in automotive and industrial applications within the automotive, industrial, food & packaging, and electronics sectors is alsoboosting the market in India.

Challenge

High Cost and Complexity of Precision Metrology Systems

For small and medium-sized manufacturers, the extensive cost and tech complexity of high precisionautocollimation makes its implementation exceptionally arduous and thus high precision autocollimators are rarely adopted. Specialized calibration, high-maintenance optical components, and skilled personnel are needed to operatesuch advanced autocollimators, leading to increased operational costs. Moreover, industries that rely on traditional measurement techniques are best placed to adapt, but they are also discouraged from switching to digital orlaser-based autocollimators due to the integration complexity involved. To solve this, manufacturers are working on cost-effective, modular and AI-basedmetrology solutions, which make it easy to be adopted across industries.

Opportunity

Advancements in AI-Powered Optical Metrology and Automation

For small and medium-sized manufacturers, the high precision autocollimation involves enormous cost and tech complexity, which makes its implementationextremely difficult, therefore the high precision autocollimator products are rarely used. Operating such sophisticated autocollimators require specialized calibration, high maintenance optical components, andexpertise, increasing operational costs. Furthermore, although sectors that utilize conventional measurement techniques are ideally suited to adapt, they are also dissuaded due to the complexity of integrating digital or laser-basedautocollimators. The cost-effective, modular and AI-based metrologysolutions can enable easy deployment of these possible solutions with end user industries, and thus manufacturers are striving for it to solve the matters.

The autocollimators market is likelyto see an above-average growth rate over the next few years (2020 to 2024) due to the growing requirement for accurate angular measurement and optical alignment in industries, including, but not limited to, aerospace, automotive, and manufacturing.

Market growth wasdriven by the aerospace and defense industries, where manufacturers applied autocollimators in mirror alignment, telescope calibration and optical component inspection. The acceptance of laser-based and electronic autocollimators increased dueto the demand for sub-arcsecond precision on defense applications.

Autocollimators were incorporated into metrology labs and quality controlprocesses in the automotive industry, measuring gear alignment, ensuring bearing tests, and verifying robotic systems. As developments in autonomous vehicles continued, the use ofautocollimators for the alignment of LIDAR sensors and verification of optical components became common among manufacturers.

Demand was also driven by the manufacturing sector, where companies turned toautomated quality control, realigning machine tools and highly accurate optical inspections. Digital and software-based autocollimators arelikely to witness high demand with the shift toward non-contact measurement technologies.

Market expansion with limited awareness in developingeconomies, high rates, and complex calibration requirements prevented widespread adoption. Nonetheless, the rapid advancements in image processing, digital sensors, and AI-powered measurement analysisgradually overcame these limitations, improving measurement accuracy and usability.

From 2025 to 2035 the autocollimators market will undergo overall transformation, fusing with AI-powered automation, IoT-enabled connectivity, and next-generationoptical technologies.

Integration of the Internet of Things (IoT) and cloud-based monitoring would allow industries to remotely control and analyze all measurement processes, providing a more efficient environment foraerospace, automotive and semiconductor manufacturing. Real-time diagnostics will minimize downtime, and automated reporting toolswill simplify ISO and MIL compliance.

Meanwhile, in the aerospace and defense sectors, upcoming laser autocollimators will feature adaptive optics with AI-enhanced calibration processes, enabling unparalleled accuracyfor tasks such as satellite alignment, optical instrument testing, and defense-grade targeting systems.

Robotic-integrated autocollimators will be adopted to test sensorsin autonomous vehicles, test lenses in precision optics, and provide AI-enhanced metrology solutions for the automotive sector. The improvements would helpboost LIDAR systems, night vision cameras and laser guidance modules.

In a way to minimize humaninvolvement and increase precision in production, manufacturers will integrate Industry 4.0-compatible autocollimators with automated optics metrology platforms. Digital twin technologyis also predicted to prosper and provide predictive maintenance and real-time simulation capabilities.

Sustainability will remain at the forefront, causing manufacturers to introduce energy-efficient, miniaturizedand eco-friendly autocollimators. As a consequence, new designs will be needed to develop low-power-consumption sensors, new recyclable materials thatmaintain the properties of optical devices, and the realization of micro-patterned thin-film devices.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Technology Evolution | Adoption of digital and laser-based autocollimators |

| Aerospace & Defense | Use in telescope alignment, mirror calibration, and satellite optics |

| Automotive Industry | Autocollimators used for gear alignment and metrology |

| Manufacturing & Industry 4.0 | Manual calibration in machine tools and precision optics |

| Sustainability & Energy Efficiency | Focus on high-precision measurement with moderate energy use |

| Cost & Accessibility | High costs and limited availability in emerging markets |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology Evolution | Integration of AI-powered, self-calibrating, and smart autocollimators |

| Aerospace & Defense | Expansion to adaptive optics, real-time AI correction, and defense targeting systems |

| Automotive Industry | Adoption of robotic-integrated autocollimators for sensor calibration and LIDAR alignment |

| Manufacturing & Industry 4.0 | Growth of IoT-connected, automated quality control, and digital twin-based predictive maintenance |

| Sustainability & Energy Efficiency | Shift toward low-power, eco-friendly, and recyclable autocollimator materials |

| Cost & Accessibility | Development of affordable, AI-enhanced, and user-friendly autocollimators |

North America is the prominent autocollimators segment, as the United States is powered by industrial arena, innovations in optical metrology, and growingadoption of precision measurement technologies in aerospace, defence and semiconductor industries. As advanced manufacturing and quality assuranceneeds grow rapidly, so does the need for precision alignment and calibration fixtures. Automated and AI-based analytical features, coupled with automation of the process are being used to add value by digitally autocollimating all modern trending integrated features by leading companies in digital autocollimators to realize calibration in metrology, which inherently enhances the functionality andthe characteristics desired by the end user.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.8% |

Market growth in the UK remains constant, as it invests significantly in research and development, optical engineering, and high-precision manufacturing. Where accurate alignment and calibration are key,the aerospace and automotive industries are among the largest contributors to autocollimator demand. The move to Industry 4.0 and afocus on miniaturization in optics and photonics are driving market growth. Additionally, government support for optical technologies fuellinginnovation also drives growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.6% |

Germany, France, and Italy are thedominant players in the EU autocollimators market, with a strong focus on high-precision manufacturing and optical instrumentation. The increasing emphasis on quality control in semiconductor manufacturing, medical imaging, and laser applications is propelling the uptakeof digital and automated autocollimators. Strong collaboration between research institutions with privateindustries in the region that lead to innovative optical metrology solutions. Moreover, the demand for green energy solutions has raised the demand for autocollimatorsin solar panel alignment.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.9% |

Japan’s autocollimators market is thriving due to the country’s advanced manufacturing capabilities and its leadership in optics and precision engineering. The demand for autocollimators is high in semiconductor manufacturing, robotics, and automotive sectors, where precision measurement is essential. The market is also witnessing increasing adoption of compact and automated autocollimators to support next-generation electronics manufacturing and high-end optical systems. Strong investment in R&D and the integration of AI-driven analytics into optical measurement tools further contribute to market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.2% |

Driven byfast-growing semiconductor and electronics industries, South Korea is one of the major markets for autocollimators. The increasingly widespread adoption of high-precision opticalmeasuring instruments and devices in the country is a consequence of the country's emphasis on automation, micro fabrication, and technology. Growth continues to be steady due to the strong presence of global electronics manufacturers along with a push for new advances in metrology, displaytechnology, and photonics. Moreover, the growing government initiatives to enhance industrial automationand smart manufacturing are further accelerating the demand for industrial robotics.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.1% |

As various industries require high-precision optical measurement equipmentfor calibration, alignment, and angle measurement, this has effectively spurred the growth of the autocollimators market. They are essentialin research labs, automotive production, aerospace, and military applications. While the electronic, digital, and visual autocollimators are receiving attention due tohigher demand for non-contact and high-precision measuring systems.

To meetthe requirements of various industries, manufacturers are concentrating on technological improvements such as higher resolution sensors, enhanced digital displays, and automation capabilities. The increasing adoption of electronic and visualautocollimators across diverse industries is driving market growth, while research institutes and high-tech industries trade are using advanced measuring equipment for precision engineering applications.

Electronic & Digital Autocollimators Lead with Superior Accuracy and Automation

In the area of electronic and digital autocollimators there is no competition; with all of the capabilityto measure angles accurately and display the results on a digital readout or use the results directly in a computer-aided measurement system. Used in automated settings like industrial processes and scientific research, these autocollimators provide instantaneous readings, higher accuracy, and lesshuman error.

Electronic autocollimators are commonly used in industries like aerospace,automotive, and optics manufacturing for precision alignment and calibration of machine tools, and optical component testing. Due to their integration with digital control systems and software-driven measurementtools, they have become more efficient and user-friendly in industrial settings.

The technology combined with CCD (Charge-Coupled Device) and CMOS (Complementary Metal-Oxide-Semiconductor) sensorswas a significant improvement in measurement precision and resolution, enabling electronic autocollimators to detect very small angular deviations with improved resolution. Technological shifts towards automated inspection systems and Industry 4.0 charge in greater demandfor digitally enhanced autocollimators with real-time data analysis and wireless connectivity.

Visual autocollimators capture a large market share,especially in manual measurement, laboratory research and optical testing applications. These are eyepiece-based angle measuring devices thatoffer highly accurate angle measurement and can be beneficial for specialized testing methodologies, reducing reliance on electronic systems.

Visual autocollimators are utilized by optical research laboratories, precision optics manufacturers,and mechanical engineering firms for checking alignment, optical flatness, and component inspection. They have low cost and relatively simple touse and durable, making them widely used in industries with no need of automatic data recording.

While there is a clear tilt toward digital alternatives inmany fields, visual autocollimators are still necessary in many traditional and low-tech environments, where simplicity, portability, and ruggedness ensure a reliable high-precision measurement solution.

Research Institutes Rely on Autocollimators for High-Precision Experiments

Some of the largest consumers of autocollimators are research institutes, using them for precise measurement in opticalexperiments, metrology research, and laser alignment studies. Electronic and visual autocollimators provide high-precision optical measurements required by universities, government laboratories aswell as private research centers for sophisticated scientific needs.

The optical products are essential for testing optical components, developing nextgeneration laser products, and calibrating scientific instruments. Demand for high-resolution, automated autocollimators for real-time data acquisition and computational analysis is higher than everdue to growing investment in quantum optics, photonics and space research.

Advancements in nanotechnology and precision engineering are driving research institutes towards the adoption of state-of-the-art autocollimators with ultra-high accuracy and sub-micron resolution, which in turn propelling marketgrowth across the scientists community.

Autocollimatoris majorly used in automotive sector, where it is used for quality control, alignment and calibration of various components. Automotive manufacturers and vendors utilize electronic autocollimators for measuring angular deviations, verifying precisionin robotic assembly lines, and probing optical essentials in the automotive sensor systems.

As the use of autonomous vehicles and ADASsystems grows, so too has the need for high-precision optical devices to perform a calibration, sometimes called an adjustment. This supports the alignment of LIDAR sensors, testing of camera-based vision systems, and verification ofoptical components prevalent in modern cars.

Also, automotive industries have been able to use visual autocollimators for hand inspection and classicoptical testing in particular legacy manufacturing environments and component validation processes. With the growing demands placed by automakers for increasing safety and performance standards, the use of electronic and visual autocollimators in production and testing facilitiesis expanding.

Rising demand fromthe precision engineering, optical metrology, and high-resolution measurement fields is propelling the autocollimators market. Laser-based, digital, and electronic autocollimators are designed for angular measurement accuracyare produced by companies operating in aerospace, defence, automotive, and industrial segments. These developments, including automated alignment systems, real-timecalibration, and miniaturized optics, enhance the competitiveness of the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Duma Optronics | 17-21% |

| Edmund Optics | 12-16% |

| Haag-Streit Group | 10-14% |

| Keaoda | 8-12% |

| Logitech Limited | 7-11% |

| Micro-Radian Instruments | 6-10% |

| Newport Corporation | 5-9% |

| Nikon Metrology | 4-8% |

| Prisms India | 3-7% |

| Shanghai Institute of Optical Instrument | 3-6% |

| Other Manufacturers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Duma Optronics | Develops high-precision electronic and laser autocollimators with automated alignment and real-time measurement capabilities. |

| Edmund Optics | Specializes in optical and digital autocollimators, integrating custom metrology solutions for industrial applications. |

| Haag-Streit Group | Offers high-accuracy optical autocollimators, widely used in laboratory calibration and optical alignment. |

| Keaoda | Produces cost-effective industrial autocollimators, focusing on compact designs and multi-axis measurement. |

| Logitech Limited | Supplies precision metrology solutions, incorporating high-resolution optics for aerospace and defense applications. |

| Micro-Radian Instruments | Develops digital autocollimators, enhancing angular measurement precision for scientific and industrial uses. |

| Newport Corporation | Focuses on automated optical alignment systems, utilizing high-speed digital processing for precision calibration. |

| Nikon Metrology | Innovates in non-contact measurement technologies, ensuring sub-micron accuracy in industrial quality control. |

| Prisms India | Manufactures customized autocollimators, catering to defense, aviation, and research laboratories. |

| Shanghai Institute of Optical Instrument | Leads in research-driven autocollimator development, advancing precision metrology for scientific applications. |

Duma Optronics (17-21%)

Duma Optronics dominates the market by integrating laser technology and real-time data processing into autocollimators for high-precision alignment tasks.

Edmund Optics (12-16%)

Edmund Optics specializes in versatile, high-resolution optical metrology solutions, ensuring precision in industrial and research applications.

Haag-Streit Group (10-14%)

Haag-Streit leads in optical autocollimator development, delivering calibration-grade accuracy for laboratory and manufacturing use.

Keaoda (8-12%)

Keaoda enhances cost-efficient measurement solutions, focusing on compact, easy-to-use autocollimators for industrial setups.

Logitech Limited (7-11%)

Logitech develops high-resolution metrology equipment, ensuring precision calibration for aerospace, defense, and engineering sectors.

Micro-Radian Instruments (6-10%)

Micro-Radian Instruments refines digital autocollimators, introducing automated error correction and AI-enhanced measurement algorithms.

Newport Corporation (5-9%)

Newport Corporation advances high-speed digital autocollimators, supporting automated optical alignment and calibration in high-tech industries.

Nikon Metrology (4-8%)

Nikon Metrology integrates non-contact measurement technologies, ensuring sub-micron accuracy in optical component inspection.

Prisms India (3-7%)

Prisms India customizes precision metrology solutions, serving defense and aviation industries with specialized optical measurement tools.

Shanghai Institute of Optical Instrument (3-6%)

Shanghai Institute of Optical Instrument pioneers scientific-grade autocollimators, improving optical system testing and calibration techniques.

Other Key Players (30-40% Combined)

New entrants and research organizations accelerate miniaturized autocollimators, AI-driven measurement systems, and multi-axis calibration solutions. Emerging players include:

The overall market size for the Autocollimators Market was USD 63.89 Million in 2025.

The Autocollimators Market is expected to reach USD USD 125.69 Million.

The demand is driven by increasing precision measurement needs in aerospace, automotive, and optical industries, advancements in laser-based autocollimators, and rising adoption in research and metrology applications.

The top 5 countries driving market growth are USA., UK, Europe, Japan, and South Korea.

Electronic & Digital segment is expected to lead in the Autocollimators Market.

Catenary Infrastructure Inspection Market Insights - Demand & Forecast 2025 to 2035

Category Management Software Market Analysis - Trends & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Heat Interface Unit Market Analysis - Size, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.