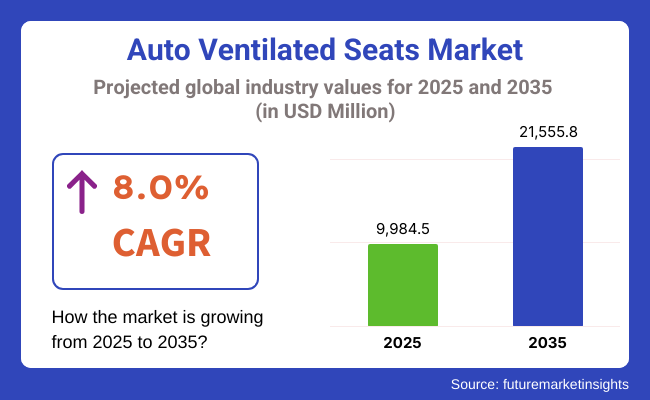

The auto ventilated seats market is poised for significant growth between 2025 and 2035, driven by increasing demand for luxury and comfort features in vehicles, advancements in climate control technologies, and the rising adoption of premium seating systems. The market is projected to expand from USD 9,984.5 million in 2025 to USD 21,555.8 million by 2035, reflecting a CAGR of 8.0% over the forecast period.

Automatic ventilated seats are tech seats that mainly use integrated fans and air channels to handle heat and humidity caused by the passenger. In turn, these air-conditioned seats become a popular feature in high-end and luxury vehicles, mainly due to the demand for them from customers who are looking for ergonomic and climate-controlled seating solutions for better driving experiences.

The main consumers of this market are the developed urbans that increase the standard of living, automobile manufacturers, and companies that are dedicated to the improvement of the standard and personal comfort in vehicles. Companies are now equipping turn seats with advanced vent technology that work on the basis of AI climate control, smart sensors, and automatic adjustments, subsequently, making these seats a distinguishing feature of top-end models and electric cars.

The sale of more electric or luxury cars is a factor for the progress, as is the consumer preferences for a more comfortable driving experience and the innovations in car interior technology consumers find attractive, marketers must highlight. The encouragement from government regulations to integrate ventilated seats in both high-end and affordable models promotes the reduction of cabin temperature and is an indirect measure to improve in-car air quality.

Related innovations include such as automatic temperature adjustment, AI-enabled seat climate shifting, and environmentally friendly, breathable materials, which characterize the next-generation auto ventilated seat market.

North America is a global player in the auto ventilated seat sector; the sustained demand for luxury cars, as well as increasing temperatures in considerable regions, and the automotive industry’s long-lasting growth, are the main drivers of this business. The sale figures indicate that the USA and Canada have begun to adopt ventilated seats more frequently in SUVs, luxury cars, and EVs as users are replacing or augmenting their own climate control with ventilated seats in order to be more comfortable.

The top-of-the-line car manufacturers, including Tesla, Cadillac, Lincoln, and BMW, stand at the forefront of the solid-ventilated seat technology. The first two brands offer the ventilated seats with multi-zone climate control along with the personalized cooling settings, and the AI-based seat ventilation adjustments. Furthermore, the increase in disposable incomes and the strong preference for premium vehicle features are fueling the demand in the region.

The European continent is in the strong market growth stage, with the largest contribution from Germany, France, UK, and Italy, where car manufacturers focus on comfort-enhancing features and the use of sustainable seating materials.

The European luxury car segment, which is led by the likes of Mercedes-Benz, BMW, and Audi, is rapidly adopting the trend of including ventilated seats as standard in high-end models. Furthermore, the offset policies of governments that require eco-friendly goods and weightless materials are the main driving factors behind this innovation referred to in the title. The people living in Southern Europe, where summer extremely hot, usually prefer automatic seat cooling technology, thus promoting the expansion of the market.

Asia-Pacific stands as the quickest-expanding market, with the leaders in such sectors as vehicle production, disposable incomes, and demand for luxury goods being present in China, India, Japan, and South Korea.

China, also the world's largest auto market, is growing quickly because the local population turns toward luxury and electric cars, while the manufacturers stress passenger comfort and high-tech interior solutions. Financial benefits from the government given to support EVs are responsible for manufacturers developing ventilated EV seats that are energy and climate-efficient.

India’s car market, which is one of the most booming ones, and the difficulties urban communities face regarding urban heat, along with the rise in mid- to high-end vehicle sales, are thus, the factors that are augmenting both local and international car brands to integrate ventilated seat technology. Furthermore, Japan and South Korea, which are well-known for their advanced equipment in vehicle interiors, are making progress in smart climate-controlled seating systems.

Developing markets such as Brazil, Mexico, UAE, and South Africa are now adopting vehicular technologies, e.g., ventilated seats, which are enabling them to overcome the challenges faced due to car shortages and climate effects. The Middle East, with its extreme climates, proves to be a strong market for the cooling seat product where, for example, SUV pagani, high-end sedan, and chauffeur-driven cars are applied.

Latin America, where Brazil and Mexico stand out in the visible transition to comfort and satisfied delivered inside the car, would be the market for potential ventilated seat manufacturers. In addition, the automotive sector in Africa is forecasted to operate in the market for a long time due to factors like urban expansion and increasing purchasing power of consumers.

Challenges

High Production & Installation Costs

The auto ventilation segment faces challenges majorly due to the substantial production costs incurred with the most assembly plants needing to use garden hose valves, fan headers, and various parts throughout the closed-loop system. The positive impact of breathable seat covers, smart sensors, and electric ventilation on manufacturing costs actually leads to the situation that ventilated seats are more available in luxury and premium vehicles than in mass-market cars.

Besides cutting-edge technology, automobile manufacturers also contend with the twin problem of producing the goods cheaply while ensuring a two-fold level of durability, comfort, and energy efficiency. In addition, the installation challenges in ventilated seats, particularly in retrofitting applications, lead to the customer incurring costs that are above those which would have occurred had the seats been a standard feature in most vehicles.

Limited Adoption in Entry-Level Vehicles

There is strong demand for ventilated seats, but they are largely a luxury car and premium car thing. because the makers of entry-level and mid-range vehicles are focused more on reducing costs than improving comfort and occupy their own mass market for ventilated seats to become a reality. The biggest challenge is figuring out how to mass-produce them cost-competitively to maintain overall vehicle prices.

Inexpensive ventilated seats could only come if manufacturers start to think out of the box such as by using lightweight cheap materials or energy-efficient cooling mechanisms. Commercial collaborations with automotive manufacturers and developments in low-cost thermoelectric refrigeration or passive ventilation systems might trigger wider usage in more affordable vehicle models without unduly increasing the terms of manufacturing costs.

Power Consumption Concerns in Electric Vehicles (EVs)

Seating ventilation consumes data from a car’s battery, and with how this affects drive distance in electric vehicles (EVs) where efficiency is key to becoming a longer distance vehicle. Seat cooling systems that use a ton of power can drain batteries faster, limiting overall vehicle performance. Some automakers need to think of cooling solutions to maintain comfort while saving power.

Innovations like low-power fans, thermoelectric cooling modules, and AI-powered ventilation control can enhance air movement while minimizing energy use. The use of lightweight materials and energy-efficient seat designs also means manufacturers of electric vehicles will be able to fit ventilated seats without impacting vehicle efficiency. And future solutions may be regenerative power or solar assist to the cooling system.

Opportunities

Integration of AI & Smart Climate Control Systems

The evolution of ventilated seats is moving towards the integration of AI-based smart climate control systems, improving comfort and energy efficiency. These sophisticated systems offer personalized cooling based on real-time monitoring of outside temperatures, occupant counts and body heat levels.

An AI-driven technology can make automatic adjustments in ventilation settings to avoid excessive energy expenditure while ensuring optimal efficiency. Voice-activated climate control, biometric sensors, and predictive temperature adjustments are just a few examples of innovations that further enhance user experience.

Intelligent climate control will be a standard application emerging on next-generation vehicles enabling seamless and energy-efficient comfort. Those manufacturers who leverage AI-powered solutions will take the market by offering dynamic climate control that keeps customers comfortable and protects their equipment.

Expansion into Mid-Range Vehicles & Aftermarket Segments

As production costs come down, expect ventilated seat technology to be available in more mainstream vehicles. With automakers and suppliers honing in on cost-effective solutions, this premium offering is now in reach for a larger majority of consumers. The aftermarket segment is also a high-potential arena, as car owners are increasingly looking to retrofit ventilated seat kits for added comfort.

Those companies that create affordable, simple to install aftermarket products will have a key advantage, particularly in developing markets where the demand for vehicle upgrades is growing. Ventilated seats will become mainstream through mass adoption, thanks to its expansion into mid-range and aftermarket segments.

Sustainable & Eco-Friendly Seat Materials

The automotive sector is pushing towards more sustainable materials for ventilated seats as eco-friendliness is the new narrative. The production of such textiles from renewable and heat-resistant, moisture-wicking materials not only will improve the comfort of passengers on planes but also will minimize the environmental impact. Implementing energy-efficient and sustainable seating solutions, these companies are using plant-based leather, recycled fabrics, and lightweight composites.

These materials improve airflow efficiency and are attractive to eco-minded consumers. Brand loyalty will be built by manufacturers investing in sustainable upholstery and innovative cooling textiles that align with global sustainability trends. The call for green textiles in ventilated seats will further marry comfort with sustainable automotive design.

The auto ventilated seats market saw a huge boom from 2020 to 2024, mainly because consumers actively seek comfort, automotive HVAC systems experienced technological innovations and the number of luxury and premium vehicles rose.

Car manufacturers added the ventilated seating technology into the mid-range and high-end cars to make the ride more enjoyable for the driver. A circular economy was addressed primarily in the field of aerodynamics of air cooling and the use of renewable energy as well as car seats that do not consume energy.

The period from 2025 to 2035 will be dominated by technical revolutions along the lines of AI climate control forms, eco-materials, and interconnection to smart vehicle infrastructure. In the course of the rise of electric and autonomous vehicles, the design of ventilated seats will be affected since energy efficiency and energy consumption will become paramount.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with safety and emission standards for HVAC systems. |

| Technological Advancements | Introduction of multi-zone climate control and thermoelectric seat cooling. |

| Industry-Specific Demand | High adoption in luxury and premium vehicles. |

| Sustainability & Circular Economy | Use of synthetic materials and increased recyclability. |

| Market Growth Drivers | Rising consumer preference for comfort and personalized climate control. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter energy efficiency regulations and sustainability mandates on automotive interiors. |

| Technological Advancements | AI-powered adaptive ventilation, smart fabric integration, and bio-sensing seat climate control. |

| Industry-Specific Demand | Expansion into mid-range, electric, and autonomous vehicles with energy-efficient seat ventilation. |

| Sustainability & Circular Economy | Widespread adoption of biodegradable, eco-friendly seat materials and reduced power consumption. |

| Market Growth Drivers | Integration with smart mobility, electrification, and AI-driven occupant monitoring systems. |

The steady development of the auto ventilated seats market in the United States is primarily attributed to the rising consumer demand for luxury vehicles, the technological advancements in automotive climate control systems, and the growing awareness of in-car comfort solutions. Initially, the ventilated seat technology has been mainly adopted by premium and high-end vehicles, while the trend is now gradually branching out to mid-range and even economy cars.

The strong production rise of electric vehicles (EVs) is also one of the important reasons for the market growth as the ventilated seats are included in the advanced temperature control systems to increase battery efficiency.

The USA automotive industry leading manufacturers and the seat producers are accumulating resources to build smart seating technologies, which integrate AI climate control and personalized comfort features. Moreover, the growth of the autonomous vehicle field is likely to intensify the demand for the ventilated seats as the end-users are looking for more relaxation and comfort in the new means of mobility.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.8% |

The auto ventilated seats market in the UK, is witnessing a stable progress owing to the soaring demand for premium vehicle features, the provision of incentives by the government for EV adoption, and a robust emphasis on sustainable automotive innovations. The British manufacturers are now using the ventilated seating system in mid-range and electric vehicles thereby enhancing passenger comfort and creating unique offerings in a competitive realm.

Amid fluctuating weather and the climate crisis, the demand for ventilated seats is escalating as it enhances a more pleasurable driving experience. This, in tandem with the partnerships formed between car makers and premier seating brands for the creation of energy-saving ventilation systems, has helped the market further grow. The country’s smart mobility strategy and the growth of connected car technologies are also expect to trigger the innovation in climate-controlled seating systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.9% |

The auto ventilated seats market in the European Union is seeing strong growth because of the rising presence of luxury cars, strict emission guidelines that promote energy-efficient solutions, and customer preference for comfort features in vehicles. The major car producers from Germany, France, and Italy are at the forefront of implementing ventilated seat technologies to both internal combustion engine and electric vehicles.

The continent's goal of cutting down on carbon emissions is a major factor driving the implementation of smart climate control solutions. The technology of ventilated seats has a central position in this area.

They help to take the load off the air conditioners and thus improve the whole vehicle's energy efficiency. Additionally, the materials and fabrics used are getting better, which adds to the durability and efficiency of ventilated seating systems, further supporting their market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.0% |

Japan’s auto ventilated seats market is on a steady growth, primarily supported by innovations in smart vehicle technology, the lift in production of electric and hybrid vehicles, and the high customer preference for features that increase comfort. Japanese manufacturers have the lead in the technological incorporation of high-performance ventilation systems which is the case for many premium and mid-range models that now have ventilated seats as a standard inclusion.

Japan's leadership in engineering and automotive research and development is the backbone of developing lightweight and very effective vented seat systems. The switch over to AI climate systems combined with the introduction of real-time climate monitoring has further improved user experience. Moreover, the Japanese ethos of compact and spatially efficient cars is resulting in adjustments in modular and ergonomic seat designs, thus increasing the ventilation in smaller car cabins.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.7% |

The auto ventilated seats market in South Korea is expanding rapidly, owing to the strong demand for high-end and comfort features, the country’s supremacy in EV production, and increased focus on automotive innovation. South Korean automotive manufacturers are making significant strides by integrating ventilated seats into both high-end and mid-range models, thus providing a more affordable advanced climate control solution.

The government's agenda for green mobility initiatives and smart transport systems is also a catalyst in the growth of the ventilated seat technology in electric and hybrid vehicles. The prevailing strengths of South Korea in high-tech materials and artificial intelligence are the prime movers of the innovation in ventilated seating systems further fueling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.1% |

The market for ventilated seats in automobiles is mainly led by luxury cars, which are being outfitted with high-tech seating systems by automakers in order to provide more comfort for their passengers. Luxury car buyers show a great interest in premium functionalities, such as multi-zone climate control, massage seats, and ventilated seating. The escalating rivalry between luxury auto brands to set their products apart is another factor driving the innovation of seat ventilation technologies.

The addition of electric and hybrid luxury cars that install energy-saving ventilation devices is also a sign of alignment with the trend of sustainability. The forecast of economic growth and the rise of consumer preference for tailored in-cabin experiences are the main drivers of the projected demand for ventilated seats in the luxury car segment over the next few years.

The mid-size car sector is not to be left behind, and it has been continuous in the transition to ventilated seats as producers offer such seats to the public on affordable models as a premium feature. The practice of auto manufacturers to include ventilated seating as a standard or optional feature is on the rise in mid-size sedans and SUVs to attract buyers being drawn by the modern technology and extra comfort.

With the proliferation of competition in the sector of mid-size vehicles, brands are taking advantage of the statement differentiation strategy by equipping them with the most modern technological seat ventilation systems which can control the car's climate better and add to the comfort of driving. The demand for mid-size cars furnished with ventilated seats is high especially in areas that face extreme climatic conditions, stressing that passenger comfort has a direct link to improved driving experience.

The ventilated seats market is being well served by the Original Equipment Manufacturers, or OEMs, by fitting factory-installed ventilation systems in additional vehicle models. The auto industry is focusing on more comfortable and luxurious in-car features and as a result, ventilated seats are formed as standard or optional upgrades in different car types.

Alongside, OEMs are also joining forces with the seat makers' realm to come up with the latest ventilation systems that can increase the efficiency of airflow while lowering energy consumption. The instantiation of electric vehicles (EVs) and driverless cars is a further inducement for OEMs to back ventilated seating solutions that provide a sumptuous and complimentary cabin with a proper temperature environment.

The aftermarket section is on the rise as car owners endeavor to change their regular seats to ventilated ones.The high demand for ventilation seats in the aftermarket was fueled by effective awareness campaigns concerning the seat ventilation advantages and the notion that aftermarket suppliers would deliver tailored solutions for an impressively wide array of car models.

Aftermarket ventilated seats find homes in the cars that roam the countries with high heat and humidity, where the introduction of comfort became the key to the paradise of driving.

The innovation in modular seat ventilation kits and plug-and-play solutions make it easier for consumers to implant ventilated seats with the help of such systems, this-backed consumer purchase arguments are persuading the segment growth.

Competitions looking at developments in the auto ventilated seats market are attractive, as the market for vented car seats is getting overheated driven by improved occasions suffered by the passersby due to technological advances in car manufacturing plus an increase in luxury and premium vehicles.

Auto ventilated seats increase the driver's comfort by adjusting the seat temperature, decreasing perspiration, and improving air circulation. These features are chiefly in demand in luxurious vehicles mainly& eventually in middle and in most of the cases in economical cars after the manufacturers' goal to increase user perception.

The adoption of the smart seating systems, such as the ones fitted with temperature sensors in addition to the one which acts as an in-car air conditioning controller, is behind the huge leap of the market.

Furthermore, the environmental aspect witnessed the push towards green and lightweight materials used in the manufacturing of ventilated seats, hence the process of innovation. The atmosphere of competition is shaped by constant and thorough research activities, collaboration, cooperation and opening new production lines by popular companies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Adient plc | 18-22% |

| Lear Corporation | 15-18% |

| Faurecia SE | 10-14% |

| Magna International Inc. | 8-12% |

| Gentherm Incorporated | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Adient plc | Develops high-performance ventilated seats with energy-efficient cooling technologies and advanced ergonomic designs. |

| Lear Corporation | Specializes in smart seat systems with integrated temperature control, focusing on luxury and electric vehicles. |

| Faurecia SE | Offers innovative ventilated seat solutions with lightweight materials and customizable climate settings. |

| Magna International Inc. | Provides advanced seating solutions with enhanced air circulation and comfort-driven designs. |

| Gentherm Incorporated | Focuses on thermal management solutions, integrating active cooling and heating functionalities in ventilated seats. |

Key Company Insights

Adient plc

Adient plc is an automotive seating industry giant offering highly advanced ventilated seats for the best comfort with energy efficiency features. The creative seating solutions provided by the company are aimed at promoting air circulation and therefore they are in high demand in luxury and high-performance cars. The firm devotes considerable resources to research and development with a view to implementing seat systems that are smart and control vehicle climate systems without integration problems.

Moreover, the company's light materials and eco-friendly manufacturing practices bestow it with a competitive edge since they are in line with the industry's transition to green automotive parts. Via collaboration with automakers, Adient is not only consolidating its market share but also making entry into new territories.

Lear Corporation

Lear Corporation deals with the plus seating technologies and it has made its mark by providing ventilated seats that not only cool but also control the seating temperature. The concern of the company about user comfort has led to the creation of intelligent seat systems that control the airflow and cooling intensity according to seat occupier preferences automatically.

Outside of the secondary market of electric and hybrid vehicles, the company is prioritizing designing energy-efficient ventilated seats that work with the battery.

Through its partnership with notable car manufacturers, the company is involved in bringing its products into the premium and mass markets. Demonstrating unwavering commitment to innovating and sustainability, Lear has been made a sought after company within the auto ventilated seat niche.

Faurecia SE

Faurecia SE Is among the most recognized names in the automotive industry. It is commonly referred to as a solution provider for intelligent and light ventilated seating. The company makes use of advanced technology to empower travelers with the independence to control their climate settings.

Faurecia’s ventilated seats incorporate high-quality sensitized materials to create a breathable, and cooling effect. Smart seating equipped with AI-thermostats is one of the newest project ideas Faurecia is venturing in. The company is firmly committed to sustainable practices and continually strives to reduce the environmental impact of its products through recycling and energy-efficient manufacturing processes.

Magna International Inc.

Magna International Inc. has earned a reputation as one of the best manufacturing seating solution companies. The organization has developed state-of-the-art ventilated seats that provide better air circulation in the cabin of the car and make the journey more pleasant for the passengers. The seating systems provided by Magna are more ergonomic and long-lasting, thus are highly preferred by both luxury and general car companies.

The company is in the process of researching and developing smart seat technology that would connect to the in-car network, empowering passengers to make adjustments to their seating climate. Besides, the company is broadening its market outreach by building new production facilities and drawing up joint-ventures with car makers.

Gentherm Incorporated

Gentherm Incorporated is a thermal management specialist providing the latest technology in ventilated seats, including both active cooling and heating. The company's main focus on climate-controlled seating has enabled the creation of new technology to improve temperature regulation and thereby ensure passenger comfort in extreme weather.

Gentherm is a trusted partner of luxury and electric vehicle marketers, offering highly effective and lightweight seat ventilation options. Their commitment to being sustainable has seen them embrace the innovation of developing energy-efficient systems that in turn will minimize overall vehicle electric power consumption even as the performance is retained at the optimal level.

The market is segmented into Economy Cars, Mid-size Cars, and Luxury Cars.

The industry is divided into OEMs and Aftermarket.

The market is categorized into Axial Fan and Radial Fan.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global auto ventilated seats market is projected to reach USD 9,984.5 million by the end of 2025.

The market is anticipated to grow at a CAGR of 8.0% over the forecast period.

By 2035, the auto ventilated seats market is expected to reach USD 21,555.8 million.

The Luxury Cars segment is expected to hold a significant share due to the increasing demand for premium comfort and advanced seating technologies in high-end vehicles.

Key players in the auto ventilated seats market include Adient plc, Lear Corporation, Faurecia SE, Magna International Inc., Toyota Boshoku Corporation, TS TECH Co., Ltd., Gentherm Incorporated, Hyundai Transys, Brose Fahrzeugteile GmbH, and Continental AG.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Fan Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Fan Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Fan Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Fan Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Fan Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Fan Type, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Fan Type, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Fan Type, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Fan Type, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Fan Type, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Fan Type, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Fan Type, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Fan Type, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Fan Type, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Fan Type, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Fan Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Fan Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Fan Type, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Fan Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Fan Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Fan Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 22: Global Market Attractiveness by End User, 2023 to 2033

Figure 23: Global Market Attractiveness by Fan Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Fan Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Fan Type, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Fan Type, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Fan Type, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Fan Type, 2023 to 2033

Figure 45: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 46: North America Market Attractiveness by End User, 2023 to 2033

Figure 47: North America Market Attractiveness by Fan Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Fan Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Fan Type, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Fan Type, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Fan Type, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Fan Type, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Fan Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Fan Type, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Fan Type, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Fan Type, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Fan Type, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Fan Type, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Fan Type, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Fan Type, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Fan Type, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Fan Type, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Fan Type, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Fan Type, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Fan Type, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Fan Type, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Fan Type, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Fan Type, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Fan Type, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Fan Type, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Fan Type, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Fan Type, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Fan Type, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Fan Type, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Fan Type, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Fan Type, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Fan Type, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Fan Type, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Fan Type, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Fan Type, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Fan Type, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Fan Type, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Fan Type, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autonomous Aerial Robot Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automated Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Autoclave Market Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automated Machine Learning Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Autonomous Driving Virtual Simulation Platform Market Forecast and Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA