The Australian Vitamin Premix market is estimated to be worth USD 284.0 million by 2025 and is projected to reach a value of USD 582.0 million by 2035, growing at a CAGR of 7.4% over the assessment period 2025 to 2035

| Metric | Values |

|---|---|

| Industry Size in 2025 | USD 284.0 million |

| Value in 2035 | USD 582.0 million |

| Value-based CAGR from 2025 to 2035 | 7.4% |

Australian vitamin premix industry is the market involved in formulating, producing, and supplying combined vitamin formulations utilized in a wide range of applications, ranging from food and beverages to animal nutrition, pharmaceuticals, and personal care. A vitamin premix is a specially formulated mix of basic vitamins-vitamins A, B complex, C, D, E, and K meant to provide specific nutritional effects.

These premixes are crucial in delivering precise nutrient fortification, product uniformity, and regulatory compliance for nutritional content. The Australian market has both animal and human nutrition segments, with the rising rate of health and wellness products fueling innovation and expansion. The increasing preventive healthcare consciousness and growing customer demand for fortified and functional foods are the key drivers of the market. In animal nutrition, vitamin premixes are crucial for improving livestock health, productivity, and sustainable farming.

The Australian vitamin premix market is characterized by a blend of domestic manufacturers and multinational companies selling specialty products for meeting regional customer specifications, regulation, and climate. The market is also supported by policy regulation of food fortification that requires the supplementation of foods such as cereals, dairy substitutes, and infant foods.

The growing elderly population is also a significant driver, with the elderly seeking products that are fortified with vitamins for bone health, cognition support, and cardiovascular health. This demographic shift demands personalized premixes for dietary supplements and pharmaceutical uses.

Explore FMI!

Book a free demo

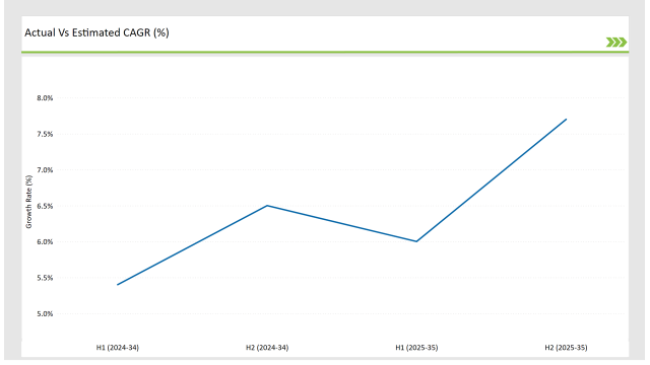

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the Australian Vitamin Premix market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Vitamin Premix sector is predicted to grow at a CAGR of 6.2% during the first half of 2025, increasing to 7.5% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 4.3% in H1 but is expected to rise to 5.6% in H2. This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian spray-dried food industry is subject to continuous changes due to regulatory advancements, changing consumer trends, and advancements in natural ingredient solutions. Such factors condition the market environment, and companies must remain adaptable and responsive.

Companies' awareness of such dynamics enables them to keep pace with regulatory change, address increasing demand for natural and functional products, and capitalize on advancements in spray-drying technology. This continuous evaluation is important in ensuring a competitive advantage and successfully dealing with the intricacies of the Australian spray-dried food industry.

Melrose Health launched the FutureLab brand, consisting of eleven products that address health issues like menopause, male hormone imbalance, sleep disorders, stress, inflammation, cardiovascular health, and cognitive function. The move is indicative of a shift in strategy to treat local health conditions in the Australian vitamin and dietary supplement market.

A number of major companies in the regions are applying functionally improved technologies to improve their production by lowering the cost of production and actively pursuing improvement and enhancement in the functionality of the products.

Custom-Fit Nutrition Revolution in Vitamin Premixes

There is growing consumer demand for customized health solutions in Australia, and therefore premix vitamins are becoming a reality. With improvements in the area of nutritional science and technology, it's now feasible to formulate premixes for people according to their individual health profiles, dietary patterns, and wellness goals. Businesses are using information from genetic testing, lifestyle surveys, and medical check-ups to design unique vitamin blends.

The movement is giving customers the ability to take care of their well-being with exacting specificity, drifting away from general supplements toward pinpointed nourishment. It makes a dent in the industry in that it ensures consumer devotion, provides new doorways to charge a premium price, and triggers partnerships among tech companies and nutritional professionals to design high-brow personalization systems.

Innovative Delivery Methods Boosting Nutrient Absorption

Innovations in distribution systems are increasing the effectiveness of vitamin premixes across Australia. Microencapsulation and nanotechnology are being used to improve vitamin stability and bioavailability. These methods preserve delicate nutrients from deterioration and enable controlled release, resulting in maximum absorption in the body. The consequence is more effective supplementation, which can lead to better health outcomes for customers. An investment in these high-tech delivery methods can help producers differentiate their products in a market that is increasingly demanding scientific substantiation and performance.

The evolution of delivery systems in the Australian vitamin premix industry is revolutionizing the way that nutrients are absorbed and processed by the body. This innovation speaks to the universal problem of the industry: breakdown of vitamins caused by heat, moisture, and stomach acid before they are absorbed. Through enhancing the stability and release pattern of vitamins, these new delivery mechanisms enhance the efficacy of functional food and supplement preparations.

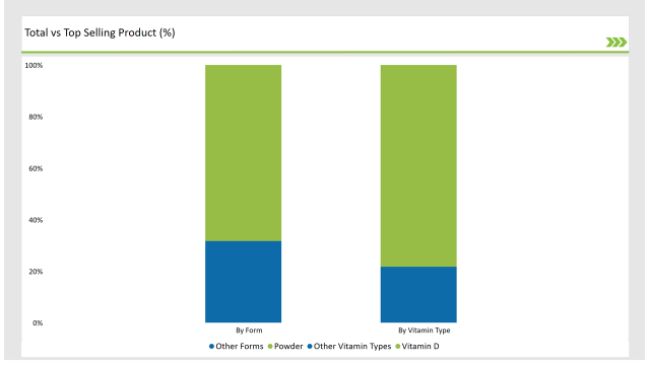

The increasing relevance of the Vitamin D segment of the Australian vitamin premix market is strongly determined by a growing perception of the level of prevalence of Vitamin D deficiency in the population. Despite ample sunshine, changed lifestyle patterns and increased indoor living have resulted in reduced sun exposure, the body's only method of producing Vitamin D. Urban living and high employment of telecommuting means that most Australians are indoors for most of the day, inhibiting their normal production of this essential nutrient.

Australian authorities and public health organizations are supporting Vitamin D supplements because of the observed dangers to human health resulting from its deficiency. Research indicates that low Vitamin D levels result in compromised bone health, immunological dysfunction, and a higher vulnerability to chronic diseases. Such public awareness has encouraged positive public health measures towards Vitamin D consumption, which is further hastening the use of Vitamin D in food fortification schemes..

The powder segment is a rising star in the Australian vitamin premix market because of its high versatility, flexibility in formulation, and capability to address varied industry requirements. Its growth is fueled by its versatility across various applications functional foods and beverages to pharmaceuticals and animal nutrition positioning it as the choice of manufacturers. The powdered form is more stable for storage and transport, with the ability to provide longer shelf life without affecting the strength of vitamins.

This is a very valuable feature in the Australian market, where huge geographical distances between production sites and distribution points require strong and easily transported products. The manufacturing efficiency that comes with powdered vitamin premixes also adds to their market dominance. Manufacturing vitamins in powdered form makes large-scale blending operations more efficient, lowering production costs without compromising quality. This is important in Australia, where increasing operational costs necessitate cost-efficient manufacturing methods.

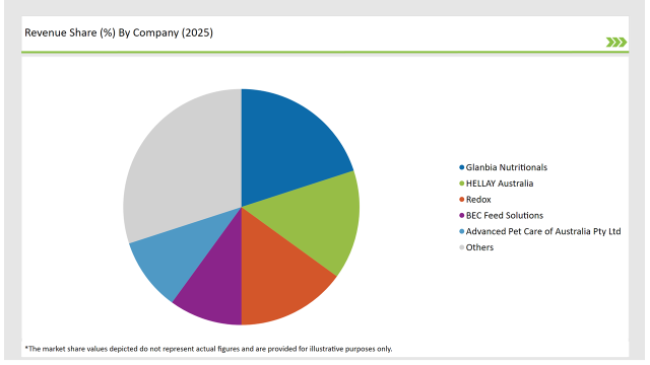

Tier 1 enterprises in Australia's vitamin premix market include global nutritional behemoths as well as seasoned domestic players with a substantial market share due to sophisticated manufacturing capabilities, extensive product ranges, and entrenched supply chains. They employ their capacity to supply high-quality bespoke premixes to a wide range of industries, including food and beverage, pharmaceuticals, and animal nutrition.

Tier 2 players are the most important in the mid-market segment, offering specialized premixes of vitamins and competing on agility and product differentiation. They specialize in niche market needs, such as functional foods, pet food, and fortified dairy, and are quick to react to emerging trends.. This agility allows them to offer tailor-made formulations to meet specific consumer requirements, such as immune system support, cognitive function, or maternal nutrition.

Tier 3 is comprised of smaller, niche firms and boutique manufacturers serving regional markets and particular customer requirements. These firms are generally smaller in scale, providing affordable and adaptable solutions to local companies, such as health food stores and niche wellness brands. Their competitive advantage is their customized service, providing small-batch production and the capacity to quickly prototype new formulations.

2025 Market share of Australian Vitamin Premix manufacturers

By 2025, the Australian Vitamin Premix market is expected to grow at a CAGR of 7.4%.

By 2035, the sales value of the Australian Vitamin Premix industry is expected to reach USD 582.0 million.

Key factors propelling the Australian Vitamin Premix market include Surge in Demand for Specialized Animal Nutrition Premixes for Enhanced Livestock Health, Increasing Collaboration between Manufacturers and Health Experts for Science-Backed Premixes, Increasing Focus on High-Purity Premixes for Pharmaceutical and Medical Applications, and Growing Awareness of Immune Support and Wellness Leading to New Vitamin Applications.

Prominent players in Australia Vitamin Premix manufacturing include Glanbia Nutritionals, HELLAY Australia, Redox, BEC Feed Solutions, National Feed Solutions Pty Ltd., Mitavite, Zagro Australia, Melrose Health, Lipa Pharmaceuticals, Prinova, and Advanced Pet Care of Australia Pty Ltd., among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various vitamin types, such as Vitamin A, Vitamin D, Vitamin K, Vitamin C, Vitamin E, and B-Complex.

The industry includes various forms such as Powder, Liquid, and Granules.

As per the end user segment, the market is segregated into Food Processing Companies,Livestock Feed Manufacturers, Pharmaceutical Companies, and Sports Nutrition Manufacturers .

USA Prenatal Vitamin Supplement Industry Analysis from 2025 to 2035

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Microalgae in Fertilizers Market - Growth & Sustainability Trends 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Potato Flakes Market Analysis Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others End Use Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.