The Australian Starch Derivatives market is estimated to be worth USD 825.0 million by 2025 and is projected to reach a value of USD 1,311.3 million by 2035, growing at a CAGR of 4.7% over the assessment period 2025 to 2035

| Metric | Values |

|---|---|

| Industry Size in 2025 | USD 825.0 million |

| Value in 2035 | USD 1,311.3 million |

| Value-based CAGR from 2025 to 2035 | 4.7% |

The Australian starch derivatives industry is the company responsible for the production, processing, and application of derived starch products obtained from natural origin such as corn, wheat, potato, and tapioca. The derivatives undergo physical, enzymatic, or chemical modifications in order to enhance their function in a manner that they become employable in multiple applications by several industries.

In Australia, the market plays a significant role since it is engaged in food and beverage manufacturing, pharmaceuticals, paper and textiles, and industries. Starch derivatives such as maltodextrins, glucose syrup, modified starches, cyclodextrins, and hydrolysates are significant ingredients utilized in food product development as thickeners, stabilizers, emulsifiers, and sweeteners.

In Australia's largest starch derivative consuming industry, food, they play a critical role in enhancing the texture, shelf life, and sensory characteristics of processed food, beverages, and confectionery. As a reaction to the increased demand for clean-label and functional food, natural and modified starches are increasingly being utilized by manufacturers to stay abreast with changing consumer needs while meeting regulatory requirements.

Besides this, the increasing trend for soya food and gluten-free food has been stimulating demand for non-wheat starch derivatives such as cornstarch and tapioca starch, which presents opportunities for Australian indigenous companies and multinational players in the domestic market.

Explore FMI!

Book a free demo

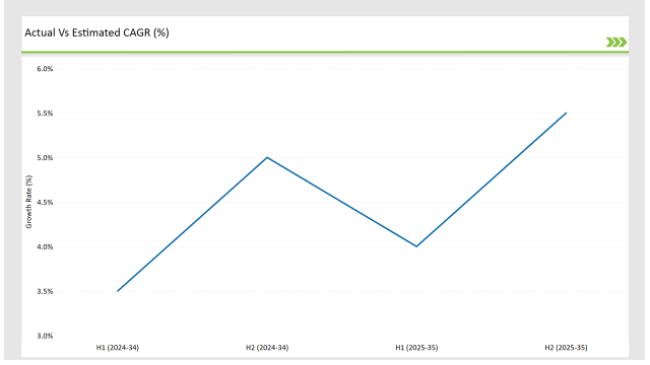

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the Australian Starch Derivatives market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Starch Derivatives sector is predicted to grow at a CAGR of 4.0% during the first half of 2025, increasing to 5.5% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 3.5% in H1 but is expected to rise to 5.0% in H2.

This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian market for starch derivatives is constantly fluctuating due to enhanced natural ingredient formulations, customer preferences, and regulatory adjustments. These changing forces need to be comprehended by companies that need to simplify their strategy, capture new development drivers, and cope with increasing market challenges.

Using a semi-annual projection to examine market trends is invaluable information that enables companies to keep up with regulatory demands, meet consumers seeking functional and clean-label offerings, and remain ahead in an ever-more innovative world.

Bioactive Starch Derivatives: The Rise of Functional Nutrition in Everyday Foods

Australian demand for healthcare products has witnessed growth in bioactive starch derivatives that are more physiologically active compared to conventional nutrition. Modified starches are manufactured with prebiotic effects to promote intestinal and immune health.

Scientists and manufacturers are developing resistant dextrins from starches, which are useful in managing blood sugar and providing digestive health. The market is large because food companies are looking for innovative ways to include starch derivatives into everyday foods including breakfast cereals, meal replacement bars, and milk substitutes. Investing in functional starches will benefit businesses as they coincide with the growing trend of personal nutrition and preventive health control.

In addition, the Australian pharmaceutical activities are included in these starch derivatives in neutrasutic supplements, so the use of food as a medicine. From this view, the competing landscape is expected to change, local producers have been forced to invest in clinical studies confirmed by research.

Nano-Starch Encapsulation: Revolutionizing Flavor, Nutrient, and Active Compound Delivery

With the application of nano-sized starch particles, it is now possible for producers to stabilize sensitive natured vitamins, antioxidants, and flavor compounds against oxidation, degradation, and loss of flavor during storage. The technology is particularly useful in protein shakes, functional waters, and probiotic drinks, where ingredient integrity is a running issue.

Aside from food and drinks, nano-starch encapsulation is also impacting pharmaceuticals and cosmetics, allowing for the controlled release of active ingredients in medicine tablets, topical creams, and even anti-aging skincare. The Australian market is ready for massive growth in this sector as demand for performance-formulations continues to grow across various industries.

One of the groundbreaking applications of starch derivatives is nano-encapsulation, where starch molecules are used as delivery agents for nutrients, active ingredients, and flavor. This new technology is particularly crucial in Australia's sports nutrition and functional drink industries, where controlled-release ingredients are greatly in demand.

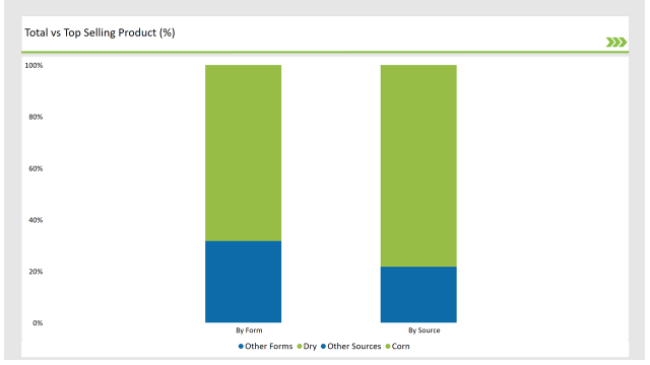

The corn segment leads the market for starch derivatives due to its affordability, versatility, and suitability for a wide range of industries. Corn starches offer better functionality, which is why they are the preferred choice for the food industry, pharmaceuticals, and industrial applications. The ability to deliver consistent texture, stability, and binding functionality renders them a fundamental ingredient in processed foods, drinks, and special industrial applications.

This dominance is supported by their sole ability to be transformed into multiple derivatives such as glucose syrups, maltodextrins, and high-fructose corn syrup (HFCS), which can fulfill evolving customers' and industries' demands. Corn derivatives have a distinctive opportunity to respond to this demand as they are capable of replicating fat and sugar textures to create rich yet wholesome products.

To illustrate, are utilized to enhance the richness and feel in the mouth for dairy-free drinks and low-sugar foods so that there is an even sensory sensation. This has led to food manufacturers opting to use corn derivatives in products primarily because the market is increasing demand for functional and specialty foods.

Dry-form dominates the market for starch derivatives because of its better handling, longer shelf life, and usability with high-level production processes. The dominance of this segment results from its functionality to be harmoniously incorporated in food, drug, and industrial uses without diminishing performance.

Dry starch derivatives provide manufacturers with the versatility of sustaining product quality while maximizing operational efficiency-critical considerations as industries embrace cost-efficient and scalable solutions to keep up with accelerating consumer demands. One of the driving factors behind the expansion of the dry-form segment is stability under storage and transport conditions.

Dry forms possess a longer shelf life and are capable of withstanding several environmental conditions compared to liquid starch derivatives, which are prone to microbial contamination and degradation. It is a highly desirable feature for manufacturers of regional and export products because it ensures uniformity of quality and performance of starch-derived products along the supply chain.

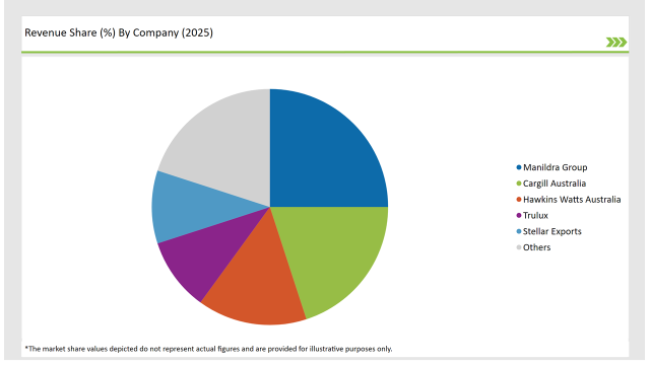

Tier 1 companies in the Australian starch derivatives market are global and domestic giants with advanced manufacturing capabilities, extensive distribution networks, and high R&D investments. They have a strong market presence through product innovation, process innovation, and supply chain integration. Their ability to produce a broad range of specialty starch derivatives-maltodextrins, glucose syrups, and modified starches-makes them key suppliers to food and beverage, pharmaceuticals, and industrial segments.

Tier 2 businesses are mid-sized regional players that specialize in niche market segments and starch applications. These companies are skilled at delivering bespoke solutions that address specific functional requirements such as texture enhancement, binding, and shelf stability improvement. For the Tier 2 companies, production agility and the ability to respond swiftly to customers tend to be the most important elements enabling them to address the changing needs of mid-sized food producers, personal care business, and industrial customers.

Tier 3 players are small producers and start-up companies that specialize in local markets and specialty uses. These companies typically gain market share by providing proprietary product formulation, customized service, and value alternatives to the majors. Through innovation in small-batch production, they can supply artisanal food manufacturers, boutique health firms, and specialty industrial uses.

2025 Market share of Australian Starch Derivatives manufacturers

The Australian starch derivatives market is poised for long-term growth, driven by ongoing innovation and increasing consumer preference for functional and health-focused foodstuffs. This developing market mirrors a rising need for sophisticated starch-based solutions in food, beverage, and pharmaceutical applications, with considerable potential for both incumbent producers and new entrants.

Demand for rapid specific and high value elements increases because consumers learn more about functional use of starch derivatives, especially in relation to food and nutrition trends such as sugar shortage, weight loss and digestive health. In extraction and modification processes, new techniques are expanding the market by helping to produce high quality derivatives that meet the requirements of different industries.

In order to create high performance, application-specific starch derivatives, it presents an attractive challenge for Australian manufacturers to invest in new R&D initiative and top modern treatment methods.

By 2025, the Australian Starch Derivatives market is expected to grow at a CAGR of 4.7%.

By 2035, the sales value of the Australian Starch Derivatives industry is expected to reach USD 1,311.3 million.

Key factors propelling the Australian Starch Derivatives market include Increasing Demand for High-Performance Texturizing Agents, Customization Surge for Specialty Industrial Applications, Rising Demand for Precision-Based Pharmaceutical Excipients, and Innovation in Starch Modification for Complex Formulations.

Prominent players in Australia Starch Derivatives manufacturing include Manildra Group, Cargill Australia, Hawkins Watts Australia, Standard Chemicals International, Corechem Pty Ltd., MP Biomedicals Australasia, Tate & Lyle, Archer Daniels Midland (ADM), Roquette, Trulux, and Stellar Exports, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various product types, such as Modified Starch, Sweeteners, Native Starch, and Cationic Starch.

The industry includes various sources such as Corn, Potato, Wheat, and Cassava.

The industry includes various forms such as Dry and Liquid.

The industry includes various functionalities such as Thickening, Stabilizing, Binding, and Emulsifying.

As per the application segment, the market is segregated into Food & Beverages, Paper & Paperboard, Feed Industry, Pharmaceuticals, and Textiles.

USA Prenatal Vitamin Supplement Industry Analysis from 2025 to 2035

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Microalgae in Fertilizers Market - Growth & Sustainability Trends 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Potato Flakes Market Analysis Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others End Use Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.