The Australian Spray Dried Food market is estimated to be worth USD 1,116.2 million by 2025 and is projected to reach a value of USD 2,229.0 million by 2035, growing at a CAGR of 7.2% over the assessment period 2025 to 2035.

| Metric | Values |

|---|---|

| Industry Size in 2025 | USD 1,116.2 million |

| Value in 2035 | USD 2,229.0 million |

| Value-based CAGR from 2025 to 2035 | 7.2% |

The Australian spray-dried food industry is the manufacture and distribution of food items which are subject to the process of spray-drying a process under which liquid or semi-liquid food is converted into powdered dry form by quickly evaporating the moisture using hot air.

This operation is widely used to preserve the nutritional value, increase shelf life, and maintain the natural flavor and aroma of food ingredients with the advantage of simpler storage, transportation, and use in food products.

Spray drying finds application in a broad range of food products from dairy powders (milk and whey) to fruit and vegetable powders, coffee, flavorings, proteins, and other specialty products. As one of the most technically advanced and developed markets, such advanced processing processes as spray drying are used continually by Australia's food industry for both industrial application and consumer requirements.

The importance of the spray-dried food industry in Australia is three-dimensional, reaching economic, industrial, and consumer levels. Economically, the industry makes a substantial contribution to the food manufacturing industry of Australia, which is one of the country's largest and most important industries.

Spray-dried foods are important in maintaining both domestic consumption and export operations, particularly in the Asia-Pacific region. Australia's image for safe, high-quality, and sustainably sourced food makes its spray-dried food products more competitive in overseas markets.

Explore FMI!

Book a free demo

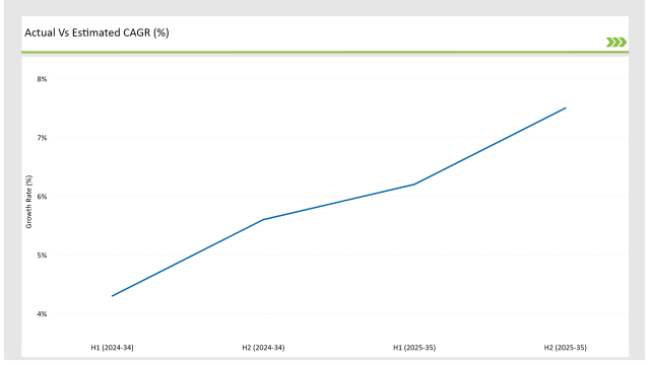

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the Australian Spray Dried Food market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Spray Dried Food sector is predicted to grow at a CAGR of 6.2% during the first half of 2025, increasing to 7.5% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 4.3% in H1 but is expected to rise to 5.6% in H2. This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian spray-dried food industry is subject to continuous changes due to regulatory advancements, changing consumer trends, and advancements in natural ingredient solutions. Such factors condition the market environment, and companies must remain adaptable and responsive.

Companies' awareness of such dynamics enables them to keep pace with regulatory change, address increasing demand for natural and functional products, and capitalize on advancements in spray-drying technology. This continuous evaluation is important in ensuring a competitive advantage and successfully dealing with the intricacies of the Australian spray-dried food industry.

Bellarine Foods leverages its technical knowledge in specific areas to service specialist market sectors such as flavor enhancement, botanical extracts, and functional food powders.Its strength lies in its ability to react to changes in consumer preference and technology rapidly.

The Product Makers (TPM), an Australia-based international flavor company, has been a leader in spray-dried food product innovation. Flavor technology experts, TPM transform products from pilot level to production volumes, delivering quality and innovation along the way. Through investment in cutting-edge facilities, TPM seeks to improve their production efficiency and continue delivering innovative solutions to customers.

Emergence of Freeze-Dried Confectionery: A New Frontier in Snack Innovation

Freeze-dried confectionery growth is transforming the Australian snack food market by offering the consumer a fresh, texturally unique, and intensity-packed substitute for traditional sweets. Propelling this revolution is the technological advancement in freeze-drying technology that allows confectioners to create products with the same flavor and nutritional value as they did when freshly out of the production line and with a crispy, airy texture.

To compare, conventional sweets are usually chewy or heavy, while freeze-dried items make a crunching sound, generating more sensory stimulation and inviting bold consumers who desire new pleasures. These consist of freeze-dried gummies, chocolate-coated fruits, and marshmallows, which retain strong flavors and possess a longer shelf life without the addition of preservatives.

Increased demand for freeze-dried confectionery also results from increasing consumer interest in "better-for-you" snacks. The process retains vital vitamins and natural taste essences of fruit, an improved alternative to the sugar-heavy kind.

Integration of Advanced Spray Drying Technologies: Enhancing Efficiency and Product Quality

Technological innovation leads the Australian spray-dried food industry, with manufacturers spending in cutting-edge spray drying equipment to enhance efficiency and product quality. The demand for plant-based diets has prompted Australian manufacturers to produce spray-dried plant-based foods, such as protein powders and plant-based milk alternatives.

This is consistent with the world trend of increasing consumption of plant-based foods, driven by health concerns and environmental sustainability. The use of technology can be likened to cost reduction, reduced energy needs, and the ability to satisfy stringent food safety standards.In addition, expanded manufacturing capability can enable Australian businesses to compete in local and international markets, enhancing export prospects and business expansion.

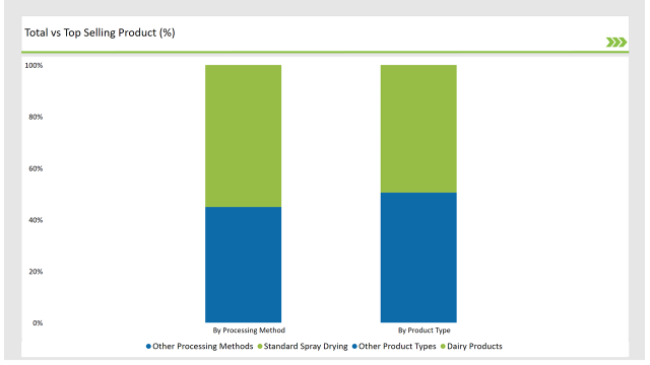

The spray-dried food market is led by the dairy products segment with its versatility, technology, and increasing demand for value-added dairy solutions. Spray-dried dairy foods, including milk powders, whey protein, and specialty dairy ingredients, are significant in many industries infant nutrition and sports supplements, bakery and confectionery.

This dominance is spurred by the ability of spray drying to maintain dairy nutritious value, extend shelf life, lower transportation expense, and improve product performance. The demand for specialty milk products is one of the most driving forces for this leadership. Consumers are searching for products specifically engineered to meet their nutritional needs, e.g., high-protein or lactose-free. Spray drying allows companies to produce customized dairy powders that are specifically formulated to provide specific health effects, e.g., muscle recovery and gut health.

The traditional spray drying segment dominates the market because it can offer uniform, scalable, and flexible solutions for various industries.

The process of transforming liquid food products into dry powders has been a favorite among food companies owing to its effectiveness in retaining product characteristics while maintaining long-term stability. Its supremacy, however, stems not merely from its technological solidity but from the ability of standard spray drying to accommodate full-scale production yet comply with changing requirements of new-generation food systems.

This diversity and effectiveness put it at the center as the foremost option both for established brand companies and startups alike in Australian spray-dried food. The process enables manufacturers to generate large quantities of spray-dried powders with little waste, offering an economical means of addressing increasing consumer demand.

The efficiency is especially critical in industries such as dairy, functional foods, and beverage powders, where high-volume production is necessary to ensure market competitiveness. Owing to its capacity for condensed production that doesn't dilute the ingredients' taste, odor, or nutrients, mass-market product provision can be supported with standard spray drying without compromise to quality.

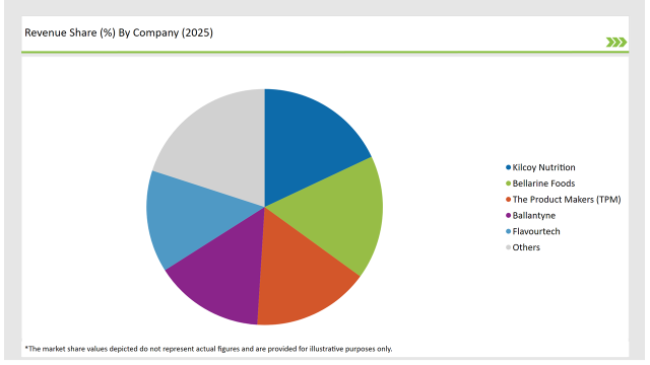

Tier 1 players in the Australian spray-dried food industry are mass-scale producers with large production capacity, high-end technology integration, and high market impact. The market leaders such as Kilcoy Nutrition and Ballantyne control the market with their broad product range and high investment in research and development. They have the capacity to produce on a large scale without compromising on the quality of products, thus they can serve domestic as well as international markets.

Tier 2 firms are in a significant position in the Australian spray-dried food sector by having a balance of strong production capacity along with the capability to provide personalized solutions. The Product Makers (TPM) and Bellarine Foods leverage their technical expertise in specialty areas to underpin specialized market segments such as flavor enhancement, botanical extracts, and functional food powders. Their strength is their ability to adapt rapidly in response to shifts in consumer preferences and technical innovation.

Tier 3 firms are small, specialized firms that specialize in offering distinctive spray-dried items and customized service in the Australian market. Such firms, both regional producers and new startups, tend to have expertise in limited-production, bespoke formulations for selected consumer groups. Their ability to quickly adapt to market changes makes them try innovative ingredients and manufacturing methods, for example, microencapsulation of sensitive bioactives or natural and organic lines.

2025 Market share of Australian Spray Dried Food manufacturers

By 2025, the Australian Spray Dried Food market is expected to grow at a CAGR of 7.2%.

By 2035, the sales value of the Australian Spray Dried Food industry is expected to reach USD 2,229.0 million.

Key factors propelling the Australian Spray Dried Food market include Rising Demand for Specialty Dairy Powders in Functional Foods, Technological Advancements in Microencapsulation Techniques, Growth in Customized Flavor Solutions for Food and Beverage Industries, and Rising Demand for Convenient and Ready-to-Use Spray-Dried Ingredients.

Prominent players in Australia Spray Dried Food manufacturing include Kilcoy Nutrition, Nestlé S.A., Ajinomoto Co., Inc., Prinova, Döhler GmbH, Spraying Systems Co., Kerry Group, International Flavors & Fragrances, Symrise AG, Sensient Technologies Corporation, Bellarine Foods, The Product Makers (TPM), Ballantyne, and Flavourtech, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various product types, such as Dairy Products, Fruits & Vegetables, Beverages, Meat & Seafood, and Others.

The industry includes various processing method such as Standard, Agglomerated, and Agglomerated.

As per the end-use application segment, the market is segregated into Food Processing, Retail/Direct Consumption, Food Service Industry, and Nutritional Supplements.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.