The Australia Sports Nutrition market is estimated to be worth USD 145.5 million by 2025 and is projected to reach a value of USD 666.5 million by 2035, growing at a CAGR of 16.4% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size (2025) | USD 145.5 million |

| Projected Australia Industry Value (2035) | USD 666.5 million |

| Value-based CAGR (2025 to 2035) | 16.4% |

The sports nutrition market in Australia describes the portion that deals with food, beverages, and dietary supplements designed to improve athletic performances, recovery, and general health.

It includes items such as protein powders, amino acids, energy bars, pre-workout and post-workout drinks, and hydration products developed for particular activities or needs. Sports participation, fitness culture, and awareness of health benefits are increasing in Australia, and the demand for sports nutrition has been expanding over the years.

There is a significant sport-oriented culture in Australia, where more people engage in exercise to either further professional sports careers or for mere enjoyment and well-being. There has been an upsurge of interest in particular health benefits that people may require, including increased muscle, control of body weight, and enhancing endurance.

Due to these requirements, the nutritional aspect of sports has been absorbed into daily athletes' or sporty persons' lifestyles as well as to healthy individuals looking for improvement.

Explore FMI!

Book a free demo

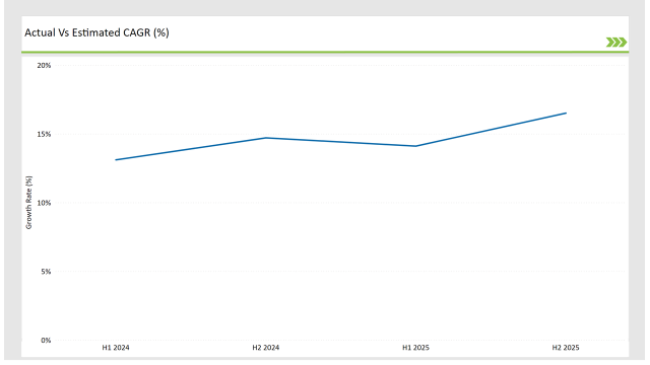

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Sports Nutrition market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Sports Nutrition sector is predicted to grow at a CAGR of 14.1% during the first half of 2025, increasing to 16.5% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 13.1% in H1 but is expected to rise to 14.7% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

These statistics underscore a fast-changed and rapidly evolving scenario of the Australian Sports Nutrition market, driven by factors such as regulatory changes, ever-changing consumer preferences, and the increasing trends of natural ingredient formulations.

This bi-annual report is crucial for those wanting to improve their strategy for optimizing an expected growth in the market while simultaneously navigating against the challenges arising from a constantly changing dynamics of the market.

| Date | Development/M&A Activity & Details |

|---|---|

| December 2023 | NxGen Brands, Inc. has signed a license deal with an Australian nutritional supplement distributor. This collaboration allows NxGen to license its goods, with considerable royalties expected through 2024 and beyond as the distributor distributes them in Australia and New Zealand. |

| 2024 | Herbalife has formed relationships with Australian sports teams to strengthen its position in the sports nutrition sector. Herbalife24®, the company's sports nutrition product, is a complete performance nutrition program that supports athletes around the clock. This seven-product range is customisable, allowing people to adapt their nutrition based on their activity level and training needs. |

Surge in Plant-Based Sports Nutrition Products

As the incidences of plant-based diets in Australia have increased, so has the demand for plant-based sports nutrition products. Consumers are moving away from animal-derived traditional supplements such as whey protein, opting for pea protein, brown rice, hemp, and all the other plant-based options.

This is not only due to ethical and health concerns but also because of the growing interest in managing chronic health conditions, such as inflammation, while maintaining athletic performance. This trend will consequently impact the market in Australia because it would fuel innovation within a high-quality line of sports nutrition products produced through plant derivation.

Manufacturers need to improve on their bioavailability and texture along with taste when handling plant-based proteins to better equate their use with those associated with animals. The call for plant-based proteins in formats of protein powder, bars, as well as RTD drinks should drive innovation while possibly nudging traditional players towards diversifying portfolios.

Personalized Nutrition and Customization in Sports Supplements

Personalized nutrition is also becoming a growing aspect in Australia's sports nutrition business because of the rise in availability of health and fitness data through wearable technologies, fitness apps, and genetic testing. Customers want to have supplements personalized to their needs, especially those that relate to their specific fitness goals, body composition, or even genetic predispositions.

The robust fitness culture inside Australia converges with the growing consumer trend for personalized wellness solutions. It can include a unique blend of protein customized packs, customized vitamin, or supplements as aligned with recovery cycle for every individual.

Apart from the current rise in unique individualized products, it provides the companies a rich source of gathering data related to the consumer for further developing product innovations.

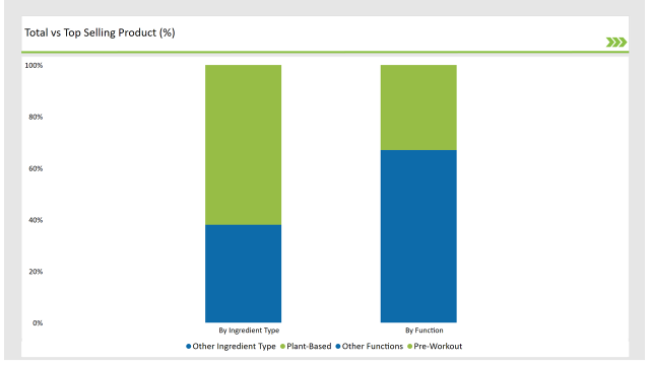

% share of Individual categories by Ingredient Type and Function in 2025

The pre-workout segment has become the market leader in Australia's sports nutrition market, given growing consumer demand for better performance from any workout and faster results. Fitness and high-intensity training regimens are hot trends in Australia, and a higher rate of supplements is sought that can immediately provide energy, enhance endurance, and improve mental concentration.

This cocktail of caffeine, amino acids, and other stimulants has become a favorite among athletes, gym-goers, and fitness enthusiasts interested in maximizing the results of their exercises.

The more individuals subject themselves to their high-intensity, time-efficient workout routines, the more they need replenishment in terms of quick energy, focus enhancement, and thus demand for pre-workout supplements. Performance enhancement products are for the needs of those requiring this for maximum effort in a short workout period.

This has cemented the plant-based ingredients segment in the sports nutrition space as the leader in the Australian market, representing a wider trend toward plant-based diets in all industries.

More and more consumers in Australia are seeking out plant-based options - from protein powders to energy bars - in response to the growing recognition of the health and performance benefits associated with plant-based nutrition.

With increasing shift away from a traditional source of animal protein, there are increasingly ethical considerations and amazing functional benefits of plant-based options, so quite appealing for fitness-conscious individuals or even the recreational athlete.

There are more clean options with the plant-based protein, which adds more benefits over animal proteins-higher fiber, lower fat, and fewer allergens. Plant-based protein powders, ready-to-drink beverages, and pre-workout formulas are experiencing increasing popularity with consumer interest for the performance that it can give.

Note: The above chart is indicative in nature

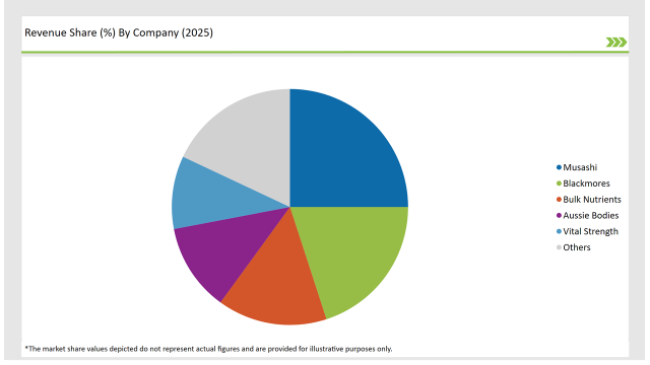

Tier 1 players in the Australian sports nutrition market are majorly the established international and local companies that possess comprehensive portfolios of products, have strong distribution channels, and robust brand power. Optimum Nutrition (Glanbia), Herbalife, and MuscleTech are some of the market leaders for this category.

These companies can innovate and offer premium products catering to sports enthusiasts, athletes, and wellness-focused consumers. They can fund the best cutting-edge research and advanced formulations besides aggressive marketing, which increases their grip even more.

Tier 2 growing brands are growing brands that acquire growth in the Australian sports nutrition market through strategic activities and niche propositions. Many companies, for instance, specialize in plant-based nutrition, women-only products, or performance-boosting formulation.

Tier 3 brands and startups comprise small, local brands and operate on a much smaller scale compared to the former. They service very niche, localized consumer demand. Companies will usually operate in niche areas with offerings such as organic, ketogenic, or allergen-free. Examples of these types of brands include Aussie Bodies and Raw Medicine, which tap into the local knowledge of the preferences of their consumers.

By 2025, the Australia Sports Nutrition market is expected to grow at a CAGR of 16.4%

By 2035, the sales value of the Australia Sports Nutrition industry is expected to reach USD 666.5 million.

Key factors propelling the Australia Sports Nutrition market include innovations in functional and performance ingredients, expansion of fitness communities and active lifestyles, innovations in flavors, and rising popularity of high-intensity training.

Prominent players in Australia Sports Nutrition manufacturing include Musashi, Blackmores, Bulk Nutrients, Aussie Bodies, Herbalife Nutrition Ltd., NxGen Brands, Inc., Nestlé Health Science, Glanbia plc, MusclePharm Corporation, Dymatize Nutrition, and Vital Strength, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

As per product form, the market is segmented into ready-to-drink, energy & protein bar, powder, and tablets/capsules.

As per ingredient type, the market is segmented into plant-based, and animal-based.

As per function segment, the market is bifurcated into energizing products, rehydration, pre-workout, recovery and weight management.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Food Grade Lubricant Market Analysis by Base Oil Type, Product Type and Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.