The Australian Sports Drink market is estimated to be worth USD 1,084.1 million by 2025 and is projected to reach a value of USD 1,833.3 million by 2035, growing at a CAGR of 5.4% over the assessment period 2025 to 2035.

| Metric | Values |

|---|---|

| Industry Size in 2025 | USD 1,084.1 million |

| Value in 2035 | USD 1,833.3 million |

| Value-based CAGR from 2025 to 2035 | 5.4% |

Australian sport beverage market consists of beverages to rehydrate, replenish electrolytes, and provide energy during or after exercise. Beverages typically contain water, sugars (carbohydrates), and significant electrolytes like sodium, potassium, and magnesium. The primary function is to replace the lost fluid through sweat and accumulate energy for extensive or strenuous exercise.

In Australia, the sports drinks category is a core part of the market for functional beverages, appealing to athletes, sports participants, and increasingly, the mass consumer seeking hydration and health. The category is propelled by increasing health awareness, increasing sporting and fitness participation, and global and local brand innovative products.

Australian sports drinks are generally categorized into isotonic, hypotonic, and hypertonic types. Isotonic drinks, with similar salt and sugar content to that of the human body, also occupy the market due to their balanced hydration and energy replenishment properties.

Hypotonic drinks offer faster hydration with less sugars, and hypertonic varieties for post-exercise recovery through their added carbohydrate supply. Sports drinks to most Australians represent an easy way to stay body-hydrated and keep their electrolytes in balance, especially in an environment where summers are warm.

Additionally, due to increased consumers' health consciousness, the direction is currently shifting towards low-sugar, natural, and functional ones that coincide with broader dietary habits. As counteraction to that, companies introduced vitamin, mineral, and plant-sourced ingredients-contained sports beverages in response to changing consumer preferences.

Explore FMI!

Book a free demo

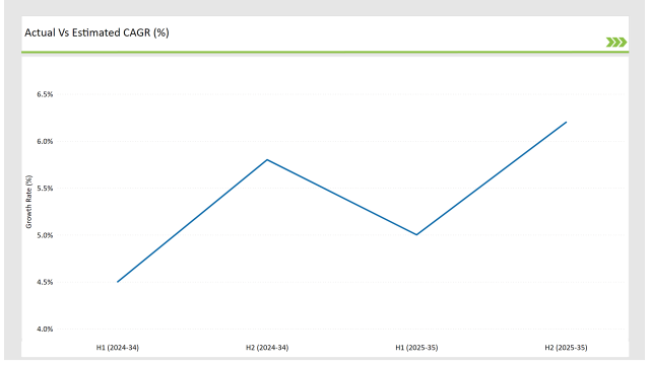

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the Australian Sports Drink market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Sports Drink sector is predicted to grow at a CAGR of 5.0% during the first half of 2025, increasing to 6.2% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 4.5% in H1 but is expected to rise to 5.8% in H2.

This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian sports drink industry is constantly evolving, fueled by changing customer demand, regulatory changes, and technological developments in natural ingredient compositions. Monitoring these shifts through bi-annual analysis is essential for companies seeking to enhance their strategy, take advantage of new opportunities, and manage market issues.

With increasing demand for functional and health-oriented drinks, staying abreast of industry dynamics enables companies to evolve, innovate, and retain a competitive edge while meeting customer demands.

| Date | Development/M&A Activity & Details |

|---|---|

| October 2024 | Posca Hydrate debuted at the 2024 C&I Expo with Australia's first sugar-free sparkling hypertonic beverage. The new formulation, inspired by an ancient Roman drink, enhances hydration by combining red wine vinegar and four electrolytes. Posca Hydrate, in grape, yuzu (citrus), and pineapple flavors, aims to offer consumers who care about their health and need to stay hydrated a healthier option than standard sports drinks. |

| July 2024 | Adelaide-based start-up PREPD Hydration made headlines following an invitation to the exclusive Camp Strava event in the USA as the only Australian brand included. Famous for its hydration aids that increase the absorption of fluid, PREPD added 'Advantage+' to its range specifically for active families and 'SAFETY' for employees under stressful conditions. The business is actively looking for investors to develop further and extend its reach into the hydration industry. |

Electrolyte Evolution: Beyond Traditional Hydration

Over the last few years, consumer consciousness around hydration has taken a dramatic leap forward, with an increase in the popularity of electrolyte-enhanced drinks. While they have always been traditionally positioned for sportsmen and women, they are increasingly being popular among the general public. According to one of these surveys, 73% of Australians do not consume the necessary amount of fluids each day, which has led to a shift in favor of electrolyte drinks as a potent hydration choice.

This is about attaining general well-being, not just about following the latest fad for staying hydrated. Additionally, electrolytes are required for fluid balance, muscle contraction, and blood pressure. Australia's warm climate also enhances the demand for premium hydration products.

Companies are responding by designing products with low added sugar and natural ingredients that appeal to customers concerned about their well-being. The trend implies that functional beverages are increasingly accepted and integrated into mainstream life outside sports purposes for general health.

Integration of Advanced Hydration Technologies

The Australian market is seeing the adoption of sophisticated hydration technologies in sport drinks. Players are looking for formulations that allow better absorption and retention of fluid, using science to create better beverages that will provide better hydration. This ranges from the implementation of certain carbohydrate-electrolyte solutions specifically designed to provide optimal hydration of the body in strenuous activity.

These technologies are most relevant to sport persons and participants in high-intensity exercise, as they provide hydration assistance needed to maintain performance and recovery. This emphasis on science-based hydration beverages reflects an approach to addressing the unique demands of customers seeking functional advantages in beverages.

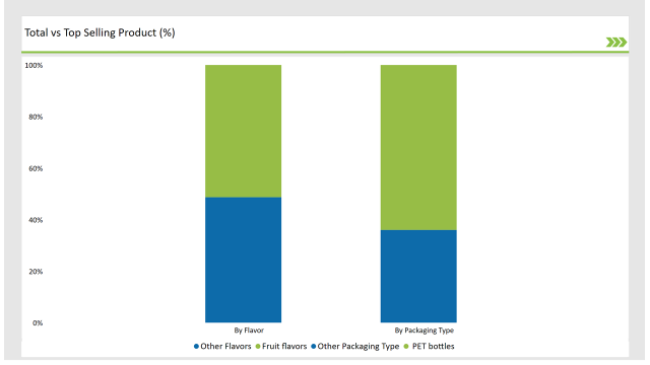

Sport drinks market is being increasingly tilted towards packaging that is strong, dynamic, and involving the consumer in some manner as evident through increased movement toward PET (Polyethylene Terephthalate) bottles. The PET bottles enjoy popularity as a result of its strength, lighter weight, and product integrity upholding nature-particularly suitable in hectic lives.

This package configuration dominates the Australian sports drink market because it not only enhances brand image and product availability but also provides for the specific needs of retailers and consumers. The durability and portability of PET bottles are two important factors that are driving their growth. Sports beverages are consumed by many during exercise at the gym, sporting activities outdoors, and during endurance racing activities.

PET bottles are a strong packaging material that is capable of resisting movement and impact without shattering. The strength provides the consumer with the ability to carry beverages without leakage or damage, hence the suitability of PET bottles for use in on-the-go consumption. In addition, they are light, hence easy to move when being carried in bulk quantities, thus lowered logistics costs for manufacturers and improved delivery convenience in urban and rural areas.

Increased demand for fruit flavors in the Australian sports drink market is a testament to high consumer demand for refreshing, comforting, and functional drinks that enhance taste and performance. The category is expanding as consumers increasingly look for flavorful hydration products that complement their active lifestyle and deliver key nutrients.

Fruit flavors in sports drinks appeal to a wide consumer base as they provide a refreshing drinking experience when combined with the functional aspect of electrolyte replacement and energy restoration.

Familiarity and liking through senses are one of the key factors for growing fruit flavors, since consumers would obviously be drawn towards what is known and reliable, and fruit flavors provide them with a reassuring, refreshing feeling that adds to the experience of drinking.

Among the most popular flavors are citrus mixes, berry blends, and tropical fruits, which appeal to a wide range of palates and offer a naturally sweet and pleasant drinking experience. Because it encourages frequent intake during and after physical exercise, this sensory appeal is particularly pertinent for physically active persons who require beverages that not only fulfill their thirst but also have a pleasing flavor.

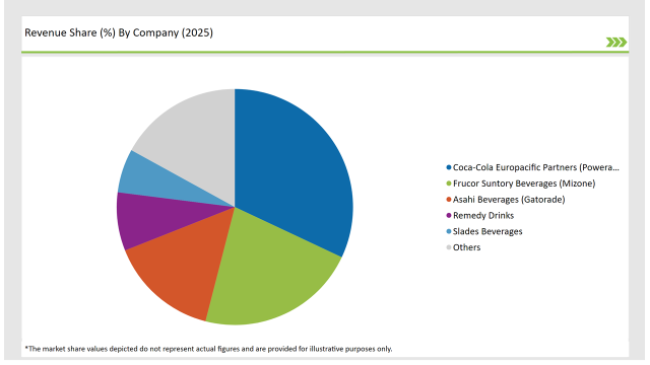

Tier 1 players in the Australia market is dominated by global and domestic players with strong distribution networks, wide market coverage, and deep consumer awareness. Brands of these well-established companies have extensive reach due to their massive shelf space positions in supermarkets, convenience stores, and online channels. Tier 1 players with a large marketing budget invest heavily in activities of building the brand that enable them to hold their market leadership, for example, endorsing sporting legends, sporting events, and sponsored commercials.

Tier 2 is composed of small-to-medium-sized firms and newer brands that establish unique positions through product innovation and niches. They will usually target specialist consumer groups like endurance sportspeople, health-conscious shoppers, or functional benefit-seeking consumers and not merely hydration. They will also experiment with off-trade routes, like specialist health stores and DTC sites, in the hope of achieving a loyal set of consumers.

Tier 3 consists of smaller, standalone brands and regional manufacturers serving localized tastes and developing consumer needs. These have limited geographic reach or product categories, selling craft, artisanal-style sports drinks or creative formulations suited for local taste buds. Their business model is based on authenticity, transparency, and community, targeting consumers who desire a departure from mass-market choices.

2025 Market share of Australian Sports Drink manufacturers

By 2025, the Australian Sports Drink market is expected to grow at a CAGR of 5.4%.

By 2035, the sales value of the Australian Sports Drink industry is expected to reach USD 1,833.3 million.

Key factors propelling the Australian Sports Drink market include Leveraging Social Media to Shape Consumer Choices, Rising Interest in Plant-Based and Natural Additives, Consumer Demand for Bold and Unique Tastes, and Increasing Demand for Portable and Single-Serve Formats.

Prominent players in Australia Sports Drink manufacturing include Coca-Cola Europacific Partners, (Powerade), Frucor Suntory Beverages (Mizone), Asahi Beverages (Gatorade), PREPD Hydration, Posca Hydrate, Remedy Drinks, Garage Beverages Manufacturing PTY LTD, JOE'S SUPPS PTY LTD, Sqwincher, Nestlé S.A., Frucor Suntory, Slades Beverages, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various product types, such as Regular sports drinks, Low-calorie sports drinks, and Natural/Organic sports drinks.

The industry includes various flavors such as Fruit flavors, Berry, Citrus, Tropical, and Others.

The industry includes various packaging types such as PET bottles, Cans, Tetra-Pack, and Others.

As per the Distribution Channel segment, the market is segregated into Convenience Stores, Online Retail, Supermarkets/Hypermarkets, Specialty Sports Stores, and Gas Stations.

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Microalgae in Fertilizers Market - Growth & Sustainability Trends 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Potato Flakes Market Analysis Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others End Use Application Through 2035

A detailed analysis of the Australian Vitamin Premix industry and growth outlook covering vitamin type, form, and end user segment

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.