The Australia Sourdough market is estimated to be worth USD 14.3 million by 2025 and is projected to reach a value of USD 26.2 million by 2035, growing at a CAGR of 6.3% over the assessment period 2025 to 2035

| Metric | Values |

|---|---|

| Industry Size (2025) | USD 14.3 million |

| Industry Value (2035) | USD 26.2 million |

| Value-based CAGR from (2025 to 2035) | 6.3% |

The Australia sourdough market is comprised of the production, distribution, and consumption of sourdough bread and other products made using a natural fermentation process with wild yeast and lactic acid bacteria.

It consists of artisanal bakeries, commercial manufacturers, and packaged sourdough bread sold in supermarkets and specialty stores. The increasing popularity in the sourdough market of Australia is associated with its awareness among increasingly health-conscious consumers and food enthusiasts.

Consumers enjoy the tangy flavor, chewy texture, and perceived health benefits that include easier digestibility and a lower glycemic index from sourdough compared to conventional bread. The rising awareness of gut health and fermentation also coincides with consumer interest in sourdough.

Artisan bakeries lead the market for sourdough in Australia, which tends to associate this bread with superior quality and mastery. Large producers, on the other hand, continue to enlarge their portfolios with offerings for more mass-market customers.

Sourdough has been taken up more as a cross-cutting category within the foodservice sector-including cafes and restaurants. Market developments mirror greater shifts in Australian baking, centered on innovation, healthy products, and cultural pride in traditional and artisanal breads.

Explore FMI!

Book a free demo

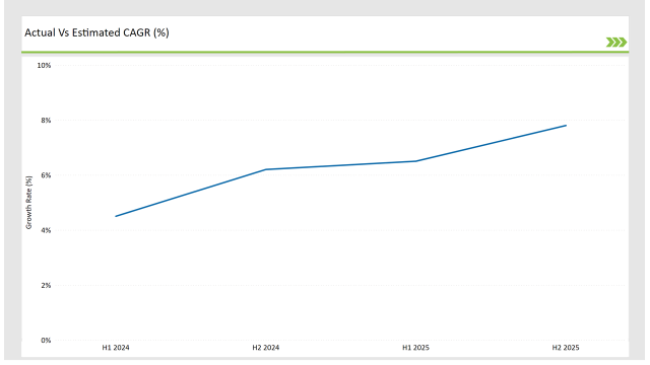

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Sourdough market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Sourdough sector is predicted to grow at a CAGR of 6.5% during the first half of 2025, increasing to 7.8% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 4.5% in H1 but is expected to rise to 6.2% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

This brings to light the dynamic and continuously evolving nature of the Australian Sourdough market, which changes according to shifts in consumer preferences, formulation technologies, and other regulatory changes.

Business houses will require periodic understandings of such trends to enable the effective modification of strategies in the pursuit of innovation and a market growth trend. This is one of the tools that is quite useful in managing the market with all its intricacies, being ahead of competition.

| Date | Development/M&A Activity & Details |

|---|---|

| October 2024 | Port Adelaide's Mayfair Bakery, run by Phil Donnelly, will double its production of gluten-free baked cheesecakes. The bakery has secured contracts to supply the desserts to correctional facilities, oil rigs, and a USA Air Force facility in the Northern Territory. The cheesecakes are also now available in Northern Territory supermarkets following a successful launch in South Australian stores. This expansion reflects the innovative approach of the bakery to product development and distribution. |

| February 2022 | Puratos unveiled a series of living sourdoughs made in Melbourne with Australian-grown flours from farmers that implement regenerative agriculture. Each sourdough has its distinct flavor profile and is nutrient-dense. Wheat and wholemeal rye flours used are single-origin, and so consumers can know their sources while appreciating the positive impact on local farming communities. |

Artisanal Renaissance: The Rise of Craft Sourdough

The Australian sourdough market is witnessing an increase in the demand for artisanal and craft-baked sourdough from consumers. The cultural shift of valuing quality over quantity drives this trend as consumers seek out handmade, small-batch products that emphasize tradition and skill.

Artisan bakeries across the country are booming, offering a variety of sourdough breads with native grains, seeds, herbs, and spices to reflect local flavors and heritage. This trend incites demand for higher-priced sourdough and introduces innovation to recipes, but it also advances regional diversity further. Local bakeries capitalize on this trend with workshops and tasting that allow customers to experience offerings

Fusion Flavors: Global Influences in Sourdough Recipes

Sourdough bread in Australia is increasingly taking on global flavors, offering the consumer a flavor profile that resonates with multicultural consumers. Miso, seaweed, kimchi, and turmeric are some of the ingredients bakers are experimenting with to create varieties of sourdough that suit the diverse tastes of Australian consumers.

These fusion flavors reflect the vibrant food culture of Australia and its openness to global trends. This shift opens up sourdough bread to a larger market share with adventurous eaters and food enthusiasts.

With distinct flavors, this will be attractive to the youth who prefer newer and more exciting things in the food they buy. This increases the usage of sourdough within the household as well as within foodservice applications.

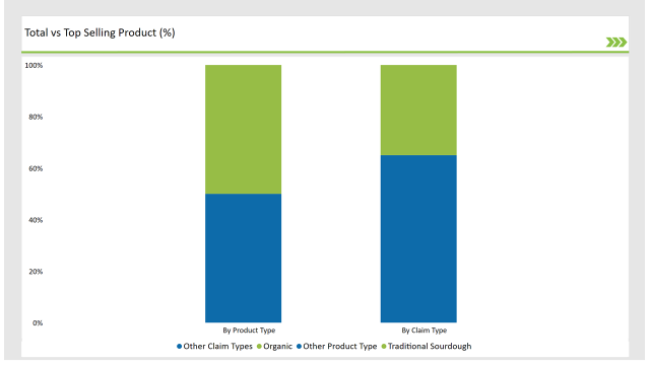

% share of Individual categories by Product Type and Claim Type in 2025

Traditional sourdough holds a significant lead in the Australian market because it taps into consumers' desire for authenticity, craftsmanship, and health. Sourdough differs from new-fangled varieties in that it uses a slower fermentation process based on natural wild yeast and bacteria that ferment it; this contributes significantly to the flavors, texture, and nutrition found in this traditional bread.

Consumers in Australia really connect with these heritage baking traditions and appreciate the sensory experience in consuming this form of traditional sourdough bread. The popularity of old-fashioned sourdough creates demand in the market for it as a way to prefer the proven methods of preparation over the industrialized products. Consumers enjoy its tangy flavor, chewy crust, and airy crumb, seeing it as a product that will provide a healthier and more satisfying experience.

Organic claim type is the leader in the Australian sourdough market due to its strong association with purity, health benefits, and transparency. People are increasingly interested in breads made from organic ingredients, free of synthetic fertilizers, pesticides, and other unnatural additives.

This is driving demand in the market for premium and niche products. Organic sourdough will appeal to an increasingly important sector of the health-conscious Australians, who believe that it's a cleaner and safer product that contains more nutrition than conventional alternatives.

The fact that there is no chemical residue on the grains, which are organically grown, increases the quality of the product, allowing it to be positioned as a high-value item by manufacturers.

Note: The above chart is indicative in nature

Tier 1 companies in the Australian sourdough market represent the large commercial producers and multinational bakery companies that command the biggest market share in terms of broad distribution networks, strong brand portfolios, and significant capacity to churn out high volumes of sourdough products sold into supermarkets, foodservice, and retail stores.

Tier 2 players are those mid-sized regional bakeries sitting at the mass production-artisanal craftsmanship middle ground. Those businesses tend to focus on sourcing sourdough to local markets, such as independent grocers, specialty stores, and cafes. This tier features further flexibility towards innovative flavors, texture, and format of a product and competes well in specific niches.

Tier 3 is comprised of small artisanal bakeries and micro-bakeries. It is within this tier that Australia's sourdough renaissance is primarily led. Traditional, slow-fermentation techniques are the core focus of such businesses, targeting niche markets comprising health-conscious consumers and bread enthusiasts. Their sourdoughs are usually handcrafted and premium in ingredients: heritage grains, native seeds, and wild yeast cultures.

By 2025, the Australia Sourdough market is expected to grow at a CAGR of 6.3%.

By 2035, the sales value of the Australia Sourdough industry is expected to reach USD 26.2 million.

Key factors propelling the Australia Sourdough market include Innovation in fusion and gourmet offerings, convenience through retail packaging, increasing popularity of home baking kits, and cultural shift toward heritage baking.

Prominent players in Australia Sourdough manufacturing include Dairy Farmers (part of the Baker's Delight, Brasserie Bread, Noisette, Bourke Street Bakery, The Bread & Butter Project, Sourdough Bakery, Baker's Treat, Wild Grain Bakery, The Organic Bread Bar, and Baker's Lane, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various product type such as traditional sourdough, flavored sourdough, specialty sourdough, and convenience sourdough.

The industry includes various packaging type such as retail packaging, bulk packaging, frozen packaging, and others.

As per the claim type segment, the market is segregated into organic, non-GMO, gluten-free, high fiber, and others.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.