The Australia Shrimp market is estimated to be worth USD 381.6 million by 2025 and is projected to reach a value of USD 1,660.5 million by 2035, growing at a CAGR of 15.8% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size (2025) | USD 381.6 million |

| Projected Australia Value (2035) | USD 1,660.5 million |

| Value-based CAGR (2025 to 2035) | 15.8% |

This simply refers to the production, processing, distribution, and consumption of a number of species of shrimp in Australia, mainly farmed and wild-caught. Shrimp is commonly called prawns in Australia, is an important constituent part of the seafood industry of Australia, adding substantial value not only from domestic consumption but also from revenue through exports. Key species include banana prawns, tiger prawns, and king prawns, all valued for flavor and versatility.

The Australian shrimp market is important in multiple ways: it is the primary sector most involved in aquaculture and wild fish industries, hence significant to local economic activities and gaining jobs along the coastal areas. Shrimp markets have been pivotal in promoting technology advancements that ensure sustainable aquaculture, entailing significant concentration on environmental conservation and biosecurity.

Shrimps are a basic meal ingredient for Australians, hence adding considerable business across retail and foodservice businesses, especially over festive holidays like Christmas.

Explore FMI!

Book a free demo

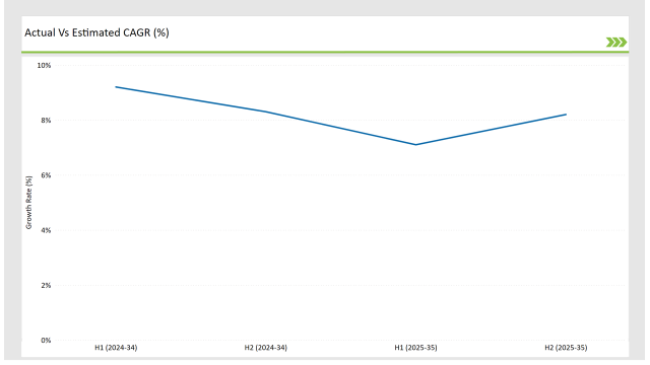

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Shrimp market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Shrimp sector is predicted to grow at a CAGR of 15.1% during the first half of 2025, increasing to 16.2% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 11.2% in H1 but is expected to rise to 13.3% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian Shrimp market landscape is dynamic, in a continuous flux of shifting consumer preferences, innovative developments, and evolving dynamics of the market. Key factors for this market include changes in product formulation, diet-related shifts, and a desire for diverse flavors in creamers, all contributing to this market growth.

This periodic analysis is helpful for businesses in sharpening strategies, tapping into emerging opportunities, and identifying challenges to efficiently overcome them and gain a competitive advantage in the marketplace.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | NaturalShrimp, Inc., a biotechnology aquaculture company, has conducted a feasibility trial in Mackay, Australia that focuses on the treatment of prawn farm wastewater. Funded by the Fisheries Research and Development Corporation and the Australian Prawn Farmers Association, it seeks to assess the patented electrocoagulation technology of the company that can improve water quality in prawn farming operations. |

| 2023 | Aquaculture, one of Australia's largest producers of abalone, mussels, and oysters, bought Eyre Peninsula Seafoods, the country's largest mussel farmer and processor. This strategic acquisition made Yumbah the largest shellfish aquaculture company in Australia, increasing its production capacity and market access. |

Tech-Powered Aquaculture Revolution

The emergence of advanced technologies in shrimp farming, such as AI-driven monitoring systems and IoT-enabled aquaculture solutions, is changing the face of Australia's shrimp farming landscape. Farmers now use real-time water quality sensors, automated feeding systems, and predictive analytics in a bid to improve shrimp yields and lower the pitfalls of operational inefficiency.

The AI tools help monitor shrimp health, identify early signs of disease, and optimize feeding schedules, which reduces waste and improves growth rates. Increased, more consistent quality production helps fill domestic and increasing export orders by shrimp farmers. Additionally, technologies help to draw the youth population into the sector, thereby helping the sector grow.

Shrimp Innovation in Convenience Foods

The Australian shrimp market addresses the demands of ready-to-eat or convenience foods due to the implementation of value-added products. A few of these rage products focus on time-poor consumers - meal kits, pre-seasoned prawns, and frozen snacks of shrimp, for example. Such innovations are packing for longer shelf life, convenient preparation like microwavable or air-fryer compatibility.

This trend benefits the market as it expands revenue streams for shrimp producers and processors by reaching a larger consumer base. Expanding into convenience foods also builds in more strength against raw shrimp demand fluctuations, as value-added products serve a larger spectrum of consumer preferences and occasions.

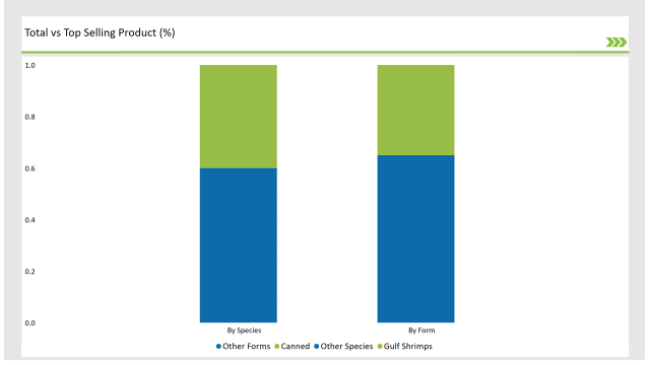

% share of Individual categories by Species and Form in 2025

The Gulf shrimp segment is leading the Australian market due to superior quality, consistent supply, and deep-rooted association with the pristine Gulf of Carpentaria. These shrimp, especially banana prawns and tiger prawns, thrive in the nutrient-rich, warm waters of the Gulf, giving them a distinct texture and flavor profile that appeals to domestic and international consumers.

Excellent conditions in the Gulf ensure a consistent source of high-grade shrimp, allowing this segment a competitive advantage within the market with established harvesting. Its reputation as a quality product has also allowed for good branding opportunities, especially in export markets where Australian Gulf shrimp is seen as a luxury seafood item.

Canned shrimp is currently dominating the Australian market with an unmatched advantage, as this particular product combines unmatched convenience and affordable prices, catering well to modern consumer lifestyles.

Australian busy city crowd and its fast shift towards the readiness in meal preparation create increased demand for households and food service providers alike with canned shrimp due to ready-to-use format. Peeling, deveining, and cooking are saved while using the same.

The wide acceptability of canned shrimp also draws from its popularity across so many types of dishes. Among these are salads, pasta dishes, and other seafood-based meals. Canned shrimp is even significantly cheaper compared to fresh and frozen seafood while its quality cannot be compromised.

Note: The above chart is indicative in nature

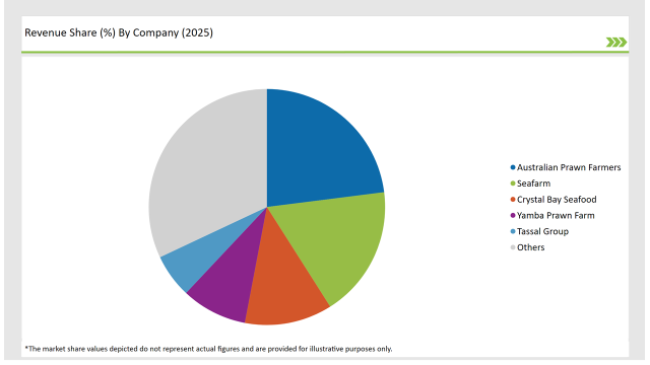

In Australian shrimp, Tier 1 companies are large-scale, vertically integrated producers with huge market share and substantial presence in the markets, both in terms of domestic and export business.

Among some of the prominent companies that meet such descriptions include Seafarms Group and Tropic Ocean Prawns, companies renowned for their large aquaculture operations, with a prime focus on high-end shrimp varieties including tiger prawns and banana prawns.

Tier 2 are the mid-sized producers and processors with a regional level of operation. Often, these companies are family-owned or regionally managed. Local fisheries or aquaculture farms would be an example of these.

They usually target state-specific demand in Queensland and New South Wales, where they focus on producing fresh or frozen shrimp for the domestic retail and foodservice sectors.

Tier 3 producers are small-scale shrimp farmers. Most are community or artisanal producers who serve the local markets, including the ones in the farmer's market, small retailers, and independent restaurants.

The volume of their production is not big, but these producers play an important role in filling local demand and providing niche, locally caught shrimp species. Mostly, they employ traditional fishing practices or small aquaculture.

By 2025, the Australia Shrimp market is expected to grow at a CAGR of 15.8%.

By 2035, the sales value of the Australia Shrimp industry is expected to reach USD 1,660.5 million.

Key factors propelling the Australia Shrimp market include increased focus on high-quality, locally sourced shrimp, shift toward convenient and ready-to-eat shrimp offerings, and consumer preference for unique Australian shrimp varieties.

Prominent players in Australia Shrimp manufacturing include NaturalShrimp, Inc., Australian Prawn Farmers, Seafarm, Crystal Bay Seafood, Yamba Prawn Farm, Queensland Prawns, Prawn Co., South Australian Prawn Farm, Gold Coast Prawns, and Tassal Group, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various species such as gulf shrimps, farmed whiteleg shrimps, banded coral shrimps, royal red shrimp, giant tiger shrimps, blue shrimps, and ocean shrimps.

The industry includes various forms such as canned, breaded, peeled, cooked & peeled, shell-on, and frozen.

The industry includes various source such as organic, and conventional.

The industry includes numerous applications such as food, pharmaceutical, cosmetics, industrial, and biotechnology.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.