The Australia Probiotic Ingredients market is estimated to be worth USD 28.3 million by 2025 and is projected to reach a value of USD 68.8 million by 2035, growing at a CAGR of 9.3% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size (2025) | USD 28.3 million |

| Projected Australia Value (2035) | USD 68.8 million |

| Value-based CAGR (2025 to 2035) | 9.3% |

The probiotic ingredients market in Australia is one of the dynamic sectors that focuses on the supply and utilization of microorganisms, for example, bacteria and yeast that provide health benefits when consumed in adequate amounts.

The ingredients are used in a wide range of different applications that includes dietary supplements, functional foods, beverages, and animal feed. With increasing consumer demand for probiotics as part of a balanced lifestyle, the market has observed increased adoption of probiotics in everyday food and supplement products.

In this regard, well-established healthcare infrastructure and a strong regulatory framework are already in place in the country, which once again plays a positive role for the growth of the market.

More so, shifting consumer preferences for healthier, more sustainable, science-based solutions open doors to customized probiotic compositions and innovative application fields such as in sports nutrition and mental wellness. Demand will likely continue for probiotics to maintain its trend in Australia while leading the list of global major probiotic ingredient market players.

Explore FMI!

Book a free demo

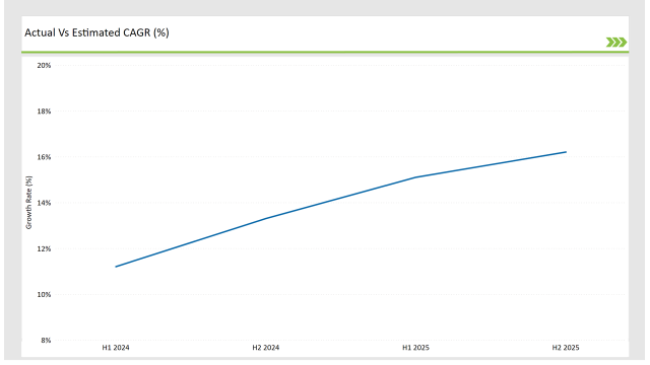

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Probiotic Ingredients market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Probiotic Ingredients sector is predicted to grow at a CAGR of 15.1% during the first half of 2025, increasing to 16.2% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 11.2% in H1 but is expected to rise to 13.3% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

These insights would depict the changing and dynamic scenario of the Australian Probiotic Ingredients market that is shaped by regulatory developments, shifting consumer preferences, and constant innovation in the formulation of probiotics.

Such semi-annual analysis is significant for businesses which need to shift their strategies accordingly, seize growth opportunities emerging out of this marketplace, and tackle the intricacies of the marketplace. An understanding of these trends will help companies make better decisions, optimize their offerings and be ahead of competition in a market which is expected to witness tremendous growth in the near future.

| Date | Development/M&A Activity & Details |

|---|---|

| 2023 | A licensing and manufacturing agreement has been secured by ProAgni, an Australian animal health solutions company, with a Singaporean biotech firm called Austrianova. The shelf-stable probiotics for cattle feed are seen to enhance the health and productivity of livestock in Australia. The use of proprietary technology from Austrianova has been planned to produce stable and effective probiotic formulations for the Australian market. |

| 2023 | Health Food Symmetry (HFS) and Sunrise Health & Wellness formed a strategic partnership to accelerate the development of PhytoBiome® and KFibre® gut health products, announced at the Australian Pharmacy Professional Conference & Trade Exhibition held on the Gold Coast. |

Probiotics in Mental Health and Cognitive Function

Such a trend in the market has profound effects on the Australian market. As the discussion of mental health is currently a hot topic amongst Australian consumers, probiotics are used increasingly to enhance mood and cognitive functions.

This trend is shaping novel formulations to combine probiotics with other ingredients such as adaptogens and nootropics to enhance mental wellness. It also opens a new avenue for the manufacturers to explore a booming market for mental health supplements. It will drive forward innovation and further research in this field.

Currently, gut health has become widely discussed for its impacts on mental well-being. This current trend relates to growing awareness of the gut-brain axis-suggesting that the gut microbiome has a critical role in mood regulation, anxiety, depression, and even cognition, thereby further inducing the incorporation of probiotics in supplements and functional food that claims to target mental health.

Probiotic Enriched Functional Beverages

Functional beverages are witnessing an increasing interest across Australia as probiotic-based drinks are gaining the top spot in becoming a preference among health-conscious consumers looking to consume the product as a one-stop shop for convenience and wellness.

Functional beverages like kombucha, kefir, and probiotic-infused water are gaining momentum in Australia through the increased numbers of consumers preferring probiotics as part of their daily diet, rather than using pills or powders.

These beverages provide an easy, fun way to drink probiotics while also providing some added health benefits such as hydration, energy, and detoxification. The popularity has been seen among the younger generation who increasingly tend towards the purchase of more functional, trendy, and healthy beverages.

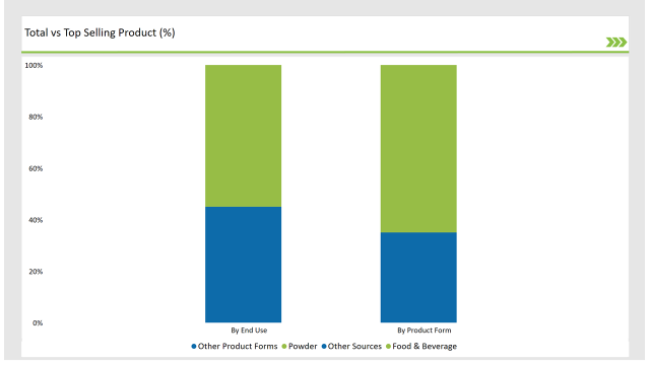

% share of Individual categories by Product Form and End Use in 2025

Functional beverages are gaining interest across Australia as probiotic-based drinks have become the center stage in becoming a choice of preference among health-conscious consumers seeking to consume the product as a one-stop shop for convenience and wellness.

Functional beverages such as kombucha, kefir, and probiotic-infused water are fast gaining acceptance in Australia by increasing consumers who prefer probiotics as part of their daily diet, instead of relying on pills or powders.

Such flexibility of powdered probiotics also, by extension, includes their availability and integration into almost every product line. From traditional supplements, powders are being added into various lines of functional foods and beverages up to even pet products.

Rising consumer demand for convenience, personalized nutrition, and multi-functional products will keep probiotic powders as the most prominent segment in terms of diversification of market and generation of new incomes for manufacturers.

The food and beverage segment is the market leader in the Australian probiotic ingredients market. Consumers are looking for functional foods that improve overall health, thus increasing demand.

The Australians want products that are more than basic nutrition, which are aimed at improving digestive health, immunity, and mental well-being. The integration of probiotics into everyday food and beverage offerings is booming, creating a large market for probiotic-enriched products.

Further, the food and beverage industry is experiencing continuous product innovation. There are Australian companies that are coming up with some unique probiotic combinations, prebiotics and other functional ingredients that enhance the benefits of probiotics, increasing demand for the enriched products.

Note: The above chart is indicative in nature

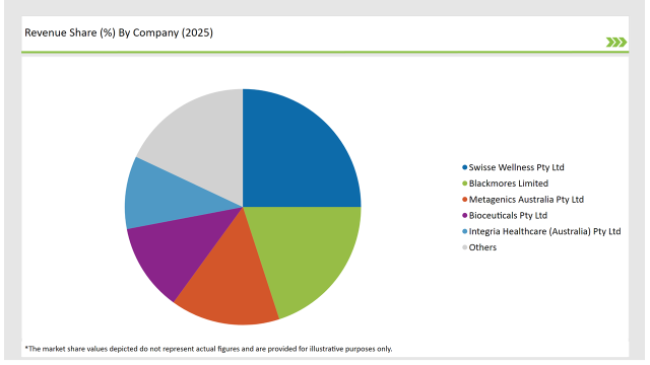

Tier 1 companies in the Australian probiotic ingredients market include companies with well-established presence in the market and strong market shares. Such companies also operate at a large scale, offering extensive portfolios of probiotic products. Such companies possess more advanced research and development capabilities to innovate and develop various forms of probiotic ingredients and formulations.

Tier 2 players are characterized to be mid-sized and having a solid presence in the market with a share. Such companies are usually regionally focused or have a type of specialty product range such as dietary supplements, functional foods or beverages. They focus on product differentiation with unique probiotic strains or specialized formulations focused on specific health benefits such as gut health, immune support or mental wellness.

Tier 3 companies in the Australian probiotic ingredients market are mostly small, specialized companies or start-ups that produce a focused portfolio of products. They usually maintain a localized market presence, and their product positioning targets niche consumers, for instance, high potency supplements, plant-based probiotics, or animal-specific probiotics.

By 2025, the Australia Probiotic Ingredients market is expected to grow at a CAGR of 9.3%.

By 2035, the sales value of the Australia Probiotic Ingredients industry is expected to reach USD 68.8 million.

Key factors propelling the Australia Probiotic Ingredients market include surge in plant-based and dairy-free probiotic products, rising awareness of the gut-brain connection, and increased focus on preventative health and immunity.

Prominent players in Australia Probiotic Ingredients manufacturing include Biolactis Pty Ltd., Blackmores Limited, Swisse Wellness Pty Ltd ., Metagenics Australia Pty Ltd., ProAgni, Bioceuticals Pty Ltd., Integria Healthcare (Australia) Pty Ltd., Probiotics Australia Pty Ltd., Bayer Australia Ltd., Danone Nutricia, and Nestle Health Science, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various form such as powder, granules, capsules, gel, and others.

The industry includes various product type such as bacterial, and yeast.

As per the end use segment, the market is segregated into food & beverages, animal feed, dietary supplements, and cosmetics & personal care.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Comprehensive Analysis of Pet Dietary Supplement Market by Pet Type, by Product Type, By Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.