The Australia Potato Flakes market is estimated to be worth USD 34.4 million by 2025 and is projected to reach a value of USD 65.7 million by 2035, growing at a CAGR of 6.7% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size (2025) | USD 34.4 million |

| Projected Australia Value 2035 | USD 65.7 million |

| Value-based CAGR (2025 to 2035) | 6.7% |

The potato flakes market in Australia relates to the manufacture, distribution, and consumption of dehydrated potato flakes made by processing and drying potatoes into thin, granular forms.

Potato flakes have been used for a wide variety of culinary purposes, including instant mashed potatoes, snacks, soups, and as a key ingredient in processed food products. The market in Australia is driven by consumer demand for convenience foods, growing popularity of ready-to-eat meals, and the need for cost-effective, long-shelf-life products.

Potatoes are of great importance for flaking in Australia. First, with such a significant agricultural sector of the country, value-added potato products support local production and any level of quality that a consumer may prefer. Secondly, Australian consumers have opted for busy fast-paced lives, making instant and easy-to-prepare food options appealing.

Potato flakes are valuable to manufacturers in the foodservice industries, catering to not only the households but also to businesses which require ingredients in bulk to prepare different types of potato dishes.

Explore FMI!

Book a free demo

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Potato Flakes market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Potato Flakes sector is predicted to grow at a CAGR of 6.2% during the first half of 2025, increasing to 6.8% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 5.3% in H1 but is expected to rise to 5.8% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 25 basis points in the second half of 2025 compared to the second half of 2024.

These numbers demonstrate the dynamic and ever-changing environment of the Australian Potato Flakes industry, which is influenced by variables such as altering customer tastes, technical breakthroughs, and market innovations. The semi-annual study is critical for firms to recognize the changing market trends and change their plans accordingly.

| Date | Development/M&A Activity & Details |

|---|---|

| 2023 | Edlyn Foods launched Instant Mash Potato Flakes, which can easily be used to prepare creamy mashed potatoes. The flakes are gluten-free, kosher certified, halal certified, and vegan suitable and cater to a wide range of dietary preferences. They come in a 10kg bulk package, thus ideal for the foodservice providers and large-scale catering operations. |

| 2022 | Lotus, which is a company that has been consistent in its pursuit of organic products, recently introduced Lotus Organic Potato Flakes. They are organic, non-GMO, and additive and sulphite free. They have become a great pantry staple for the consumer in search of convenient meal solutions like instant mashed potatoes, soups, vegetable patties, and as a thickener in several dishes. |

Growth in Demand for Convenience Foods and Ready-to-Eat Meals

The increasing demand for convenience foods in Australia has driven the potato flakes market considerably. As the Australians increasingly demand ready-to-eat meals and easy-to-prepare food products, potato flakes are becoming the staple in every household and in the foodservice industry.

Consumers today are looking for fast, yet nutrient-rich meals and thus turn their attention toward instant mashed potatoes, soups, and all the other potato-based snacks that can be prepared very quickly and have a long shelf life. The ever-growing urbanization, dual-income households, and individuals spending more time at the office are further merging to propagate this trend towards the use of potatoes in preparation of instant meals.

Technological Advancements in Potato Processing

Technological advancements in food processing have improved the production efficiency, quality, and varieties of products in the Australian potato flakes market. Recent advanced dehydration techniques ensure that minerals and flavor are retained in greater amounts, making it a more desirable product for consumers as well as food manufacturers.

Technologies that help the producers retain freshness and nutritional profiles of potatoes and improve cost-effectiveness in production can be very important. Automation and better processing technologies are assisting Australian potato flake manufacturers in mass production to overcome the increased needs for convenience food.

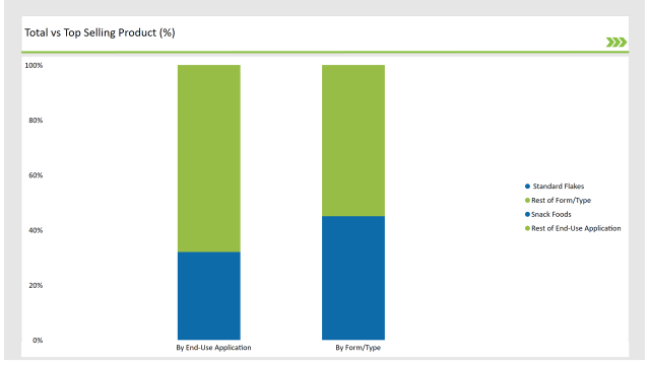

% share of Individual categories by Form/ Type and End-Use Application in 2025

The Leading Role of Standard Potato Flakes in Australia’s Market

The Standard Flakes segment remains the market leader among potato flakes in Australia because of its utility, value for money, and widespread customer acceptance. This is one of the most popular forms of potato flake; therefore, it has gained a strong footing across various sectors, including the foodservice, retail, and industrial markets.

The preference in Australia for standard flakes can be attributed to many key factors. These factors also reflect consumer behavior and market dynamics. Standard flakes are often the flakes used with instant mashed potatoes, soups, and many ready-to-eat meals which reflect this upsurge toward time-saving foods.

Snack Foods: Driving Growth in the Australian Potato Flakes Sector

The Snack Foods end-use segment leads the Australian potato flakes market owing to the surge in popularity for convenient, ready-to-eat snacks, driven by the on-the-go busy lifestyle of Australians. Potato flakes are being widely used as the key ingredient for snack foods including chips, crisps, and baked snacks whose demand continues growing.

This is one segment whereby consumer preferences are shifting and the snack food industry in Australia is increasing. In addition, snack producers are increasingly targeting innovation within their products to grasp a diverse consumer market, ranging from products that focus on specific consumer requirements such as low-fat, gluten-free, or high protein items.

Note: The above chart is indicative in nature

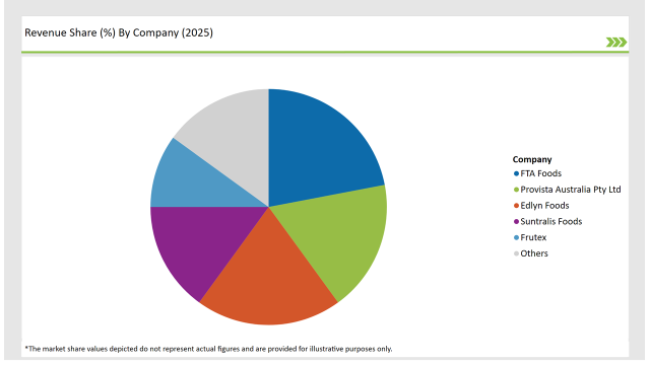

Tier 1 segment of the Australian potato flakes market is spearheaded by the global and Australian players which have a high share in the market. These companies are well-established, have robust distribution networks, and possess vast manufacturing capabilities.

Tier 2 in the Australian potato flakes market consists of mid-sized regional manufacturers who have a strong presence within specific regions or market segments but do not hold the same market share. These companies often serve local or niche markets, and their operations may be more focused on particular aspects of the potato flakes industry, such as health-conscious products, customized formulations for foodservice, or premium offerings.

Tier 3 players are the smaller players, boutique manufacturers, new entrants, and small local producers in the Australian potato flakes market. Such companies might only operate at the regional level and often depend on smaller-scale production and service for specific consumer segments.

By 2025, the Australian Potato Flakes market is expected to grow at a CAGR of 6.7%

By 2035, the sales value of the Australian Potato Flakes industry is expected to reach USD 65.7 million.

Key factors propelling the Australian Potato Flakes market include the health and dietary trends shaping consumer preferences, expanding snack food market and new product innovations, and rising demand for convenience foods and ready-to-eat meals.

Prominent players in Australia Potato Flakes manufacturing include FTA Foods, Provista Australia Pty Ltd., Edlyn Foods, Suntralis Foods, Frutex, Lasting Harvest, Shiloh Farms, Lotus, J.R. Simplot Company, IDF - International Dehydrated Foods, and S&D Potato Co., among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various forms/type of Potato Flakes such as Standard Flakes, Mashed Potato Pellets, Powder/Granules, and Specialty Flakes

The industry includes various end-use application Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others

Fish Waste Management Market Analysis by Source and End Use Industry Through 2035

Kelp Protein Market Analysis by Form and End Use Through 2035

Fish Soup Market Analysis by Form, Format, Packaging and Sales Channel Through 2035

Fish Silage Market Analysis by Fish, Fish Type, Application and Form Through 2035

Fish Roe Enzymes and Extracts Market Analysis by Type, Source and Application Through 2035

Edible Seaweed Market Analysis by Product Type, End Use Application, Extraction Method and Form Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.