The Australian Postbiotic Pet Food market is estimated to be worth USD 36.0 million by 2025 and is projected to reach a value of USD 55.6 million by 2035, growing at a CAGR of 4.5% over the assessment period 2025 to 2035.

| Metric | Values |

|---|---|

| Industry Size in 2025 | USD 36.0 million |

| Value in 2035 | USD 55.6 million |

| Value-based CAGR from 2025 to 2035 | 4.5% |

This is a niche but fast-growing segment of the bigger pet nutrition industry; the trend driving this increase in demand is gradually raising awareness of gut health, particularly related to overall pet well-being. Postbiotics are bioactive compounds formed during the fermentation of probiotics by metabolically active cells.

They contain positive metabolites like enzymes, peptides, short-chain fatty acids, and organic acids. In contrast to probiotics, which are living bacteria, postbiotics are not subject to special storage requirements and are more stable, so they are a desirable ingredient in pet food. These substances contribute to enhanced digestion, strengthened immunity, decreased inflammation, and healthier skin and coat in pets.

With pet owners in Australia humanizing their pets, demand is increasingly building for functional foods beyond normal nutritional levels that tie into the general trend of premiumization of the pet food sector. Australia's pet humanization trend has significantly influenced consumer behavior during the purchase decision-making process, as, increasingly, pet owners require scientifically studied nutritional solutions mimicking the pattern of human health trends.

Increased interest in the role of the microbiome in overall wellness prompted consumers to desire pet food with functional ingredients like prebiotics, probiotics, and postbiotics. Postbiotics are easily added to dry kibble, treats, and canned food without reducing their potency.

Explore FMI!

Book a free demo

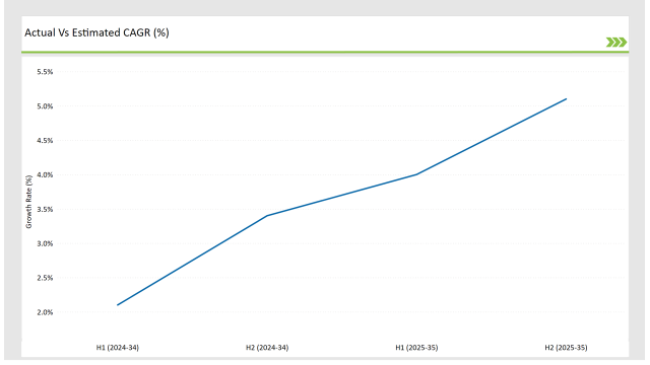

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the Australian Postbiotic Pet Food market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Postbiotic Pet Food sector is predicted to grow at a CAGR of 4.0% during the first half of 2025, increasing to 5.1% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 2.1% in H1 but is expected to rise to 3.4% in H2.

This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian postbiotic pet food market is constantly in motion, influenced by changing customer behaviors, innovation in functional pet nutrition, and regulatory shifts. Formulations centered on gut health and the inclusion of natural ingredients are propelling the market growth, with evolving guidelines impacting product formulation and packaging.

A bi-annual review of market trends is necessary for companies to position themselves strategically, take advantage of new opportunities, and effectively tackle industry challenges. Understanding these dynamic shifts enables companies to enhance their product offerings, refine marketing strategies, and stay ahead in the competitive landscape of postbiotic pet nutrition.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Colgate-Palmolive entered the fresh pet food market by acquiring Australia's Care TopCo Pty Ltd, the parent company of Prime100. This move carried out through its Hill's Pet feeding division, intends to strengthen Colgate's position in the premium pet feeding industry. |

| 2024 | Real Pet Food Co., in its Billy + Margot brand, launched Australia's first dog food with black soldier fly (BSF) protein as the key ingredient. The ground-breaking product is supplemented with TruMune™ postbiotics to aid healthy digestive well-being and can be found at Petbarn stores across the country and online only. |

Bio-Engineered Nutrition: The Rise of Tailored Postbiotic Pet Formulations

The new bio-engineered nutrition category is transforming the Australian pet food market by introducing customized postbiotic pet meals for specific life stages, breed types, and health issues. In contrast to regular pet foods that offer universal benefits, the new formulation involves patented postbiotic strains for specific pet well-being markers, including gut microbiome diversity, reduced inflammation, and metabolic well-being.

Pet owners are willing to spend on genetic and microbiome testing to identify their pet's digestive type and individualized food needs. Businesses are taking this information to develop postbiotic-enriched pet foods based on the genetic makeup of a pet. For example, high-energy dogs like Border Collies need postbiotics for gut effectiveness and metabolic control, while small breeds like Cavalier King Charles Spaniels need postbiotics for cardiac and gastrointestinal health.

This innovation will be pushing high demand for pet food individualization and new business models that involve pet owners getting their pets' health profiles and getting their customized postbiotic solutions.

Functional Chews and Snacks: The Rise of Postbiotic Treat Therapy

Postbiotic-supplement chews and treats that promise certain benefits beyond normal mealings have fast-developing demand in Australia as an effect of a profound paradigm shift concerning consumption habits in the pet foods market. Pet owners who wish to promote their pets' gut health without changing their diet have an on-the-go solution through these therapeutic treats made with gut-friendly postbiotics rather than traditional treats that are laden with fat and additives.

Traditional treats contain high levels of fat and additives. This is particularly so in urban Australian homes, where convenience and simplicity are priorities and pet owners prefer single-serve functional treats over full dietary changes. The postbiotic-enriched treats are designed to address single health problems at a time, such as digestive upsets, immunity deficits, skin allergic responses, and oral health.

Increased demand for postbiotic snacks as "mini wellness boosters" is also being driven by veterinarian endorsements, which allow for the controlled dosing of functional substances. This technology will transform the pet snack industry, with therapeutic treats becoming an essential part of Australia's daily pet care routines.

Australia's increasing trend of using postbiotic-enhanced pet food is largely motivated by the country's strong cultural and emotional bonding between Australians and dogs. Compared with other animals that are considered pets, dogs have a close attachment to family forms, where the owners tend to focus on ensuring their long-term health, digestion, and immunological resistance.

This transformation is redefining buying behaviors in that pet owners actively pursue gut-friendly, science-advanced, and proven options that correspond with the changing nutrition requirements of dogs. Active lifestyles of Australian dogs further fuel the demand for meals rich in postbiotics. Such pets require enhanced digestive support to help them sustain suitable energy levels and immunological functioning, whether working dogs in country environments or house dogs in cities.

Pet owners are utilizing formulas that provide support to the gut, assisting in nutrient absorption, muscle repair, and reducing inflammation because dogs are often engaging in high-level exercises such as hiking, agility exercises, and longer outdoor walks.

The considerable consumer demand in Australia for dry postbiotic pet food is fueled by the syncretic interplay of nutritional efficiency, increased shelf life, and changing pet owner behavior. With the pet food market increasingly welcoming gut-supportive innovation, dry formulations have become the preferred method of incorporating postbiotics, blending digestive balance with uncompromising practicality and quality.

One major reason for this trend is that dry food can be easily adapted to any type of feeding routine. As most Australian pet owners have active lifestyles with dedicated time for pets, they are looking for formulations that provide them with something consistent in nutritional value with minimal preparation time.

Compared to wet food, where refrigeration and portion control may be necessary, dry postbiotic pet food is convenient to store, measure in exact feeding quantities, and maintain gut health benefits over time by having stabilized postbiotic compounds.

From a dietary perspective, dry pet food ensures maximum retention of postbiotics since controlled processing maintains the integrity of the beneficial gut-supporting compounds. This stability reassures dog or cat owners that their pets are always receiving the necessary digestive support.

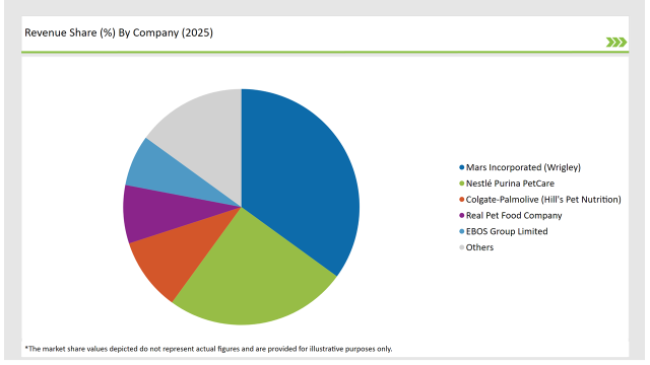

Tier 1 of the Australian postbiotic pet food industry is dominated by industry leaders and established multinational companies with a strong presence in the pet food sector. These companies, such as global giants Nestlé Purina and Mars Petcare, are setting the standard for scientific research, mass distribution, and high-end product offerings. Their leadership is the product of extensive research and development, which has enabled them to be the first to deliver clinically tested postbiotic solutions that appeal to pet owners looking for science-backed nutrition for digestive health, immunity, and lifespan.

Tier 2 comprises mid-sized, fast-growing companies that are establishing a robust position in the Australian postbiotic pet food market through segment-focused innovation, local leadership, and direct-to-consumer approaches. Tier 2 brands like to project themselves as luxury boutique brands selling clean, highly digestible, and locally manufactured postbiotic pet food products.

Tier 3 includes emerging companies, niche brands, and pet food innovators that are pioneers in postbiotic pet food in Australia. These firms, often small and independent, are pushing the forefront of fermentation biology, microbiome research, and hyper-local material sourcing to craft genuinely novel postbiotic pet foods.

2025 Market share of Australian Postbiotic Pet Food manufacturers

By 2025, the Australian Postbiotic Pet Food market is expected to grow at a CAGR of 4.5%.

By 2035, the sales value of the Australian Postbiotic Pet Food industry is expected to reach USD 55.6 million.

Key factors propelling the Australian Postbiotic Pet Food market include Locally Sourced Ingredients Transforming Digestive Care, Combatting Digestive Disorders with Advanced Postbiotic Pet Foods, Adapting Postbiotic Diets to Apartment-Living Companions, and Growing Influence of Canine and Feline Digestive Health Experts.

Prominent players in Australia Postbiotic Pet Food manufacturing include Mars Incorporated (Wrigley), Nestlé Purina PetCare, Colgate-Palmolive (Hill's Pet Nutrition), ZIWI, Hypro Pet Foods, Meals for Mutts (MfM), ZamiPet, Cobber, Real Pet Food Company, and EBOS Group Limited, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

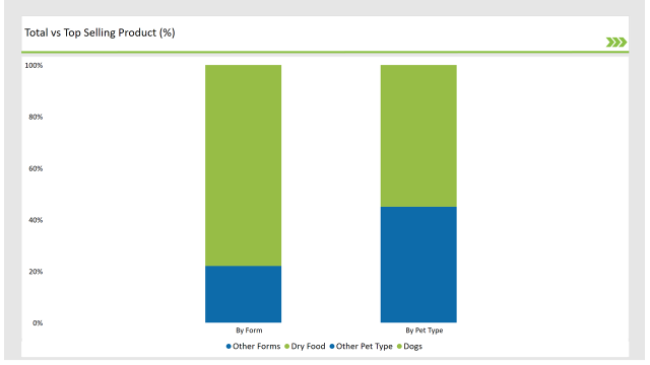

The industry includes various pet types, such as Dogs, Cats, and Other pets.

The industry includes various forms such as Dry Food, Wet Food, and Treats & Supplements.

As per the distribution channel segment, the market is segregated into Pet Specialty Stores, Online Retail, Veterinary Clinics, and Supermarkets/Hypermarkets.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.