The Australian Plant-based Preservatives market is estimated to be worth USD 147.8 million by 2025 and is projected to reach a value of USD 321.9 million by 2035, growing at a CAGR of 8.1% over the assessment period 2025 to 2035

| Metric | Values |

|---|---|

| Industry Size in 2025 | USD 147.8 million |

| Value in 2035 | USD 321.9 million |

| Value-based CAGR from 2025 to 2035 | 8.1% |

The Australian botanical preservatives market refers to that industry segment responsible for the manufacture, distribution, and application of naturally derived, botanically based preservatives. The use of these preservatives is generally found in food and beverages, cosmetics, and personal care markets for extending the shelf life of the product, preventing microbial deterioration, and ensuring the quality of the product at the expense of not applying artificial chemicals.

Some of the most common plant-based preservatives include essential oils (such as rosemary, thyme, and clove), botanical extracts (such as green tea and citrus), and organic acids (citric and ascorbic acids).

The growth in demand for plant-based preservatives in Australia is influenced by heightened awareness of possible health hazards associated with synthetic additives by many consumers, regulatory pressures for cleaner labels, and an increasing demand for natural and organic products.

Nowadays’ consumers are more likely to opt for products that contain no artificial preservatives, which has spurred the take-up of plant-based substitutes in various industries. In Australia, the importance of the plant-based preservatives market is threefold. One of the main reasons for its expansion is the trend in consumer behavior toward clean-label and organic food and personal care products.

As health awareness rises, Australian consumers demand food and personal care products with minimal processing and natural ingredients. This demand has prompted manufacturers to reformulate products with plant-based preservatives to maintain product integrity while adhering to regulatory standards.

Explore FMI!

Book a free demo

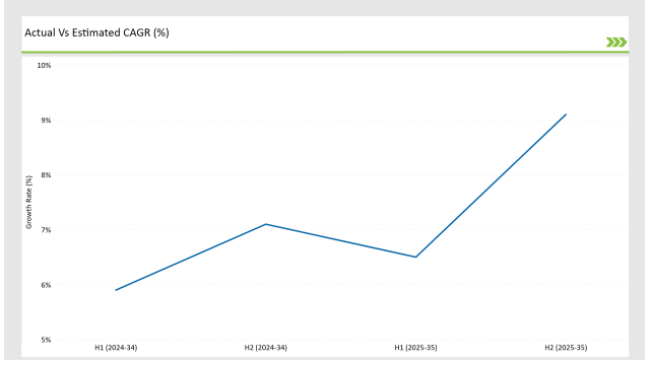

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the Australian Plant-based Preservatives market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Plant-based Preservatives sector is predicted to grow at a CAGR of 6.1% during the first half of 2025, increasing to 7.1% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 4.4% in H1 but is expected to rise to 5.5% in H2.

This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian plant-based preservatives business is evolving owing to a few crucial factors that comprise legislative events, changing client requirements, as well as enhanced natural preservation science. Clean label and sustainability policy is influencing enterprise to design and create products in different ways.

Simultaneously, rising clientele pressure for the use of chem-free, all-natural offerings is building improvements for plant-based preservation science. This in-depth research provides organizations with key information to remain competitive, respond to new trends, and understand the complexities of the Australian market.

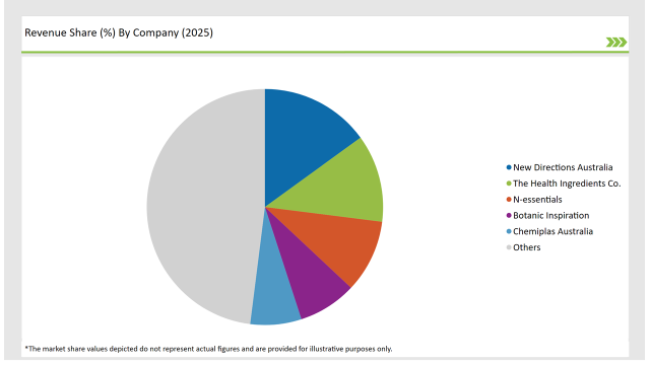

Located in Marrickville, NSW, New Directions Australia offers a variety of natural preservatives for use in cosmetic products. Their ingredients, including Plantaserv A and Plantaserv N, are formaldehyde-free and paraben-free, consistent with the clean-label trend. Plantaserv A is a blend of benzyl alcohol and dehydroacetic acid that works well in products with a pH of 6 or lower, while Plantaserv N uses glyceryl caprylate and glyceryl undecylenate, providing broad-spectrum protection with added emollience.

Based in Hunter Valley, NSW, Botanic Inspiration offers natural preservatives for DIY skincare recipes. Their Preservative Eco, or Geogard™ ECT, is a broad-spectrum preservative certified by COSMOS and ECOCERT. They blend benzyl alcohol, salicylic acid, glycerin, and sorbic acid and is compatible with products having a pH level of 3 to 8. This preservative is heat-sensitive and must be added during the cool-down stage of product development.

Advanced Extraction Technologies: Enhancing Efficacy and Stability

The adoption and development of sophisticated extraction technologies are transforming the market for plant-based preservatives in Australia. Processes like supercritical CO₂ extraction and ultrasonic-assisted extraction allow the effective isolation of bioactive compounds from plant material while maintaining their potency and stability.

The use of advanced extraction technology enhances the potency and shelf stability of plant-derived preservatives. For manufacturers, this means improved and more reliable preservation systems involving fewer synthetic additives. Consumers also enjoy cleaner labeling and longer freshness, which satisfies the increasing popularity of natural and safe food and cosmetic products. In addition, these technologies could reduce production cost, making natural preservatives generally more affordable and accessible.

Indigenous Botanical Integration: Harnessing Australia's Native Flora

Australia's high biodiversity features an abundance of native flora with inherent preservative characteristics. The use of indigenous botanicals like Kakadu plum, lemon myrtle, and Tasmanian pepperberry in preservative formulations is on the rise. These species are highly prized for their antioxidant and antimicrobial activities, making them suitable candidates for natural preservation.

The use of indigenous botanicals in plant-based preservatives presents a twofold benefit. First, it offers a point of differentiation for Australian manufacturers, making their products stand out in domestic and foreign markets. Second, it promotes the sustainable harvesting and economic growth of indigenous communities, creating a mutually beneficial relationship between industry and traditional landowners.

This trend not only adds to the market attractiveness of natural preservatives but also resonates with ethical sourcing and community engagement principles.

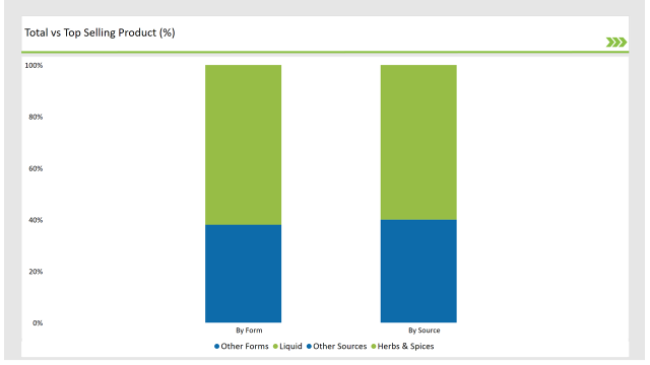

The rising application of plant-based preservatives in Australia has taken the herbs and spices category to the limelight, primarily owing to their high antimicrobial and antioxidant activity. Herbs and spices like rosemary, thyme, oregano, and cloves have become crucial ingredients in natural preservation systems in a wide range of industries.

Their own unique chemistry contains bioactive ingredients like polyphenols, flavonoids, and essential oils that not only exhibit antimicrobial effects but also inhibit oxidation spoilage. That activity gives them the popularity of the greatest natural preservatives for the best-selling chemical replacement products, responding to consumers' desire not to use artificial chemicals without losing safety and freshness from food.

Rosemary extract, for instance, is commonly used to increase the shelf life of meat products by limiting lipid oxidation, whereas clove oil is utilized in baked foods to inhibit mold growth. This adaptability is also seen in the cosmetics and personal care industries, where herb-based preservatives serve as natural antimicrobials, replacing parabens, and maintaining the integrity of organic skincare products.

Plant-based Preservatives (FOS) are most sought because of their versatile emotional formulation, ease of The liquid form segment has proved to be an important driver for the Australian market of plant-based preservatives because of its ease of application, higher flexibility, and compatibility with conventional manufacturing practices.

Natural ingredient-based liquid preservatives such as herbs, spices, and plant extracts are popular in most sectors such as food and beverages, personal care, and pharmaceuticals. This is due to the necessity for preservation methods that ensure product shelf life and quality while remaining fully compatible with existing production processes.

The feature is extremely advantageous for applications such as sauces, beverages, and vegetable milk substitutes, which require continual preservation after preparation. For these applications, liquid form ensures effective and homogenous dispersion of antibacterial ingredients, preventing localized degradation and improving overall product stability.

Tier 1 companies are characterized by their massive operation size, comprehensive R&D strength, and extensive distribution networks. Tier 1 companies possess diversified lines of products and utilize leading technologies to optimize plant-based preservatives' performance. They have the ability to invest in state-of-the-art technology such as supercritical CO₂ and cold-press in producing high-quality functional preservatives as a response to the demand for natural-based products.

Tier 2 players play a significant role in the Australian plant-based preservatives market through offering niche solutions to address special segments. Mid-size companies are very responsive and agile to respond to changing consumer demands and regulations in the marketplace. They will focus on working on customized solutions to address individual preservation challenges of product categories like plant-based dairy, meat substitutes, and natural beverages.

Tier 3 companies are upstart firms and start-ups that introduce new concepts and disruptive innovation in the Australian market for plant-based preservatives. These small organizations tend to specialize in sustainable sourcing, craft-style processes, and innovative preservation methods utilizing underleveraged plant ingredients. These players excel in domestic, small-scale production, allowing them to play with new ingredients and natural preservation blends.

2025 Market share of Australian Plant-based Preservatives manufacturers

By 2025, the Australian Plant-based Preservatives market is expected to grow at a CAGR of 8.1%.

By 2035, the sales value of the Australian Plant-based Preservatives industry is expected to reach USD 321.9 million.

Key factors propelling the Australian Plant-based Preservatives market include Growing Consumer Preference for Chemical-Free Preservation, Advancements in Bio-Extraction for Enhanced Efficacy, Rising Demand for Extended Shelf Life in Plant-Based Products, and Integration of Preservatives in Plant-Based Convenience Foods.

Prominent players in Australia Plant-based Preservatives manufacturing include New Directions Australia, Cargill, Lonza, BASF SE, Kemin Industries, Evonik Industries, Tate & Lyle PLC, The Health Ingredients Co., N-essentials, Botanic Inspiration, and Chemiplas Australia, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various sources, such as Herbs & Spices, Plant Extracts, Fruits & Vegetable, and Essential Oils.

The industry includes various forms such as Powder, Liquid, and Others.

As per the functionality segment, the market is segregated into Antimicrobial, Antioxidant, Anti-enzymatic, and Others.

As per the application segment, the market is segregated into Bakery & Confectionery, Dairy & Frozen Products, Snacks & Beverages, Meat & Poultry, and Sauces & Dressings.

Dairy-Free Cream Market Insights – Plant-Based Dairy Alternatives 2025 to 2035

Dairy Flavors Market Trends – Growth & Industry Forecast 2025 to 2035

Egg Protein Market Insights – High-Protein Nutrition & Market Growth 2025 to 2035

Dried Eggs Market Insights – Shelf-Stable Nutrition & Industry Growth 2025 to 2035

Egg Substitute Market Insights – Plant-Based Alternatives & Industry Growth 2025 to 2035

Egg-Free Dressing Market Trends – Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.