The Australia Pet Dietary Supplements market is estimated to be worth USD 24.4 million by 2025 and is projected to reach a value of USD 93.9 million by 2035, growing at a CAGR of 14.3% over the assessment period 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size (2025) | USD 24.4 million |

| Projected Australia Value (2035) | USD 93.9 million |

| Value-based CAGR (2025 to 2035) | 14.3% |

In Australia, the pet dietary supplements market is on those products that improve overall health, nutrition, and well-being in pets. These products are available for dogs, cats, birds, and other pets, and the range of supplements includes forms like powders, chews, tablets, and liquids.

They are targeted at solutions such as joint support, digestive issues, skin and coat quality, immune system fortification, and even anxiety. Often they are prepared from ingredients that have vitamins, minerals, omega-3 fatty acids, probiotics, and extracts from plants.

This market has great importance for Australia. With the pet ownership rate so high in Australia and with an increasingly humanizing of pets as members of a family, more people have turned into seeking premium natural functional products that would guarantee that their pets were healthy and remained so. Increased awareness pertaining to pet diseases and conditions-such as pet obesity, arthritic complaints, and food sensitivities-prod the industry demand for bespoke nutrition.

Scientific improvements in formula as well as input from veterinarian support the up-gradation demand within the country's market line. Australia-with healthy pet-care products and incomes-holds open-ended potential market segments for expanding and evolving to fulfill the nutrition demand of savvy pet owners more responsive to its diet.

Explore FMI!

Book a free demo

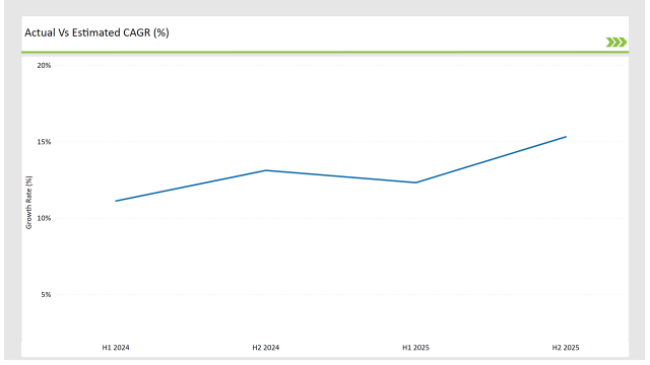

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Pet Dietary Supplements market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Pet Dietary Supplements sector is predicted to grow at a CAGR of 12.3% during the first half of 2025, increasing to 15.3% in the second half of the same year.

In 2024, the growth rate is anticipated to slightly decrease to 11.1% in H1 but is expected to rise to 13.1% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

These findings exhibit the dynamic, ever-changing aspects of the Australian pet dietary supplement business, under the influence of various factors: changing consumer taste, improved supplementation formulations, and shifting pet health goals.

Therefore, in-depth analysis of these trends, every six months will help a company develop more strategic moves as they embrace newly arising opportunities to understand particular challenges emanating from the new expansion business. With such analysis, this is the very tool that a firm can project what will come out, how they will beat competition, and design new alternatives fit for what pet owners are requiring in Australia.

| Date | Development/M&A Activity & Details |

|---|---|

| November 2024 | The Australian Veterinary Association (AVA) has approved a new certification procedure for pet nutritional supplements, guaranteeing that only high-quality, scientifically supported products are offered to Australian pet owners. |

| March 2024 | Advance, an Australian pet food producer, recently introduced a new line of joint and mobility supplements for elderly pets, responding to the growing demand for specialist pet care products. |

Tailored Nutrition for Pet Wellness: The Rise of Breed-Specific Supplements

In Australia, pet owners have increasingly shown interest in breed-specific dietary supplements to give their furry companions a more tailored kind of care. Companies started formulating around specific genetic predispositions and health conditions based on the diverse nutritional needs that different breeds entail.

Large breeds of dogs, for instance, Labrador types, may require supplements with glucosamine and chondroitin as these are easily affected by joint and hip conditions, while Chihuahuas would need answers in dental care.

Breed-specific supplements are also presented as a niche product, to which Australia's health-conscious owner is willing to pay for individually tailored care. Companies embracing breed-specific solutions are likely to enjoy a competitive advantage by attracting fastidious consumers looking for accuracy in pet nutrition.

The Boom of Functional Pet Treats: Merging Nutrition with Indulgence

Functional pet treats are becoming increasingly popular in Australia because they integrate health benefits with indulgence. They fill the gap between supplements and everyday feeding. These are fortified with ingredients that are believed to improve areas of health such as gut health (probiotics), stress relief (L-theanine), and skin health (omega fatty acids) and still taste like a treat.

The reason for the surge in functional treats is the convenience factor-owners find it easier to administer supplements in treat form rather than capsules or powders.

Moreover, pets are pampered, and these products resonate with owners' preferences for combining care with bonding moments. Australian pet owners, who have a high engagement in their pets' welfare, are seeking functionally activated treats as part of their pet's daily practice. This makes the products more diversified and premiumized and helps expand consumer adoption of pet supplements.

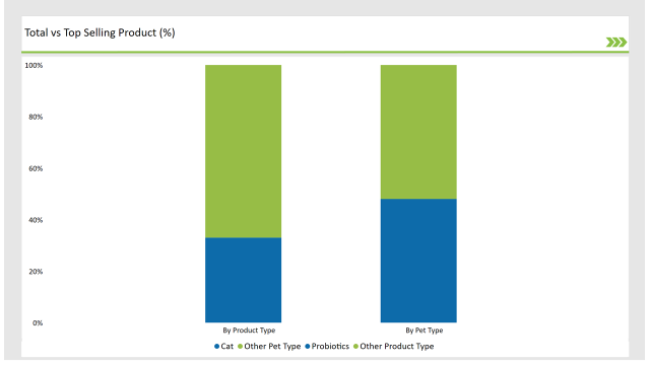

% share of Individual categories by Pet Type and Product Type in 2025

Gut Health Revolution: Why Probiotics Dominate the Australian Pet Supplement Market

The probiotics segment is the largest in the Australian market for pet dietary supplements. The main reason behind it is an increased awareness of the relationship between gut health and general pet well-being. More and more pet owners have realized that gut microbiota are critical to immunity, digestion, nutrient absorption, and even behavior.

Probiotic supplements, aimed at maintaining the right balance of gut flora, have become the first choice for many Australian consumers since gastrointestinal problems like diarrhea, bloating, and food sensitivities are very common in pets.

Preventive healthcare is one of the main drivers for this trend in Australia. Veterinary professionals and pet nutritionists are educating the owners about how probiotics work not only for acute digestive conditions but also as a long-term health maintenance process.

Canine Care Dominance: Leading the Australian Pet Supplement Market

The segment of dogs leads the Australian market for pet dietary supplements because the Australians have deep cultural and emotional attachment towards their canine companions. Dogs are considered the most common pets in Australia, with most households owning a dog, irrespective of whether the household is based in an urban or rural region.

This strong relationship also forces pet owners to spend on health, happiness, and lengthening the lifetime of their canines, with an increased thrust on dietary supplements to this marketplace.

Supplements addressing joint health, hydration support, and recovery are therefore in very high demand. Another factor to consider is Australia's warm climate, which has an impact on skin and coats of dogs; hence, demand for omega-3 supplements as well as for products that cater to skin health.

Note: The above chart is indicative in nature

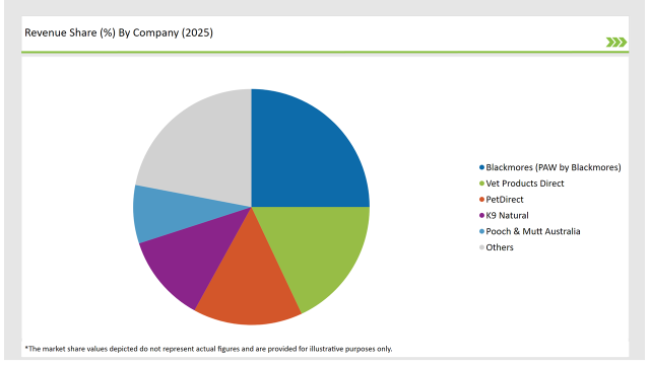

Tier 1 players in the Australian pet dietary supplements market are global and Australian players holds the strong distribution network, brand name, and a strong amount of R&D investment.

The companies capturing through their stronghold are Nestlé Purina, Mars Petcare, and H&H Group or Zesty Paws. These leaders offer a diverse range of high-quality products targeting common health issues such as digestive, joint care, and immunity with veterinary endorsements and clinical research to back.

Tier 2 would have regional and national manufacturers focus on delivering a high-quality pet supplement at the right price point. These firms cater to mid-tier market positioning, where these products balance out the cost effectiveness with efficacy, often emphasizing regionally relevant formulation, such as supplements for Australia's climate related skin health concerns, to stand as a household name among both pet owners and veterinary professionals.

Tier 3 is much smaller, and made up of newer, emerging brands and niche players focusing on highly specific or innovative market segments. Examples include startups or boutique manufacturers for unique, specialized products such as probiotics-only formulations or natural supplements tailored specifically for aging pets.

Normally sold through online platforms or specialty pet stores, the bulk of this tier's focus is in building loyalty through transparency, personalized service, and niche innovations.

By 2025, the Australian Pet Dietary Supplements market is expected to grow at a CAGR of 14.3%

By 2035, the sales value of the Australian Pet Dietary Supplements industry is expected to reach USD 93.9 million.

Key factors propelling the Australian Pet Dietary Supplements market include increasing focus on preventive pet healthcare, shift towards premium and science-backed pet products, and urbanization and rising cases of stress-induced pet health issues.

Prominent players in Australia Pet Dietary Supplements manufacturing include Blackmores (PAW by Blackmores), Petsafe Australia, Royal Canin (Mars Petcare Australia), Natural Health Pet, Pet Wellbeing (Australia), Vet Products Direct, PetDirect, K9 Natural, Pooch & Mutt Australia, and Advanced Pet Care, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

As per the industry, the pet type segment is bifurcated into cat, dog, birds, and others.

The industry includes various product type such as glucosamine, probiotics, multivitamins, omega 3 fatty acid and others.

As per the market, the application segment is segregated into joint health, digestive health, weight management, skin and coat health, dental care, and others.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.