The Australia Oral Clinical Nutrition Supplements market is estimated to be worth USD 83.6 million by 2025 and is projected to reach a value of USD 211.0 million by 2035, growing at a CAGR of 9.7% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size (2025) | USD 83.6 million |

| Projected Australia Value (2035) | USD 211.0 million |

| Value-based CAGR (2025 to 2035) | 9.7% |

Oral clinical nutrition supplements in Australia refer to products especially designed to supply essential nutrients to individuals who have difficulty meeting their nutritional needs through regular food intake.

These supplements are used in medical settings or for patients with specific health conditions, such as malnutrition, chronic illnesses, or recovery from surgery. They are available in the form of drinks, powders, and bars and are designed to provide a balanced mix of vitamins, minerals, protein, and other nutrients.

This is of great significance in the Australian market, especially since there is a high demand for specialized nutrition solutions. With an aging population, an increase in chronic diseases, and increased health awareness, there is a greater need for oral clinical nutrition products to support health and recovery. Furthermore, with a high standard of healthcare in Australia and nutrition incorporated into treatment protocols, this market enjoys further growth.

Explore FMI!

Book a free demo

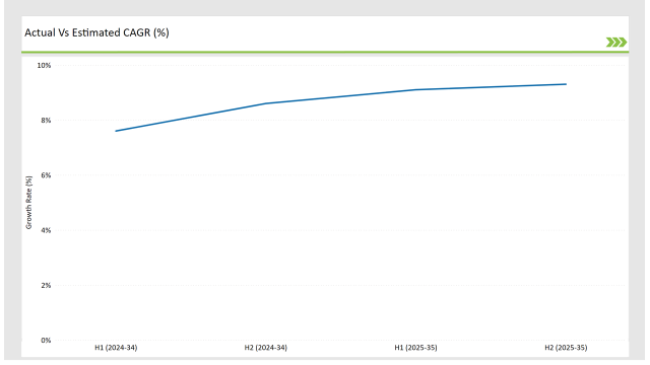

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Oral Clinical Nutrition Supplements market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Oral Clinical Nutrition Supplements sector is predicted to grow at a CAGR of 9.1% during the first half of 2025, increasing to 10.3% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 7.6% in H1 but is expected to rise to 8.6% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

These insights bring out the continually changing scenario of the Australian Oral Clinical Nutrition Supplements market, influenced by regulation, changing consumer demand, and changes in formulation technologies. The semi-annual review offers valuable information to businesses to strategize their placement in line with the growth of the market and navigate the intricacies associated with evolving trends and consumer preferences.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Melrose Health launched a new range of Longevity vitamins, Melrose FutureLab, to address chronic diseases in Australia. Its first product range targets four key health areas, while other products are in progress for menopause, male hormone imbalance, sleeplessness, stress, inflammation, cardiovascular health, and cognitive function. |

| 2024 | Hologram Sciences recently entered a strategic partnership with Maeil Health Nutrition in Korea, enabling it to introduce personalized nutrition services in Korea. Even though this is a Korean-based partnership, the trend towards more personalized nutrition solutions in the industry may be of consequence for the Australian market. |

Increasing Demand for Specialized Supplements for the Aging Population

This market is significantly influenced by the aged population of Australia. Since the median age of Australians keeps increasing, the demand for custom nutrition solutions for the elderly increases because they require care to keep good health, to recover faster, and to enhance quality of life. The elderly are more susceptible to chronic diseases such as osteoporosis, sarcopenia, and cognitive decline, which can be benefited by specific nutrition.

This trend will make manufacturers come up with more products that cater to the nutritional needs of older adults. In addition, intestinal health supplements and boosting immunity will also become extremely popular as older adults suffer from impaired nutrient absorption.

Integration of Medical Nutrition into Preventative Healthcare

As Australians become increasingly health conscious, the trend is towards healthcare in which oral clinical nutrition supplements have come to be positioned not merely as a tool for recovery but for maintaining good health over the longer run.

The trends are toward health which includes prevention, general well-being, and risk reduction of diseases, such as obesity, diabetes, and cardiovascular problems. This trend will have a significant impact on the market because consumers will seek supplements to prevent and manage chronic conditions before they happen. Metabolic health, weight management, immune function, and general vitality supplements will be in high demand.

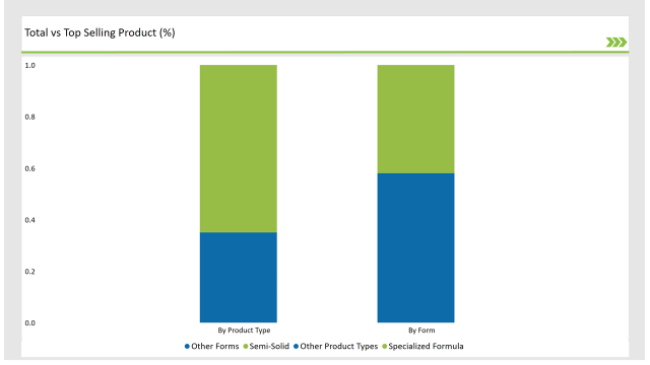

% share of Individual categories by Form Type and Product Type in 2025

The Rise of Specialized Formula Products: Addressing Unique Health Needs in Australia

The specialized formula product segment is the leader in the oral clinical nutrition supplements market in Australia because of its ability to cater to the growing demand for tailored nutrition solutions for people with specific health conditions. In a market where personalized healthcare is increasingly important, specialized formulas play a critical role in meeting the diverse and often complex needs of consumers.

These products fulfill the nutritional gap of people with chronic diseases, malnutrition, gastrointestinal issues, or age-related conditions. So, these products are of utmost importance to the Australian healthcare sector. Demand also increases due to Australia's aged population, which needs nutrition products to help in the support of bones, retention of muscle mass, cognitive function, and immune support.

Semi-Solid Formulas: A Preferred Choice for Convenience and Effective Nutritional Delivery in Australia

Semi-solid form currently dominates the oral clinical nutrition supplements market in Australia. It is solely driven by the reason that semi-solids offer both convenience and effective nutrient delivery. Semi-solid products such as nutritional bars, gels, and pudding-like supplements will provide an ideal solution for a patient who often faces difficulties in consuming liquid-based formulas or cannot eat much solid food because of certain medical conditions. Some of the reasons why most people opt for semi-solid formulas are because they are easy to ingest.

Compared to liquids, some individuals, particularly the elderly and those suffering from dysphagia or difficulties in swallowing, may find them quite difficult to consume; thus, the fear of chocking. These benefits are critical in the Australian healthcare market, where management of chronic conditions, rapid recovery, and nutrition are of prime importance..

Note: The above chart is indicative in nature

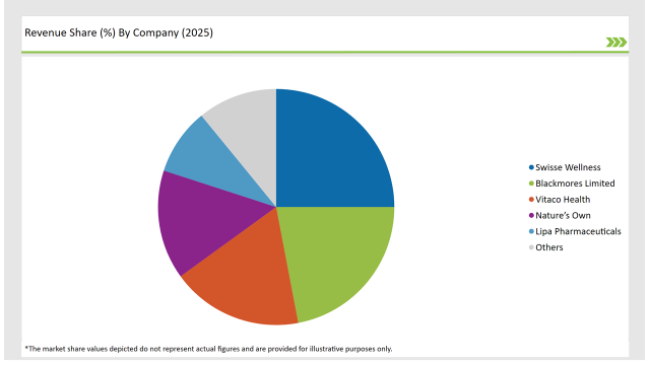

Tier 1 of the Australia Oral Clinical Nutrition Supplements market includes large, established global and Australian brands that have high market shares in the market, driven by a strong distribution network, brand awareness, and large product offerings. These companies are market leaders, with considerable financial muscles, broad lines of products, and well-established partnerships with health care providers.

Tier 2 in the Oral Clinical Nutrition Supplements market in Australia comprises of emerging national brands and mid-sized companies. It has not been the case that players in this tier have the same level of market presence or financial resources as a company, but on the other hand, they are most known for innovation, quality, and offering specific niches in the market.

Tier 3 players in the Australia Oral Clinical Nutrition Supplements market are small local brands and private label manufacturers. These firms primarily target niche markets, where specialized or low-priced alternatives to offerings from the large players can be sold. Though these firms hold smaller market shares, they still provide a very crucial function by filling market gaps based on specific needs like dietary restrictions or cost-sensitive customers.

By 2025, the Australia Oral Clinical Nutrition Supplements market is expected to grow at a CAGR of 9.7%

By 2035, the sales value of the Australia Oral Clinical Nutrition Supplements industry is expected to reach USD 211.0 million.

Key factors propelling the Australian Oral Clinical Nutrition Supplements market include increasing demand for personalized nutrition, integration of clinical nutrition in hospital and home care settings, and shift towards convenient and on-the-go nutritional solutions.

Prominent players in Australia Oral Clinical Nutrition Supplements manufacturing include Swisse Wellness, Blackmores Limited, Vitaco Health, Nature’s Own, Mead Johnson Nutrition, Melrose Health, Baxter International, Danone Nutricia, Nestlé Health Science, Abbott Laboratories, and Lipa Pharmaceuticals, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various product type of Oral Clinical Nutrition Supplements such as standard formula, and specialized formula.

The industry has segmented into Disease-Related Malnutrition (DRM), Renal Disorders, Hepatic Disorders, Oncology Nutrition, Diabetes, and Others (12%).

The industry includes various forms such as liquid, semi-solid, and powder.

The industry includes numerous sales channel such as prescription-based and over-the-counter.

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Microalgae in Fertilizers Market - Growth & Sustainability Trends 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Potato Flakes Market Analysis Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others End Use Application Through 2035

A detailed analysis of the Australian Vitamin Premix industry and growth outlook covering vitamin type, form, and end user segment

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.