The Australian Omega-3 market is estimated to be worth USD 185.4 million by 2025 and is projected to reach a value of USD 403.7 million by 2035, growing at a CAGR of 8.1% over the assessment period 2025 to 2035.

| Metric | Values |

|---|---|

| Industry Size in 2025 | USD 185.4 million |

| Value in 2035 | USD 403.7 million |

| Value-based CAGR from 2025 to 2035 | 8.1% |

The Australian omega-3 market is a successful division of the general dietary supplements, functional foods, and pharmaceutical business, fueled by increasing health awareness and an increasing aging population. Omega-3 fatty acids are obtained mainly from fish oil, krill oil, algal oil, and vegetable sources of flaxseed and chia seeds and are all-important polyunsaturated fats.

The growth of the market is driven by growing consumer awareness of the preventive benefits of omega-3 against chronic diseases such as heart disease, arthritis, and mental illness. Consumers in Australia are especially predisposed to preventive health, and as a result, demand for omega-3-fortified food, dietary supplements, and even pharmaceutical products has seen a major boost.

The market, however, is moving towards sustainable and plant-based sources of omega-3, like algae-based DHA and EPA, based on environmental factors and eating habits, including rising vegan and vegetarian consumers. The pediatrics segment is also contributing equally, with parents looking for children's cognitive health and immunity supplements containing omega-3.

Increased e-commerce and online health platform penetration have transformed the distribution environment to facilitate direct-to-consumer selling and raise the availability of premium omega-3 products.

Explore FMI!

Book a free demo

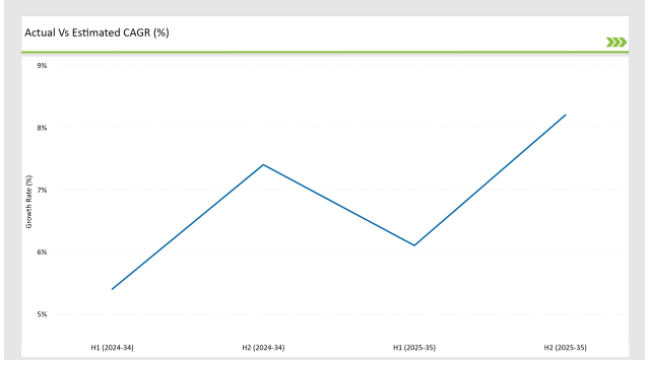

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the Australian Omega-3 market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Omega-3 sector is predicted to grow at a CAGR of 3.9% during the first half of 2025, increasing to 8.1% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 3.2% in H1 but is expected to rise to 4.7% in H2. This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian Omega-3 sector is evolving in response to changing client demands, regulatory developments, and advances in formulation technology. Increased research into Omega-3's health benefits, as well as advances in delivery modalities, are driving industry development.

Every six months, organizations in this fast-paced industry perform significant research to help them adapt their strategy, capitalize on market possibilities, and overcome obstacles. Firms should be very interested in these developments if they want to improve their products and stay competitive in the fast-expanding Omega-3 sector.

| Date | Development/M&A Activity & Details |

|---|---|

| 2023 | Blackmores Limited, one of Australia's leading health supplement businesses, launched a new series of sustainably sourced marine-based Omega-3 products. This new release was intended to satisfy increasing consumer demand for high-quality Omega-3 supplements. |

| 2023 | Polaris, an Omega-3 solutions company, was acquired by Cerea Partners, an investment firm headquartered in France. This acquisition was intended to bolster microalgae oil expertise and grow Polaris's global reach, including future expansion in the Australian market. |

Sensory-Neutral Omega-3: The Era of Taste-Optimized Supplements

The fishy aftertaste of traditional omega-3 products has long represented a roadblock to consumer compliance, especially within the Australian marketplace, where the sense of taste drives supplement consumers. Understanding the issue, suppliers are leading the way in the development of sensory-free omega-3 products that suppress taste and aroma entirely while leaving potency intact.

With microencapsulation, esterification, and advanced oil purification technology, companies now produce ultra-refined omega-3 supplements that easily pour into food and beverage without diluting taste profiles. The innovation is inducing the utilization of omega-3 in non-traditional areas such as effervescent tablets, dissolve-on-strip items, and sugar-free chews to simplify supplementing.

Moreover, sensory-neutral omega-3 is driving expansion in the pediatric nutrition category, with taste-sensitive children increasingly likely to take these healthy fatty acids without complaint. Increasing demand for plant-based sources of omega-3, including algal oil, is also benefiting from this trend as the sensory optimization process improves its marketability.

As taste-optimized products become more widely accepted, they are likely to boost consumer retention, enhance compliance, and increase the demographic penetration of omega-3 supplementation in Australia.

Cognitive Clarity: Nootropic Omega-3 for Mental Performance

With Australians placing ever-growing importance on mental wellness, demand for nootropic omega-3 supplements - tailored to strengthen cognitive ability, concentration, and stress resistance - is booming. While omega-3 has enjoyed a long-time reputation as good for the brain, advances in neuroscience have pushed the creation of nootropic-amplified blends of omega-3, using DHA combined synergistically with brain-enhancing nutrients like phosphatidylserine, L-theanine, and ginkgo biloba.

These supplements are particularly becoming in demand among students, working professionals, and the elderly who desire to have memory and brain speed. Clinical trials are being conducted in research laboratories in Australia to validate the use of omega-3 as a neuroprotection against diseases like Alzheimer's and dementia, thus validating its credibility for the realm of cognitive well-being.

As concerns about brain health optimization grow, the trend is poised to cement the position of omega-3 as a normative cognitive enhancement supplement in the Australian well-being market.

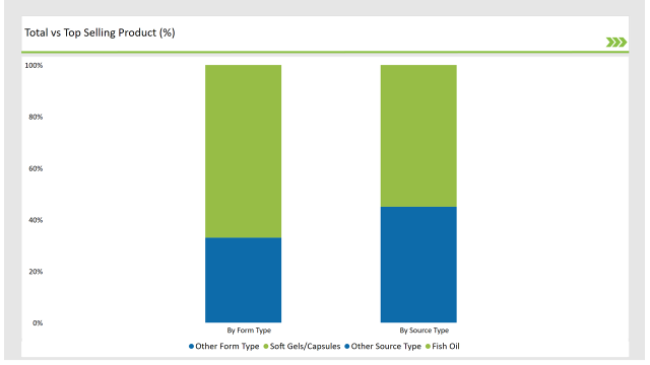

The fish oil category remains the gold standard for Omega-3 supplements, and its dominant position is sustained based on its unrivaled efficacy, scientific proof, and mass consumer confidence. Several decades of clinical studies have established fish oil as one of the most bioavailable and bioactive sources of EPA and DHA, thus being the most sought-after supplement by Australians who are concerned with heart, brain, and joint well-being.

This scientific support has made fish oil a household name in both general health and specific therapeutic uses, providing steady demand among various consumer groups, such as aging populations, athletes, and patients with chronic diseases.

Pharmaceutical and nutraceutical companies are capitalizing on the strong evidence for the efficacy of fish oil by developing advanced formulations with high-purity concentrates, odor-reducing technologies, and enhanced absorption methods. The demand for high-strength Omega-3 products has given rise to the emergence of triglyceride and re-esterified forms, which are more bioavailable compared to conventional ethyl ester forms.

With increased awareness among Australian consumers, they are migrating towards these potency products, making a trend towards purchasing high-quality fish oil supplements with clinically researched dosages.

Soft gels and capsules continue to dominate the Omega-3 industry due to their unmatched dosage precision, increased stability, and worldwide consumer acceptance of an established and reliable supplement form. As more Australians are becoming health-aware, supplements with consistent strength, ease of swallowing, and maximum absorption are in greater demand. Soft gels and capsules are best suited to these requirements therefore, they are most attractive to clients who desire an orderly approach to Omega-3 nutrition.

Some of the most effective growth drivers of this segment are pharmaceutical-grade encapsulation technology ensuring the efficacy of Omega-3 from production through consumption. The most recent capsule technology, which uses nitrogen-flushed encapsulation and oxygen-barrier coating, is used to prevent degradation and efficacy since oxidation makes omega-3 fatty acids unstable.

The technique assures consumers of the purity and therapeutic efficacy of nutritional supplements by ensuring their optimum shelf life.

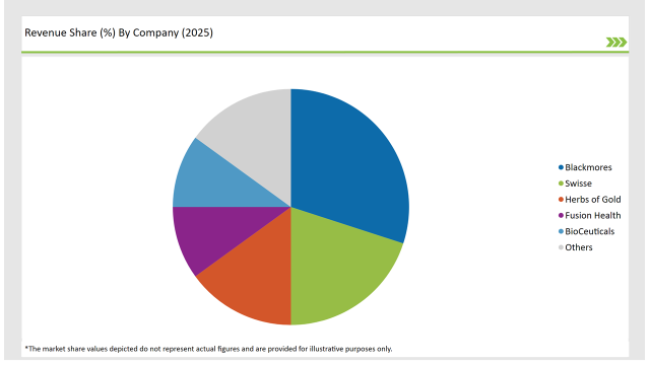

The Tier 1 segment of the Australian Omega-3 market is controlled by multinational pharmaceutical and nutraceutical majors, as well as established local brands that have entrenched themselves through extensive research-based product offerings and mass-scale distribution networks. These players establish industry benchmarks by heavily investing in clinical trials, cutting-edge formulation technologies, and regulatory affairs, ensuring their products retain superior efficacy and credibility. Their capacity to establish exclusive alliances with healthcare practitioners, pharmacies, and large retail chains provides them with a competitive edge, further solidifying their market leadership.

The Tier 2 category includes mid-sized firms and up-and-coming brands that compete based on product differentiation, niche marketing, and value pricing. In contrast to Tier 1 leaders who command through size and reputation, these players build themselves on distinctive value propositions, such as proprietary Omega-3 blends, alternative sources such as algae-based DHA, or bespoke formulations for specific lifestyle or dietary needs.

Tier 3 markets involve regional and small-volume companies, manufacturers, and specialty pharmacies selling to targeted populations or a specific region. These businesses thrive on highly specific formulas that usually reflect high-end natural supply chain management, craft manufacturing practices, or emerging Omega-3 configurations appealing to the health-sensitive seeking solutions targeting a particular market segment.

2025 Market share of Australian Omega-3 manufacturers

By 2025, the Australian Omega-3 market is expected to grow at a CAGR of 8.1%.

By 2035, the sales value of the Australian Omega-3 industry is expected to reach USD 403.7 million.

Key factors propelling the Australian Omega-3 market include omega-3’s expanding role in mental health and neuroprotection, pharma-grade high-potency solutions for chronic disease management, and omega-3 in veterinary health: expanding benefits to companion animals.

Prominent players in Australia Omega-3 manufacturing Blackmores, Swisse, Herbs of Gold, Fusion Health, Nutrigold, Polaris, Life Extension, GNC Holdings, Nature's Bounty, Valiant Australia Pty Ltd, and BioCeuticals, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various product types, such as Docosahexaenoic acid (DHA), Alpha-linolenic acid (ALA), and Eicosapentaenoic acid (EPA).

The industry includes various sources such as Fish Oil, Krill Oil, Algal Oil, Chia Seeds, and Flaxseeds.

The industry includes various form types such as Soft Gels/Capsules, Gummies, Powder, and Oil.

As per the application segment, the market is segregated into Dietary Supplements, Food & Beverages, Pharmaceuticals, and Pet & Animal Feed.

USA Prenatal Vitamin Supplement Industry Analysis from 2025 to 2035

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Microalgae in Fertilizers Market - Growth & Sustainability Trends 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Potato Flakes Market Analysis Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others End Use Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.