The Australian Mezcal market is estimated to be worth USD 2.5 million by 2025 and is projected to reach a value of USD 8.2 million by 2035, growing at a CAGR of 12.7% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size (2025) | USD 2.5 million |

| Projected Australia Value (2035) | USD 8.2 million |

| Value-based CAGR (2025 to 2035) | 12.7% |

The Mezcal market in Australia has been increasing steadily over the last few years. Consumers, particularly, seek unique, premium spirits that would give them not only a rich flavor but also cultural heritage attached to it. The spirit made from agave is Mezcal, a traditional Mexican spirit gaining popularity among the Australian consumers as they move away from conventional alcohol such as whiskey and vodka toward premium, artisanal options.

The growing craft cocktail culture, interest in experimentation and novel taste experiences, and increased interest in sustainable and transparent food and beverage production have all increased the popularity of Mezcal across bars, restaurants, and retail outlets in Australia.

In addition, the trend towards sustainability and transparency in food and beverage production resonates with many Australian consumers, and thus aligns well with Mezcal's traditional small-batch processes that are artisanal and authentic.

A rapidly growing awareness of agave-based spirits and wider Latin American culture influence also further contribute to Mezcal's growth. More entry brands to the market coupled with an Australian consuming audience willing to try something more adventurous positions the Mezcal market increasingly towards becoming a premium spirit, therefore creating scope in this Australian market, and thus going on expanding because demand is emerging for quality diversified drinking experiences.

Explore FMI!

Book a free demo

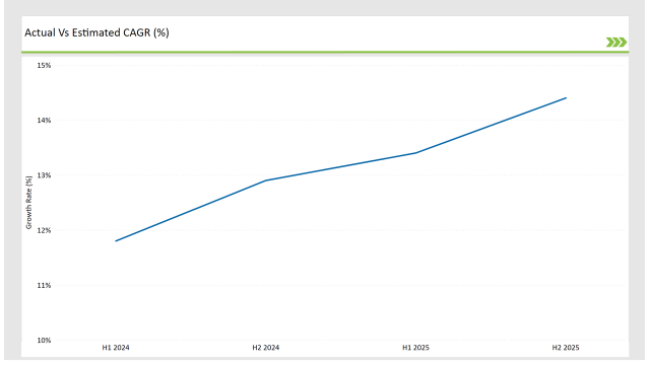

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Mezcal market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Mezcal sector is predicted to grow at a CAGR of 6.6% during the first half of 2025, increasing to 7.0% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 5.9% in H1 but is expected to rise to 6.4% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

These insights reveal that the Australian Mezcal market has been dynamic, changing, and evolving with preferences of consumers and innovations in markets and changes in industry regulations.

A semiannual analysis of the trends is indispensable for businesses interested in refining strategies, leveraging opportunities, and combating challenges in this competitive Mezcal sector. Only by understanding such factors can a company stay one step ahead of the market which values authenticity, creativity, and a premium drinking experience.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Madre Mezcal has added another product to its portfolio with Madre Tequila, an unaged blanco tequila that uses no additives. Made in conjunction with the Padilla family distillery in Jalisco, the 48% ABV spirit showcases the crisp, natural essence of agave and is sold online and through select fine spirit retailers. |

| 2023 | The Australian Mezcal market experienced a significant growth in the availability and popularity of agave spirits, such as Mezcal. The Australian spirits scene is dynamic and very innovative; thus, it welcomed these unique offerings, leading to a more considerable selection of Mezcals in retail and on-trade channels. This trend was acknowledged in a feature by The Australian, which recognized growing appreciation for agave distillates among Australian consumers. |

Craft Cocktail Evolution: Mezcal’s Rising Star in Australia’s Cocktail Scene

The cocktail culture in Australia is rapidly changing these days, shifting to more intricate, high-grade spirits that not only offer uniqueness but also offer a twist of the traditional beverages. Mezcal has carved a niche for itself in this aspect because of the bold, smoky flavor that distinguishes mezcal from others, such as tequila.

Mezcal has become a signature cocktail feature in many popular bars and restaurants in major cities such as Sydney, Melbourne, and Brisbane, and this has pushed growth within the hospitality sector. This is curving the trend of the Australian market, infusing Mezcal to be a premium variant of the classic spirits.

Because there are more customers seeking craft cocktails and bespoke drinking experiences, the increased demand for diversified and high-class drink offerings would benefit Mezcal. Inventive mixologists experiment with this spirit in not only traditional cocktails such as Margaritas but also in the newest concoctions such as a Negroni made with Mezcal or Smoky Mojitos to introduce Mezcal to Australians in all of its versatility.

Celebrity Endorsements and Brand Collaborations Expanding Mezcal’s Reach

Celebrity endorsements and brand collaborations have helped to propel a number of the alcohol categories throughout the world and are not a new phenomenon within the Australian Mezcal market, where over the last few years, several international celebrities and also Australian influencers adopted Mezcal for themselves by creating their own brand or collaborating with existing producers in order to spread the spirit.

This trend has proven successful in other markets, especially North America and Europe, where celebrity-driven campaigns have triggered new interest in agave spirits. Lifestyle appeals of celebrities along with their influence over consumer behavior are helping Mezcal become trendy and desirable to younger demographics more likely to be influenced by lifestyle appeals of celebrities.

% share of Individual categories by Product and Distribution Channel in 2025

Mezcal Joven: The Spark of Innovation Capturing Australia’s Spirit of Adventure

The Mezcal Joven, or young Mezcal, is becoming quite the leader in the Australian market because of its unique fresh and vibrant flavors paired with great versatility in premium cocktails and sipping experiences. Unlike the more aged varieties, such as Mezcal Reposado or Añejo, Mezcal Joven usually gets bottled right after distillation, the purest unaltered characteristics of the agave plant come alive in it.

Australia's cocktail culture, typified by a quest for new and adventurous experiences, fits nicely with the Mezcal Joven sector. Its lighter, smoother profile makes it a favorite base for experimenting in cocktails, especially in the emerging craft cocktail scene.

Australians, and in particularly their citizens in the larger cities, like Sydney and Melbourne, seek spirits that are new; Mezcal Joven serves this need with its introduction of versatility and complexity that is less intense than the aged varieties but is still distinctly agave-forward.

The Mezcal Moment: How On-Trade Channels Ignite Mezcal's Growth in Australia

The On-Trade channel, representing bars, restaurants, pubs, and hotels in Australia, has dominated Mezcal sales, thanks to the experience nature of the spirit and changes in drinking culture. The intricacy, exclusive flavor profiles, and artisanal origins of Mezcal are experienced most effectively through social channels by expert bartenders and crafted experiences to educate and encourage consumers.

The On-Trade channel in Australia is fueled by the craft cocktail culture. Sydney and Melbourne are now places of innovation in mixology, where bartenders are experimenting with premium spirits to create bespoke cocktails. Mezcal's smoky, earthy profile adds depth and intrigue to modern cocktail recipes, capturing the attention of adventurous drinkers.

Note: The above chart is indicative in nature

Tier 1 in the Australian Mezcal market is commanded by well-known global brands with high brand recognition within the premium spirits category, primarily Del Maguey, Montelobos, and Diageo's Mezcal. This is primarily due to a large network, strong brand equity, and powerful marketing channels.

Tier 2 brands include emerging Mezcal brands and regional players that gradually gain markets in Australia. They normally appeal to niche markets where, for example, small batch production, unique agave varieties, or quirky branding becomes a marketing angle.

Tier 3 is tiny, niche Mezcal producers and new entrants looking to get into the Australian market. Their brands are mainly targeting niche consumer groups such as craft spirit enthusiasts or those concerned with environmental sustainability. They will be found in select bars, boutique liquor stores, and online platforms with a localized or grassroots marketing strategy.

By 2025, the Australian Mezcal market is expected to grow at a CAGR of 12.7%

By 2035, the sales value of the Australian Mezcal industry is expected to reach USD 8.2 million.

Key factors propelling the Australian Mezcal market include expansion of mezcal in hospitality and retail channels, rising preference for unique tasting experiences, and expansion of mezcal in hospitality and retail channels.

Prominent players in Australia Mezcal manufacturing include Del Maguey, Agave Lux, Montelobos, Sombra Mezcal, El Silencio, Diageo, Mextrade, Destileria Tlacolul, MEZCAL CARRENO, Alipus Mezcal, and Rey Campero, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various product type such as mezcal joven, mezcal reposado, mezcal anejo, mezcal vidrio, and others.

The industry includes various sources such as espadin, tobala, tobaziche, tepeztate, arroqueno, and others.

As per the industry, the market is segregated into 100% agave mezcal, and blends.

The industry includes numerous distribution channel such as on-trade channel, and off-trade channel.

A detailed analysis of the Australia Licorice Root industry and growth outlook covering form, and application segment

UK Licorice Root Industry Analysis from 2025 to 2035

USA Licorice Root Industry Analysis from 2025 to 2035

USA Lactase Industry Analysis from 2025 to 2035

USA Snack Pellets Industry Analysis from 2025 to 2035

USA Monoprotein Industry Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.