The Australian Lactase market is estimated to be worth USD 41.8 million by 2025 and is projected to reach a value of USD 67.7 million by 2035, growing at a CAGR of 4.9% over the assessment period 2025 to 2035.

| Metric | Values |

|---|---|

| Industry Size in 2025 | USD 41.8 million |

| Value in 2035 | USD 67.7 million |

| Value-based CAGR from 2025 to 2035 | 4.9% |

Australian lactase market is referred to as the production, distribution, and use of lactase enzymes used in breaking down lactose-a milk and dairy product sugar-into galactose and glucose, hence making it digestible for an individual with lactose intolerance. The market includes different types of lactase-based products like dietary supplements, lactase enzyme drops, and dairy lactose-free food.

The growing health concern, coupled with heightened consumer awareness about digestive health and the benefits of lactose-free products, has propelled market growth. Moreover, the trend towards functional foods and tailored nutrition is extending the lactase enzyme uptake as the consumers actively look for foods that address particular nutritional requirements and health status.

Also, it is consistent with a trend across the world of consumers shying away from wellness and health, for which demand shoots up for natural, clean-label, and easily digestible food. Dairy companies are able to produce low-lactose and lactose-free dairy products due to lactase enzymes, boosting customer options and driving innovation in the food and beverages industry.

This innovation can be seen more specifically in creating lactose-free milk, yoghurt, cheese, and ice cream products, which have alternatives without diluting taste and nutritional content. Australian consumers are also increasingly becoming label-aware and are actively seeking out products supporting digestive health. This change in behavior has encouraged food makers to invest in high-end lactase formulations and new product launches, which have contributed further to market growth.

Explore FMI!

Book a free demo

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the Australian Lactase market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Lactase sector is predicted to grow at a CAGR of 3.5% during the first half of 2025, increasing to 5.3% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 2.9% in H1 but is expected to rise to 4.2% in H2. This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian lactase industry is dynamic and liquid as customer tastes change, laws evolve, and technology improves in natural enzyme products. Food safety regulations and labeling are changing in direct reaction to the manufacture and sale of lactase-derived products, requiring changes in compliance by manufacturers to ensure customer trust.

In addition, increasing demand for lactose-free and digestive wellness products indicates changing consumer tastes, driving innovation in lactase product and total product line creation. This market analysis is crucial to companies seeking to create successful strategies, take advantage of development possibilities, and comprehend the dynamics of Australia's emerging lactase industry.

| Date | Development/M&A Activity & Details |

|---|---|

| December 2024 | Norco Co-operative launched a new line of lactose-free flavored milks under the Minecraft brand, launching the brand in the Australian food and beverage industry. The single-serve milks in 375ml serving sizes, sold in flavors such as Choc Charger and Strawberry Slam, were created to provide healthy, lactose-free drinks for both kids and adults. |

| November 2024 | Kerry Group PLC launched NOLA® Fit and Ha-Lactase™ lactase solutions to meet the growing demand for lactose-free dairy products in Australia and New Zealand. The move is intended to help dairy producers develop lactose-free products that maintain authentic taste and texture while optimizing natural sweetness without the use of sugars. |

Probiotic-Enriched Lactase Supplements: Enhancing Digestive Health

The combination of lactase enzymes with probiotics offers a two-pronged approach: lactase breaks down lactose into easier-to-digest carbohydrates, and probiotics enhance the growth of beneficial bacteria. Synergy can enhance digestive comfort for lactose intolerant individuals as well as immune system function.

Australia's market is going towards multifunctional health products. To discover probiotic microbes that are in support of lactase, manufacturers are funding studies. Such a product addresses consumers who are mindful of their entire digestive system's health as well as those lactose intolerants. In Australia, there is increased consumer demand for holistic digestive health solutions.

Consequently, there have been developments of probiotic-enhanced lactase supplements, where lactase enzymes are combined with health-promoting probiotics. This blend is designed to not only assist in lactose breakdown but also encourage a healthy gut microbiome.

Expansion of Lactose-Free Artisanal Dairy Products: Catering to Gourmet Preferences

There is growing demand in Australia for gourmet and artisanal dairy products that happen to be lactose-free too. Consumers want high-end products like specialty ice creams, yogurts, and cheeses that are lactose-free without making any sacrifices when it comes to taste and quality.

Artisanal manufacturers are meeting this challenge by adding lactase enzymes into their classic formulas so that they can provide lactose-free variants of their premium products. This strategy preserves the true flavors and textures that sophisticated consumers demand, yet makes the products available to a wider market.

In addition to diversifying the range of products available within the Australian dairy industry, this trend is helping regional producers access a growing but niche market. Collaborations between lactase enzyme suppliers and specialist dairy manufacturers are fostering innovation and making quality of paramount importance at all times.

The fungal-derived lactase is gaining popularity due to its better ability to deliver consistent performance across a broad spectrum of applications and production conditions. Compared with lactase from bacteria or yeast, fungal lactase enzymes, particularly those from Aspergillus oryzae and Aspergillus niger, have a broader operating pH range.

This adaptability makes them very valuable for use in acidic as well as neutral conditions, allowing manufacturers to add them to a wide variety of dairy as well as non-dairy foods. In the Australian market, where consumer preference is shifting toward specialty dairy foods and lactose-free products, this is an especially valuable asset.

Fungal lactase's ability to thrive at different pH levels enables efficient lactose hydrolysis in foods such as yogurt, processed cheese, and flavored milk beverages without modifying flavor, texture, or nutrient value. Fungal lactase's superior heat resistance ensures that it remains active even upon exposure to high-temperature treatment, making it more efficient at producing shelf-stable, lactose-free dairy products.

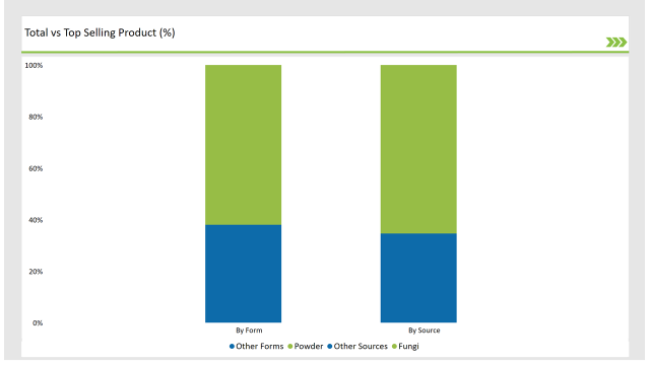

The powdered lactase has a dominance in the Australian market due to its unrivaled versatility and ability to maintain enzyme stability under a wide array of applications. Powdered state offers manufacturers more flexibility such that they can introduce lactase to a large number of dairy and non-dairy foods to provide assurance for the functionality of the enzyme throughout the manufacturing process as well as during storage.

It is the best option for producers who would like to keep production simple without sacrificing enzyme performance because of being in a dehydrated state, which not only facilitates exact measurement but also minimizes degradation over time. Such constancy of action is needed to enable consistent lactose hydrolysis across a large range of milks from the powders all the way down to other specialized nutritional products.

In contrast with solutions, powered lactase has no difficulty adding to dry blend and thus adding to dairy foods without any complications prior to their reconstitution.

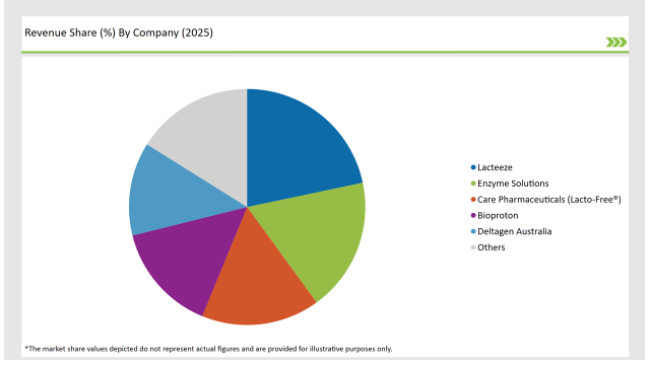

Tier 1 -companies in the Australia's lactase industry stand out for its extensive activities, strong technical foundations and market management. Their ability to produce lactase enzymes for the application has helped them get a large market share. Their management is based on an increase in R&D expenses, enabling them to offer enzyme products that correspond to the developed needs of end users and industrial producers. These companies maintain their own supply chain in the companies to have good quality control and guaranteed delivery of goods.

With their technical expertise and value addition on enzymes, Tier 2 producers have extremely powerful middle position in the Australian lactase market. These companies are able to effectively provide custom lactase products with correctly manufactured products to specialty customers despite not being able to dictate the large economies of scale where they specialize.

These companies possess most companies' ideals of responsiveness and speed of response, which enable them to quickly react to developing trends and market needs. Their lactase solutions intended for application in dairy-like soy foods, nutraceuticals, and lactose-free functional beverages put them in a good position.

Tier 3 players comprise a diverse set of niche innovators and new entrants with expertise in specialized and localized niches of the Australian lactase market. Their target is mostly small-scale dairy farmers, specialist food companies, and DIY lactose-free items for individual purchase. Their key competitive strength is offering differentiated, application-specific lactase products which cater to new dietary fads and personalized nutrition.

2025 Market share of Australian Lactase manufacturers

By 2025, the Australian Lactase market is expected to grow at a CAGR of 4.9%.

By 2035, the sales value of the Australian Lactase industry is expected to reach USD 67.7 million.

Key factors propelling the Australian Lactase market include Increasing Shelf Space for Lactose-Free Dairy, Expanding Lactase Use in Digestive Supplements, Incorporating Lactase in Fortified Dairy Alternatives, and Increasing Adoption of Lactose-Free Ingredients.

Prominent players in Australia Lactase manufacturing include Lacteeze, Enzyme Solutions, Care Pharmaceuticals (Lacto-Free®), Bioproton, Chr. Hansen Holding A/S, Kerry Group PLC, Norco Co-operative, Custom Enzymes, Renzym Australia, Bioproto, and Deltagen Australia, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various sources, such as Fungi, Bacteria and Yeast.

The industry includes various forms such as Powder, Liquid, and Others.

As per the grade segment, the market is segregated into Food-grade, and Feed-grade.

As per the application segment, the market is segregated into Dairy Products Manufacturing, Infant Formula Production, and Beverage Processing.

USA Prenatal Vitamin Supplement Industry Analysis from 2025 to 2035

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Microalgae in Fertilizers Market - Growth & Sustainability Trends 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Potato Flakes Market Analysis Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others End Use Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.