The Australian Instant Dry Yeast market is estimated to be worth USD 142.7 million by 2025 and is projected to reach a value of USD 265.8 million by 2035, growing at a CAGR of 6.4% over the assessment period 2025 to 2035

| Metric | Values |

|---|---|

| Industry Size in 2025 | USD 142.7 million |

| Value in 2035 | USD 265.8 million |

| Value-based CAGR from 2025 to 2035 | USD 6.4% |

The Australian market for instant dry yeast is defined as the production, distribution, and consumption of a type of specialized baker's yeast that has been dehydrated and treated to enable it to activate immediately without first having to be proved. The yeast is widely used throughout the bakery industry for bread, pastry, and other products that use yeast as a leavening agent because it can be stored with a long shelf life, can be easily stored, and rapidly ferments.

In contrast to active dry yeast, which needs to be dissolved in water prior to use, instant dry yeast can be added to dry ingredients and hence is extremely convenient for commercial as well as home bakers. The Australian market for instant dry yeast is an important segment of the larger baking ingredients market, fueled by consumers' quest for ease, the increasing popularity of home baking, and food manufacturers' and bakeries' industrial production needs.

The importance of the instant dry yeast market in Australia lies in the nation's highly developed food and beverage industry, where bread and bakery items have a high percentage of daily consumption. The market caters to a broad spectrum of industries, from commercial-scale baking operations to craft bakeries and the increasing home-baking sector.

The growth in demand for organic and natural baking options has also driven innovation in yeast products, such as clean-label and preservative-free versions. In addition, the growth in health-conscious consumer trend has increased demand for whole-grain, gluten-free, and specialty bread, in which instant dry yeast is an important factor for delivering consistent quality and texture.

Explore FMI!

Book a free demo

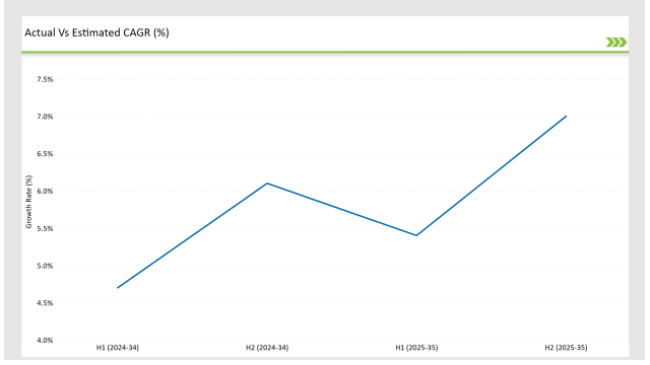

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the Australian Instant Dry Yeast market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Instant Dry Yeast sector is predicted to grow at a CAGR of 5.0% during the first half of 2025, increasing to 6.4% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 4.5% in H1 but is expected to rise to 5.6% in H2. This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian Instant Dry Yeast industry keeps changing as a result of diverse circumstances, ranging from regulatory environments, changing customer needs, to innovation in nature-based feed options. These pressures significantly influence shaping market trends, spurring innovation, and enhancing sustainable solutions. Companies can optimally leverage market growth and compete by keeping current with regulatory issues and consumer tendencies. This business plan is essential to navigating the complexities of the Instant Dry Yeast industry and obtaining long-term commercial viability.

In 2024, Angel Yeast's unveiled its novel product i.e. FrozDo Instant Dry Yeast, a specially designed frozen dough application product. This product has outstanding freeze resistance, which is essential in keeping the dough stable during freezing and long-term storage. The conventional yeast tends to lose its fermentation ability after extended freezing, resulting in unequal quality of the product.This innovation is especially valuable for commercial bakeries and food processors in Australia who use frozen dough to streamline operations and minimize labor costs.

Healthy Baker has grown to be a reputable brand that offers all manner of baking ingredients, including quick dry yeast. The yeast, which comes in 500g packs, seeks to enhance the baking experience for both home bakers and commercial bakers. The product can be purchased in a range of places, ranging from online stores like Mama Alice and eBay, so it is easy for bakers in all parts of Australia to include it in their recipes.

Rise of Artisanal Baking: Crafting Authenticity with Instant Dry Yeast

The increasing requirement for premium instant dry yeast products is specially designed to meet the needs of craftsmen baking. To end this, manufacturers develop yeast variants that improve the taste and stability of handmade bread and pastry. In response, companies produce variants of yeast that increase the quality of handmade bread and pastry. On the other hand, the establishments of small -scale bakery and home companies increases the amount of consumers, causing more retail of dry yeast.

This change not only increases sales, but also increases innovation when companies try to meet the sophisticated requirements for artisan backers. In recent years, there has been a strong consumer's tendency for craftsman bread in Australia. It's about maintaining all traditional bread methods, quality materials and innovative flavor combinations. Immediate dry yeast is central to this trend because it provides continuity and convenience without compromising the authenticity of craftsmen wanting bakers.

Expansion of Plant-Based and Vegan Baking: Yeast as a Key Ingredient

The growing popularity of vegan and plant-based diets in Australia has resulted in a higher demand for baking ingredients that complement these lifestyles. Instant dry yeast, which is natively vegan, has become the preferred ingredient in plant-based baking. Its nature allows for the creation of a wide range of vegan-friendly baked goods, including breads and pastries. This trend affects the market by increasing the consumer base for instant dry yeast.

Producers are taking advantage of this by selling their yeast products directly to vegan and health-conscious consumers. Additionally, partnerships between yeast producers and plant-based food producers are on the rise, resulting in the creation of innovative baking products to serve this demographic. The focus on health and well-being inherent in vegetarian diets also leads to the development of yeast products with increased nutritional content, including fortified vitamins and minerals.

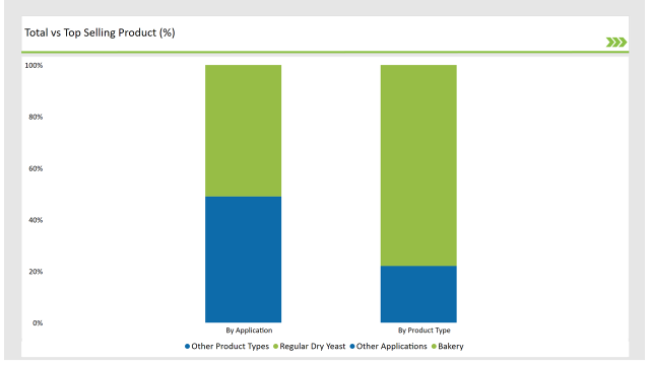

The regular dry yeast category dominates the Australian instant dry yeast market based on its high degree of versatility, value for money, and consistency in producing baking outcomes across a wide range of applications. This type of yeast is both popular among industrial-scale bakeries and domestic bakers alike because it has a long shelf life and is convenient to use, hence posing as a consistent choice in ensuring product quality over time.

Large commercial bakeries require ingredients that provide consistent performance at high levels, and common dry yeast accomplishes this through dependable fermentation rates and storage life. With the foodservice market increasing day by day, particularly in the café and quick-service bakery segments, dry yeast remains the preferred leavening agent due to its ability to aid quick production cycles without compromising on the quality of the product.

The bakery application sector dominates the instant dry yeast market in Australia, owing to rising demand for high-quality, diverse baked goods that respond to changing customer preferences. This development is driven by a cultural shift, with fresh, high-quality bakery items now being part of the daily eating patterns. Large and small bakeries depend on this yeast because it can provide consistent fermentation, a key component in the production of all types of baked goods, from gourmet pastries and artisan bread to the daily requirements of sandwich loaves and rolls.

Australia's emerging cafe culture is moving forward in bakery innovation. With its rich coffee culture, you focus on offering fresh baked, yeast housing accessories such as brioche, and savory cakes along with special beverages. It has urged the bakers to upgrade their offers to experiment with new products and to fulfill customers seeking craftsman experiences. The requirement for consistent and skilled yeast allows the bakery to maintain a production program and offers a better quality end product.

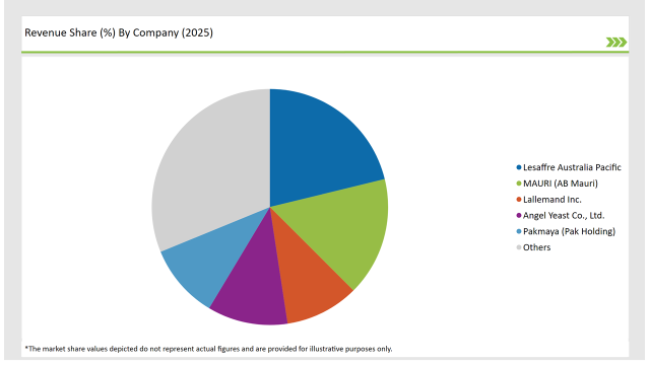

Tier 1 players in the Australian instant dry yeast industry are characterized by their large-scale production capacity, strong distribution channels, and established brand reputation. These global players command a large market share through the use of sophisticated yeast fermentation technologies and economies of scale.

Tier 2 players occupy a key middle ground in the Australian instant dry yeast market, balancing competitive price and product differentiation on a tightrope. Tier 2 players focus on specialty lines of products, such as organic formula yeast or yeast especially for specialized uses in baking such as whole grain or gluten-free.

Tier 3 firms in the Australian instant dry yeast market are smaller in scale and focus on very specialized or local market niches. They supply local bakeries, independent retailers, and health-oriented customers seeking non-GMO, biodynamic, or custom-fermented yeasts. Their smaller size allows them to try out new manufacturing processes and react quickly to customer feedback.

2025 Market share of Australian Instant Dry Yeast manufacturers

By 2025, the Australian Instant Dry Yeast market is expected to grow at a CAGR of 6.4%.

By 2035, the sales value of the Australian Instant Dry Yeast industry is expected to reach USD 265.8 million.

Key factors propelling the Australian Instant Dry Yeast market include Product Innovation Meeting Diverse Culinary Preferences, Café-Driven Pastry Demand Accelerating Yeast Usage, Yeast Performance Enhancements Supporting Large-Scale Production, and Home Baking Surge Driving Yeast Consumption.

Prominent players in Australia Instant Dry Yeast manufacturing include Lesaffre Australia Pacific, Honest to Goodness, Bake and Brew, Angel Yeast Co., Ltd., Healthy Bakers, MAURI (AB Mauri), Lallemand Inc., Angel Yeast Co., Ltd., Farm Fresh Organics, and Pakmaya (Pak Holding), among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various product type, such as Regular Active, Premium Active, and Rapid-Rise.

The industry includes various applications such as Bakery, Food Service/QSR, Food Processing, and Retail/Household.

As per the distribution channel segment, the market is segregated into Direct Sales/B2B, Distributors/Wholesalers, Retail Stores, and Online Stores.

USA Prenatal Vitamin Supplement Industry Analysis from 2025 to 2035

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Microalgae in Fertilizers Market - Growth & Sustainability Trends 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Potato Flakes Market Analysis Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others End Use Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.