The Australian Hydrolyzed Vegetable Protein market is estimated to be worth USD 5.9 million by 2025 and is projected to reach a value of USD 22.5 million by 2035, growing at a CAGR of 14.3% over the assessment period 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size (2025) | USD 5.9 million |

| Projected Australia Value (2035) | USD 22.5 million |

| Value-based CAGR (2025 to 2035) | 14.3% |

The Hydrolyzed Vegetable Protein (HVP) market in Australia is mainly driven by the growing demand for plant-based protein ingredients across the food sectors. HVP, made by hydrolysing vegetable proteins-from soy, wheat, or corn-experiences a breaking down into smaller peptides and amino acids, thus enhancing its flavor properties and making it easily digestible.

In Australia, it is influenced by growing consumer interest in plant-based diets and by growing awareness in the sustainable food sourcing and healthy eating habits.

HVP is commonly used in the form of flavor enhancer, seasoning and meat substitute, which is mostly applied in a number of ready-to-eat meals, snacks, soups, sauces and others. In Australia, it has tremendous relevance in the true sense because of its adaptability, nutritional profile, and potential for making plant-based alternatives more appealing.

As consumer tastes change towards better and healthier food decisions that are also sustainable, HVP is expected to drive growth, setting it up as a key player in the new Australian

Explore FMI!

Book a free demo

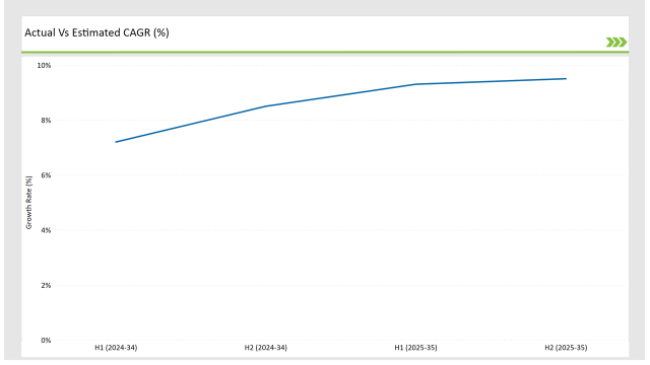

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Hydrolyzed Vegetable Protein market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Hydrolyzed Vegetable Protein sector is predicted to grow at a CAGR of 14.3% during the first half of 2025, increasing to 15.5% in the second half of the same year.

In 2024, the growth rate is anticipated to slightly decrease to 11.1% in H1 but is expected to rise to 13.5% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The given insights outline the fast-changing nature of the Australian Hydrolyzed Vegetable Protein market, which is influenced by an array of factors such as shifts in consumer preference, changes in regulatory conditions, and food processing innovations.

It is essential to have a bi-annual overview for businesses interested in understanding the dynamics of the market and how to position themselves to benefit from the growth. It keeps companies updated with the trends in the HVP sector, so they can understand the complexity and opportunities in the development of the product, its distribution, and consumer engagement.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Ajinomoto strengthens Australian presence with acquisition of local HVP distributor. The move also fits in with Ajinomoto's general global strategic expansion plan, whereby it has been heavily investing in key markets to establish the company as a leading provider of innovative food ingredients. Australia represents a situation in which, on the back of its established skills in producing HVP and a good sense of the marketplace, the firm stands to realize high returns because the demand for savory, umami-rich flavor enhancers continues to grow. |

| 2023 | Tate & Lyle Plc. supports Australian presence with acquisition of leading HVP manufacturer. By deepening its reach in the Australian market, the company is doing more than merely solidifying its position as one of the top providers of specialty food ingredients: it is also positioning itself to take advantage of the country's shifting consumer patterns and the rising role of HVP as an all-purpose flavor enhancer. |

Emerging Flavor Innovations: Unlocking the Versatility of HVP

The Australian HVP industry has discovered an expanding number of unique flavor applications, which are fueled by ever-changing local tastes and preferences. With more Australians seeking various and engaging taste experiences, food makers use HVP's adaptability to create new flavor profiles that meet evolving consumer preferences.

One of the leading trends is adding HVP into ethnic and fusion cuisines. Australian consumers tend to be open to internationalized food types. Food companies react to this and add HVP to dishes with a combination of traditional Australian recipes and international influences. A new trend in HVP is a focus on individual and customized food experiences.

Consumers want products tailored to their tastes, and with its ability to enhance and modulate flavors, HVP proves invaluable for the manufacturers. Thus, by introducing products infused with HVPs having unique flavor profiles, the company can easily benefit from this rising trend toward personalization, making the consumers have a better, more individual dining experience.

Expanding Use of HVP in Convenience Foods and Ready Meals

The rising demand for convenience foods and ready-to-eat meals in Australia is fueled by busy lifestyles along with the increasing need for quick nutritious food solutions. This has led to increased demand for meal kits, frozen foods, and on-the-go snack products because consumers are trying to streamline the process of meal preparation without sacrificing nutritional content.

Hydrolyzed Vegetable Protein is important in these products because it improves the flavor, texture, and protein content of the food product, thus making it more attractive to the consumer who wants to have a convenient, high-protein meal.

As the demands of Australian consumers continue to evolve towards healthier yet easy-to-carry meal solutions, HVP usage is rapidly increasing in ready-to-eat meals, soups in packages, sauces, and frozen foods. The fact that it adds a savory, rich umami flavor, without needing additional artificial seasonings or complex additives, makes it an ideal component for these products.

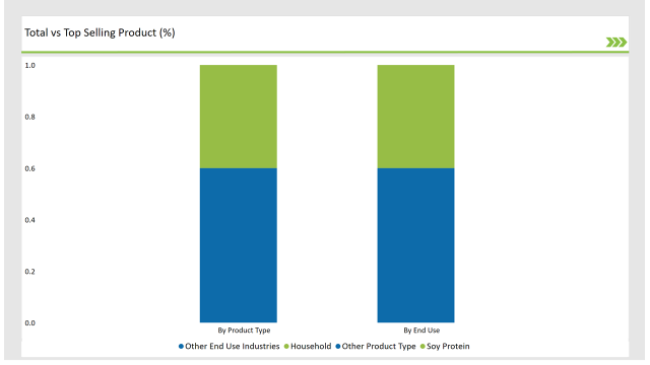

% share of Individual categories by Product Type and End Use in 2025

Chunking It: The Rising Popularity of HVP in Chunk Form

The chunk segment in the Hydrolyzed Vegetable Protein (HVP) market is driven majorly in Australia because of the growing demand in plant-based meat alternatives and ready-to-eat meals. The Australian consumers are increasingly demanding varied and protein-rich food that would have an almost similar feel, taste, and mouthfeel of traditional meat products. HVP in chunk form fills that need exactly, a product that mimics the texture of meat but is plant-based and high in protein.

This form of HVP is ideal for manufacturers in the vegan and vegetarian food sectors looking to create products with a more authentic meat-like experience. In addition, HVP chunks can easily fit into Asian and Mediterranean culinary associations for most Australian consumers who are increasingly interested in diverse and interesting flavors.

Soy Protein: Leading the Charge in Australia's Vegetable Protein Evolution

Another factor contributing to soy protein market domination is its functionality. It is an excellent ingredient in the formulation of plant-based meat products, vegan dairy alternatives, protein bars, and fortified ready meals in the Australian food industry.

Its great flexibility from flavor-neutral taste to simulated meat texture makes it the hub for manufacturers searching for something to meet the growing demand for plant-based and high-protein foods. In Australian food industry, particularly, this is the trend for soy-based food products, that is, in plant-based meat substitutes, dairy alternatives, protein-enriched snacks, gaining significant market value.

Soy protein, especially when hydrolyzed, is extremely digestible too, so an optimal source of nutrition for everybody with different nutritional preferences, focused on muscle recovery, weight management, or more general health requirements.

Note: The above chart is indicative in nature

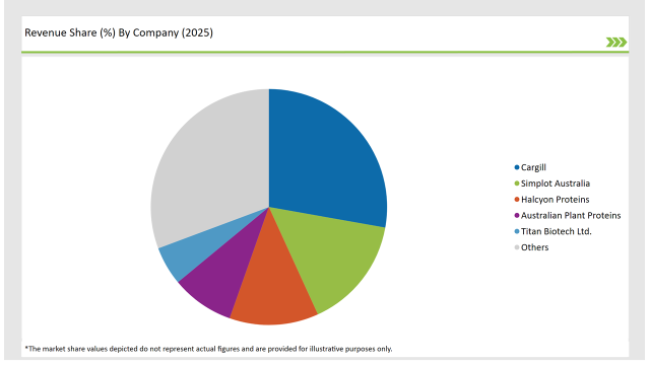

Tier 1 companies have a strong global presence with good manufacturing and distribution capabilities in the Australian Hydrolyzed Vegetable Protein (HVP) market. Their leadership stems from extensive product portfolios, well-established supply chains, and huge investments in R&D for innovation in ingredients.

Tier 2 players in the Australian HVP market are regional key players and specialized manufacturers making their product offering tailored to the local market. Many of these players maintain a healthy relationship with the manufacturers of Australian food products, taking regional expertise and knowledge to tackle specific preferences of the Australian consumer, especially in the emerging plant-based protein segment.

The smaller, local players and emerging firms that make up Tier 3 companies in the Australian HVP market are carving out niches in plant-based protein and food ingredients. Generally, highly specialized, smaller batch products or unique formulations appeal to small consumer segments. Examples include Solvay and other startups developed in Australia.

By 2025, the Australian Hydrolyzed Vegetable Protein market is expected to grow at a CAGR of 14.3%.

By 2035, the sales value of the Australian Hydrolyzed Vegetable Protein industry is expected to reach USD 22.5 million.

Key factors propelling the Australian Hydrolyzed Vegetable Protein market include growing appetite of Australian consumers for diverse and bold flavor experiences, shift towards the development of specialized dietary and functional food products, and Innovations in processing techniques, ingredient sourcing, and product development are enabling Australian manufacturers to create more sophisticated and differentiated HVP-based offerings.

Prominent players in Australia Hydrolyzed Vegetable Protein manufacturing include Cargill, Simplot Australia, Halcyon Proteins, Australian Plant Proteins, Titan Biotech Ltd. Tate & Lyle Plc, Ajinomoto Co., Inc. Australian Plant Proteins, Ingreland, and Akola Chemicals (I) Limited among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

As per the form, the segment is bifurcated into chunks, slice, flakes, and granules

The industry includes various source type such as soy protein, wheat protein, pea protein, rice protein, chia protein, flax protein, corn protein.

The industry includes various end use industries such as household, commercial, food industry, and animal feed.

The industry includes numerous distribution channel such as direct channel and indirect channel.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.