The Australia herbs and spices market is estimated to be worth USD 5,352.1 million by 2025 and is projected to reach a value of USD 6,999.1 million by 2035, growing at a CAGR of 2.7% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size in 2025 | USD 5,352.1 million |

| Projected Australia Value in 2035 | USD 6,999.1 million |

| Value-based CAGR from 2025 to 2035 | 2.7% |

The herbs and spices market in Australia is inevitable for the food and health sectors as they present an ingredient from where flavoring can be improved and provide natural health benefits. Increasing interest in organic and healthy food trends in Australia has further increased demand for herbs and spices that offer functional properties such as anti-inflammatory or digestive and other health benefits.

The market ranges between local Australian herbs including bush tucker and international spices like turmeric and cumin. Local farmers are integrating more sustainable farming practices in order to meet the consumer's demand for ethically sourced, organic products.

Moreover, as more Australians start home cooking and where people catch up with the trend of food as medicine , people look for herbs and spices for flavor but also to support wellness. On an economic outlook, the growth trend of Australia in herbs and spices is impressive as more individuals engage in consumption with ethnic-based foods and uptake in plant-based diet uptake. Demand locally also benefits in terms of good quality product and export out because of strength demand both nationally and internationally.

Explore FMI!

Book a free demo

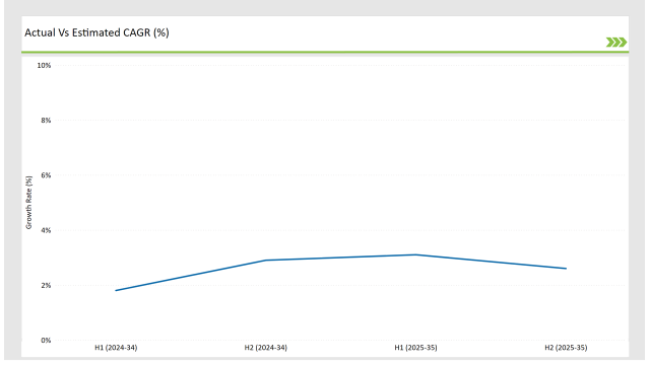

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australia herbs and spices market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Herbs & Spices sector is predicted to grow at a CAGR of 1.8% during the first half of 2025, increasing to 2.9% in the second half of the same year. In 2024, the growth rate is anticipated to slightly increase to 3.1% in H1 but is expected to decrease to 2.6% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

These figures reflect a dynamic marketplace for Australian herbs and spices, susceptible to factors like shifting trends in consumer preferences, changing regulations, and continuous innovation of natural flavoring and coloring solutions.

It is a comprehensive, semiannual analysis designed to enlighten businesses seeking to adapt to these market trends, exploit emerging trends, and present challenges that characterize a moving industry. Such drivers of change have allowed companies to position themselves effectively for growth and have helped companies understand the nuances in the Australian herbs and spices sector.

| Date | Development/M&A Activity & Details |

|---|---|

| 2023 | Australian company Mingle Seasoning has launched a new seasoning inspired by the retro Light & Tangy flavor of chips. Since the new seasoning combines onion, tomato, and paprika in a classic combination to remind people of the nostalgic flavor without added sugars or artificial enhancers, it immediately received much attention at launch. Consumers are looking for healthier snack flavors to replace the ones they have been enjoying traditionally. |

| 2022 | The Solina Group, a France-based company, purchased Saratoga Food Specialties, a USA company that specializes in custom seasoning blends. Although this is an international acquisition, it has an impact on the Australian market because international companies often affect the local offerings by expanding product lines and distribution channels. |

Increased Popularity of Indigenous Australian Herbs

Australian herbs have gained acceptance in the food and health market due to an increased demand from consumers who want a more unique taste that is also native and comes with functional health benefits. Flavors such as Kakadu plum, wattle seed, and lemon myrtle were once associated with niche culinary experiences but are now gaining widespread use in Australian cooking. It's a move inspired by both authentic, native flavors and health benefits, since most of these herbs are known to be superfoods.

Australian cuisine is changing due to the addition of local herbs to all manner of everyday food products-from sauces and marinades to teas and health supplements. Interest in the food culture and history of local produce has prompted chefs and food manufacturers to explore the possibilities with native plants, which they frequently combine with others to produce fusion products to satisfy the eclectic culinary landscape of Australia.

Fusion of International Spices in Australian Home Kitchens

Rising cultural diversity in Australia and a heightened interest in cooking at home have seen the rise in usage of international herbs and spices. Spices from Southeast Asia, the Middle East, and Mediterranean regions are becoming staple items in Australian kitchens. This trend can very well be seen with the advancement of cooking challenges, food bloggers, and dishes that are widely streamed on social media.

This trend has really shifted consumer spending, making a little more Australian spice sellers sell multiple spicy products. In addition, this demand for spice blends categorized according to a specific cuisine, such as Indian, Thai, and Mexican, would make further inroads into innovation in the market, where brands are introducing pre-mixed spice kits to busy consumers.

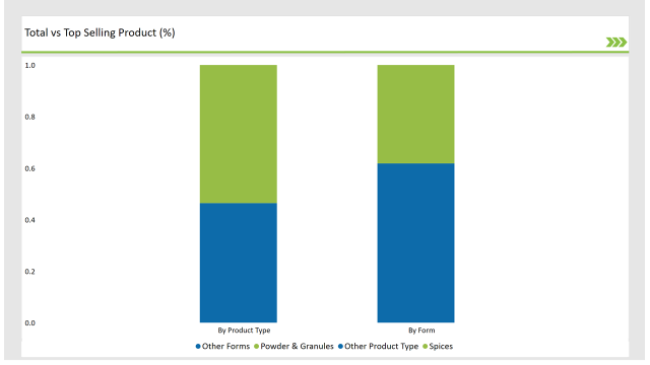

% share of Individual categories by Product Type and Form in 2025

The spices product type segment is dominating the Australian herbs and spices market through an unusual convergence of consumer preference, culinary exploration, and health-driven demand. It is quite evident that Australians increasingly look for varied bold flavors in their everyday meals in both homes and foodservice.

There are several reasons for the shift in interest toward spice over traditional herbs that propel the segment into market dominance. As the multicultural population grows in Australia, there is an increased need to re-create authentic high-quality spices from these international dishes at home. Local chefs and other influencers again tend to accelerate this trend with spice-centric recipes that foster creativity in flavor discovery.

The Australian herbs and spices market is led by the powder and granules segment, primarily because of rising demand for convenient, versatile, and health-enhancing products that keep pace with hectic, health-oriented lifestyles. The type of spice in question is both easier to store and more accessible for modern consumers to whom efficiency matters not at the cost of flavor or health.

With Australians cooking more at home and meal prepping, powdered and granulated spices are easily added to dishes without grinding or further preparation. This is particularly important for busy households or those seeking fast, flavorful solutions.

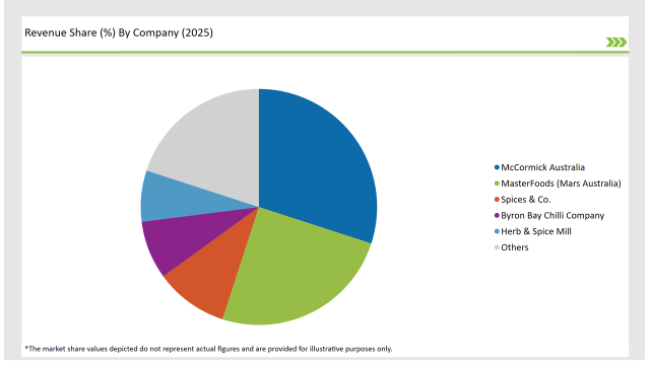

2025 Market share of Australia Herbs & Spices manufacturers

Note: The above chart is indicative in nature

Tier 1 of the Australian herbs and spices market consists of the leading, established players with strong distribution networks, recognized brands, and a broad product line. These companies include global brands with a large presence in Australia and the largest local players.

Tier 2 players in the Australian herbs and spices market consist of regional, mid-sized companies and innovative brands targeting niche markets. Such players usually specialize in organic, artisanal, or functional spice offerings. Regional producers can be specialized in native Australian herbs or offer high-quality, small-batch spice blends.

Tier 3 players will be smaller emerging players in the Australian herb and spice market. The brands that operate on a more localized level are usually offering artisanal, handcrafted, or boutique herb and spice products and might even focus on very specific market niches like small-batch, organic, or locally sourced herbs.

By 2025, the Australian Herbs and Spices market is expected to grow at a CAGR of 2.7%.

By 2035, the sales value of the Australian Herbs and Spices industry is expected to reach USD 6,999.1 million.

Key factors propelling the Australian Herbs and Spices market include growing interest in native Australian herbs and spices, rising popularity of multicultural and ethnic cuisines, and evolving consumer palates toward bold and unique flavors.

Prominent players in Australia Herbs & Spices manufacturing include McCormick Australia, Master Foods (Mars Australia), Bulk Spices Australia, Byron Bay Chilli Company, Herb and Spice Mill, Mingle Seasoning, Solina Group, Spice & Co., Herbie's Spices, Oostra Spices, Whittingtons, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various forms of Herbs & Spices such as powder/granules, flakes, paste, and whole or fresh.

The industry includes various source type such as coconut, almond, soy, corn, and others.

The industry includes different end use industries such as food, beverage, foodservice, and retail sales.

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

USA Aqua Feed Additives Market Analysis from 2025 to 2035

Comprehensive Analysis of Europe Fish Meal Market by Product Type, Application, Source, and Country through 2035

Comprehensive Analysis of ASEAN Fish Meals Market by Product Type, by Application, Source, and Region through 2035

A Detailed Analysis of Brand Share Analysis for Fungal Protein Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.