The Australian Fruit Snacks market is estimated to be worth USD 280.2 million by 2025 and is projected to reach a value of USD 545.2 million by 2035, growing at a CAGR of 6.9% over the assessment period 2025 to 2035.

| Metric | Values |

|---|---|

| Industry Size in 2025 | USD 280.2 million |

| Value in 2035 | USD 545.2 million |

| Value-based CAGR from 2025 to 2035 | USD 6.9% |

The Australian market for fruit snacks covers a spectrum of packaged food products consisting of real fruit, fruit concentrates, or fruit flavors. The Australian fruit snacks constitute dried pieces of fruit, bars of fruit, fruit leathers, gummies, and several other fruit desserts. Fruit snacks, in general terms, are described as a quick and healthier alternative to conventional candy. They are poised to fulfill the needs of both health-conscious consumers and consumers looking for fast and convenient options.

With emphasis on natural ingredients, lower sugar levels, and functional attributes such as added vitamins, fiber, and organic certification, the Australian market has transformed to address changing consumer demands. The market is driven by increasing consumer awareness of nutrition and the demand for clean-label offerings, particularly among parents seeking healthier snack foods for children and active consumers.

Growing health consciousness among consumers in Australia has translated to a departure away from high-level processed food items and a push towards health-focused and naturally procured ones. Fruit snack has been in accordance with the current trend by typically being sold with labels as "100% fruit," "no added sugar," or "filled with vitamins."

Furthermore, an escalating disease occurrence of diet-caused disease has fueled sales growth for controlled-size and fortified products. The government policies of the Australian public health, for example, encouraging healthier eating by measures like the Health Star Rating scheme, have continued to propel consumers in this direction towards healthier-for-you snacking.

Explore FMI!

Book a free demo

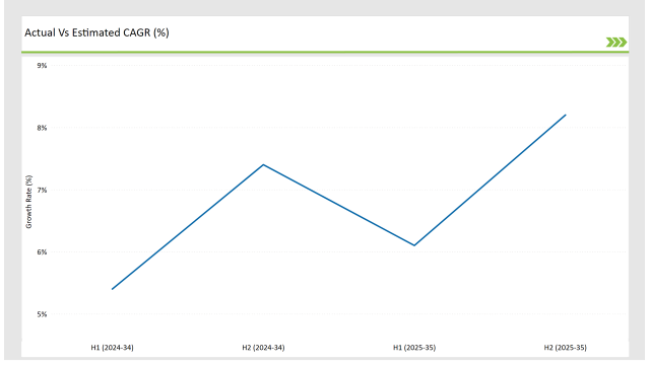

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the Australian Fruit Snacks market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Fruit Snacks sector is predicted to grow at a CAGR of 6.1% during the first half of 2025, increasing to 8.2% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 5.4% in H1 but is expected to rise to 7.4% in H2. This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian fruit snacks industry is evolving owing to changing consumer tastes, regulatory modifications, and innovation in natural ingredient technologies. These forces inform market dynamics that drive product innovation and competitive actions. Monitoring market development every two years is essential for companies to leverage new opportunities and overcome challenges. This comprehensive evaluation assists companies in refining their strategy, align with evolving customers' expectations, and comply with regulatory requirements to remain competitive in a dynamic economy.

| Date | Development/M&A Activity & Details |

|---|---|

| December 2024 | Snack brand Nibblish launched a range of half-dipped fruit items, which brings the natural sweetness of dried fruits together with a chocolate top. This assortment was made available solely in Woolworths supermarkets throughout Australia, providing consumers with a healthier pleasure alternative. |

| September 2023 | An Australian company I Am Grounded (IAG) that is turning a small portion of the world's 20 billion-kilogram coffee fruit waste issue on its head has today announced a partnership to bring its functional snack bars to Harris Farm stores nationwide. |

Bushfood-Infused Fruit Snacks: Elevating Native Australian Ingredients

The use of native Australian foods in fruit snack is quickly coming into vogue, providing a combination of both cultural value and novelty flavor opportunities. Consumers become more attracted toward native superfoods like Kakadu plum, Davidson's plum, finger lime, wattleseed, and lemon myrtle with their high quality nutrient density along with their singular flavors. In addition, bushfood-infused fruit snacks usher in the potential for storytelling-driven branding, in which businesses have the opportunity to reveal indigenous know-how, environmentally friendly practices, and the background story of such ingredients.

Not only does this create a robust emotional bond with customers but also promotes brand legitimacy. The influence of this trend will be far-reaching in premium and artisanal segments, in which customers desire one-of-a-kind and exclusive flavors. Additionally, it presents export opportunities since overseas markets more and more eagerly look for authentic Australian food experience.

Freeze-Dried and Air-Dried Innovations: A Revolution in Texture and Flavor Retention

Freeze-dried and air-dried fruit snacks are also appearing in multi-textured snack mixtures, paired with yogurt chips, nuts, dark chocolate, and superfood seeds to make them more sensorially appealing. These airy, crunchy snacks are appealing to those who want flavorful textures without any artificial additives. This technology is particularly groundbreaking on water-rich fruits such as strawberries, mangoes, pineapples, and apples, which lose their color using regular drying processes.

The result is a light, full-flavored, and nutrient-dense snack with a rich sensory experience free of added sugars or preservatives. Whereas dried fruit snacks have long been a part of the Australian market, freeze-dried and air-dried fruit snacks are revolutionizing the category by maintaining natural flavor, texture, and nutrient content more effectively than conventional drying processes. In contrast to chewy textured conventional dried fruits, these sophisticated drying processes produce crispy, light, and melt-in-the-mouth pieces of fruit that find appeal with a wider range of consumers.

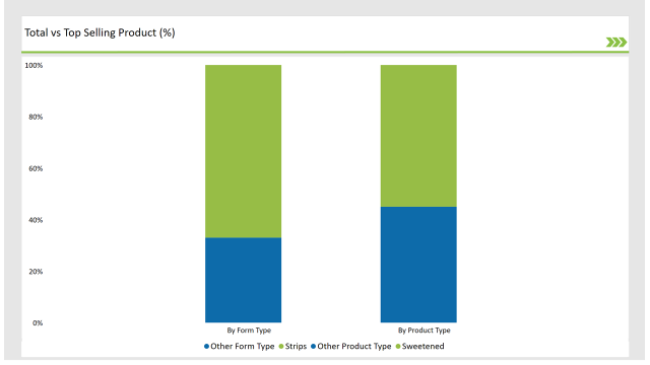

The fruit strip segment is gaining growing relevance because it has the ability to deliver a unique combination of flavor, portion control, and sensory satisfaction in a package that fits multiple consumer needs. Fruit strips contrast with typical fruit snacks because the latter are an engaging and active eating experience, as their multi-layered composition allows consumers to peel, roll, and consume the treat over time.

This creative and sensory feature appeals to both children and adults, adding to the simplicity of the eating experience. Fruit strips also provide prolonged freshness and convenience while maintaining product quality. Small in size, they are easy to store, transport, and consume, making them excellent for busy lifestyles. This aspect is in line with consumer consumption patterns where snacks are increasingly being consumed as meal replacements or between-meal snacks. In addition, the longer shelf life of fruit strips makes them extremely attractive to retailers who want products that will not spoil over time and need complex storage systems.

The segment for sweetened fruit snacks continues to resonate with consumers by providing an indulgent but accessible snacking experience that combines taste with perceived health. While unsweetened or naturally sweet items appeal to a narrow health-conscious base, sweetened fruit snacks reach more consumers by offering a familiar and pleasing taste profile.

This category thrives by marrying sensory pleasure with an active consumer approach, where enjoyment comes to the fore along with mindful consumption. Today's consumers increasingly desire so-called "permissible indulgence" treats for themselves in moderation, as part of overall balanced diets. Sweetened-to-taste fruit snacks work perfectly with this ethos, providing controlled portions to indulge without enabling overeating. This trend has led companies to launch mini-packs, portion-controlling strips, and resealable pouches, which enhance consumer trust through the delivery of portioned indulgence.

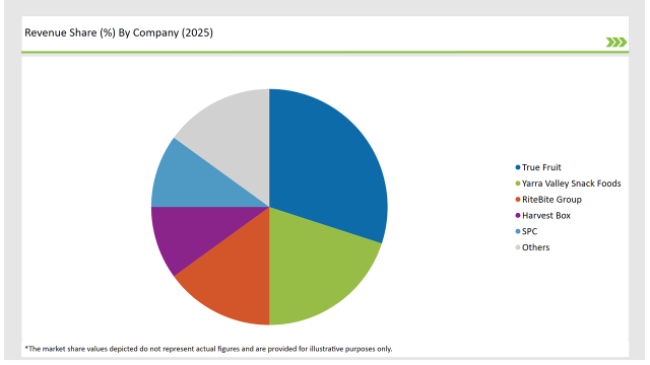

Tier 1 players in the Australian fruit snack marketplace are characterized by their established brand names, extensive distribution channels, and continuous innovation. These market giants overwhelm with huge investments in product innovation, advertising, and consumer engagement policies.

They prefer to have a multi-product portfolio addressing various consumer preferences, ranging from sweetened and functional fruit snacks to premium and craft products. Their ability to leverage advanced manufacturing capabilities allows them to deliver stable product quality as they scale up operations to meet fluctuating consumer demand.

Tier 2 players in the Australian fruit snack market occupy a niche position by targeting specific consumer groups and offering differentiated products. These players generally concentrate on niche segments, like functional fruit snacks, bushfood-inspired variants, and low-sugar options, reflecting the increasing interest in personalized and healthy snacks. Tier companies tend to focus on flexibility and adaptability, enabling them to respond rapidly to emerging consumer behavior and develop limited-edition products that reflect changing tastes.

Tier 3 firms are small-scale, local manufacturers and artisanal brands that help to drive regional tastes and micro-trends in the Australian fruit snacks industry. They survive through the use of craftsmanship, small batches of production, and hyper-local sourcing. They tend to target niche communities and boutique retailers, where shoppers are looking for distinctive, handmade experiences. These tier players differentiate themselves by presenting unique flavor profiles that mirror regional tastes, like the use of indigenous Australian bushfoods or fruits harvested in season.

2025 Market share of Australian Fruit Snacks manufacturers

By 2025, the Australian Fruit Snacks market is expected to grow at a CAGR of 6.9%.

By 2035, the sales value of the Australian Fruit Snacks industry is expected to reach USD 545.2 million.

Key factors propelling the Australian Fruit Snacks market include Increased Consumer Demand for Novel Textures and Formats, Hybrid Fruit Snacks Blending Textures and Flavors, Personalized Fruit Snacks Catering to Unique Tastes, and Customized Snack Packs Offering Mix-and-Match Options.

Prominent players in Australia Fruit Snacks manufacturing include True Fruit, Yarra Valley Snack Foods, Nibblish, RiteBite Group, Harvest Box, SPC, General Mills Inc., I Am Grounded (IAG), The Kraft Heinz Company, Nestlé S.A., Mondelez International, and Kellogg Company, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various product types, such as Sweetened, Unsweetened, Freeze-dried and Other.

The industry includes various form type such as Strips, Shaped pieces, Bars, Dried whole fruits, and Rolls.

As per the fruit type segment, the market is segregated into Mixed Fruits, Apple, Berries, Tropical Fruits, and Citrus.

As per the processing methods segment, the market is segregated into Supermarkets/Hypermarkets, Convenience stores, Online Retail, and Specialty stores.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.