The Australian Fructo-Oligosaccharides market is estimated to be worth USD 122.9 million by 2025 and is projected to reach a value of USD 224.9 million by 2035, growing at a CAGR of 6.2% over the assessment period 2025 to 2035.

| Metric | Values |

|---|---|

| Industry Size in 2025 | USD 122.9 million |

| Value in 2035 | USD 224.9 million |

| Value-based CAGR from 2025 to 2035 | 6.2% |

The Australian Fructo-Oligosaccharides (FOS) market is an emerging niche in the overall functional food and dietary fiber sector, fueled by growing consumer consciousness of digestive health, the demand for prebiotics, and the trend towards natural and plant-based ingredients.

Fructo-oligosaccharides are fructose molecules with a short chain, which are naturally derived from sources like sugar beets, chicory root, and other plant material using enzymatic hydrolysis or extraction methods. The FOS industry is of key importance in Australia with the nation's increasing preventative medicine and push towards healthier eating and the growth of the functional foods and nutraceutical industries.

Australian consumers have become increasingly more health-conscious in their food consumption, preferring added functional benefits alongside general nutrition from their foods. This has led to a boom in demand for prebiotic-enriched products like FOS, which are extensively utilized in infant formula, dietary supplements, functional beverages, and milk substitutes.

The rising prevalence of gastrointestinal diseases, such as irritable bowel syndrome (IBS), and the aging population further highlight the importance of FOS as a natural and effective solution for improving gut health and maintaining smooth bowel movements.

Explore FMI!

Book a free demo

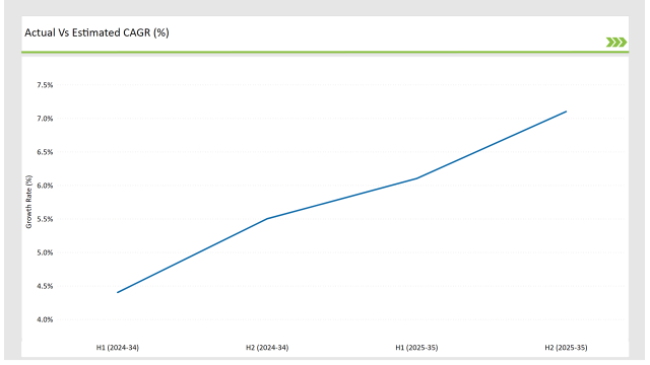

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the Australian Fructo-Oligosaccharides market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Fructo-Oligosaccharides sector is predicted to grow at a CAGR of 6.1% during the first half of 2025, increasing to 7.1% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 4.4% in H1 but is expected to rise to 5.5% in H2.

This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian market for Fructo-Oligosaccharides (FOS) remains dynamic, based on several underlying factors including the development of policies, changing tastes among consumers, and innovation in natural ingredient systems. It is important for organizations to understand the dynamics in order to align strategy with upcoming trends and take advantage of opportunities within the market expansion.

This biannual market report is a goldmine for businesses seeking to navigate the complexity of the FOS market, with intelligence that enables the identification of opportunities for growth, address supply chain challenges, and adapt in line with shifting consumer demand.

Consumer awareness of the health benefits linked with FOS has been increasing in Australia. Fructo-oligosaccharides are known to promote the growth of beneficial colonic bacteria, enhance digestion, and maintain heart health. They occur naturally in several fruits and vegetables such as garlic, onion, leek, asparagus, and banana. Including FOS in the diet can serve to relieve digestive disorders, promote normal blood glucose levels, and improve lipid metabolism.

Food Standards Australia New Zealand (FSANZ) considered an application to vary the Food Standards Code, permitting the addition of short-chain FOS produced from sucrose to infant formula foods, infant foods, and formulated supplementary foods for infants and young children. The consideration aimed at harmonizing Australian regulation with international practice, considering the prebiotic potential of FOS in maintaining gut health in infants.

Microbiome-Driven Personalization: Tailoring FOS for Individual Gut Health

The increasing awareness of the role of the gut microbiome in overall health is propelling the move towards personalized nutrition, and FOS is becoming a central element in this shift. Consumers are increasingly realizing that their gut flora is individualized, affecting digestion, immunity, and even mental health.

Accordingly, customized FOS products are being developed based on microbiome reports and AI-driven suggestions. This trend is highly relevant in Australia, where interest in precision health solutions is building through online platforms of health and home kits for testing microbiome. Companies are now supplying customized blends of prebiotics, e.g., different chain-length FOS types, to treat specific gut problems like bloating, IBS, or even metabolic illness.

They tend to be marketed in combination with AI-driven nutrition guidance, and the customer is provided with an evidence-based optimum approach to optimal gut health.

FOS in Functional Pet Food and Animal Gut Health

FOS is being developed as high-end pet food brands, veterinary feed additives, and animal treats for dogs, cats, and livestock. As it works to promote good gut bacteria, FOS is also finding uses in the prevention of gastrointestinal disorders in pets, the reduction of antibiotic reliance in livestock, and improved feed efficiency for use in agriculture.

In Australia, where there is common ownership of pets and increasing demand for effective pet foods, manufacturers are marketing FOS-enriched products as a replacement for man-made probiotics. Additionally, with increasing concern about pet allergies and digestive intolerance, natural prebiotics like FOS provide a safe, effective way of maintaining pet gut health.

One of the most notable advances is the addition of FOS to pet food and animal supplements to promote digestive health, immunity, and nutritional absorption.

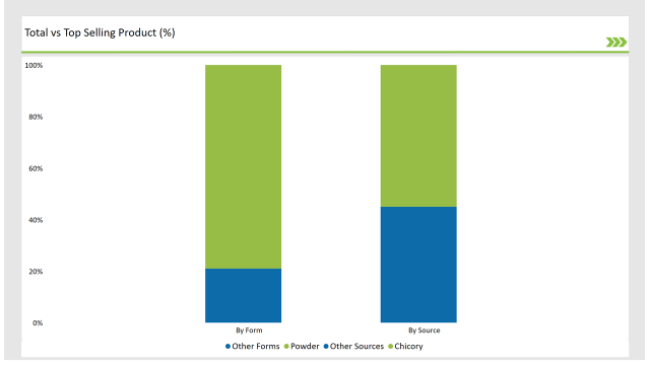

Chicory source segment dominates the Fructo-Oligosaccharides (FOS) market because it is scientifically proven to have health benefits, has better extraction yield, and can be formulated according to changing needs of consumers. Chicory root is inherently high in inulin, a precurser to FOS, and its chemical composition permits economical and large-scale production of high-purity FOS by enzymatic hydrolysis.

This places chicory-derived FOS not only as a regular source but also as a product that is compatible with the growing demand for functional digestive health items. In Australia, where the consumers specifically search for gut-health-focused solutions, chicory-based FOS is a key part in various sectors, from infant nutrition to food supplements and functional drinks.

FOS products that use chicory-derived FOS can highlight benefits like improved digestive function, boosted calcium absorption, and improved immune support, which will attract more health-conscious consumers.

Fructo-oligosaccharides (FOS) are most sought because of their versatile emotional formulation, ease of use and better stability such as powder, which is suitable for them to include them in a wide range of functional foods and nutraceutical agents. In Australia, where bowel -friendly products and digestive health gain popularity, companies now use Powder FOS to offer customized and effective solutions in many product categories.

Its unique physical properties enable the manufacturers to easily mix this powder into diverse product ranges, from dietary supplements to functional beverages, without compromising product integrity. It also remains structurally stable during high-temperature processing and is thus ideal for bakery applications and high-temperature processing procedures, like in the manufacturing of snacks and baby food.

The Australian Fructo-Oligosaccharides (FOS) industry level Tier 1 is controlled by multinational companies with well-developed research facilities, scale economies and extensive distribution agreements. These sectoral giants, with international bases and local subsidiaries, invest heavily in high -tender technology, and produce Foss solutions that change the expectations of the customers of gut and functional nutrition. They are cost -rating because for the economies of the scale, and their regulatory experience ensures that they meet Australia's high food safety rules.

Tier 2 companies in the Australian FOS industry have a central position with the stressed in the niche product area, smooth production capacity and fast market reaction. They are generally regional manufacturers or creative medium -sized companies that are good in special markets, including plant -based materials, low -suction products and tailor -made prebiotics. Their flexibility enables them to respond to the new consumer pattern immediately, such as the will of multi-use health products and support for the intestinal brain axis.

Tier 3 includes nascent domestic producers, start-ups, and specialty producers targeting in-region production and artisanal product innovation. They serve hyper-niche consumer demands, including small-batch, organic, and boutique prebiotic products, in line with increasing demand for personified health solutions. Their reduced size enables more experimentation and the capacity to rapidly launch innovative FOS uses in functional snacks, beverages, and specialty diets.

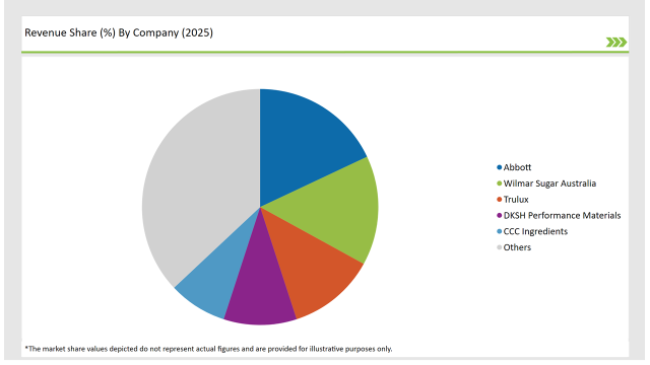

2025 Market share of Australian Fructo-Oligosaccharides manufacturers

By 2025, the Australian Fructo-Oligosaccharides market is expected to grow at a CAGR of 6.2%.

By 2035, the sales value of the Australian Fructo-Oligosaccharides industry is expected to reach USD 224.9 million.

Key factors propelling the Australian Fructo-Oligosaccharides market include Increased Adoption of Prebiotic-Infused Nutraceuticals, Growing Demand for Prebiotic-Enhanced Performance Products, Increasing Use of FOS to Mimic Human Milk Oligosaccharides, and Growing Interest in Functional and Personalized Wellness Solutions.

Prominent players in Australia Fructo-Oligosaccharides manufacturing include Abbott, Wilmar Sugar Australia, Trulux, Megazyme, Galam, Danisco, Tate & Lyle, Royal FrieslandCampina, DKSH Performance Materials, and CCC Ingredients, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various sources, such as Chicory, Sucrose, Inulin, and Jerusalem Artichoke.

The industry includes various forms such as Powder and Liquid.

As per the end-product segment, the market is segregated into Short-chain FOS, Medium-chain FOS, and Long-chain FOS.

As per the application segment, the market is segregated into Food & Beverages, Infant Formula, Dietary Supplements, Animal Feed, and Pharmaceuticals.

As per the processing methods segment, the market is segregated into Fermentation, and Enzymatic Synthesis.

USA Prenatal Vitamin Supplement Industry Analysis from 2025 to 2035

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Microalgae in Fertilizers Market - Growth & Sustainability Trends 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Potato Flakes Market Analysis Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others End Use Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.