The Australian Fish Protein market is estimated to be worth USD 22.8 million by 2025 and is projected to reach a value of USD 43.5 million by 2035, growing at a CAGR of 6.7% over the assessment period 2025 to 2035

| Metric | Values |

|---|---|

| Industry Size in 2025 | USD 22.8 million |

| Value in 2035 | USD 43.5 million |

| Value-based CAGR from 2025 to 2035 | 6.7% |

The Australian fish protein industry produces, processes, and markets protein from various fish species, either as fish meal, hydrolyzed fish protein, fish protein concentrates, or isolates. These proteins are used in various industries, including food and drinks, animal feed, aquaculture, nutraceuticals, and cosmetics.

Fish protein is renowned for its high bioavailability, dense amino acid profile, and vital nutrients; hence, it is a highly desired ingredient in human and animal nutrition. As consumers increasingly demand sustainable and high-quality protein sources, the Australian market for fish protein has seen consistent growth.

Australia also possesses substantial health-food-conscious consumers who are in search of high-protein, functional foods. Fish protein hydrolysates and isolates are gaining attention for use in sports nutrition, meal replacement, and dietary supplements because of their high digestibility and bioactive peptides.

The increasing demand for omega-3-enriched protein foods and marine collagen-based products is also driving the market. Growing awareness of other protein sources has encouraged food producers to consider fish protein as a sustainable substitute for conventional animal protein sources such as beef or chicken.

Explore FMI!

Book a free demo

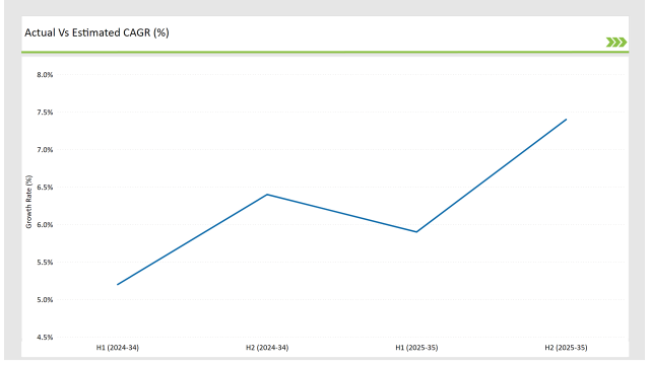

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the Australian Fish Protein market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Fish Protein sector is predicted to grow at a CAGR of 5.9% during the first half of 2025, increasing to 7.4% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 5.2% in H1 but is expected to rise to 6.4% in H2. This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian fish protein market is evolving continuously, underpinned by changing consumer behaviors, regulatory evolution, and progress in ingredient solutions. Developments in expert-level protein blends and natural extraction technology are influencing the next generation of products, dictating demand patterns in different segments.

Monitoring these changes in the market on a bi-annual basis is imperative for companies that wish to further streamline their approach, capitalize on growth opportunities, and tackle challenges in the industry effectively.

| Date | Development/M&A Activity & Details |

|---|---|

| October 2024 | Smart Foods of the Gold Coast acquired The Aussie Plant-Based Co, along with its plant, equipment, inventory, intellectual property, and brands vEEF and Love Buds. The acquisition was made after the liquidation of The Aussie Plant-Based Co and was intended to resuscitate its plant-based protein products with an expansion plan for distribution across Australia. |

| 2023 | Cooke Inc., a Canadian seafood giant, invested USD1.5 billion in Australian salmon producer Tassal, slightly ahead of schedule. This strategic acquisition increased Cooke's worldwide aquaculture business and solidified its Australian market presence. |

The Blue Bioeconomy Boom: Marine-Based Protein Beyond Seafood

Australia is leading the blue bioeconomy revolution where marine resources are not just a matter of seafood consumption anymore but are being transformed into high-value fish protein ingredients for multiple purposes. Marine biotechnology breakthroughs are behind this trend, where fish proteins are being derived and used in areas such as biomedicine, pharmaceutical innovation, and tailored nutrition.

Tasmanian and Western Australian research facilities and biotech firms are leaders in the search, exploring bioactive peptides derived from fish protein for potential applications in anti-inflammatory drugs, brain function improvement supplements, and sport recovery supplements.

Perhaps most exciting in the evolution of this trend is the introduction of marine collagen-derived protein formulations into anti-aging skincare, joint health supplements, and hair growth solutions. Australian wellness and beauty industries are pioneering by incorporating hydrolyzed fish protein peptides into the next wave of nutricosmetic. The innovation is a significant departure from traditional applications for fish proteins, expanding its appeal into premium wellness markets.

The Rise of Fermented Marine Protein

A revolutionary technology in the Australian fish protein sector is the production of biohacking and precision-fermented fish proteins. This process takes microbial fermentation and applies it to mimic or optimize the amino acid profiles of natural fish protein to produce more bioavailable, functionally superior, and flavor-impartial protein products.

Australian synthetic biology entrepreneurs are actively developing ways to engineer microbial strains that will ferment marine-derived proteins into ultra-pure, high-protein products. This is particularly exciting because it solves the traditional problems of fish odor, allergenicity, and digestibility issues, making fish protein palatable for plant-based consumers, medical diets, and specialty health applications.

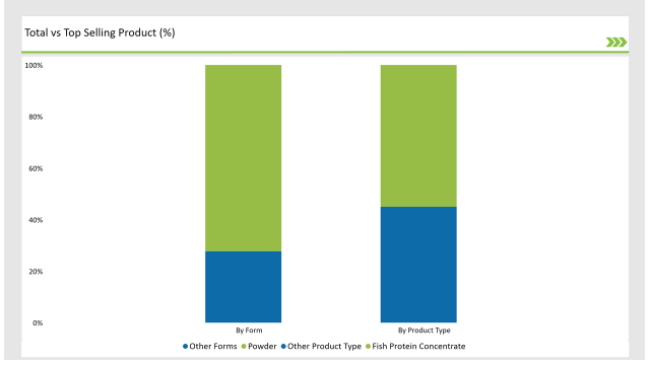

Fish protein concentrate (FPC) is currently the market leader, with increasing demand for bioactive foods and precision nutrition. Functional efficiency has overtaken broad-spectrum protein intake in Australian sport, health, and medical nutrition markets. FPCs are unique among conventional protein sources by their increased bioavailability, high content of amino acids, and enhanced digestibility, making them a desirable ingredient in most uses.

The inclusion of bioactive marine peptides in medical nutrition therapy has transformed the therapeutic use of FPC in formulae. Researchers and clinical nutritionists are homing in on unique amino acid sequences within fish protein concentrates that are implicated in the upkeep of muscles, repair of tissues, and mental acuity-making them highly suited against age-related muscle loss, surgical convalescence, and intensive care.

Australian biotech companies are now designing protein-enriched enteral diets and condition-specific meal substitutes for aged care nursing homes, hospitals, and personalized nutrition programs, further validating FPC's credibility.

The growth of fish protein powder as the top segment is fueled by its versatility across various industries, including specialty nutrition, food fortification, and industrial uses. With changing consumer and industrial requirements toward value-specific protein solutions, the powder format has become the most technologically versatile, effective, and adaptable format that has found massive adoption in sports nutrition, functional foods, pharmaceutical products, and high-value feed systems.

Increasing interest in scientifically developed performance nutrition has driven demand for easily digestible, high-purity protein ingredients. Fish protein powder is uniquely positioned in muscle recovery supplements, functional beverages with high protein, and endurance nutrition due to its fast rate of absorption and enhanced amino acid profile. Unlike more bulky or less soluble protein ingredients, the powder provides precise dosing, instant dispersion in liquids, and smooth blending into pre- and post-exercise supplements.

This trend is especially evident in Australia's elite sports and high-performance fitness sectors, where tailored protein blends are the go-to option over more traditional choices.

Tier 1 consists of large seafood corporations, aquaculture giants, and vertically integrated businesses with marketplace dominance by the sheer volume of output, advanced processing technology, and humongous distribution networks. Their market differentiator is economies of scale, in which they can afford to invest in the latest protein extraction technology, sustainable aquaculture practices, and value-added product creation.

Tier 2 segment includes medium-scale fish protein manufacturers, specialty seafood companies, and new-age biotech firms with product differentiation innovations and niche product solutions. They are leaders in using AI-driven production technologies, eco-friendly extraction technologies, and novel fish protein applications-seafood protein-fortified plant foods, bioactive peptides of fish for sports recovery, and hybrid protein mixtures for clinical nutrition.

The Tier 3 market is defined by small-scale fish protein start-ups, artisanal seafood processors, and marine-based biotech businesses working in highly specialized niches. These businesses are innovating new protein extraction technologies, new feedstock sources, and localized processing techniques to differentiate themselves from the mainstream fish protein producers. Their clients are boutique food manufacturers, specialty health supplement firms, and premium pet food manufacturers, who place a high value on small-batch, high-purity marine protein.

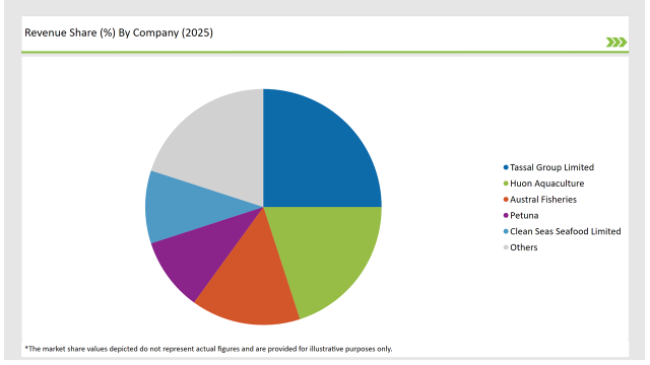

2025 Market share of Australian Fish Protein manufacturers

By 2025, the Australian Fish Protein market is expected to grow at a CAGR of 6.7%.

By 2035, the sales value of the Australian Fish Protein industry is expected to reach USD 43.5 million.

Key factors propelling the Australian Fish Protein market include aquafeed evolution: optimizing growth and immunity in farmed species, marine proteins in functional animal nutrition, expanding therapeutic uses of fish-derived proteins, and merging marine and plant proteins for next-gen nutrition.

Prominent players in Australia Fish Protein manufacturing Tassal Group Limited, Tassal Group Limited, Huon Aquaculture, Austral Fisheries, Petuna, Clean Seas Seafood Limited, Australian Fish Protein Pty Ltd., Marine Bioproducts Australia, Ocean Blue Protein, Barossa Aquaculture, Markwell Foods, and Sea Harvest Australia, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various product types such as Fish Protein Concentrated, Fish Protein Isolate, and Fish Protein Hydrolysate.

The industry includes various sources such as Powder and Liquid.

As per the application segment, the market is segregated into Food & Beverages, Dietary Supplements, Pharmaceuticals, Cosmetics & Personal Care, and Others.

Dairy-Free Cream Market Insights – Plant-Based Dairy Alternatives 2025 to 2035

Dairy Flavors Market Trends – Growth & Industry Forecast 2025 to 2035

Egg Protein Market Insights – High-Protein Nutrition & Market Growth 2025 to 2035

Dried Eggs Market Insights – Shelf-Stable Nutrition & Industry Growth 2025 to 2035

Egg Substitute Market Insights – Plant-Based Alternatives & Industry Growth 2025 to 2035

Egg-Free Dressing Market Trends – Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.