The Australian Ferulic Acid market is estimated to be worth USD 8.6 million by 2025 and is projected to reach a value of USD 17.4 million by 2035, growing at a CAGR of 7.3% over the assessment period 2025 to 2035.

| Metric | Values |

|---|---|

| Industry Size in 2025 | USD 8.6 million |

| Value in 2035 | USD 17.4 million |

| Value-based CAGR from 2025 to 2035 | 7.3% |

Ferulic acid is a potent antioxidant normally derived from vegetable sources such as citrus fruits, rice bran, and oats. It is hydroxycinnamic acid that has the ability to neutralize free radicals and has been reported to be an important ingredient in many industries, particularly in the cosmetics, pharmaceutical, and food production industries.

The Australian ferulic acid market is supported by increased demand from consumers for plant-derived and natural products as well as heightened awareness of the compound's benefits for skincare and health. Of special prominence among these is the cosmetics and personal care industry where ferulic acid is utilized in anti-aging serums, sunscreens, and creams due to its ability to offer skin-whitening as well as protection from the UV light.

Besides, the ability of ferulic acid to stabilize and strengthen the action of other antioxidants such as vitamins C and E further contributes to its utility in advanced skincare products. Apart from cosmetics, the Australian pharmaceutical sector employs ferulic acid for its potential anti-inflammatory, antimicrobial, and cardiovascular use.

It is being investigated for use in the treatment of chronic diseases like diabetes and neurodegenerative diseases, which indicates the growing emphasis on preventive medicine and nutraceuticals. The food and beverage industry also contributes to market growth, as ferulic acid is employed as a natural preservative and functional ingredient to enhance shelf life and nutritional content of different products. This supports the Australian market's focus on clean-label offerings and natural preservatives to address consumer need for safer, less processed food.

Explore FMI!

Book a free demo

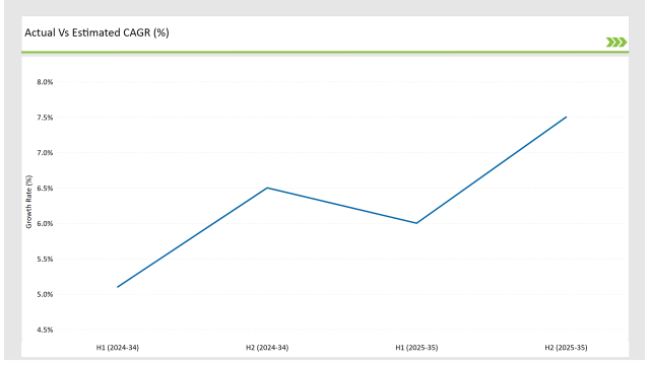

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the Australian Ferulic Acid market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Ferulic Acid sector is predicted to grow at a CAGR of 6.0% during the first half of 2025, increasing to 7.5% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 5.1% in H1 but is expected to rise to 6.5% in H2. This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian ferulic acid market is in a state of continuous flow due to consumer trends, regulatory changes and changes in fruit development, including natural elements. For those companies that want to surf the growth drivers and coordinate their strategy with progress in the future, it will be necessary to track changes.

As an increasing consumer interest in natural, durable products encourage innovation in the use of ferulic acid, affecting the supportive regulatory structure industry with a focus on safe, plant -based additives. Companies can remain similar to these changing dynamics and inform strategic planning options to maximize development and market status for Australian ferulic acid.

| Date | Development/M&A Activity & Details |

|---|---|

| 2023 | Medik8 launched the Super C Ferulic 30ml serum in Australia in 2023. The potent recipe contains 30% ethylated L-ascorbic acid, an antioxidant-stable form of vitamin C, as well as ferulic acid, which brightens the face and combats visible signs of aging.Its introduction addressed the growing need for antioxidant-rich, high-strength skincare products. |

| 2023 | SkinCeuticals continued to sell its award-winning C E Ferulic Serum in Australia until 2024. The serum contains 15% pure vitamin C, 1% vitamin E, and 0.5% ferulic acid, which supports environmental health and anti-aging. Its widespread appeal underscores the Australian market's penchant for high-quality antioxidant skincare products. |

Cosmeceutical Synergy: Merging Skincare and Pharmaceuticals with Ferulic Acid

In Australia, the "cosmeceutical" market has been created wherein products not just beautify the outside but also provide therapeutic value. Ferulic acid is a powerful antioxidant derived from plants that are highly valued in the marketplace. Its ability as a free-radical scavenger to neutralize potentially harmful free radicals and protect cells from environmental damage makes it highly sought after by sophisticated skincare professionals. Incorporation of ferulic acid in cosmeceuticals addresses the growing trend towards consumers' desire for multitasking skincare products.

Australian consumers are increasingly seeking products that provide both beauty and health benefits, such as anti-aging activity, skin lightening, and defense against damage by UV-induced formation of free radicals. The stability and increased activity of other antioxidants, including vitamins C and E, which ferulic acid obtains are highly effective and also play a role in its popularity in combined products. The influence of the trend on the Australian ferulic acid market is enormous. Companies are pursuing research and development to come up with groundbreaking cosmeceuticals that are based on the properties of ferulic acid. This has led to numerous serums, creams, and lotions not only to assure cosmetic value but also lasting health benefits to the skin.

Flavor-Enhancing Antioxidants Redefining Functional Foods

Ferulic acid is proving to be a revolutionary ingredient in the food and beverage market, fueled by its two-in-one capability of being a highly effective antioxidant as well as an enhancer of sensory perception. Long known in the skincare and pharmaceutical sectors, ferulic acid is now picking up pace in food uses as it can provide shelf life extension while retaining the natural flavors and nutritional content of products.

The Australian food and beverage market is witnessing a surge in demand for functional foods that not only impart health benefits but also enhance flavor and texture. Such ability to fight against rancidity and ensure the freshness of a product is extremely beneficial in cases of plant-based alternatives, dairy, and functional beverages. For fortified juices and nutritional beverages, for example, ferulic acid shields susceptible vitamins and bioactive nutrients against degradation when put in contact with light and oxygen so that people gain the required health benefits with an extended life cycle.

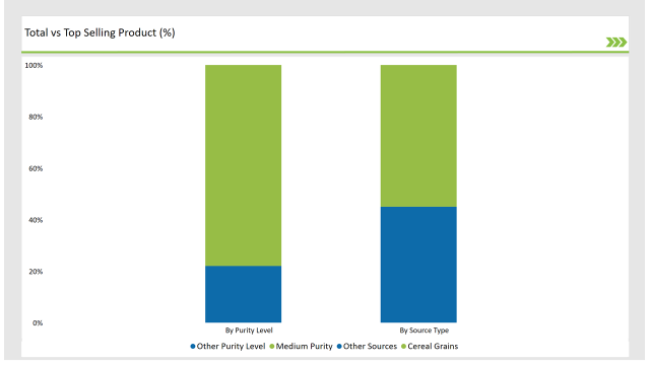

Cereal grains, particularly their bran and germ parts, naturally abound in ferulic acid. It has been determined through studies that ferulic acid makes up a high percentage of the total polyphenolic content of cereal grains. Particularly, it has been found that the ingestion of ferulic acid contributes to approximately 77% of the total consumption of cereal polyphenols and 99% of total cereal phenolic acids from cereal food.

This increased concentration translates into more productive extraction processes, resulting in more ferulic acid per raw material unit. The natural occurrence of ferulic acid in cereal grains thereby increases the productivity and profitability of its extraction and use. The addition of ferulic acid production to the existing cereal grain industry not only adds value to farm products but also promotes growth in allied industries. Expansion in international demand for natural antioxidants fuels export opportunities, further substantiating Australia's international standing.

Ferulic acid in the food industry is used to extend the shelf life of a variety of products due to its antioxidant function of inhibiting oxidation degradation. The medium-purity form provides a suitable practical alternative, providing the best preservative effect at an economical price. This proves particularly useful for producers who require maintaining product quality but within budget constraints. Usage of medium-purity ferulic acid is the cost-cutting trend of the industry, under which the consumer gets a safe and palatable food product and the producer does not have to bear excessive cost of production.

Dominance of the medium-purity ferulic acid segment in Australia is an affirmation of the strategic balance between efficiency and cost. By satisfying the functional needs of industries like cosmetics, food preservation, and pharmaceuticals at affordable prices, medium-purity ferulic acid enables the manufacturing of high-quality, low-cost products. Such equilibrium not only propels business growth but also makes the beneficial properties of ferulic acid accessible to a larger population, solidifying its fundamental position in diverse industries.

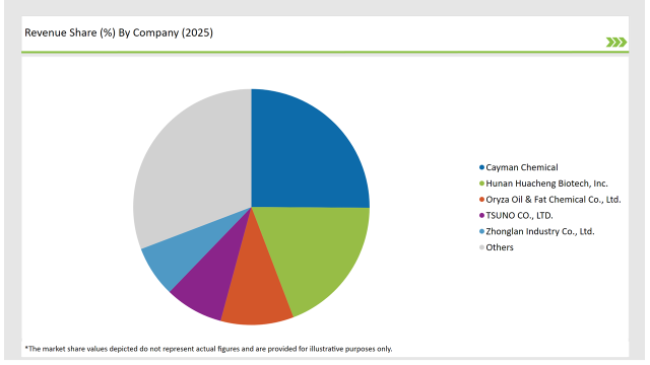

Tier 1 companies in Australia's ferulic acid industry are characterized by massive production capacities, widespread distribution networks, and heavy investments in R&D. These industry giants, comprising domestic-based multinational firms, dictate industry standards in quality, innovation, and supply chain effectiveness. They are driven by state-of-the-art extraction technology and their ability to offer a broad portfolio of products that are tailored to meet the evolving needs of industries such as food preservation, pharma, and cosmetics.

Tier 2 companies, strategically placed between incumbents and new entrants, are tasked with bridging the gap between massive production numbers and individual consumers' needs. The medium-sized companies excel in manufacturing medium-purity ferulic acid to suit cost-sensitive industries without sacrificing functionality. Their ability to respond quickly to volatile market conditions and tailor products to specific needs makes them the preferred option.

Tier 3 enterprises in Australia's ferulic acid industry are typically start-ups or small businesses that operate in specific markets and provide regional solutions. These tier players focus on low-purity ferulic acid for commodity segments, such as food additives and agricultural preservatives, where costs are more prioritized than expectations for high-quality formulations. Market positions of such players are characterized by adaptability and ability to react to changing consumer trends through innovative offerings.

2025 Market share of Australian Ferulic Acid manufacturers

By 2025, the Australian Ferulic Acid market is expected to grow at a CAGR of 7.3%.

By 2035, the sales value of the Australian Ferulic Acid industry is expected to reach USD 17.4 million.

Key factors propelling the Australian Ferulic Acid market include Expanding Demand for Functional Skincare Solutions, Rising Integration in Specialty Food Preservation, Increased Utilization in Sports Nutrition and Supplements, and Technological Innovations in Antioxidant Delivery Systems.

Prominent players in Australia Ferulic Acid manufacturing include Cayman Chemical, New Direction Australia, SkinCeuticals Australia, Paula Choice, ChemSupply Australia, Medik8, DKSH Performance Materials, Vigon International, Hunan Huacheng Biotech, Inc., Oryza Oil & Fat Chemical Co., Ltd., TSUNO CO., LTD., and Zhonglan Industry Co., Ltd., among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various source types, such as Cereal Grains, Fruits & Vegetables, Herbs & Spices, and Synthetic Production.

The industry includes various purity level such as Low Purity, Medium Purity, and High Purity.

As per the application segment, the market is segregated into Food & Beverage, Pharmaceuticals, Cosmetics & Personal Care, Agriculture, and Industrial.

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Hydrotreated Vegetable Oil Market Analysis by Type and Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.