The Australia Fermented Ingredients market is estimated to be worth USD 250.0 million by 2025 and is projected to reach a value of USD 884.1 million by 2035, growing at a CAGR of 13.5% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size (2025) | USD 250.0 million |

| Projected Australia Value (2035) | USD 884.1 million |

| Value-based CAGR (2025 to 2035) | 13.5% |

The fermented ingredients market in Australia pertains to the food and beverage, pharmaceutical, and personal care industries that apply products developed by controlled microbial fermentation. Key ingredients in this category include enzymes, organic acids, probiotics, amino acids, and fermented dairy proteins.

Fermented ingredients are used in most dairy products, plant-based foods, dietary supplements, and functional beverages, thus following the natural and minimally processed food trends. The food industry also depends on fermentation for unique flavors, textures, and healthier formulations such as lactose-free or reduced-sugar products.

The country's strong agricultural industry coupled with the advancement of biotechnology enables the feasibility of producing fermented ingredients in Australia. In addition, the demand is critical to the sustainability of the market since fermentation offers resource-efficient production with minimal environmental impact.

Furthermore, the rather strict food safety regulations in Australia and the increasing exports to Asia-Pacific markets make the fermented ingredient products manufactured in Australia more credible and in demand globally. It is the market in which innovation for consumer health and wellness is key.

Explore FMI!

Book a free demo

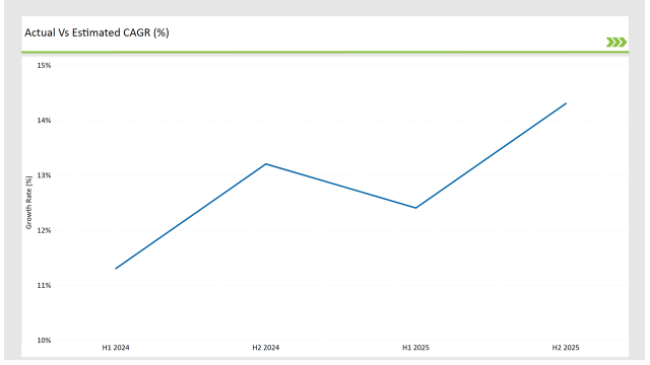

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Fermented Ingredients market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Fermented Ingredients sector is predicted to grow at a CAGR of 12.4% during the first half of 2025, increasing to 14.3% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 11.3% in H1 but is expected to rise to 13.2% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

This brings to light the dynamic and continuously evolving nature of the Australian Fermented Ingredients market, which changes according to shifts in consumer preferences, formulation technologies, and other regulatory changes.

Business houses will require periodic understandings of such trends to enable the effective modification of strategies in the pursuit of innovation and a market growth trend. This is one of the tools that is quite useful in managing the market with all its intricacies, being ahead of competition.

| Date | Development/M&A Activity & Details |

|---|---|

| October 2024 | Cauldron Ferm unveils plans for high-tech precision fermentation facility in Mackay, Queensland. Funded by the Queensland Government, the facility is expected to drastically reduce production costs and increase capacity significantly, placing Cauldron Ferm as a leading contract manufacturer for precision-fermented bioproducts in the Asia-Pacific region. |

| 2023 | All G plans to release its first product containing lactoferrin by mid-2025, and other products in the rest of the markets including Australia and New Zealand. This will strengthen All G Foods commitment towards further development of precision fermentation technologies and to make animal-free lactoferrin available worldwide. |

Fermented Alternatives Revolution: Plant-Based Proteins Take the Stage

This is fostering innovation in the use of fermented plant-based ingredients in Australia, as demand for plant proteins around the world grows. While global demand for plant proteins is visible, the emphasis in Australia lies in fermentation as a means of improving the texture, flavor, and nutritional value of plant-based alternatives.

This trend is envisioned to expand the fermented ingredients market in plant-based food production, which will provide an attractive business opportunity for the manufacturers. Fermented ingredients will drive consumer adoption of these alternatives when the sensory and nutritional challenges of a plant-based diet are addressed. Moreover, this trend fits the current growth drivers of vegan and flexitarian demography of Australia, and going into the future, it is a key driver of growth.

Gut-Savvy Innovations: Personalized Probiotic Breakthroughs

The demand for targeted probiotic solutions is seen to be rising in the Australian fermented ingredients market. Consumers look for specific health benefits, for example, digestion improvement, immune system improvement, and relief for conditions such as IBS.

This has motivated companies to formulate advanced fermented probiotics that respond to different needs for health benefits. This is transforming impacts the market.

Market fermentative ingredient manufacturers are placing additional funds in researching the patents of innovative strains, thus making their food differently valuable than others. This also leads to the modification of the functional food and beverage segment since probiotics are being combined with non-dairy applications such as fortified juice, plant-based yogurt, and snack bars.

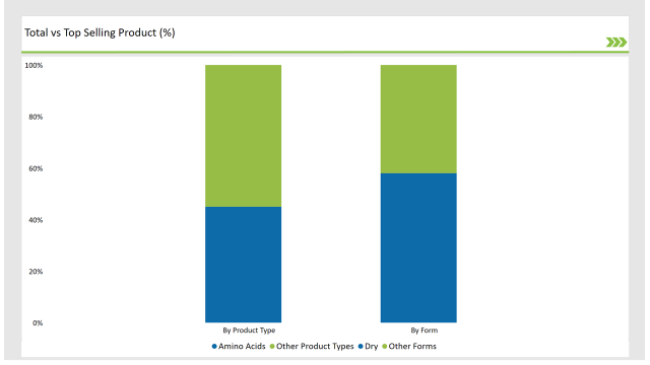

% share of Individual categories by Product Type and Form in 2025

The dry form segment dominates the Australia fermented ingredients market, following superior stability, versatility, and cost-effectiveness. Dry fermented ingredients in their forms as powders, granules, and capsules are relatively easy to handle, store, and transport, making them the first preference of both manufacturers and consumers.

Such wide applications of dry ingredients in foods and beverages to nutraceuticals and personal care products account for one of the main forces driving this trend. Dry forms are consistent, with longer shelf life, low replenishment frequency, and lesser need for refrigeration, eliminating logistical complexities when frequently restocking and maintaining temperatures.

For instance, powdered probiotics and enzymes are used in the manufacture of functional foods because they are easily incorporated into the final product without altering the texture or stability.

The highest share of fermented ingredients in the Australian market comes from amino acids, as this is the essential component in performance nutrition, health maintenance, and animal feed efficiency. These fermentation-derived bioactive compounds are considered vital for developing high-demand products for the human and animal health sectors.

In human nutrition, amino acids such as leucine, lysine, and glutamine have become a necessity for athletes, fitness enthusiasts, and individuals with specific dietary needs. Australian sport and culture is big and ever-growing with people now enjoying more energetic lifestyles, necessitating amino acid-enriched supplements and functional foods.

Consumers increasingly require these products for maximizing muscle recovery, enhancing endurance, and maintaining general well-being. This awareness has motivated the manufacturers to add amino acids to sports drinks, protein powders, and health supplements and increase the reach in the market.

Note: The above chart is indicative in nature

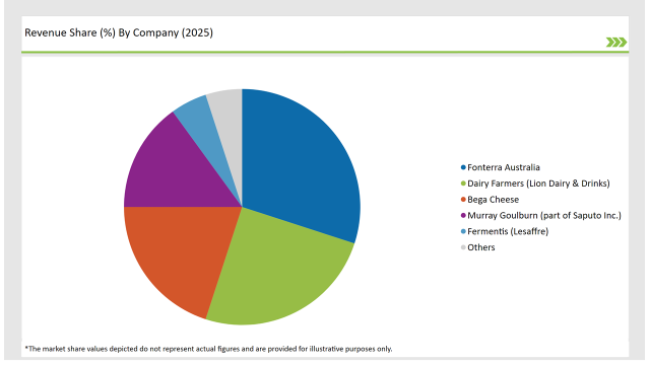

Tier 1 players in the Australia fermented ingredients market include established multinationals as well as major domestic players who have strong production capacities, strong R&D capabilities, and have a strong presence in the market.

Some of the companies which fall in this category are Fonterra Australia, Saputo Inc. (Murray Goulburn), and Lion Dairy & Drinks. They have a majority share in the market due to their economies of scale, the latest fermentation technology, and efficient distribution networks.

Tier 2 is small and regional firms that concentrate their offerings on niches or specific fermented ingredients, including Bega Cheese and Fermentis (Lesaffre). These companies are typically product-focused differentiation plays targeting a well-defined need of consumers for gut health, sports nutrition, or specialty fermented ingredients for food formulations.

Tier 3 includes emerging firms, startups, and small-scale manufacturers, which introduces new concepts or disruptive technologies into the fermented ingredients market. Some of such companies include The Natural Food Company, NutraLife, and Probiotec. Such players focus on high-quality, local products, often capitalizing on the vast agricultural resources of the country and unique consumer preferences.

By 2025, the Australia Fermented Ingredients market is expected to grow at a CAGR of 13.5%.

By 2035, the sales value of the Australia Fermented Ingredients industry is expected to reach USD 884.1 million.

Key factors propelling the Australia Fermented Ingredients market include increasing advancements in fermentation technology, thriving livestock and animal nutrition industry, and collaborations between research institutions and industry.

Prominent players in Australia Fermented Ingredients manufacturing include Dairy Farmers (part of the Lion Dairy & Drinks), Fonterra Australia, Bega Cheese, Murray Goulburn (now part of Saputo Inc.), Cauldron Ferm, Australian Dairy Products Federation (ADPF), Fermentis (part of Lesaffre), All G, BioCare Copenhagen, Probiotec, The Natural Food Company, and NutraLife, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various form such as dry, and liquid.

The industry includes various product type such as amino acids, organic acids, biogas, polymer, vitamins, antibiotics, and industrial enzymes.

As per the application segment, the market is segregated into food & beverages, pharmaceuticals, paper, feed, others.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.