The Australia Energy Gel market is estimated to be worth USD 3.2 million by 2025 and is projected to reach a value of USD 13.1 million by 2035, growing at a CAGR of 15.0% over the assessment period 2025 to 2035

| Metrics | Values |

|---|---|

| Industry Size (2025) | USD 3.2 million |

| Industry Value (2035) | USD 13.1 million |

| Value-based CAGR (2025 to 2035) | 15.0% |

The energy gel is a growing portion of the market in Australia concerning the sports nutrition and functional foods industry, because it is supposed to provide ready-to-use fast-acting energy for athletes during long periods of physical activity.

These gels are usually mixed with carbohydrates and electrolytes together with other additional ingredients such as caffeine or amino acids, thereby enhancing performance while delaying fatigue in endurance events including marathons, cycling, or hiking.

The Australia energy gel market is of great importance to Australia mainly owing to its very strong sporting culture. Whether they are recreational or professional athletes, these athletes look for specialized products that can help them perform better. Australia is also witnessing an increased health and wellness trend among the population as people are more aware of their fitness and diet.

Explore FMI!

Book a free demo

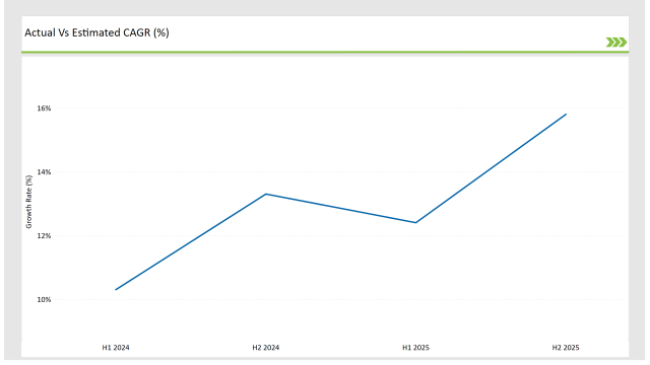

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Energy Gel market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Energy Gel sector is predicted to grow at a CAGR of 12.4% during the first half of 2025, increasing to 14.3% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 11.3% in H1 but is expected to rise to 13.2% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

This brings to light the dynamic and continuously evolving nature of the Australian Energy Gel market, which changes according to shifts in consumer preferences, formulation technologies, and other regulatory changes.

Business houses will require periodic understandings of such trends to enable the effective modification of strategies in the pursuit of innovation and a market growth trend. This is one of the tools that is quite useful in managing the market with all its intricacies, being ahead of competition.

| Date | Development/M&A Activity & Details |

|---|---|

| 2023 | Fixx Nutrition launched the range of completely natural, vegan friendly, and gluten-free energy gels called Gel X PRO. The energy gels were for the 2023 Gold Coast Marathon and came in flavors like Lemon Sorbet and Coldbrew Espresso. Formulation was done to improve performance in sports while providing a cocktail of amino acids, carbohydrates, and sodium. |

| 2022 | GU Energy Labs unveiled its new flavors and formulations for their energy gel to cater to a wide range of consumer preferences. Another factor is that GU Energy Labs has had other different sponsorships of campaigns and events involving endurance sports as well as athletes, which increases its brand presence and market reach. |

Growth of Plant-Based and Natural Ingredients in Energy Gels

The companies manufacturing energy gel in Australia, in response to the rising consumer demand for plant-based and natural food products, are introducing ingredients that are clean, natural, and based on plants.

Among these are ingredients such as coconut water, chia seeds, and organic sugars that align with athletes' preference for wholesome, minimally processed foods. The result of this is a very impactful trend on the Australian market.

As more and more consumers demand products that suit vegan, gluten-free, and allergen-friendly diets, energy gels based on plant-derived ingredients will surely see a considerable increase in demand.

Clean energy boosts provided by these gels will be appreciated by athletes, especially in endurance sports like marathon running and triathlons, without relying on synthetic additives or artificial sweeteners. Furthermore, the formulation usually focuses on better digestion and absorption of nutrients, which is important for long-distance athletes.

Personalized Nutrition and Customized Energy Gel Offerings

A growing trend in the Australian energy gel market is the increasing demand for personalized nutrition. The consumer is increasingly looking for something that caters to their personal needs, such as specific sports, body type, or performance goals.

The companies are taking up this challenge by offering options based on various dietary preferences, energy requirements, and even duration of physical activity. This trend will further propel innovation in the formulation process because companies will be encouraged to formulate specialized products catering to diverse Australian consumers' needs.

Personalized energy gels will allow athletes to play around with amino acid, caffeine, or electrolyte combinations to fit their personal energy expenditure profiles, hence further diversifying the market.

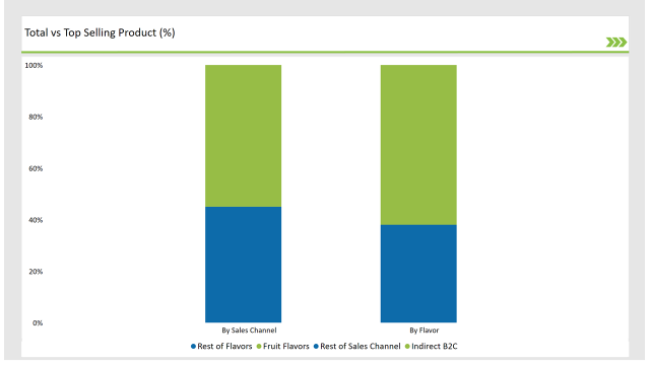

% share of Individual categories by Flavors and Sales Channel in 2025

The fruit flavor segment of energy gels tops the list of Australia, due to natural flavors that consumers consider refreshing, with the kind of pleasant flavor to enjoy while undergoing physical activities. Orange, berry, mango, and tropical mix flavors are very popular for being highly colored flavors, giving them a vibrant flavor profile.

For this reason, athletes and athletes in training appreciate them psychologically to quench and hydrate for more energetic workout sessions. The preference for fruit flavors in energy gels has a huge impact on the Australian market in several ways.

The fruity taste masks the sometimes unpleasant aftertaste of functional ingredients, creating a more enjoyable consumption experience during long endurance activities like running, cycling, or triathlons.

In the Australian energy gel market, there has been more indirect B2C sales than other forms of distribution of the product. This is because they can increase the penetration of energy gels among different groups of consumers.

Third-party retailers, which include supermarkets, health food stores, and gyms, amongst others, continue to enable greater access to the product than direct sales by manufacturers. This trend affects the market in several ways. The indirect channel of sales gives energy gel brands access to a broader customer base by tapping into the already existing consumer networks of large retailers.

This convenience fosters impulse buying and helps brands reach both dedicated athletes and general health-conscious individuals who may not have initially set out to purchase specialized products.

Note: The above chart is indicative in nature

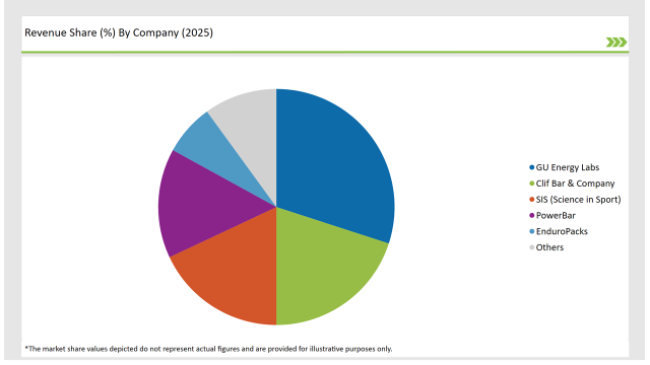

Tier 1 segment of the Australia energy gel market is characterized by dominance of global and national players. Brands that are present here are equally strong among both professional athletes and the general fitness community. Its success in Australia is mainly based on extensive networks of distribution including major retail chains, health food stores, and online platforms.

PowerBar, EnduroPacks, and Honey Stinger Tier 2 players in the Australian energy gel market. While they may not be the household names, these brands have developed niches for themselves within certain sports and fitness segments. Often, it is their niche offerings of specialized formulations for particular athlete needs: vegan, gluten-free, or low-sugar options.

Tier 3 encompasses emerging or minor players including the likes of Huma Gel, Tailwind Nutrition, Nutrend, and even Gatorade's products with energy gel as a portfolio part. These companies captures relatively smaller parts of the Australian market but each manages to enter smaller sub-segments like the more casual athlete and gym regular.

By 2025, the Australia Energy Gel market is expected to grow at a CAGR of 15.0%.

By 2035, the sales value of the Australia Energy Gel industry is expected to reach USD 13.1 million.

Key factors propelling the Australia Energy Gel market include growing focus on personalized and performance-based nutrition, consumer preference for convenient, portable energy sources, and integration of fruit flavors and natural tastes.

Prominent players in Australia Energy Gel manufacturing include GU Energy Labs, Clif Bar & Company, SIS (Science in Sport), PowerBar, Fixx Nutrition EnduroPacks, Honey Stinger, Huma Gel, Tailwind Nutrition, Gatorade, and Nutrend, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various flavors such as fruit flavors, lemonade/limeade flavors, chocolate flavor, coffee/espresso flavor, others.

As per the pack size segment, the market is segregated into single-serve, and multi-serve.

As per the sales channel segment, the market is segregated into Direct (B2B), and Indirect (B2C).

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Bouillon Cube Market Analysis by Type and Distribution Channel Through 2035

Food Fortification Market Analysis by Type, Process and Application Through 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Bone and Joint Health Supplement Market Analysis by Product Type, Form and Sale Channels Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.