The Australia Dehydrated Onions market is estimated to be worth USD 31.2 million by 2025 and is projected to reach a value of USD 57.3 million by 2035, growing at a CAGR of 7.0% over the assessment period 2025 to 2035.

| Metrics | Values |

|---|---|

| Industry Size (2025) | USD 31.2 million |

| Industry Value (2035) | USD 57.3 million |

| Value-based CAGR (2025 to 2035) | 7.0% |

The dehydrated onions market in Australia is referred to as the industry that manufactures and sells onions, which are dried to remove moisture, hence making them shelf-stable and easier to transport. They usually come in the forms of flakes, powder, or granules.

Dehydrated onions have a long shelf life and convenience in cooking and are used in food manufacturing, retail, and foodservice. For instance, they are used in soups and sauces, flavorings, ready-to-eat meals, etc.

The dehydrated onions market in Australia is significant in that the country has a very strong agricultural sector, therefore promoting the production of quality onions. The demand for processed and convenient foods increases as the demand for healthier, preservative-free ingredients used in food products increases with the growth.

Additionally, the foodservice sector of the country, consisting of restaurants, snack manufacturers, and packaged food companies, makes use of dehydrated onions as an ingredient.

Explore FMI!

Book a free demo

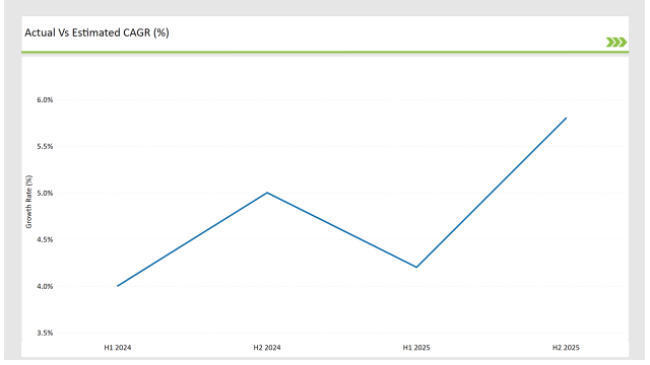

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Dehydrated Onions market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Dehydrated Onions sector is predicted to grow at a CAGR of 4.2% during the first half of 2025, increasing to 5.8% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 4.0% in H1 but is expected to rise to 5.0% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

These statistics reflect the dynamic and evolving nature of the Australian Dehydrated Onions market, of course with perspectives in terms of policy changes, the dynamics in consumer preferences, and improvements in natural ingredient solutions.

It is the company's general strategy by observing and refining their strategies, grasping opportunities for growth, and responding to the trends of this market. By monitoring these trends and shifts, businesses can better position themselves to capitalize on future demand while navigating potential challenges in the dehydrated onions sector.

| Date | Development/M&A Activity & Details |

|---|---|

| 2023 | Anuha Food Products (AFPPL) launched a variety of ready-to-cook items under its dehydrated gluten-free brand, Zilli's. Here, it has launched dehydrated onion flakes and garlic cloves that come under the category of easy-to-cook meals, as everyone needs these types of healthy meal solutions today. |

| 2024 | Agri-Neo, a manufacturer of food safety technology, teamed up with Olam International, a global agribusiness firm, to supply dried onions pasteurized organically in Australia. This alliance is meant to improve the food safety of the conventional and organic components of Olam by bringing together Olam's experience in dried onions and Agri-Neo's pasteurization technology. |

Increased Demand for Convenience Foods and Ready-to-Eat Meals

With an increasing awareness of health in Australia, there is a surge in demand for natural and nutritious ingredients. Dehydrated onions, bearing their high nutritional profile-from antioxidants to low calorie contents, are widely used today as the first ingredient in healthy meals.

Another trend that is seen is more plant-based diets and low-sodium or low-fat consumers. Thus, dehydrated onions are increasingly used in health-conscious food products. Dehydrated onions provide a natural, savory way to add flavor to dishes and get the benefits of real whole vegetables.

It has especially become vital in the ever-expanding industry of plant-based foods, using dehydrated onions in products that are both vegan and vegetarian, including meat alternatives, sauces, and seasoning blends.

Expansion of Online Grocery Shopping and E-commerce Channels

The online grocery shopping and e-commerce have also revolutionized the Australian food market, and dehydrated onions are no more an exception. As more consumers will go digital to shop for their groceries, the online sale of dehydrated onion products will also get a strong boost.

With e-commerce, the dehydrated onion products offer a wide variety of products, which may be less available offline. One may find specialty onion products, such as organic or single-origin varieties, that are less easily accessed in physical stores.

This trend is highly relevant in rural or remote areas where access to traditional retail outlets may be limited. Thus, e-commerce creates an easy source for such shoppers to acquire some of the high-quality dehydrated onions either from local dealers or foreign.

Additionally, rising subscription-based models and direct-to-consumer platforms present a pathway for brands in developing customer franchises and acquiring ongoing revenue streams.

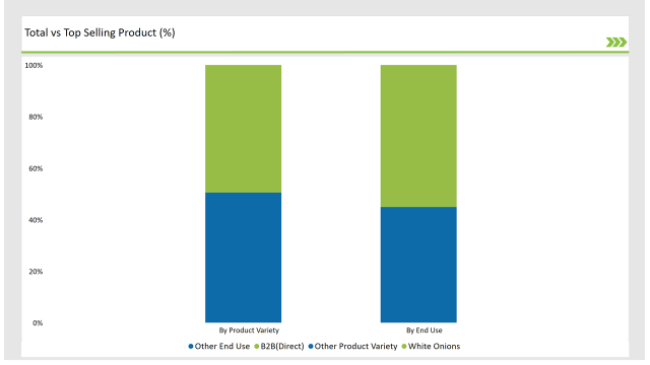

% share of Individual categories by Product Variety and End Use in 2025

The white variety of onion stands as the preferred segment in Australian dehydrated onion markets in terms of being a flavor sensation with versatile utility in a food product range from sweet to spicy. White onions are known by their mild yet slightly sweet tastes, which easily gain popularity not only in a raw form but also in well-cooked style, making dehydrated varieties very popular products.

Such flexibility has rendered them to a high extent application in processed foods, seasoning blends, soups, sauces, and ready-to-eat products, where flavor uniformity becomes critical. The dehydrated white onions lose not much pungency or their balanced taste as compared with other onion species.

To provide uniformity of flavor by diverse foodstuff, ranging from snacks to manufactured meals, was the reason which made white onion the first pick for food product manufacturers in Australia.

The B2B (Business-to-Business) end-use segment has dominated the dehydrated onion market in Australia because it can provide better efficiency, scalability, and product customization for food manufacturers.

With continuous growth in demand for processed and convenience foods, food manufacturers prefer to buy dehydrated onions directly from suppliers for guaranteed quality, competitive price, and a reliable supply chain.

This model also enables manufacturers to have their ingredient needs tailored more precisely, which makes B2B transactions more beneficial than the traditional retail purchase. This is important in the food manufacturing industry where product consistency and timely delivery ensure that production runs according to schedules and market demands are met.

Note: The above chart is indicative in nature

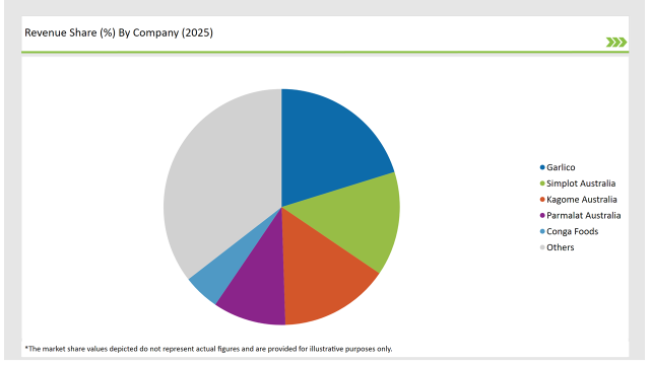

Tier 1 companies are major players in the Australian dehydrated onions market, which have considerable market share, big brands, and financial resources. Most of these companies have large-scale operations, advanced manufacturing, and a broad distribution network in both the local and international markets.

They are experienced players in this business, operating in the field for decades; they offer dehydrated onions in the forms of flakes, powder, or granules suited to the diverse requirements of most food manufacturers.

Tier 2 firms are regional players that own a good market share in the dehydrated onion business but with smaller market shares than the Tier 1 leaders. They have strong local operations and often cater to niche markets or specific customer segments, which they can serve through agile competitive products with embedded features or particular value proposition.

Tier 3 companies in Australian dehydrated onion market can be smaller and newer players entering the market where they target certain niche markets and can be organized by product variation, for instance, organic or small bulk capacity dehydrated onions, for specialty retailers’ smaller food processors and local foodservices. These enterprises are considered a regional supplier by producing high quality, smaller quantity production for individual customer bases.

By 2025, the Australia Dehydrated Onions market is expected to grow at a CAGR of 7.0%.

By 2035, the sales value of the Australia Dehydrated Onions industry is expected to reach USD 57.3 million.

Key factors propelling the Australia Dehydrated Onions market include increased preference for long-shelf life products, focus on quality control and consistency in dehydration processes, evolving retail distribution channels for dehydrated onion products, and rising consumer preference for flavored and seasoned onion products.

Prominent players in Australia Dehydrated Onions manufacturing include Garlico, Harvest Moon, Bega Cheese Patties Foods, Anuha Food Products (AFPPL), Simplot Australia, Agri-Neo, Kagome Australia, Parmalat Australia, Conga Foods, Mitolo Group, and Oakville Produce among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

As per the product variety segment, the market is segregated into white onions, red onions, pink onions, and hybrid onions.

The industry includes various product type such as Chopped, Minced, Granules, Powder, Flakes, Others.

As per the end use segment, the market is segregated into B2B (Direct), food service, and retail (B2C).

As per the processing technology segment, the market is segregated into air drying, freeze drying, microwave drying, others.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.