The Australian Cultured Wheat market is estimated to be worth USD 14.3 million by 2025 and is projected to reach a value of USD 57.1 million by 2035, growing at a CAGR of 14.9% over the assessment period 2025 to 2035.

| Metric | Values |

|---|---|

| Industry Size in 2025 | USD 14.3 million |

| Value in 2035 | USD 57.1 million |

| Value-based CAGR from 2025 to 2035 | USD 14.9% |

Australian cultured wheat industry is the segment of food ingredients market that manufactures and supplies cultured wheat a natural preservative made through controlled fermentation of wheat flour. The product is commonly used in baked goods, snacks, and other foods since it can enhance shelf life as well as maintain the freshness of a product. Cultured wheat is produced through the fermentation of wheat flour using specific bacterial cultures, typically lactic acid bacteria, which cause the formation of natural organic acids.

The acids act as antimicrobial chemicals, inhibiting the growth of spoilage microorganisms and undesirable organisms such as mold and yeast. The Australian demand for cultured wheat is growing significantly with consumer preferences for clean-label, natural, and lightly processed food products. Manufacturers are increasingly relying on this ingredient as a substitute for man-made preservatives like calcium propionate with the purpose of ensuring product stability and food safety.

The importance of the cultured wheat market in Australia is that it aligns with major consumer trends, regulatory requirements, and the overall food manufacturing industry. Consumers in Australia are increasingly health-conscious and expect food products to be labeled clearly, prompting food manufacturers to find natural preservation avenues.

Cultured wheat, being a naturally derived and known ingredient, is a simple addition to the "clean-label" trend a key driver of innovation throughout the Australian food and beverage sector. Furthermore, Food guidelines Australia New Zealand (FSANZ) regulatory guidelines encourage the use of safe, natural food preservatives, making cultured wheat more widely accepted in food applications. This sector is particularly interesting to Australia's substantial bakery industry, which includes bread, pastry, and other baked foods where shelf-life extension is an important consideration.

Explore FMI!

Book a free demo

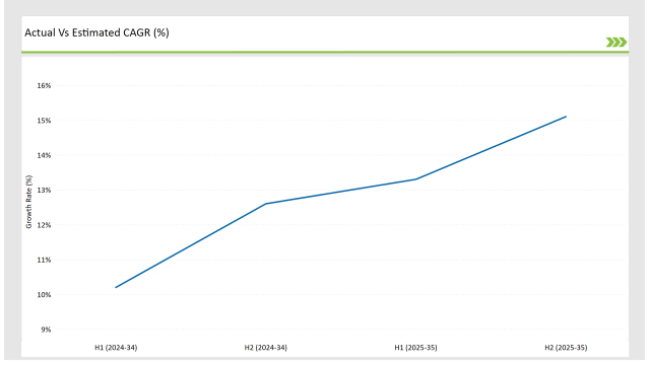

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the Australian Cultured Wheat market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Cultured Wheat sector is predicted to grow at a CAGR of 13.3% during the first half of 2025, increasing to 15.1% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 10.2% in H1 but is expected to rise to 12.6% in H2. This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian cultured wheat industry is dynamic, influenced by regulatory developments, consumer behavior, and technological innovation in natural preservation. Understanding these drivers provides organizations that have an interest in being up-to-date with upcoming trends and maintaining competitiveness. Demand for cultured wheat is driven by consumer demand for clean-label foods, as they are seen to be healthier and more transparent as a food preservation technology. In addition, continued technology development in fermentation technology and natural antibacterial agents broadens the working and usability of cultured wheat to other food groups.

| Date | Development/M&A Activity & Details |

|---|---|

| March 2023 | Allied Pinnacle, an Australian flour and bakery production company, acquired exclusive rights to market CSIRO-bred High-Fibre Wheat. The wheat contains six times more fibre than regular wheat flour, produced using traditional breeding methods. The flour produced retains the flavor and baking characteristics of regular flour but provides a healthier option without sacrificing sensory qualities. |

| March 2023 | GrainCorp is a dominant player in the Australian wheat industry. While GrainCorp is primarily known for grain storage, handling, and marketing, its involvement in the wheat supply chain makes way for increased distribution and access to higher quality wheat varieties produced through breeding programs. Their extensive network links Australian grain farmers to local and export markets, and also promotes the adoption of better wheat varieties. |

Precision Fermentation: Revolutionizing Cultured Wheat Production

Australia's cultured wheat industry is changing as a result of precision fermentation. By using gene-modified bacteria to produce certain compounds, precision fermentation improves the functionality of wheat that has been cultivated. Australian companies employ precision fermentation to produce cultured wheat with desired properties, such as enhanced antibacterial activity and shelf life, without the use of standard chemical preservatives.

The application of precision fermentation is consistent with the global shift toward healthy and sustainable food production. The trend is particularly critical in Australia since the country has a well-developed biotechnology sector, and consumer’s desire natural food additives. The conventional fermentation processes are subject to environmental factors, causing batch inconsistency. However, precision fermentation comes with a controlled environment that provides consistent uniformity in quality and strength of cultured wheat products. That reliability is vital for Australian food manufacturers that desire to uphold high standards and adhere to strict food safety standards.

Functional Ingredient Synergy: Combining Cultured Wheat with Probiotics

A new trend in the Australian cultured wheat market is the synergistic blend of cultured wheat and probiotics to produce multifunctional food ingredients. While cultured wheat acts as a natural preservative, probiotics provide health benefits by supporting a healthy gut microbiome. Food and beverage consumers in Australia increasingly demand more foods and beverages that enhance immune function, gastrointestinal wellness, and overall well-being.

Companies can design products that benefit from these trends among consumers regarding health and achieve a competitive edge by adding probiotic cultures to cultured wheat products. Cultured wheat-probiotic blends also create new opportunities for product differentiation. The manufacturers can position these multi-functional as added-value ingredients for use in many different applications such as baked products, dairy substitute, and snacks. This cross-pollination across market segments provides manufacturers an opportunity to capture more than one segment of customers ranging from healthy-oriented consumers to convenient and nutritious food seekers.

The increase in laboratory -developed wheat in Australia reflects a food building revolution operated by constant quality, advanced technology and individual nutritional solutions. The market is steamy as it has the ability to offer controlled returns with high functionality, so that food producers can meet the increasing requirement for expert wheat products. With the implementation of sophisticated bioproso technologies, laboratory-produced wheat provides better adaptation, where manufacturers can increase the properties such as textures, protein content and durability-important in modern food applications. One of the specific benefits of laboratory -created wheat is the ability to eliminate natural variability. Traditional wheat crops are exposed to climate and soil conditions, which distinguishes quality and accessibility. This uniformity is important for industries where standardized product properties are required, such as bakery, snack food and food processing industry. Australian food processors are especially ready for this accuracy, as they want to ensure the integrity of the product and remain to the exact standards of domestic and foreign markets.

The Australian food processing sector is embracing cultured wheat as a game changer in response to the demand for advanced formulations that improve product quality, functionality, and consumer acceptability. Its adaptability and beneficial properties make it an ideal ingredient for processed foods that require consistency and effectiveness. Growth in this segment is an indicator of the demand for ingredients offering better texture, longer shelf life, and enhanced sensory qualities without sacrificing product stability. Food producers in Australia are taking advantage of these benefits and incorporating cultured wheat into a wide range of processed foods, ranging from bakery products to ready-to-eat foods. Cultured wheat also helps to enhance sensory qualities of processed foods, a key aspect to ensure customer loyalty and product distinction. Its capacity to enhance dough handling, texture, and moisture retention makes it a must-have in baked products, which account for a major share of the Australian processed food industry.

Tier 1 players in the Australian cultured wheat market are large-volume producers and food processing giants worldwide with a commanding presence through innovative research, huge production capacity, and wide distribution networks. They utilize sophisticated fermentation technologies to create high-value cultured wheat for reliable and effective performance in various food applications. Their dominance is a function of significant investment in product development, which allows them to customize cultured wheat solutions to specific end uses like baked goods, snacks, and functional foods.

Tier 2 of the Australian cultured wheat market is controlled by medium-sized companies and specialized regional players that focus on concentrated product lines and reactive market strategies. These companies are likely to develop competitive niches through the establishment of niche applications of cultured wheat, such as gluten-free foods or foods for the organic/natural foods market.

Tier 3 players in the Australian market comprise new start-ups, small-scale operators, and specialist market leaders who introduce novel ideas and pilot methods to cultured wheat uses. These firms produce ultra-specialized products for healthy consumers, i.e., non-GMO, allergen-free, or reduced-processing products. Although they have limited production levels and market outreach, their edge is that they try out novel fermentation methods and offer customized solutions to small-scale food producers.

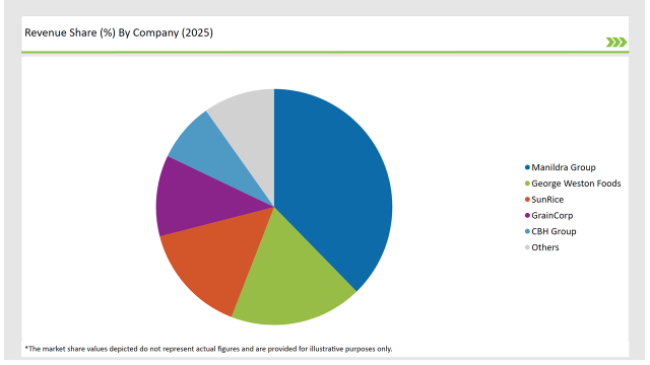

2025 Market share of Australian Cultured Wheat manufacturers

By 2025, the Australian Cultured Wheat market is expected to grow at a CAGR of 14.9%.

By 2035, the sales value of the Australian Cultured Wheat industry is expected to reach USD 57.1 million.

Key factors propelling the Australian Cultured Wheat market include Increasing Demand for Transparent Ingredient Sourcing, Technological Advancements in Bioprocessing, Expansion of Functional Food Applications, and Increased Investment in Food Safety Standards.

Prominent players in Australia Cultured Wheat manufacturing include Manildra Group, Archer Daniels Midland (ADM), Cargill, Inc., Allied Pinnacle, Grain Corp, Wholegrain Milling Company, Four Leaf Milling, Ancient Rituals, George Weston Foods, SunRice, GrainCorp, and CBH Group, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

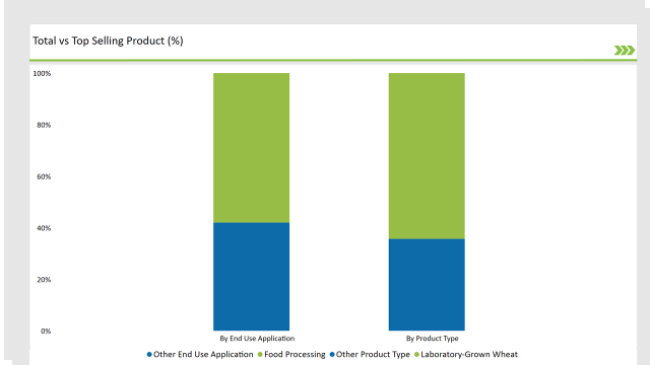

The industry includes various product types, such as Laboratory-Grown Wheat and Cell-Culture Wheat.

As per the technology segment, the market is segregated into Cellular Agriculture, Tissue Engineering, and Fermentation-Based.

As per the end use application segment, the market is segregated into Food Processing, Research & Development, and Animal Feed Alternatives.

USA Prenatal Vitamin Supplement Industry Analysis from 2025 to 2035

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Microalgae in Fertilizers Market - Growth & Sustainability Trends 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Potato Flakes Market Analysis Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others End Use Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.