The Australian Collagen Peptide market is estimated to be worth USD 28.9 million by 2025 and is projected to reach a value of USD 48.5 million by 2035, growing at a CAGR of 5.3% over the assessment period 2025 to 2035.

| Metric | Values |

|---|---|

| Industry Size in 2025 | USD 28.9 million |

| Value in 2035 | USD 48.5 million |

| Value-based CAGR from 2025 to 2035 | 5.3% |

Australian collagen peptide market is the industry of producing, selling, and consuming hydrolyzed collagen, a bioavailable form of collagen that is widely used in health, wellness, and functional food industries. Collagen peptides from bovine, marine, porcine, or poultry sources undergo enzymatic hydrolysis, cleaving the collagen into peptides and amino acids with lower molecular weights for enhanced bioavailability and intestinal absorption in humans.

The market is being driven by growing consumer awareness of the significance of collagen for skin beauty, joint health, gut well-being, and general well-being.

In Australia, the market for collagen peptides has witnessed significant momentum due to shifting consumer demand for natural and functional ingredients, growing interest in protein nutrition, and expanding influence of health and beauty trends. The importance of the collagen peptide market in Australia is due to several factors, most importantly the increasing health-conscious population actively pursuing preventive healthcare solutions.

Australians have increasingly shown a preference for dietary supplements, superfoods, and functional beverages, with collagen peptides being a prominent ingredient in such products.

Explore FMI!

Book a free demo

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the Australian Collagen Peptide market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Collagen Peptide sector is predicted to grow at a CAGR of 3.9% during the first half of 2025, increasing to 5.3% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 3.2% in H1 but is expected to rise to 4.7% in H2. This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

These findings emphasize the dynamic and fast-changing nature of the Australian Collagen Peptide market, which is influenced by changing consumer preferences, innovations in bioactive formulation, and policy changes. The bi-annual market analysis becomes an important input for companies to sharpen their strategy, take advantage of emerging prospects, and resolve industry challenges.

With increasing demand for novel collagen-based solutions, companies need to remain nimble to take advantage of market growth while conforming to changing industry norms and consumer-driven trends.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | The "Nextida" platform was unveiled by Rousselot at Vitafoods Europe 2024. It is a novel approach with distinct collagen peptide compositions targeted at particular health advantages, such as reducing blood sugar increases after meals. |

| 2022 | Vital Proteins launch its new product range in Australia exclusively in stores in Priceline Pharmacy. They have teamed up together to inspire the world to live healthy and more vibrant lives. |

Electrolyte-Infused Collagen: The Hydration Synergy Formula

Australia's warm climate and outdoor lifestyle have made hydration a critical component of health and wellbeing. Collagen supplements that contain electrolytes are the most recent innovation in the collagen peptide market. These supplements are intended to offer the dual advantages of skin hydration and cellular electrolyte balance.

These products are made for sportsmen, campers, and individuals who tend to sweat excessively due to the tropical climate in Australia. They combine essential factors such as salt, potassium, and magnesium with cow or sea collagen peptides. Collagen-based hydration has an important role as it is a staple product within the active lifestyle and sports nutrition industries at the moment.

Australian companies are taking advantage of this by creating on-the-go collagen hydration sticks, ready-to-consume electrolyte-enriched collagen drinks, and powder mixes. These products become a consumer value in that buying for multipurpose health benefits in the convenience of a single format: to refill depleted fluids, electrolyte support, and feed the skin simultaneously.

This business category will find rapid uptake by the Australian sports fitness and endurance market's population, namely runners who partake in marathon racing, athletes of the cyclist and cycling worlds, and recreation-bound outdoors adventurers.

Collagen for Gut-Brain Axis: The Holistic Healing Approach

Australia's growing interest in gut health and microbiome research has led to innovation in the collagen sector, namely the amount of collagen utilized to feed the brain axis. It is motivated by research linking intestinal integrity to mental health, immune function, and edema, which has made collagen an important component of the whole therapy strategy.

Collagen is high in glycine, glutamine, and proline, amino acids that are famous for their healing properties. Progressive Australian companies are now developing intestinal-targeted collagen products and peptides to support digestive health with prebiotics, postbiotics, and anti-inflammatory herbs such as turmeric, redemption, and smooth elm.

These products are aimed at individuals suffering from irritable bowel syndrome (IBS), dripping intestines, and stress-related digestive problems, which are common among modern consumers.

The rise of nutritional collagen peptides in the Australian market is driven by an emerging bioactive nutrition revolution in which the consumer becomes increasingly interested in specifically proven, evidence-based health solutions rather than across-the-board supplementation.

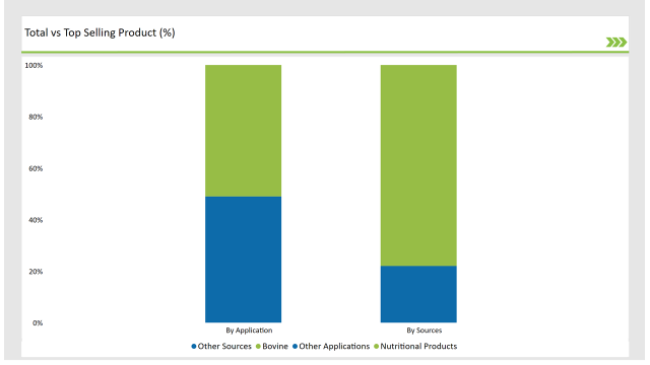

This transformation extends beyond mere dietary supplementation typically observed, highlighting collagen's functional advantage of enhancing physiological performance beyond minimum joint and skincare advantages. The category of nutrition products now leads due to the rise of precision nutrition, sports science technology, and a growing wellness-first culture among Australians. Among the strongest drivers of the trend is the addition of collagen peptides in performance-based nutrition.

Being sportspeople, fitness enthusiasts, and active consumers, they challenge themselves, and thus, collagen-enhanced recovery supplements, endurance boosters, and muscle-supporting products are in huge demand. Scientific studies establishing collagen's role in tendon recovery, muscle mass maintenance, and injury prevention have fueled its popularity among the sports performance segment, taking it from a beauty supplement to a staple functional nutrition compound.

The bovine collagen peptide industry has secured its dominance in the market in Australia through growing demand for high-performance health products, biomimetic nutrition, and functional uses with defined applications.

While science-based supplementation and bioavailability optimization have become leading consumer shopping paradigms, bovine-sourced collagen has gained popularity on account of efficacy, structural complementarity with human collagen, and multidimensional health benefits for utilization in sports nutrition, joint nutrition, and aesthetic-enhancing applications.

The fact that bovine collagen is the most bio-friendly source to include in bioactive performance nutrition is one of the elements that led to its development. Type I and Type III collagen, which are essential for preserving tendon integrity, muscle healing, and connective tissue health, are only found in bovine collagen peptides. As a result, physiotherapist-directed mobility programs, postop recovery programs, and high-intensity training regimens are now quite common.

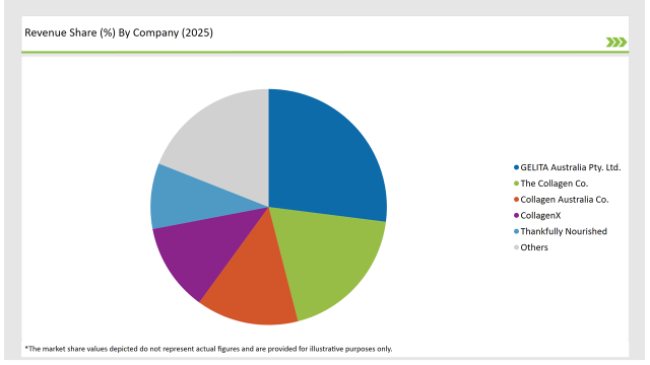

Tier 1 players are the market leaders with a strong brand presence, science-driven product innovation, and enormous distribution chains. They have access to the latest technology, proprietary extraction technology, and bulk production facilities to produce consistent quality and high bioavailability of collagen peptides. Their ability to invest heavily in R&D makes them introduce science-driven formulations such as bioengineered collagen, hybrid peptide complexes, and targeted nutritionals.

Tier 2 collagen peptide companies are growth businesses with nascent product development and local market leadership. Tier 2 brands usually have specialist products for particular applications, i.e., pescatarian marine collagen, gut health collagen, or functional beauty beverages. These products are aimed at individuals suffering from irritable bowel syndrome (IBS), dripping intestines, and stress-related digestive problems, which are common among modern consumers.

Tier 3 collagen peptide companies, domestic country-of-origin supplement companies, and small cottage health operations catering to niche customer needs. Since they provide handcrafted, ethically produced, or niche collagen products that are attractive to ethical consumers, they gain popularity despite not necessarily being as large or having as much marketing budget as more traditional competitors.

2025 Market share of Australian Collagen Peptide manufacturers

By 2025, the Australian Collagen Peptide market is expected to grow at a CAGR of 5.3%.

By 2035, the sales value of the Australian Collagen Peptide industry is expected to reach USD 48.5 million.

Key factors propelling the Australian Collagen Peptide market include personalized wellness with targeted collagen blends, collagen’s expansion into pharmaceuticals and pet nutrition, and skin-deep beauty: the rise of inner wellness supplements.

Prominent players in Australia Collagen Peptide manufacturing GELITA Australia Pty. Ltd., The Collagen Co., Collagen Australia Co., CollagenX, Rousselot, Nitta Gelatin, PB Leiner, Devro, Vital Proteins AU, and Thankfully Nourished, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various sources such as Bovine, Porcine, and Marine & Poultry.

The industry includes various sources such as Dry and Liquid.

As per the application segment, the market is segregated into Nutritional Products, Food & Beverages, Cosmetics & Personal Care Products, and Pharmaceuticals.

Dairy-Free Cream Market Insights – Plant-Based Dairy Alternatives 2025 to 2035

Dairy Flavors Market Trends – Growth & Industry Forecast 2025 to 2035

Egg Protein Market Insights – High-Protein Nutrition & Market Growth 2025 to 2035

Dried Eggs Market Insights – Shelf-Stable Nutrition & Industry Growth 2025 to 2035

Egg Substitute Market Insights – Plant-Based Alternatives & Industry Growth 2025 to 2035

Egg-Free Dressing Market Trends – Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.