The Australian Bakery Ingredient market is estimated to be worth USD 8,314.6 million by 2025 and is projected to reach a value of USD 37,898.7 million by 2035, growing at a CAGR of 16.4% over the assessment period 2025 to 2035

| Metrics | Values |

|---|---|

| Industry Size in 2025 | USD 8,314.6 million |

| Value in 2035 | USD 37,898.7 million |

| Value-based CAGR from 2025 to 2035 | 16.4% |

The Australian bakery ingredients market includes flour, sugar, fats, oils, leavening agents, stabilizers, emulsifiers, and flavorings. The ingredients include numerous bakery products such as bread, cakes, pastries, cookies, and other sweets.

In terms of significance, the bakery ingredients market in Australia is very considerable as it feeds into a burgeoning food manufacturing industry with big industrial players and smaller artisanal bakers. Ingredient quality, consistency, and price point fuel formulation innovation that balances product quality, convenience, and healthiness.

Gluten-free, vegan, and low-sugar options are quickly becoming the new battleground for ingredient composition and processing methods. The bakery industry plays a significant role in the economy of Australia. In this regard, local manufacturers draw ingredients from both domestic and international markets. Diversities like consumer preferences or growing demand for convenience foods and factors related to food safety regulations impact the market.

Explore FMI!

Book a free demo

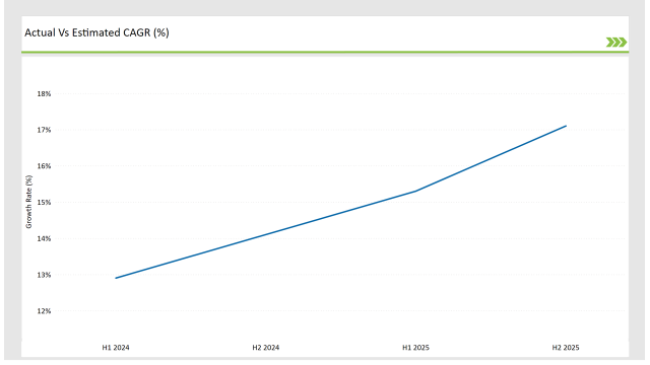

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Bakery Ingredients market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Bakery Ingredients sector is predicted to grow at a CAGR of 15.3% during the first half of 2025, increasing to 17.1% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 12.9% in H1 but is expected to rise to 14.1% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The above figures reflect how the Bakery Ingredients market in Australia is constantly in a state of flux, given factors such as changes in regulatory environments, evolving consumer preferences, and continuous innovations.

This bi-annual review is important to companies that will refine their strategy as it shows expected growth of the market and challenges that firms are likely to face. Understanding these dynamics allows businesses to position themselves even better to be able to reap emerging opportunities as well as navigate the ongoing transformation within the bakery ingredients sector.

| Date | Development/M&A Activity & Details |

|---|---|

| December 2023 | Goodman Fielder launched its novel product, Pastry Gems, which will help bakers to consistently bake perfect pastry. This innovation represents the company's commitment to the baking industry with high-quality ingredients and solutions. |

| 2022 | Puratos launches a new sourdough selection, which the company produced using Australian-grown flours farmed in Australia by regenerative agriculture practitioners, in Melbourne. Each of them has a special flavor and a high nutrient profile, since flours used contain single-origin wheat and wholemeal rye. |

Adoption of Functional and Fortified Bakery Products

Functional foods, with the inclusion of added nutrients including vitamins, minerals, antioxidants, and probiotics, are experiencing growth in Australia, especially in bakery products. Consumers are focusing on getting more from foods than just basic nutrition, which is opening innovations in the bakery ingredients market.

This trend mainly influences huge manufacturers and small in-house bakeries to invest in advanced formulations that offer specific health benefits. For example, probiotics have fast turned out to be the most popular ingredients for the fermentation of bakery goods, such as sourdough, to be included in the digestive health of customers. Baked products fortified with plant-based ingredients such as spirulina, flax seeds, and turmeric also fit the trend to move towards functional foods providing immunity and skin health, among others.

Popularity of High-Protein Bakery Products is increasing among Australian Consumers

Protein-enriched bakery items are expected to proliferate in Australia due to the health and fitness culture, which is rapidly gaining momentum, and because of the shift towards higher-protein diets. In pursuit of tasteful functional foods that do not compromise on nutrition, consumers have been increasingly looking for high-protein variants such as protein-enriched breads, muffins, and bars.

Such bakery items appeal not only to people and fitness lovers but also serve as products used in general weight management and care for health as well. It includes the usage of protein powders derived from whey, peas, rice, and other plant-based sources. In addition, manufacturers incorporate protein-enriched ingredients like hemp seeds, quinoa, and pulses in baked goods and expand the offerings in the market.

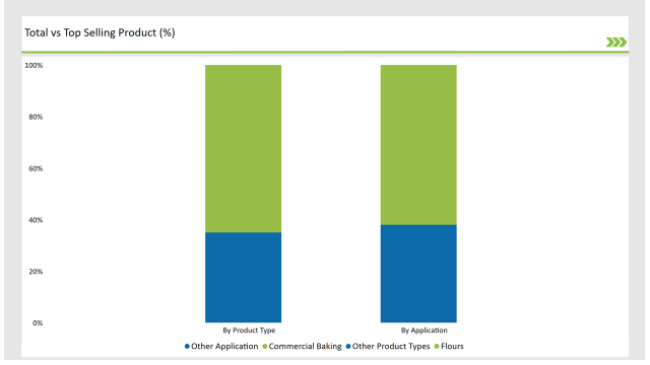

% share of Individual categories by Product Type and End User in 2025

The bakery ingredients market, flour is still the leader in Australia as it finds key application in foundational production for a wide range of baked goods. It acts as the mother base ingredient for almost every baked product, including cakes and cookies, from bread to pastries.

The markets for flour in Australia are expanding owing to the traditional use in baked products but also on account of increased demand for specialty flours owing to changed dietary trends. In addition, whole grain and ancient grain flours such as spelt and quinoa have gained popularity over the years and altered the face of the market to offer consumers healthier options that are not sacrificed for taste and texture..

The commercial baking segment is the market leader in bakery ingredients because it is capable of responding to the increasing demand for mass-produced, high-quality bakery products at scale. Commercial baking operations, which supply supermarkets, restaurants, and food service providers, have become the driving force behind ingredient demand as they focus on maintaining efficiency, consistency, and cost-effectiveness in large-scale production.

The commercial baking segment is of great importance to the dynamics of the industry as a whole owing to the growing demand for ready-to-eat bakery products. Commercial bakers are able to produce these items in large quantities while maintaining uniformity in taste, texture, and appearance. This scalability allows bakeries to supply products on a national scale and meet the needs of diverse consumer segments, from fast food outlets to high-end cafes.

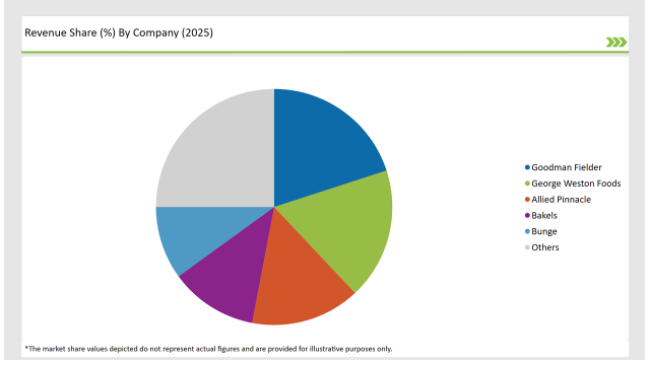

2025 Market share of Australia Bakery Ingredients manufacturers

Note: The above chart is indicative in nature

Tier 1 consists of the industry's largest and most established businesses, who dominate due to their massive market share, huge distribution networks, and strong brand awareness. These companies are usually international corporations with a diverse product line that includes staple components like flour, oils, sugars, and stabilizers, as well as specialist solutions like gluten-free or high-protein blends.

Tier 2 companies are known to be established players within the Australian Bakery Ingredients market but do not have the same level of global reach or product diversity. They usually cater to both commercial bakeries and smaller artisanal bakeries, with solutions meant to preserve the emphasis on quality, functionality, and innovation.

Tier 3 players in the Australian Bakery Ingredients market can be perceived as relatively smaller, and more recent entrants, possibly market specific for niche ingredients in specific product lines or capitalizing on emerging trends with consumers. For example, gluten-free flours and other alternative grains and plant-based foods specifically targeted at health-conscious consumers.

By 2025, the Australian Bakery Ingredients market is expected to grow at a CAGR of 16.4%.

By 2035, the sales value of the Australian Bakery Ingredients industry is expected to reach USD 37,898.7 million.

Key factors propelling the Australian Bakery Ingredients market include increased popularity of specialty and gourmet bakery products, integration of advanced milling and processing techniques, growing preference for high-protein baked alternatives, and proliferation of artisan and boutique bakeries.

Prominent players in Australia Bakery Ingredients manufacturing include Goodman Fielder, George Weston Foods, Bakels, Don Smallgoods, Bunge, Cargill, Allied Pinnacle, La Manna, Puratos, The Natural Confectionery Company, and The Cookie Man, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

As per the product typesegment, the market is segregated into flours, sweeteners, leavening agents, fats and oils, among others.

As per the application segment, the market is segregated into commercial baking, home baking, and industrial baking.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

USA Aqua Feed Additives Market Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.