The Australian Aqua Feed Additives market is estimated to be worth USD 75.8 million by 2025 and is projected to reach a value of USD 124.9 million by 2035, growing at a CAGR of 5.1% over the assessment period 2025 to 2035.

| Metric | Values |

|---|---|

| Industry Size in 2025 | USD 75.8 million |

| Value in 2035 | USD 124.9 million |

| Value-based CAGR from 2025 to 2035 | USD 5.1% |

The Australian Aqua Feed Additives Industry is pivotal to the viable aquaculture of the country, which is accountable for meeting domestic and export seafood needs. Aqua feed additives are technical products that are incorporated in aquafeed recipes with a view to enhancing nutritional quality, enhancing fish health, enhancing feed efficiency, and optimizing aquatic animal growth like fish, crustaceans, and mollusks.

These additives consist of amino acids, vitamins, minerals, prebiotics, probiotics, enzymes, antioxidants, and other functional food ingredients that play a role in improving feed quality overall and aquaculture production sustainability. Aqua feed additives are essential in Australia due to their capacity to enhance productivity, control diseases, and ensure environmental sustainability.

Increasing market demand for aquaculture products that are sustainable and high quality. Increased consumer awareness in Australia about where their food comes from and its environmental impact is placing pressure on aquaculture producers to be more sustainable. As the aquaculture sector grows with seafood demand continuing to increase and wild fish supplies declining, demand for innovative and effective feed additives is also increasing.

Feed additives are also vital in assisting aquaculture producers to minimize the use of wild fish as feed by improving the digestibility of alternative plant protein and feed conversion ratio (FCR). This subsequently enables the producers to generate fish with minimal environmental footprint but similar or even improved growth rates.

Explore FMI!

Book a free demo

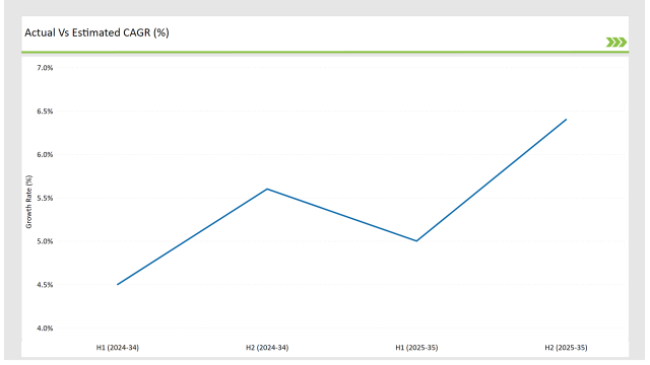

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the Australian Aqua Feed Additives market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Aqua Feed Additives sector is predicted to grow at a CAGR of 5.0% during the first half of 2025, increasing to 6.4% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 4.5% in H1 but is expected to rise to 5.6% in H2. This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian aqua feed additives industry keeps changing as a result of diverse circumstances, ranging from regulatory environments, changing customer needs, to innovation in nature-based feed options. These pressures significantly influence shaping market trends, spurring innovation, and enhancing sustainable solutions.

Companies can optimally leverage market growth and compete by keeping current with regulatory issues and consumer tendencies. This business plan is essential to navigating the complexities of the aqua feed additives industry and obtaining long-term commercial viability.

Aqua Fulvics Group is a company that deals with the formulation of innovative aquafeed additives, specifically natural fulvic acid-based products, to boost aquaculture productivity and sustainability. Their signature product, Fulvat Aqua, is a functional feed additive containing a proprietary blend of natural fulvic acids, chelated minerals, amino acids,and natural antimicrobial compounds.

Ridley Corporation Limited established a new state-of-the-art extrusion plant in Westbury, Tasmania, specifically to supply the salmon and fish feed markets, as well as pet food manufacturers. The plant has an initial production capacity of 50,000 tons of extruded feeds, with allowance for future expansion to accommodate increasing demand.

Seaweed-Derived Feed Additives: Harnessing Marine Bioactives

Australia's long coastline has a diverse range of seaweed species along it with untapped aquafeed development potential. Scientists and industries are investigating the use of seaweed-based bioactive as part of aquafeed mixtures. The marine bioactive have already been proven to increase growth, gut health, and immune systems of farmed aquatic animals.

The usage of native seaweeds now not simplest gives a sustainable and domestically sourced additive however additionally reduces reliance on conventional fishmeal and artificial additives. This technique aligns with global developments closer to herbal and promoting feed additives, offering Australian aquaculture a competitive area in each domestic and global markets.

Indigenous Ingredient Integration: Embracing Native Resources

Australia's endemic flora provides a rich source of native plants with potential uses in aquafeed additives. Native ingredients like wattle seed and Kakadu plum extracts are being considered for use due to their nutritional and health-promoting properties. Native resources contain essential nutrients and bioactive compounds that could boost the health and growth of cultured aquatic animals.

The inclusion of native ingredients not only has functional advantages but also benefits indigenous communities and biodiversity. The trend is an appreciation of a revival of traditional knowledge and the sustainable harvesting of native Australian resources for contemporary aquaculture practice.

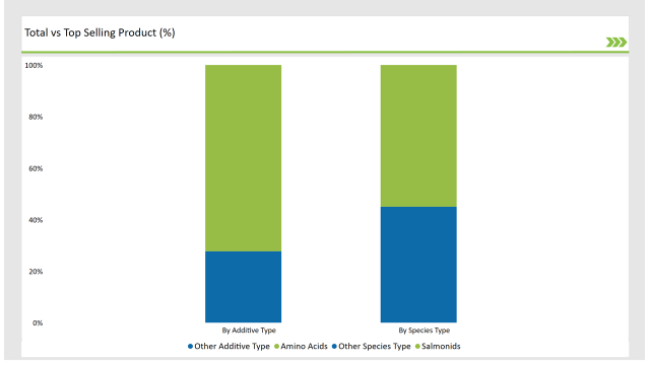

The salmonids category dominates the Australian aquafeed additives market based on the premium economic value and increasing consumer demand for high-end seafood. Among these, Atlantic salmon has emerged as a key species in Australian aquaculture, influenced by its high demand in the market, high nutritional value, and versatility of application in cooking.

The dominance of this species has a direct effect on the aquafeed additives market because manufacturers concentrate on innovative formulation strategies to enhance fish health, growth, and product quality. Salmonids possess highly unique diets that correspond to their physiology, which brings about innovation among feed additives such as growth drivers, immunoenhancers, and coloration. With consumer demands for quality product consistency and enhanced texture, taste, and aquafeed companies invest in newer technologies to meet these altered needs.

The amino acids additive segment leads the Australian aquafeed additives market due to its central role in enhancing the growth, health, and overall productivity of farmed aquatic animals. As aquaculture operations in Australia move towards maximizing output without compromising quality, amino acids have emerged as a necessity for increasing feed efficiency and enabling optimal physiological development in fish and crustaceans.

The growth of the amino acids segment is among the most important success drivers arising from the growing focus on feed conversion ratio optimization. Aquaculture profitability is based on the capacity of aquatic animals to convert food into biomass. Lysine, methionine, and threonine are some of the basic amino acids for protein use as well as maximum use of nutrients. By incorporating these vital amino acids in the feeding products, Australian aquaculture farmers can save waste, decrease operation cost, and increase production.

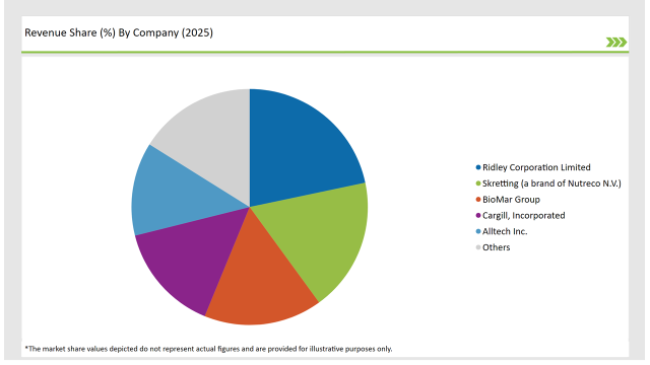

Tier 1 Australian aquafeed additive manufacturers are worldwide behemoths with robust R&D centers, advanced manufacturing facilities, and extensive distribution networks. They are pioneers in establishing industry standards and offering patented additive solutions to suit the nutritional requirements of key farmed animals such as salmon, and shrimp. Their good financial position allows them to invest in heavily in technology-based formulations such as amino acids, probiotics, and functional bioactive ingredients.

Tier 2 players possess a nimble middle level within the Australian aquafeed additives industry, with equilibrium of focused ranges of products and trend sensitivity. These companies specialize in narrow niches of additives, e.g., immune-enhancing peptides, mineral chelates, and stress-reduction molecules, where technical skills can be leveraged to create competitive niches. They are competitive on the basis of short innovation cycles and the capacity to provide bespoke blends of additives that provide measurable improvements in performance.

Tier 3 players in the Australian aquafeed additives industry are generally smaller, regionally oriented suppliers that specialize in providing customized and specialized additive solutions to regional aquaculture facilities. These companies tend to focus on the utilization of local raw materials and natural bioactives, appealing to producers who require localized and affordable feed improvements. Their market share is strongest in regional aquaculture centers where customized feed solutions are critical for species such as yellowtail kingfish and tropical prawns.

2025 Market share of Australian Aqua Feed Additives manufacturers

By 2025, the Australian Aqua Feed Additives market is expected to grow at a CAGR of 5.1%.

By 2035, the sales value of the Australian Aqua Feed Additives industry is expected to reach USD 124.9 million.

Key factors propelling the Australian Aqua Feed Additives market include Expanding Functional Additives to Boost Aquatic Resilience, Optimizing Digestive Health with Advanced Enzyme Technologies, Enhancing Feed Efficiency through Precision Formulation, and Tailored Solutions for Diverse Aquaculture Species Profiles.

Prominent players in Australia Aqua Feed Additives manufacturing include Ridley Corporation Limited, Archer Daniels Midland Company (ADM), Charoen Pokphand Group, Novus International, Aqua Fulvics Group, Skretting (a brand of Nutreco N.V.), BioMar Group, Cargill, Incorporated, Bionetix International, and Alltech Inc., among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various species type, such as Salmonids, Tilapia, Cat Fish, Crap, Crustaceans, and Mullet.

The industry includes various additive types such as Amino Acids, Vitamins, Minerals, Antibiotics, Acidifiers, Anti-oxidants, and Others.

As per the ingredient segment, the market is segregated into Soybean, Corn, Peas, Fish Oil, Sunflower Seed, and Others.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.