The Australian Animal Feed Alternative Protein market is estimated to be worth USD 465.8 million by 2025 and is projected to reach a value of USD 1,434.5 million by 2035, growing at a CAGR of 11.9% over the assessment period 2025 to 2035.

| Metric | Values |

|---|---|

| Industry Size in 2025 | USD 465.8 million |

| Value in 2035 | USD 1,434.5 million |

| Value-based CAGR from 2025 to 2035 | 11.9% |

Australia's animal feed alternative protein industry is expanding in importance as the country strives to enhance cattle nutrition, reduce reliance on traditional protein sources such as fishmeal and soybean meal, and address sustainability concerns. This market offers a wide range of alternative protein sources, including single-cell proteins (microbial proteins from fungus, yeast, and algae), plant proteins (pea, canola, and lupin protein), insect meal (e.g., black army fly larvae), and precision-fermented proteins.

Australia's over-reliance on imported soybean meal for feed has compelled the demand for locally sourced alternative proteins, which can improve food security with lower environmental footprint. The significance of this market lies in its potential to lower greenhouse gas emissions, conserve land and water resources, and provide more resilient supply chains for the livestock, poultry, and aquaculture industries.

In addition, alternative proteins like insect and microbial proteins possess higher digestibility and amino acid balance, and therefore are nutritionally equivalent or better than conventional feed ingredients. Aquaculture is a rapidly growing industry in Australia, and is one of the major drivers for demand for sustainable feed, as overfishing of the seas creates questions on the sustainability of fishmeal.

To increase domestic production capacity, the Australian government, academic institutes, and commercial firms are investing extensively in alternative protein production technologies such as large-scale insect farming and fermentation-based feed technology.

Explore FMI!

Book a free demo

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the Australian Animal Feed Alternative Protein market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Animal Feed Alternative Protein sector is predicted to grow at a CAGR of 9.8% during the first half of 2025, increasing to 12.9% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 9.0% in H1 but is expected to rise to 10.1% in H2.

This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Animal Feed market develops with Australian alternative protein regulation reforms, and changes customers taste and innovation in permanent feed production. The tendency of the market is affected by the increasing demand for sustainable and nutritional feed opportunities such as insect protein, single cell protein and plant -based alternatives.

Feed policy and stability norms have an important role to play in the industrial strategy, and scientific progress in natural and bio-based feed mixtures for traditional animal feed proteins and even more effective and value-for-money alternatives.

| Date | Development/M&A Activity & Details |

|---|---|

| October 2024 | The Israeli company Kinoko-Tech has entered into a collaboration with an Australian company Metaphor Foods, and markets a variety of Mycellium-based protein products. The purpose of this collaboration is to create nutritious, mushroom rituals such as burgers, sausages and protein bars using the products from the food industry, so to handle questions about waste and stability. |

| May 2024 | Goterra, an Australian company, specializing in insect -based solutions, has worked with skating Australia to mix locally produced insect proteins for water food. The purpose of this collaboration is to evaluate the use of the street's insect food in local aquaculture species, then promote permanent feeding alternatives. |

High-Performance Insect Protein Blends for Species-Specific Nutrition

Precision-formulated insect protein mixtures which might be tailor-made to specific farm animals, aquaculture, and pet diets are changing conventional insect meal packages inside the Australian animal feed industry. The next step inside the development method is to modify the amino acid profiles, fatty acid compositions, and bioactive compounds in insect feed to meet the nutritional wishes of quite a few species, in spite of the fact that black soldier fly (BSF) larvae protein is becoming increasingly popular.

Bioactive compounds in insect -based totally feed to match the nutritional necessities of various species. This change towards centered insect protein formulations will growth feed efficiency, growth and preferred fitness in cattle and aquaculture. By growing customized combos with omega fatty acids precise to fish, enhancing the calcium content material of poultry or immune-enhancing homes for cattle, feed manufacturers can create high price, overall performance-orientated feed solutions.

Furthermore, it will open up prospects for local insect protein manufacturers to establish themselves as top class suppliers in both country wide and worldwide markets.

Bio-Encapsulated Microalgae Proteins for Enhanced Digestibility

Bio-encapsulation complements nutrient stability and managed launch, ensuring farm animals and fish get hold of most beneficial nutrient absorption over the years. This method is especially beneficial in monogastric animals like chicken and swine, where digestibility plays a vital position in boom performance. In the aquaculture zone, encapsulated microalgae proteins offer an alternative to fishmeal with advanced lipid balance, decreasing nutrient loss in water and enhancing feed conversion ratios.

As encapsulation era will become extra cost-effective, microalgae proteins will become a mainstream alternative protein source, benefiting big-scale feed producers looking for subsequent-generation feed answers. Microalgae are wealthy in vital fatty acids, proteins, and pigments, but their bioavailability has been a undertaking because of anti-nutritional factors and oxidation problems.

Innovations in encapsulation the use of herbal biopolymers and advanced emulsification strategies are supporting triumph over these barriers.

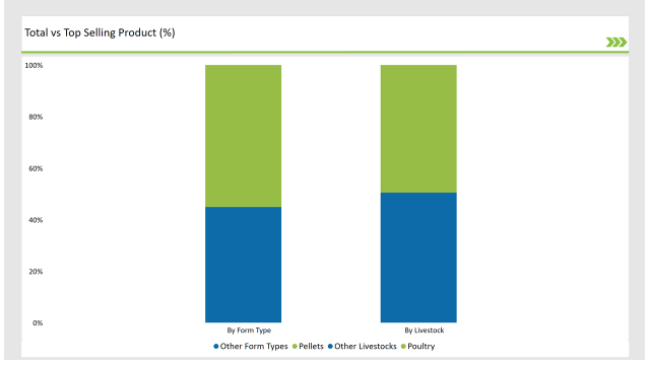

The poultry region leads the trend in alternative protein consumption such as the rapidly growing production cycle, the efficiency of feed use and high protein, changes consumers' demand for cheap meat products. In all livestock production fields, poultry farming is unique to the characteristics of the abbreviation period, which is quickly able to adopt new formulations with feed and monitor their impact on productivity and health.

Compared to cattle and wild boar, poultry requires a lower feed input per kilo of meat produced, causing them to test and scale alternative protein sources such as insect foods, algae -based protein and fermented feed materials. The feeding industry is sensitive to the variation in the cost of feed, and the alternative protein is increasing due to the requirement for nutritional feed of poultry producers that are also affordable, which assess the prices of volatile grain and soybeans.

Therefore, pest proteins from local sources and single cell proteins become the most promising, stable and scalable feeding options compared to imported feed materials. These protein sources increase feed conversion rates and intestinal health, leading to better weight gain and low mortality, which are important for large poultry farms.

The pelleted feed segment has emerged as a preferred choice in livestock and poultry farming, due to the frequent nutritional structure, increase in digestive power and better handling efficiency. Compared to mash or cruel feed, the pellets provide a smooth feed structure, ensuring that animals get balanced nutrition in each bite.

This unities component prevents separation and selective feeding, causing adapted growth rates and improves general health in chicken, cattle and swine. The growing game towards pelleted feed is largely controlled by feed conversion efficiency and consumption of controlled nutrients, especially in intensive livestock systems. Farmers and feed producers believe that fine feed particles in the form of mash often cause waste and uneven consumption, causing nutritional imbalance between animals.

The pellet reduced the problem by compressing all the ingredients in a single, compact form, and ensuring frequent intake of essential proteins, vitamins and minerals. It is especially beneficial in poultry and pig production, where accurate nutritional absorption affects the performance of direct growth and the quality of meat.

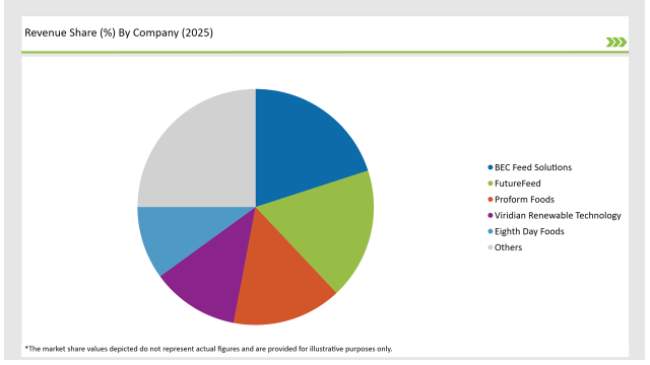

Tier 1 -companies dominate due to the construction of large scale, state R&D and large -scale supply chain networks. These industry leaders, including important agricultural activities and global feed producers, use modern processing technology and strategic collaboration to increase the product's efficiency and scalability. Their influence is outside national boundaries, with a strong alliance worldwide, insect foods, algae-based protein and new protein sources, including microbial fermentation, ensures access to protein sources.

Tier 2 enterprises drive market expansion and innovation. These mid-sized businesses, specialty ingredient suppliers, and regional feed producers prioritize product differentiation and targeted market penetration. Unlike Tier 1 giants, they emphasize adaptability, developing niche formulations that cater to specific livestock needs or emerging consumer-driven trends, such as functional animal nutrition.

Tier 3 companies serve as the disruptive force to transform the industry-from the ranks of startups, small-scale innovators, and research-driven firms-are more likely found in incubator ecosystems, tasked with developing feed alternatives that solve some of the most urgent problems for the livestock industry, such as feed efficiency or methanogenic resistance.

2025 Market share of Australian Animal Feed Alternative Protein manufacturers

By 2025, the Australian Animal Feed Alternative Protein market is expected to grow at a CAGR of 11.9%.

By 2035, the sales value of the Australian Animal Feed Alternative Protein industry is expected to reach USD1,434.5 million.

Key factors propelling the Australian Animal Feed Alternative Protein market include Farm-Fresh Fermentation: Microbial Proteins Reshaping Feed Formulations, Precision Blends for High-Performance Livestock, Advanced Protein Blends Boosting Egg and Meat Yields, and Native Plant Proteins Supporting Livestock Growth.

Prominent players in Australia Animal Feed Alternative Protein manufacturing include BEC Feed Solutions, FutureFeed, Proform Foods, Viridian Renewable Technology, Australian Plant Proteins Pty Ltd, V2food, Roam Agricultural, Real Pet Food Co., Manildra Group, Gelita Australia, and Eighth Day Foods, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various feed types, such as Insect Based Protein, Plant based Protein, Fish Meal Alternative, Single-cell proteins, and Others.

The industry includes various forms such as Meal, Pellets, Liquid, and Freeze-Dried.

As per the livestock segment, the market is segregated into Poultry, Swine, Cattle, Equine, and Aquaculture.

USA Prenatal Vitamin Supplement Industry Analysis from 2025 to 2035

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Microalgae in Fertilizers Market - Growth & Sustainability Trends 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Potato Flakes Market Analysis Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others End Use Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.