The Australia Animal Feed Additives market is estimated to be worth USD 171.1 million by 2025 and is projected to reach a value of USD 615.9 million by 2035, growing at a CAGR of 13.7% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size in 2025 | USD 171.1 million |

| Projected Australia Value in 2035 | USD 615.9 million |

| Value-based CAGR from 2025 to 2035 | 13.7% |

The Animal Feed Additives market in Australia is related to manufacturing, as well as usage of ingredients added to animal feeds for quality and nutritional augmentation and efficiency of feeding. These include vitamins, minerals, enzymes, amino acids, antibiotics, probiotics, and antioxidants, all applied to promote growth, health, and production of animals. In Australia, this market is a very important key to the sectors of livestock and poultry, which constitute the biggest parts of the agricultural economy.

The inclusion of animal feed additives improves the productivity and efficiency of animals in bringing better yield and quality meat, eggs, and dairy products, therefore contributing to food security, sustainability, and competitiveness of exports in the agricultural sector in Australia.

Besides, the rising awareness concerning the health of animals and the need for quality animal products have seen Australian farmers embracing these additives not only to meet domestic standards but also international ones. Feed additives that are innovation-based, such as natural and organic alternatives, are also in higher demand for consumer desire for healthier and more sustainable food consumption options.

Explore FMI!

Book a free demo

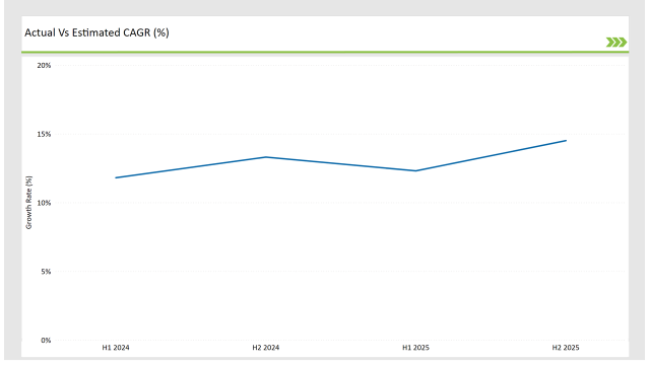

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Animal Feed Additives market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Animal Feed Additives sector is predicted to grow at a CAGR of 12.3% during the first half of 2025, increasing to 14.5% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 11.8% in H1 but is expected to rise to 13.3% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

These figures illustrate the dynamic and constantly changing landscape of the Australian Animal Feed Additives market, which is shaped by factors such as regulatory developments, shifting consumer demands, and advancements in innovative feed solutions. The semi-annual analysis will be valuable for businesses to adjust their strategies in order to take advantage of growth opportunities that will arise while overcoming the challenges in the market.

| Date | Development/M&A Activity & Details |

|---|---|

| November 2024 | New nutritious feed solutions specifically designed for the dairy sector in Australia and New Zealand were presented by NOVUS International . In order to meet the unique demands of dairy producers in the area, these products are designed to maximize animal wellbeing, increase milk supply, and boost reproductive function. |

| June 2024 | CH4 Global and CirPro Australia have released a methane-reducing feed additive to reduce methane emissions from cattle. The early testing showed a 25% reduction in methane emissions, with the resultant beef slated for distribution in the local Australian market. |

Growing Demand for Functional Feed Additives

Increased demand for better animal health and productivity has created massive demand for functional feed additives in Australia. As compared to simple basic nutrition, these feed additives improve the immunity, digestive ability, and general health of the livestock.

Probiotics, prebiotics, and enzymes are considered popular functional additives due to the ability to maximize feed utilization and reduce disease outbreaks, thereby increasing overall performance in animals. Moreover, with the development of precision farming practices, where individual health of the animals is monitored closely, the growth and demand for functional feed additives will increase.

With time, as technology turns from general treatment to one that is more specific, need-based additives will increase in demand. Therefore, Australians will have to manufacture more targeted, functional additives, which will lead to more efficiency and a healthy approach towards feeding the animals, thereby increasing production and profit in this animal farming industry.

Integration of Digital Technologies for Feed Additive Optimization

Integration of digital technologies into animal feed will mark one of the major trends going to influence this Australian market most. Developments in data analytics, IoT, and AI, for instance, have led to better optimization of feed additives with precision and efficiency.

Digital technologies can actually enable farmers to monitor real-time data coming in from their stock in the way of growth, health metrics, and intake behavior of feeds. This section suggests feed formulations that can be customized using AI-powered tools and machine learning algorithms that give formulated feeds optimized for different additive usage levels based on particular animal requirements, thus reducing unwanted dosages and waste.

For example, IoT sensors on animals or in feeding systems monitor feeding behavior. The data thus obtained can be analyzed to alter the type or amount of additives in their feed. This ensures that animals get the exact level of nutrients needed for maximum health and growth.

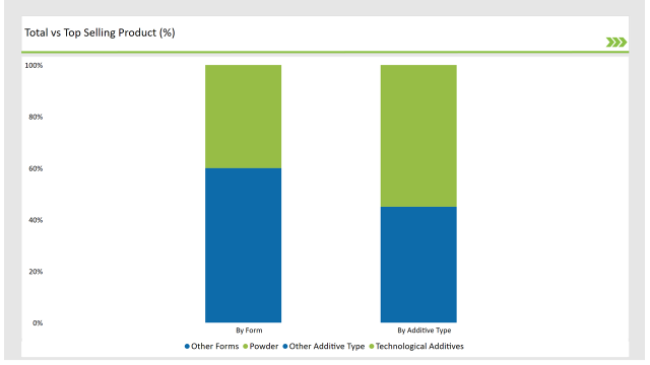

% share of Individual categories by Additive Type and Form in 2025

The powder form of animal feed additives leads the Australian market because it is practical, cost-effective, and compatible with various farming practices. Since Australia's agricultural industry aims to increase feed efficiency while reducing operational costs, powdered additives offer several advantages that meet these objectives.

Powdered additives are flexible and can be used in almost all types of animal feeds, including livestock and poultry. Since powder is mixed evenly, the dosages received by animals will always be consistent. This ensures health and increased productivity in animals.

This flexibility is what makes powdered additives more appealing to farmers with diverse livestock or specialized feeding systems. The powder form can easily be mixed directly into premixes or added to compound feeds; hence, it reduces the complexity involved in looking for a simplified feeding process by farmers.

Technological additives, such as enzymes, probiotics, prebiotics, and amino acids, are on the rise since they enhance not only the nutritional value of animal feed but also feed efficiency, animal health, and overall productivity. More Australian farmers seek feed additives that will provide a more targeted solution in ensuring that animals receive exactly what they need at different stages of growth.

This is on the same wavelength as the integration of advanced technology in farming such as Artificial Intelligence and data analytics, along with IoT. Through the implementation of the above technologies, feeding processes are continuously monitored and optimized in real time, hence enhancing efficiency levels in feed additives.

The technological feed additives segment is gaining a high level of penetration in the Australian animal feed market with the growing use of innovative technologies that enhance nutrition for livestock and increase efficiency at the farm. This is partly because more detailed and data-oriented solutions to tackle the nutritional challenges of livestock, as well as the complexities in modern farming, are gaining higher demand.

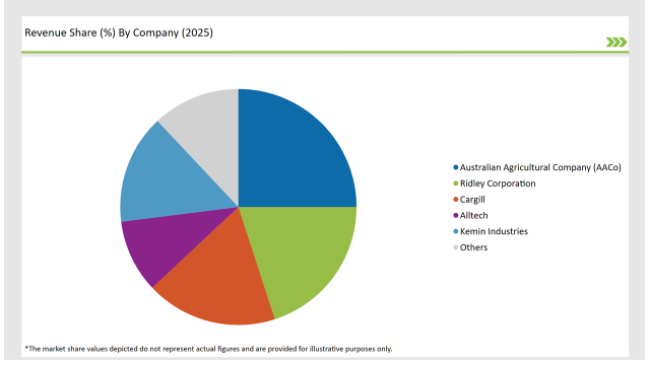

2025 Market share of Australia Animal Feed Additives manufacturers

Note: The above chart is indicative in nature

Tier 1 companies in the Australian animal feed additives market include larger multinationals that are spread across the globe and have a big portfolio of products. Examples include the strong presence from global firms like Cargill, BASF, Kemin Industries, and ADM Animal Nutrition with well-established brand names, vast distribution networks, and high financial strength.

This Tier 2 consists of regional leaders and specialized companies that are strong in Australia but have less size or diversification in the global market compared with Tier 1 competitors. Companies included in this tier are Alltech, Evonik Industries, and Nutreco. Such groups generally work in niche lines of feed additives, like probiotics, enzymes, amino acids, within particular market niches, or within specific animal sectors, for example, poultry or aquaculture.

Tier 3 players of the Australian animal feed additives market would include small local players and new companies targeting specific niche markets or particular regions. Such companies, including Ridley Corporation and other small Australian agricultural businesses, are likely to be competitive on price and also responsive to local farmer and feed producers' needs.

By 2025, the Australian Animal Feed Additives market is expected to grow at a CAGR of 13.7%.

By 2035, the sales value of the Australian Animal Feed Additives industry is expected to reach USD 615.9 million.

Key factors propelling the Australian Animal Feed Additives market include Integration of data-driven solutions in livestock management, adoption of alternative protein sources for animal feed, and growing demand for functional and specialized feed additives.

Prominent players in Australia Animal Feed Additives manufacturing include Ridley Corporation, Cargill, Alltech, BASF, Kemin Industries, Evonik Industries, Nutreco, ADM Animal Nutrition, Hubbard Feeds, and Australian Agricultural Company (AACo), among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various form such as powder, granules, and liquid.

The industry includes various additive type such as technological additives (preservatives, emulsifiers, and others), sensory additives (sweeteners, lutein, and others), and nutritional additives.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.