The Australian Allergen Free Food market is estimated to be worth USD 130.9 million by 2025 and is projected to reach a value of USD 513.8 million by 2035, growing at a CAGR of 14.7% over the assessment period 2025 to 2035

| Metrics | Values |

|---|---|

| Industry Size in 2025 | USD 130.9 million |

| Value in 2035 | USD 513.8 million |

| Value-based CAGR from 2025 to 2035 | 14.7% |

In Australia, the food market without allergens has recently become significant, owing to awareness about food allergies, health problems, and shifts in diet patterns. Food allergies in Australia rank amongst the highest globally; the estimated cases among children stand at around 1 in 10 and for adults at about 1 in 20. This has led to a surge in demand for allergen-free products, especially among consumers seeking safer food choices or managing medical conditions such as celiac disease, lactose intolerance, and nut allergies.

More recently, however, food manufacturers are taking advantage of healthier eating and the clean-label concept to innovate new allergen-free formulations. In addition, food consumers have developed a higher sensitivity toward the composition of foods eaten, making demands for a broader variety of more accessible allergen-free food offerings in supermarkets, restaurants, and other food service outlets nationwide.

Explore FMI!

Book a free demo

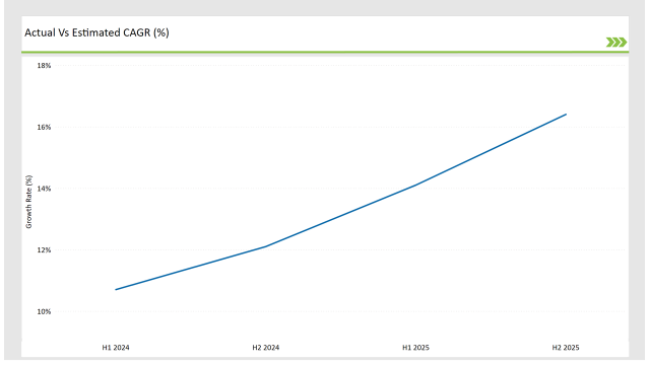

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Allergen Free Food market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Allergen Free Food sector is predicted to grow at a CAGR of 14.1% during the first half of 2025, increasing to 16.4% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 10.7% in H1 but is expected to rise to 12.1% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024. These numbers reflect the ever-changing face of the Australian allergen-free food market, which is affected by important variables such as changing rules, fluctuating consumer preferences, and advances in product innovation, notably in areas such as natural coloring solutions.

This bi-annual research is critical for businesses wishing to adjust their strategy, capitalize on growth possibilities, and efficiently negotiate the complexity of the allergen-free food sector as it grows and evolves.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2023 | Roma Foods, Australia extended its market by exporting gluten-free and allergen-free products to Chile. Its products are now available across the country, including in major supermarkets like Cencosud's Jumbo chain. |

| 2023 | Schär is a company that leads the gluten-free and allergen-free food market with its wide selection of products specifically designed for particular diets. Among these are bread, pasta, snacks, and pizza bases made without common allergens. They aim to make products free from common allergens. |

Rise of Allergen-Free Snacking as a Convenient Option

Convenience has become an essential aspect for food trends as well, but allergen-free snacks are leading the pack by leaps and bounds. Busy lifestyle and increased concerns over food allergy have led the market to continuously expand in finding on-the-go allergen-free snack options, from allergen-free protein bars, chips, and baked good to dairy-free smoothies, energy balls-snacks mostly for those sensitivities but could be for healthier and more accessible snack options on the go as well.

The main significance of this trend in Australia is fast-paced modern living, where time is considered priceless, and consumers are often looking for a quick yet healthy meal or snack solution. The market will be filled with innovative products that are not only allergy-free but are high in nutritional content and provide more protein, fiber, and essential vitamins.

Technical Advancements in Allergen-Free Product Formulations

As people with food allergies grow increasingly vocal about their demands, Australian food producers are investing extensively in R&D to improve allergen-free food formulations. Food technology advancements are allowing companies to make allergen-free versions of traditional favorites that closely resemble the flavor, texture, and nutritional profile of their allergic counterparts.

Advances in enzyme technology, fermentation methods, and alternative protein sources are expanding the options in the allergen-free food sector. Such innovations in technology are likely to make huge ripples in the market for the fact that they would alleviate the complaints of consumers about food quality free from allergens.

In the light of improved formulations for products, the Australians would also be attracted toward buying allergen-free foods if they are allergic or for merely following a healthy diet and lowering the presence of processed foods in their diets.

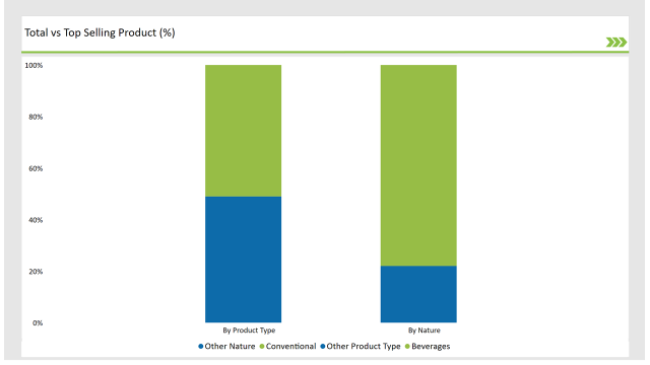

% share of Individual categories by Product Type and Nature in 2025

Even though the more niche, specialty foods are gaining more traction in the allergen-free food market of Australia, conventional remains at the forefront. It can be said that consumer behavior, distribution, and price point all jive with what a larger population of customers want.

Conventional allergen-free foods, such as gluten-free bread, dairy-free snack options, and nut-free packaged meals, have been around long enough to establish themselves as staples for the consumer who is managing food allergies.

As these products become more ubiquitous, their penetration into the larger food supply chain, including large-scale retailers, is growing. The attraction is that most consumers can select from a wide range of familiar, allergen-free options without having to visit specialty stores or pay premium prices.

The segment is beverages because of the general appeal, versatility, and convenience experienced in Australia's allergen-free food market. Many consumers are going for allergen-free products like dairy-free milk alternatives, gluten-free energy drinks, and allergen-free smoothies, which tend to be well in line with modern health trends and allow easy, on-the-go solutions to their dietary needs.

This is transforming the market because consumers look for healthier and more convenient options in their everyday food and beverage. As the incidence of lactose intolerance, dairy allergy, gluten sensitivity has increased, staple beverages in Australian homes are almond milk, oat milk, coconut water, gluten-free protein shakes, among others catering to the desire to remove allergens yet not compromise on taste or nutrient composition.

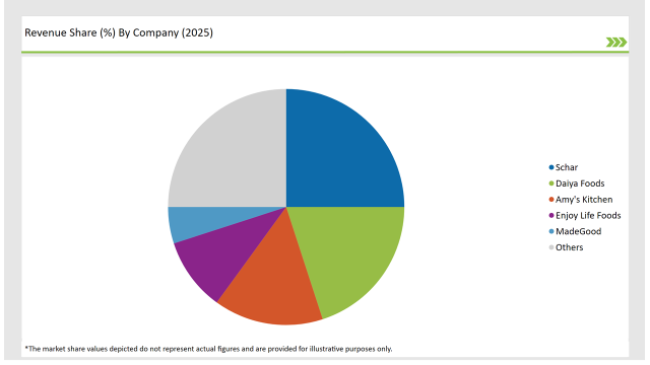

2025 Market share of Australia Allergen Free Food manufacturers

Note: The above chart is indicative in nature

Tier 1 players are the leading and largest in the Australian allergen-free food market, covering brands with substantial market share, wide distribution networks, and huge product lines. These companies have the best records in terms of product innovation as well as consumer trust.

Such companies have cornered the market by offering an array of choices across different categories, including baked goods, snacks, ready-to-eat meals, and beverages. They have a strong relationship with large retailers so that their products appear in mainstream supermarkets, which makes allergen-free foods accessible to a greater portion of the population.

Tier 2 is represented by new, more emerging brands in the Australian allergen-free food market. Brands have started gaining recognition and continue on the path of growth. These companies are solidly present in their market and often narrow down their offerings to niches within the allergen-free food market, for example, gluten-free or dairy-free snacks with an increased interest in quality and innovation.

Tier 3 are the niche players and start-ups that represent smaller operations in the Australian allergen-free food market. Companies will usually be small in size and have very niche-specific needs such as allergen-free desserts, protein shakes, or artisanal snacks. Though not yet mainstream and operating on much smaller and niche markets, they still are vital to the diversity and innovation in the sector.

By 2025, the Australian Allergen Free Food market is expected to grow at a CAGR of 14.7%.

By 2035, the sales value of the Australian Allergen Free Food industry is expected to reach USD 513.8 million.

Key factors propelling the Australian Allergen Free Food market include innovation in allergen-free ingredients and product formulations, expansion of allergen-free options in foodservice and retail channels, and rising prevalence of food allergies and intolerances in the Australian market.

Prominent players in Australia Allergen Free Food manufacturing include Enjoy Life Foods, Free2b Foods, Schar, MadeGood, Daiya Foods, Amy's Kitchen, Roma Foods, Bionaturae, Earth Balance, No Nuts! Foods, and Green Valley Creamery, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

As per the nature segment, the market is segregated into conventional and organic.

The industry includes various product type such chocolate, beverages, processed meat & poultry, and others.

As per the application segment, the market is segregated into sugar-free, GMO-free, and others.

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Hydrotreated Vegetable Oil Market Analysis by Type and Application Through 2035

Children’s Health Supplement Market Analysis by Product Type, Application and Age Group Through 2025 to 2035.

Hyaluronic Acid Supplement Market Product, Type, Application, Distribution Channel and Others Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.