The global Augmented and Virtual Reality (AR/VR) in Education market, driven by advancements in immersive learning technologies, growing adoption of digital learning solutions, and increasing investments in Ed Tech, is estimated to see significant growth from 2025 until 2035.

Extended Reality in education (both AR and VR) are revolutionizing the education industry, making interactive and immersive learning experience possible, which ultimately leads to improved retention of knowledge along with knowledge delivery to students even when they are in separate geographical locations.

Market Overview

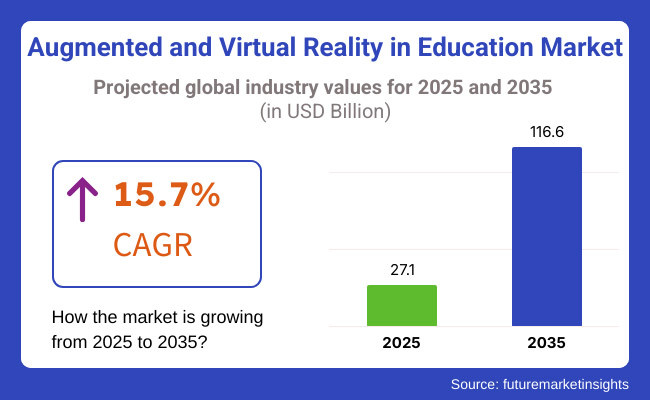

The global augmented and virtual reality (AR/VR) market size is expected to be valued at around USD 116.6 billion by 2035 while growing at a CAGR of 15.7% during the forecast period. Several drivers including increasing need for personalized learning, emergence of AI based education tools, and government initiatives to expand digital education in various background across the world is pushing the eLearning market to grow globally.

Additionally, the scalability and range of immersive learning platforms are positively impacted by the addition of AR/VR with 5G and cloud computing.

Explore FMI!

Book a free demo

North America is the leader in the AR/VR in education market, owing to strong technological infrastructure, high adoption of Ed Tech solutions, and significant investments in digital learning.

The USA is leading the way in the application of immersive technologies to classrooms, with initiatives at many of the nation’s largest universities coupled with AR/VR learning tools from major tech firms such as Google, Microsoft and Meta that have made these tools accessible to schools. The growth of regional markets is driven by the presence of established AR/VR developers.

The AR/VR education market in Europe is expanding rapidly because UK, Germany, and France are already adopting immersive learning solutions in their schools and other higher education institutions. In this regard, government-supported digital education programs and initiatives undertaken by universities & technology companies to run these programs are responsible for market growth. The region’s focus on STEM education and workforce training using VR simulations is another driver of growth.

The AR/VR in education market at the highest growth in the Asia-Pacific region due to the increasing investment of the Government in digital education, increasing smartphone penetration, and an increase in the growth of EdTech. So here’s China, India, and Japan adapted AR/VR in their education systems to make education more engaging and accessible. Adoption in the region is being further propelled by the rapid expansion of online learning platforms and partnerships with international EdTech companies.

The AR/VR education market is slowly expanding in Latin America, Middle East and Africa while the focus is now on the digital transformation in education. Brazil, South Africa, UAE, and many more global regions exemplify such investments in immersive learning technologies for educational gap training and conveying factors of student engagement. The growth of the market in these regions is further accelerated by the growing availability of affordable AR/VR hardware and software solutions.

Challenge

High Implementation Costs

High costs of hardware, software and infrastructure pose challenges for Augmented Reality (AR) and Virtual Reality (VR) integration in education. Education requires a massive investment into VR headsets, AR-ready devices, devices to create digital content, creating a barrier to widespread adoption.

Technical and Accessibility Limitations

Technical limitations: Numerous educational institutions encounter technical constraints like poor internet connectivity, compatibility problems with current systems, as well as insufficient technical skills among educators. Moreover, not all students have AR/VR devices at home, which results in an unequal opportunity for learning.

Opportunity

Immersive Learning Experiences

AR & VR: Exploring Step into the Future of the EdTech Realm These technologies allow students to interact with complicated ideas in science, history and medicine in immersive simulations, making learning a more enjoyable process and an effective one as well.

Expansion of Remote and Hybrid Learning

With the growing trends of digital education and remote learning, the need for AR/VR-powered learning environments has been generated. By utilizing virtual classrooms, 3D models, and interactive educational content, we can provide a more integrated educational experience that bridges the gap between physical and remote learning.

AR and VR in education gained steady momentum between 2020 and 2024, facilitated by technology development and digital transformation, as well as the need for the remote learning solutions. For example, educational institutions tried out VR-enabled simulations, AR-enhanced textbooks, and virtual field trips for increased student engagement. But issues like cost and access have impeded the movement’s uptake.

As a result, those in the space researched ways to build affordable tools and curricula to bring AR/VR into the classroom. The market is anticipated to grow exponentially (2025 to 2035) as technology becomes more and more accessible through the development of AI driven interactive learning experiences, low cost AR/VR hardware, and the penetration of met averse-based education.

We will see more collaborations between tech companies, well-established educational institutions, and governments that will create standardized AR/VR curricula. Moreover, individual with learning experience, AI learning assistant, holographic would put a new way how to learn.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | The Rise Of AR/VR Education Policies And Pilot Programs |

| Technological Growth | Creation of AR textbooks, VR-based field trips and gamified learning |

| Industry Adoption | Slow take up in STEM education, medical training, vocational learning |

| Supply Chain and Distribution | High-end VR device dependency and limited content availability |

| Market Competition | Launch of ed-tech startups and collaboration with universities and AR/VR companies |

| Market Growth Drivers | This requires immersive learning, remote education solutions, and interactive digital content. |

| Accessibility and Affordability | Explaining high costs and lack generally available in poor areas |

| Integration of AI and Big Data | Adaptive learning and virtual tutors - early-stage AI |

| Future of Education | Adoption of virtual labs teaching and AR based class rooms teaching |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Standardized AR/VR curricula, government-backed funding for technology integration |

| Technological Growth | AI-powered interactive learning, metaverse-based virtual campuses, and real-time 3D content creation |

| Industry Adoption | Widespread integration across K-12, higher education, and corporate training |

| Supply Chain and Distribution | Affordable AR/VR headsets, cloud-based educational content distribution, and expanded developer ecosystem |

| Market Competition | Increased investment by global tech giants, competitive expansion of AR/VR-driven educational platforms |

| Market Growth Drivers | Personalized AI-driven learning, metaverse-enabled collaboration, and fully immersive educational environments |

| Accessibility and Affordability | Mass-market AR/VR adoption, government initiatives for equitable access, and cost-effective education tools |

| Integration of AI and Big Data | Advanced AI-driven educational assistants, real-time analytics, and predictive learning models |

| Future of Education | Full-scale immersive metaverse education, real-time translation tools, and globally connected virtual campuses |

The USA augmented and virtual reality market in education is booming, with growing Ed Tech investments, increasing use of immersive learning experiences, and continuous improvement of AR/VR productivity in terms of hardware and software. The growth of the market is also augmented by government programs and initiatives that promote digital learning.

| Region | CAGR (2025 to 2035) |

|---|---|

| United States | 15.9% |

Solutions Providers/Copy: The UK market is expansive, driven by robust growth with AR/VR technologies becoming more increasingly integrated throughout classrooms, corporate training programs, and online education platforms. The market is also fueled by supportive policies and partnerships with educational institutions.

| Region | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 15.5% |

The large-scale application of AR/VR in education in Europe is also being propelled by digital transformation efforts, increasing government funding for Ed Tech solutions, and a growing demand for interactive learning experiences in schools and higher education institutions.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 15.6% |

High adoption rate of technology in education, government investment in smart classrooms, along with the rising preference for immersive and AI-enabled learning environments are working in momentum for the augmented and virtual reality in education market in South Korea.

| Region | CAGR (2025 to 2035) |

|---|---|

| South Korea | 15.8% |

Market Overview: The global augmented and virtual reality in education market is anticipated to grow at a significant rate during the forecast period, primarily due to the rising need for digital media/technology and its integration into traditional education systems, as well as initiatives taken by educational institutes to embrace interactive and engaging technology.

Global CAGR (2025 to 2035): 15.7%

Education and Training Augmented and Virtual Reality Market is growing as Educational institutions are increasingly utilizing immersive technologies to enhance learning experiences. Interactive and engaging educational tools, Augmented Reality (AR) and Virtual Reality (VR), improve student comprehension and retention. They offer this type of hands-on learning by simulating real-world scenarios so that abstract and complex concepts can be seen in action and made tangible and easier to understand.

Accelerated digital transformation in education through growing advancements in AR, VR hardware, software and cloud-based solution adoption are driving the growth of the market. From schools and universities to corporate training centers, these technologies are being used to create interactive classrooms, virtual field trips, and realistic training simulations.

Amidst a worldwide shift towards personalized and remote learning, the demand for AR and VR driven education platforms is on the rise. As technology continues to trace new heights, and investment into Ed Tech compounded, there is little doubt AR and VR will become instrumental in modern education systems globally.

The education sector within AR and VR solutions for education lead the market among different offerings. Interactive applications, virtual classrooms, and AI-powered adaptive learning programs have become standard software solutions across educational institutions and corporate training modules. This interactive and immersive approach helps students and professionals understand difficult concepts in an accessible way.

Smart glasses, AR headsets, and VR goggles: Hardware solutions are at the forefront as these contribute significantly to the growth of the market. Immersive devices rather take advantage of the real-time interaction with digital contents and lead to a better engagement.

As technology evolve and the cost of hardware decrease, adoption will only increase as the market continues to grow. These factors, combined with the increasing availability of advanced software applications and hardware, will continue to push the incorporation of AR and VR into education.

From deployment mode, cloud-based solutions are gaining tremendous adoption because of accessibility, cost-performance, and scalability. Seamless content delivery, remote learning opportunities, and real-time collaboration among students and educators are just a few advantages that cloud platforms promote. Thanks to cloud-based AR and VR solutions, schools can have immersive learning without the cost of heavy investment in physical infrastructure.

In higher education and specialized training sectors where data security and customization are priorities, on-premises deployment is still relevant for institutions that require more oversight. While more schools and universities are likely to prioritize accessibility and flexibility in their learning environments, the demand for cloud-based solutions is likely to grow.

AR & VR content can easily be accessed from anywhere so, AR & VR software development for educators can be effectively done on Cloud and SEE the rapid growth of cloud technology, it is giving strength to use of cloud deployment in education sector.

The augmented and virtual reality (AR/VR) in education market is experiencing rapid growth due to increasing demand for immersive learning experiences, technological advancements, and the growing adoption of digital learning tools. Key drivers include AI-powered learning platforms, interactive simulations, and the integration of AR/VR in K-12, higher education, and corporate training environments.

Market Share Analysis by Key Players & Technology Providers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Google LLC | 20-25% |

| Microsoft Corporation | 15-20% |

| Meta (formerly Facebook) | 12-16% |

| Lenovo | 8-12% |

| HTC Corporation | 5-9% |

| Other Technology Providers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Google LLC | AR/VR-enabled educational tools, including Google Expeditions and Google Lens. |

| Microsoft Corporation | HoloLens mixed reality solutions for immersive learning experiences. |

| Meta | VR-powered education initiatives through Oculus and Horizon Workrooms. |

| Lenovo | Standalone VR headsets and AR solutions designed for classroom engagement. |

| HTC Corporation | VR learning environments and simulation-based education tools. |

Key Market Insights

Google LLC (20-25%)

Google tops the list with their AR/VR enabled education tools, such as Google Expeditions, to improve interactive learning.

Microsoft Corporation (15-20%)

Microsoft provides immersive learning solutions using HoloLens and AI-driven mixed reality applications.

Meta (12-16%)

Meta emphasizes on virtual reality (VR) powered learning experiences via Oculus devices which leads to collaboration and training.

Lenovo (8-12%)

Lenovo: Building educational AR/VR headsets designed for classroom interactive learning & training holograms.

HTC Corporation (5-9%)

One of HTC's focuses is VR-based education environments and simulation tools for hands-on learning.

Other Key Players (30-40% Combined)

The AR/VR in education market continues to evolve with the contributions of different types of technology providers, such as:

The overall market size for Augmented and Virtual Reality in Education market was USD 27.1 Billion in 2025.

The Augmented and Virtual Reality in Education market is expected to reach USD 116.6 Billion in 2035.

The Augmented and Virtual Reality in Education market is set to grow due to increasing demand for immersive learning experiences. By Offering, hardware advancements, such as VR headsets and AR-enabled devices, will drive adoption, while solutions and services will enhance content delivery and engagement. By Deployment Mode, cloud-based solutions will dominate due to scalability and accessibility, while on-premises deployment will appeal to institutions prioritizing data security. By Application, K-12 and higher education will benefit from interactive learning, while vocational training will leverage AR/VR for hands-on skill development, boosting market expansion.

The top 5 countries which drives the development of Augmented and Virtual Reality in Education market are USA, European Union, Japan, South Korea and UK.

Cloud-Based Deployment demand supplier to command significant share over the assessment period.

Push-to-Talk Market Trends - Demand & Growth Forecast 2025 to 2035

Network Engineering Service Market Trends – Demand & Forecast 2025 to 2035

Quantum Cryptography Market Insights - Growth & Forecast 2025 to 2035

Paper And Plastic Film Capacitors Market Trends - Growth & Forecast 2025 to 2035

Selective Soldering Market Growth - Trends & Forecast 2025 to 2035

Network Cameras and Video Analytics Market Analysis – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.