The atrophic vaginitis treatment industry is valued at USD 3.21 billion in 2025. As per FMI's analysis, the industry will grow at a CAGR of 8% and reach USD 6.93 billion by 2035.

The demand for atrophic vaginitis or vaginal atrophy treatments is a key driver of industry growth. It was growing at a very fast rate in 2024 because more people were using bioidentical hormone therapy and other therapies that didn't use hormones.

Pharma companies introduced new estrogen-based therapies, expanding options for prescriptions and over-the-counter use. Regulatory approvals in key target markets, particularly in North America and Europe, fuelled the introduction of new formats and increased prescription levels. As telemedicine and other digital health products have become more popular, they have made it easier for more people, especially older people, to get treatment for vaginal atrophy and similar conditions.

Personalized medicine is gaining popularity, leading to the development of AI-powered diagnostic technologies. These innovations will make treatment more effective. Furthermore, the increasing health expenditures in emerging landscapes will expand the patient base.

Industry players must be leveraged in a bid to dedicate themselves to enterprising drug delivery technologies, including transdermal patches and intravaginal rings, until 2035, when the industry would obtain a solid foothold in the long run.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.21 Billion |

| Industry Value (2035F) | USD 6.93 Billion |

| CAGR (2025 to 2035) | 8% |

Explore FMI!

Book a free demo

The atrophic vaginitis treatment industry is growing rapidly over the 2035 forecast period, underpinned by growing awareness, technical improvements in hormone-based treatments, and increasing use of non-hormonal treatments. Pharmaceutical companies and telemedicine companies could benefit from rising patient needs and good regulatory environments.

On the other hand, traditional treatment companies that rely on pure stand-alone formulations may find it difficult to compete. New ways of delivering drugs, better diagnostic tools, and easier access to health care in developing economies will shape the future of the industry.

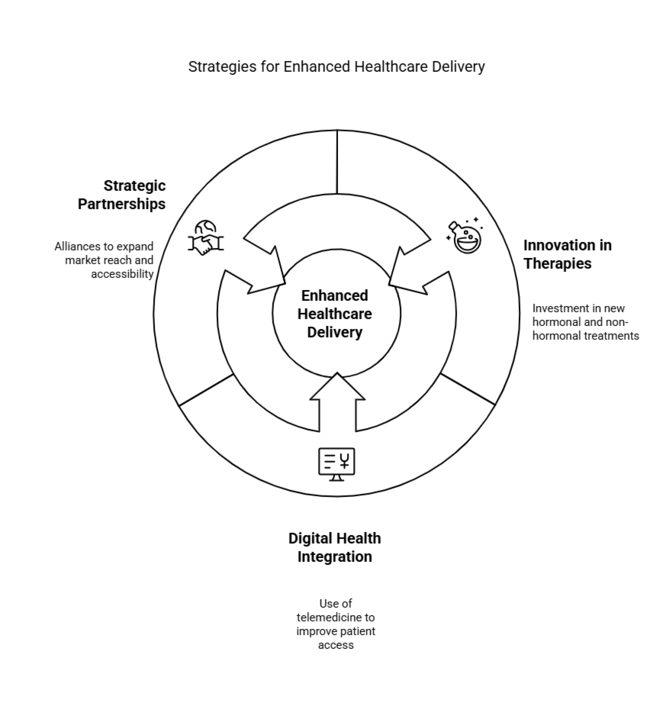

Accelerate innovation in hormonal and nonhormonal therapies

Pharmaceutical companies should invest in R&D to develop future-ready estrogen-based and bioidentical hormone therapies. They should also expand their non-hormonal options to meet the needs of a wide range of patients.

Leverage Digital Health and Telemedicine for Wider Access

Leverage the growing use of telemedicine by integrating digital consultation and prescription services, enhancing patient reach and improving treatment adherence.

Increase Strategic Partnerships for Industry Penetration

Forming alliances with healthcare providers, retail pharmacies, and e-commerce sites expands distribution channels, enhances product accessibility, and reaches new customers in developing idustries.

| Risk | Probability & Impact |

|---|---|

| Regulatory Hurdles for New Drug Approvals | High Probability-High Impact |

| Rising Competition from Generic Alternatives | Medium Probability-High Impact |

| Patient Reluctance Toward Hormone-Based Treatments | High Probability-Medium Impact |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Expansion of Digital Health Integration | Establish strategic partnerships with telemedicine providers |

| Regulatory Compliance for Emerging Therapies | Engage with regulatory bodies to streamline approval processes |

| Industry Penetration in Emerging Economies | Develop localized distribution networks and awareness campaigns |

To stay ahead, companies need to focus on fast R&D on next-generation medicines, especially those that aren't hormone-based and can be tailored to each patient's needs. Access will be increased by using digital health solutions and telemedicine partnerships, and approvals will be sped up by working strategically with regulators.

One of the main goals should be to become the long-term leader in the industry while entering growth economies through regional distribution and selective alliances. The time to move decisively is now, applying these lessons to refine the company’s strategy and seize enduring industry leadership.

Regional Variance

FMI finds that advanced drug delivery methods and increased telemedicine adoption are driving industry growth.

Regional Trends

FMI foresees the industry's direction in the coming decade being influenced by the three priorities- investment in patient education, regulation simplification, and health in digital.

Almost everyone in the world agreed that access and safety should be improved, even though different regions have different treatment options, regulatory environments, and price sensitivity.

High Consensus: Regulatory compliance, improved patient education, and treatment innovation.

Key differences

Strategic Insight

A universal approach is ineffective. For the industry to grow in the long term, drug companies need to tailor their strategies to each region. For example, in North America, they need to focus on affordability; in Europe, on sustainability; and in Asia, on over-the-counter growth.

| Countries | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | The Center for Drug Evaluation and Research (CDER) of the FDA regulates hormone and non-hormone therapy. Recent FDA guidance has emphasized the need for longitudinal safety data on HRT. Compounded bioidentical hormone therapy is also under increased regulation because of potential risks. |

| United Kingdom | The Medicines and Healthcare Products Regulatory Agency (MHRA) covers prescription medicines. Labeling and safety rules are stricter in the UK now that Brexit is over, and NICE guidelines say how to treat atrophic vaginitis. Policies are recently promoting sustainable packaging for medicines. |

| France | The French National Agency for the Safety of Medicines and Health Products (ANSM) demands extensive testing before approving HRT. Reimbursement policy favors non-hormonal treatments, limiting industry access for estrogen products. |

| Germany | The Federal Institute for Drugs and Medical Devices ( BfArM ) and both countries adhere to strict EU sustainability and safety requirements for hormone-based treatments, prioritizing green formulas and localized production. |

| Italy | The Italian Medicines Agency (AIFA) controls how vaginal atrophy is treated, which means that HRT is subject to stringent oversight by the AIFA. Recent regulatory developments promote insurance for non-hormonal therapy, further increasing demand. |

| South Korea | The Ministry of Food and Drug Safety (MFDS) says that hormone treatments are needed to make sure that high safety standards are met. Lower regulation hurdles in natural and probiotic medicine offer more investment in substitutes. |

| Japan | The Pharmaceuticals and Medical Devices Agency (PMDA) wants clinical tests of new hormone therapies to follow stricter rules. Patients' strong doubts about HRT makes people hesitant about quick approval and leans toward over-the-counter options that don't contain hormones. |

| China | The National Medical Products Administration (NMPA) has stringent drug safety regulations that that impose stricter requirements on TCM compared to conventional pharmaceuticals. Reform in drug pricing policies has also put more competition among global brands recently. |

| India | The Central Drugs Standard Control Organization (CDSCO) governs the approval process. Price sensitivity is closely linked to industry access. Because of this, non-hormonal treatments won with cultural preference. |

The diagnosis segment is anticipated to grow at a CAGR of 7.8% during 2025 to 2035, with pelvic exams taking the lead as they are used routinely in gynecological check-ups. FMI analysis revealed that urine tests are becoming increasingly popular as a non-invasive tool for estrogen deficiency detection, particularly in point-of-care applications. Acid balance tests, although effective, are underutilized because of a lack of awareness.

The incorporation of AI-based diagnostic systems in hospitals is enhancing detection levels, boosting industry growth. According to FMI, advancements in home diagnostics solutions and automated lab technology will increasingly drive the implementation of early screening methods.

The treatment segment is anticipated to grow at a CAGR of 8.2% during 2025 to 2035, where vaginal moisturizers are leading based on consumer preferences for hormone-free products. FMI research indicated that water-based lubricants are witnessing fast-paced adoption because of their cost-effectiveness and OTC status. With increasing patient awareness about long-term vaginal health, pH-balancing and organic products are gaining traction.

The prevalence of non-prescription products is an indicator of the trend toward self-care. According to FMI, the brands emphasizing medical-grade, long-lasting products with clinically proven efficacy will gain the largest industry share in this segment during the forecast period.

The therapy type segment is expected to grow at a CAGR of 8.5% from 2025 to 2035, with estrogen-based medication maintaining industry leadership. The FMI study showed that more people in North America and Europe want bioidentical hormone therapy. While estrogen-based medicines remain the strongest selling, the adoption of non-estrogen-based medication, including among females interested in availing safer long-term options, is on the rise.

Launching selective estrogen receptor modulators (SERMs) and herbal formulations is boosting options for treatments. Firms investing in next-generation hormone therapies with enhanced safety profiles will be at an advantage in the changing regulatory scenario.

The segment for distribution channels is expected to grow at a compound annual growth rate (CAGR) of 8.1% from 2025 to 2035. Online pharmacies will be the segment that grows the fastest. According to estimates from FMI, the popularity of e-commerce platforms is due to the ease of home delivery, low prices, and growing use of digital healthcare.

Hospital pharmacies continue to lead because of physician-recommended therapy, but retail pharmacies maintain robust hold for OTC drugs. Regulation changes toward telemedicine-based prescriptions propel online sales even higher. Digital-first businesses putting money into AI-driven recommendations and subscription-based replenishment models will see continued expansion in the following years.

The United States' atrophic vaginitis treatment industry is expected to register a CAGR of 8.5% between 2025 and 2035. Increased awareness, widespread healthcare reach, and rapid uptake of digital health technology are responsible for the high CAGR. According to FMI research, prescription hormone therapies make up most of the landscape.

On the other hand, non-hormonal treatments like vaginal moisturizers and laser therapy are becoming more popular. Growth in telemedicine and insurance reform increases access. However, the regulatory focus on compounded bioidentical hormones and the cost factor can pose a challenge. Pharmaceutical companies investing in new drug delivery systems will be at a competitive edge.

In the United Kingdom, the atrophic vaginitis treatment industry is expected to grow at a CAGR of 7.2% from 2025 to 2035. Strong government support and fewer post-Brexit drug regulations support women's health programs, as surveyed by FMI studies. The National Health Service (NHS) covers prescription treatments partially, and low-cost solutions are a priority for manufacturers.

Sustainability policies also affect how medicines are made and packaged, and campaigns to raise awareness help more people get diagnosed. Companies that offer hormone-free options and digital integration of healthcare will do better, since patients want safer treatments that last longer.

The French industry for the treatment of atrophic vaginitis is expected to advance at a 5.7% CAGR during 2025 to 2035. FMI research shows that strict rules for pharmaceutical companies and the preference for non-hormonal treatments are slowing the industry's growth. France’s health system prioritizes reimbursement for non-hormonal treatments, reducing reliance on estrogen-based therapies.

Additionally, more demand for plant and organic therapy complements France's green-pharma initiatives. Companies that invest in non-hormonal therapy that has been shown to work in clinical trials will gain industry share, while companies that rely on traditional hormone therapy may face problems with regulators and customers.

The industry for atrophic vaginitis treatment in Germany is expected to experience a CAGR of 6.8% from 2025 to 2035. FMI studies recognized that Germany's strict EU-compliant regulations support the adoption of innovative and eco-friendly treatments. Low-dose and transdermal estrogen therapies are widely used due to their lower risk profile. While industry growth is driven by high healthcare spending and advanced pharmaceutical R&D, profitability remains a challenge due to strict price controls and reimbursement restrictions.

In the competitive scenario, FMI is of the opinion that firms that focus on value-based healthcare products and environmentally friendly formulations will be the ones to watch. Adoption of digital health is also a key factor, with remote patient consultations gaining more weight.

The atrophic vaginitis treatment industry in Italy is also expected to grow at a 6.2% CAGR during 2025 to 2035. The government's healthcare programs and growing awareness of postmenopausal diseases support the landscape. However, insurance reimbursement primarily covers generics and non-hormonal treatments, making affordability a key factor in treatment selection.

There is a growing need for personalized treatments, and bioidentical hormone therapy is becoming more popular among both doctors and patients. Companies providing cost-efficient, customized treatment solutions will lead the industry, while regulatory intricacies pose a significant obstacle to the introduction of new products in the highly regulated pharma space.

The South Korean industry for atrophic vaginitis treatment is expected to witness growth at a CAGR of 7.9% during the period 2025 to 2035. Urbanization, the rise in private healthcare centers, and escalating interest in women's health fuel industry growth.

Hormonal treatments are available, but cultural taboos and government opposition to estrogen therapy make people look at herbal and probiotic-based treatments instead. Adoption of telehealth is on the rise, providing improved access to treatment in rural areas. FMI observes that brands emphasizing natural, clinically proven alternatives and availability of healthcare online will see strong growth over the coming years.

The industry for the treatment of atrophic vaginitis in Japan is anticipated to grow between 2025 and 2035 at a CAGR of 5.5%. Growth is hampered due to regulatory issues and conservatism toward hormone-based treatments, as per FMI estimates. The Japanese industry allocates greater weight to non-hormonal, OTC products such as vaginal moisturizers and probiotic-based products.

Awareness campaigns remain in their infancy, resulting in treatment and diagnosis rates lower than those in Western markets. An aging population, however, provides long-term potential. Companies that invest in localized treatment options and culturally appropriate education programs will be most likely to thrive.

The Chinese industry for atrophic vaginitis treatment is forecast to expand at a CAGR of 8.3% during the period between 2025 and 2035. Strong growth is caused by higher spending on healthcare, greater awareness, and easier access to women's health care. Traditional Chinese medicine (TCM) is still a big part of deciding what treatments are available, even though Western pharmaceuticals and herbal and alternative medicines are also available.

The government's push toward local pharmaceutical innovation offers prospects for local players. Multinational companies that want to do well in this quickly growing industry need to figure out how to deal with complicated regulatory processes and work with local healthcare providers.

The industry for the treatment of atrophic vaginitis is expected to grow at a CAGR of 8.7% from 2025 to 2035, as prognosticated for India. Urbanization, improvement in quality healthcare infrastructure, and rising concerns about female health complications increase the size of the market, FMI analysis says. However, affordability remains a key challenge, with the majority of patients opting for cheaper, non-hormonal treatments.

The OTC segment is expanding as consumers seek self-administered therapies. FMI anticipates that participants emphasizing affordability, wide distribution, and localized educational initiatives will drive the market, while expensive treatments may not find traction among price-sensitive consumer bases.

Companies that make medicines to treat vaginal atrophy have to deal with competition from industry leaders when it comes to pricing, new product development, growing strategic partnerships, and going global. FMI research shows that companies are putting a lot of money into research and development to make estrogen and non-estrogen therapies safer and more effective.

It's also possible for patients to get more care through digital health solutions like telemedicine integrations. Strategic alliances with healthcare providers and retail pharmacy networks are expanding distribution channels. Firms emphasizing affordability, regulatory clearances, and individualized treatment choices will be well-placed to thrive, while slow-growth businesses that do not keep pace with changing consumer demands may experience industry stagnation.

Industry Share Analysis

Pfizer Inc.

Novo Nordisk A/S

Bayer AG

AbbVie Inc. (Allergan)

TherapeuticsMD (acquired by Mayne Pharma Group)

Amneal Pharmaceuticals

Key Developments in 2024

In Q1 2024, the FDA approved a reformulated version of Premarin that was better at being bioavailable and following treatment plans. This made Pfizer Inc. even stronger in the market, even though there was more competition. It also more strictly implemented direct-to-consumer ad campaigns in targeted areas, which bolstered the number of prescriptions.

Novo Nordisk formed a strategic alliance with a digital health platform in March 2024 to help patients stick with their hormone replacement treatments. The partnership makes AI-powered reminders and teleconsultations work better together, focusing on European women who have gone through menopause.

A temporary setback for Bayer AG came in February 2024 when a rival filed a patent challenge against Angeliq in Germany. Bayer quickly resolved the conflict, maintaining its industry exclusivity in profitable regions.

AbbVie Inc. remained busy building out its purchased Allergan women's health franchises, introducing a new direct-to-physician educational program in the United States to support Estrace Cream sales to gynecologists.

After acquiring Therapeutics MD in 2023, Mayne Pharma Group focused on expanding insurance coverage for Imvexxy in 2024, which led to a 15% increase in prescriptions by mid-year.

Catching strong demand for cost-effective therapies, Amneal Pharmaceuticals launched a new generic vaginal estrogen cream that quickly gained broad formulary acceptance in Q2 2024.

More people becoming aware of the problem, more women going through menopause, new developments in hormone and non-hormone therapies, and higher demand for over-the-counter (OTC) products are all driving sales.

Rising acceptance of personalized therapies, expanded online pharmacy channels, and innovation in non-estrogen treatments position the industry for rapid growth.

Major players are Shionogi, Duchesnays, Pfizer Inc., Hormos Medical, QuatRx Pharmaceuticals, Novo Nordisk A/S, Pantarhei Bioscience, Mithra Pharmaceuticals, Allergan (AbbVie Inc.), AMAG Pharmaceuticals, Bayer HealthCare Pharmaceuticals Inc., Theramex, Endoceutics, Inc., Bayer AG.

Products that contain estrogen are still the most popular, but therapies that don't contain estrogen are becoming more popular because of safety concerns and changes in the law.

The industry is anticipated to grow to USD 6.93 billion by 2035, at a CAGR of 8% during the period 2025 to 2035.

The industry is segmented into pelvic exam, urine test and acid balance test.

It is bifurcated into vaginal moisturizers and water-based lubricants.

It is bifurcated into estrogen based drugs and non-estrogen based drugs.

It is fragmented into hospital pharmacy, online pharmacy and retail pharmacy.

The industry is studied across North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East & Africa.

Automated Sample Storage Systems Market Growth - Trends & Forecast 2025 to 2035

SPECT Scanning Services Market Growth - Trends & Forecast 2025 to 2035

Preventive Medicine Market Growth - Trends & Forecast 2025 to 2035

Hadron Therapy Market Growth - Trends & Forecast 2025 to 2035

Wound Irrigation Systems Market Growth – Trends & Forecast 2025 to 2035

Western Europe Medical Recruitments Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.